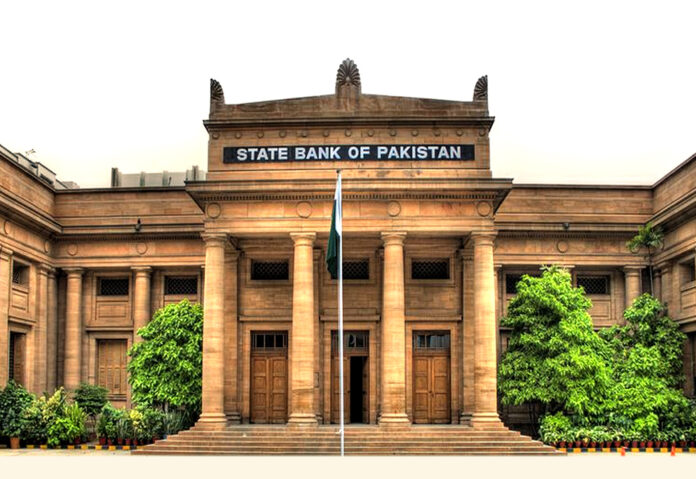

The State Bank of Pakistan’s latest Monetary Policy Report paints a picture of hard-won stability. Titled “Staying the Course,” the August 2025 document chronicles Pakistan’s dramatic economic recovery, inflation plummeting from 29% to 4.5%, foreign reserves rebuilding, and GDP growth accelerating. After slashing rates by 11% from their 22% peak, the central bank now holds steady at 11%, projecting continued success with inflation expected to remain in the 5-7% target range through FY26.

It’s a compelling narrative of monetary discipline rewarded and macroeconomic stability restored. But beneath this official optimism lies a more troubling reality: Pakistan’s central bank may have backed itself into an unsustainable corner, pursuing a policy stance that risks undermining the very recovery it seeks to protect.

The Recovery That Wasn’t?

The MPR’s headline achievements are undeniable. The current account swung to a $2.1 billion surplus in FY25, remittances hit record levels at $38.3 billion, and the fiscal deficit improved to 5.6% of GDP. These are genuine accomplishments born of coordinated fiscal consolidation and aggressive monetary tightening.

Yet the economic fundamentals reveal a more complex picture. With inflation forecasts anchored in the 5-7% range and growth projected at 3.25-4.25%, the SBP’s 11% policy rate implies real interest rates of 4-7%, well above both natural rate estimates and the bank’s own growth projections. This isn’t prudent monetary policy; it’s economic misalignment that risks choking off the very investment and consumption needed for sustainable recovery. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan