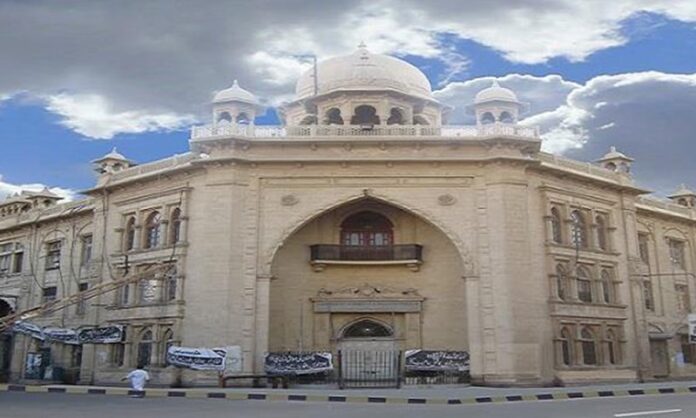

KARACHI: Karachi Chamber of Commerce & Industry (KCCI) President Agha Shahab Ahmed Khan has urged the State Bank of Pakistan (SBP) to bring down the policy rate from 9pc to 4pc in view of the extraordinary circumstances caused by the coronavirus pandemic.

In a letter sent to SBP Governor Dr Reza Baqir, the KCCI president stressed that small reductions in policy rate were not enough to provide the much-needed stimulus to the economy. “Hence, it is necessary to significantly reduce the interest rate in one go to help the businesses sail through this unprecedented crisis.”

He said there was now ample justification for reduction in policy rate, as the inflation rate has declined sharply due to a steep fall in prices of crude oil, commodities and raw materials, while the overall demand has also been suppressed.

The KCCI president appreciated the measures taken by SBP to support the industries and exporters, who were facing liquidity issues due to prolonged lockdowns caused by coronavirus.

Acknowledging that the government, in its ‘industrial package’, had kept interest rates at 4pc and 5pc for filers and non-filers, he said that in view of the special circumstances, the rate of interest should be zero so that the industries could sustain for at least a year.

He stressed that there was a dire need to announce a ‘rescue package’ for small enterprises, which contribute around 40pc to GDP.

“Small entities do not enjoy any credit facility or relationship with banks and have very limited resources. Yet the sector is employing a very large number of skilled and unskilled labourers. Being an important link in the supply chain, it is crucial to support those SMEs that are struggling for survival and are forced to lay off their workers.”

He requested the SBP to disburse loans up to Rs1.5 million among SMEs through commercial banks at zero per cent mark-up rate.

“The banks should only require the CNIC of the owner and verify the address of premises at which business activity is conducted. No collateral should be required by banks and loans may be approved against personal guarantee,” he added.

Highlighting the plight and difficulties of importers, Shahab pointed out that due to the lockdowns and closure of markets, recoveries throughout the entire supply chain have been stopped for over a month. Consequently, the importers have now run out of liquidity and were unable to make payments to the banks to retire import documents and clear imported consignments from the port.

“They are not in a position to pay duties and taxes at import stage. Thousands of import containers are stranded at the port, with importers incurring heavy port charges and demurrage.”

He feared that if the situation persists, many importers would default on their obligations to the banks and would not be able to pay due taxes and duties to the exchequer.

Please forward this suggestion to the relevant department

Dear Team,

We are satisfied with the policies and new initiatives being taken by the government under present crisis of Covid 19 pandemic in Pakistan in order to stabilise and try to boost the economy by helping different sectors of business entities for survival

Intrest rates reduced by 4.25% in one month which is very right and encouraging decision to single digit 9% for boost up of economy.

In this scenario I want to give one suggestion regarding reduction in intrest rates should be kept higher then normal rates for the following categories only as a special case under some fixed limit of amount

Categories.

Senior citizen who are getting income in terms of pension and savings already kept in financial institutions

Non pension citizens depends only on savings by getting intrest on monthly basis by keeping funds in banks and national savings schemes

Please note that persons above in the mentioned categories are not in a position to work further due to age factors criteria in pakistan and they only depend on the interest amount they get on their savings of life kept in banks which is secured by all means

Further reduction in intrest rates in coming time will hit hard on these peoples earnings and will make it difficult to survive

The suggestion is given for some consideration in your policy matter of intrest rates for future decisions

Many thanks and regards

Asif Javed Khan

03365825836

Pakistan Zindabad