Earlier this month, the market was abuzz with talks that Indus Motor Company (IMC), the makers of Toyota Corollas in Pakistan, is replacing its hottest brands Xli and Gli, with new 1300cc variants – a hatchback Yaris and a sedan Vios. However, the company quickly refuted the news, saying it was not making that move, at least not for now.

“We constantly study and plan to secure new and exciting products from Toyota that will further strengthen the existing product slate to provide a wider choice to customers. At the moment there is nothing concrete. When the time comes, the company will share the information,” IMC’s Chief Executive Officer Ali Asghar Jamali told Profit, responding to queries that specifically asked if they completely ruled out discontinuation of these two models.

What we imply from the CEO’s carefully chosen response, and from our own research, is the launch of a new model is rather a question of when, not if – and that seems to be the line taken by everyone at IMC. The company has prepared a study, which is business as usual, but that doesn’t mean it is going to implement it very soon, a senior official had told us in a previous report.

Some of the analysts we spoke to also throw their weight behind the CEO, and why wouldn’t they? After all it’s Corolla 1300cc, a household name in Pakistan and the undisputed leader in the 1300-2000cc category, the most fiercely fought market segment for locally assembled cars.

“For the Vios or Yaris [sold as Vitz in some countries], we do not think that the company would compromise on production of its flagship product (Corolla) while introducing a completely new product line would take two to three years,” said a research analyst, on the condition that he would not to be named.

IMC is working on full capacity since 2015, the analyst said, with delivery time ranging from four to nine months depending on the variant, a clear indication of an excessive demand for its signature car series. Corolla sales will remain strong in the coming months and it will increase it further after debottlenecking of the paint shop in March 2018, he said.

Besides a strong demand for both Xli and Gli, the analyst argued it might not make a business case for IMC to go for such a large expansion. When they launched the new model of Corolla in 2014, it cost them up to Rs7.5 billion, he said, adding, the company will have to consider recovery (payback period) options before going for a long-term bet, which is not an easy decision in Pakistan’s volatile environment.

“Why would you risk your premium product for a completely new model and that, too, when new players are expected to enter the market,” the analyst said, referring to Kia and Hyundai that are already testing their products in the country.

However, Profit’s findings are quite to the contrary.

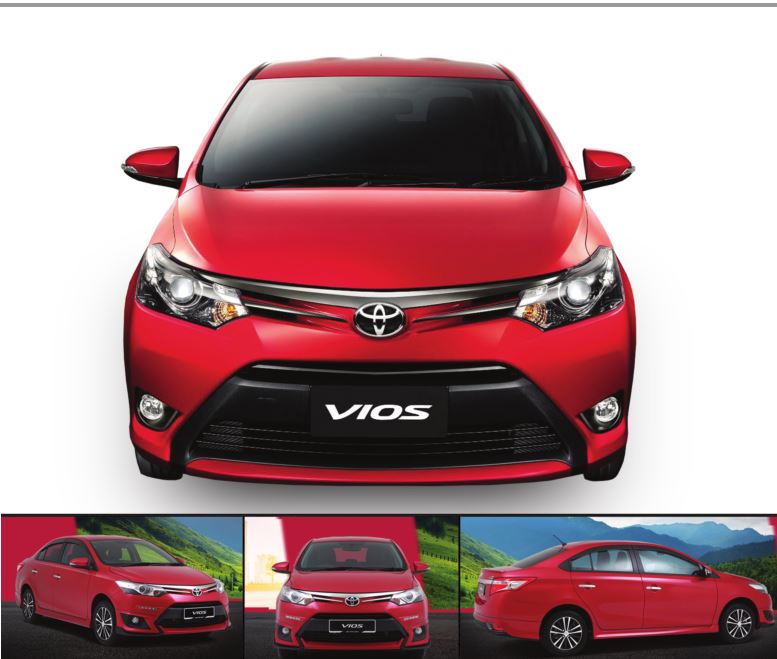

This is not the first time the talks of IMC discontinuing its flagship Corolla Xli and Gli variants made rounds in the market. In December 2014, similar news was published by Pakwheels.com, the largest automobile portal in the country known for its vibrant community of car enthusiasts – and usually the first ones to break auto-related news. The website even published pictures of both Yaris and Vios saying IMC imported these vehicles for test and analysis, a standard practice before launching a new model. The car was shown to select vendors as well. Yaris, the hatchback, will be available in 1300cc while Vios will fill the gap for sedan in the same market segment, the report said. The new models will hit the roads in mid-2017 and old 1300cc variants will discontinue, it said.

There was some substance to the report, as verified by Profit.

The pictures published by Pakwheels.com were of Yaris 1200cc, bearing registration number BCP 405, and Vios 1500cc, bearing registration number BCP 411, which were imported by the IMC in 2014. Both the vehicles are owned by the company, according to Sindh Government’s online vehicle verification portal.

Upon digging further, we learned that the mid-2017 timeline by Pakwheels.com was true at the time. “The Xli and Gli variants had to discontinue this year, according to the decision taken by Japan [global headquarter], which banned 1300cc Corolla following complaints of engine seizures,” an insider told Profit, requesting we don’t identify him because he was not authorized to speak on the subject.

“The production of 1300cc variants were almost halted earlier this year but then the management sought extension from the Japanese to continue procuring Xli and Gli parts till 2018 so they could complete the long queue of existing orders,” said he.

“The Xli and Gli will discontinue in 2018 for sure because Japan has approved only 1600cc for its Corolla range,” the official said. The work on the new variant project has commenced already and IMC’s team has been visiting Thailand for training classes regarding the launch of Vios, a 1000cc sedan, which will hit the market end of next year, he said – and if numbers are any indication, Toyota Japan can’t afford a further delay.

IMC has been producing 240 units a day, but still not being able to meet the pressing demand because of some production constraints – the company website is showing five-month delivery time for Xli and Gli, but market survey shows it’s longer than that, nine months in some cases.

On the other hand, Honda has been increasing its market share in 1300cc and above category, which accounts for 44% of total sales (as of June 30, 2017) of local car manufacturers. Though IMC still holds more than half of that segment as of September 2017, Honda has reduced the gap and may soon threaten the former’s leadership position.

In its last financial year, the company achieved the highest daily production of 180 units, in two shifts, which is almost double of what it was producing the previous year. As a result, Honda increased its share to 43% in 1300cc and above category at the end of July-September quarter, up from 29.4% for the year ending June 2016. During the same period, IMC’s share slipped from a whopping 65.8% to 52.4% while Pak Suzuki maintained their under 5%.

Honda sales in July-September quarter grew by 56% to 12,600 units (including the newly launched BRV) compared to 8,100 units of the corresponding period of last year whereas IMC sales recorded a growth of 5% to 15,100 units (including Fortuner and Revo) against 14.4k units.

The 2017 fiscal was challenging for the manufacturing division amidst a pressing demand to meet production targets, IMC said in its annual report, noting the Company migrated from the legacy SAP system to the state-of-the-art SAP S/4 HANA version, which required slowing down the pace of production. “We also witnessed the innate challenges related to run-out of the first generation Fortuner and 7th generation Hilux. In the last quarter, preparations were made for minor model changes in the Corolla that required the making of new tools for parts and improving the process by addition of safety features in the vehicle. This also resulted in a brief loss in production volume.”

Responding to a question about the latest quarter, Jamali said, “There were several holidays during July-September quarter like Eid and Moharram, which caused reduced production – a usual feature.”

The CEO said, IMC is continuously improving its production capacity. “A multi-billion rupee investment was made in the paint shop to increase production capacity, which is expected to yield results from the last quarter of next year [FY2018]. This will further help in our drive to reduce the delivery period and intensify customer satisfaction,” states the annual report.

The projections of market analysts polled by Profit also point the current trend will persist for another six months.

IMC is working on full capacity and yet may not achieve the same growth as Honda, said one analyst. The Civic is booked through March 2018 while City till December 2017, said another.

“Honda launched its new 10th-generation Civic in mid-2016 when there was no competition from any new model. And that boosted their sales,” said Arsalan Hanif, an investment analyst at Arif Habib Research. “Aggressive sales, timely delivery and new innovation ate into the demand for Corollas,” he added. Corolla’s peak time had by then reduced, as its newest model was launched back in 2015. With no alternate in sight, Honda Civic’s launch was timed to perfection, for it filled the gap,” he said.

Owing to production constraints, IMC could not reach its potential while competition, Honda, gained traction and increased volumes by 44%, the company acknowledged in its annual report but added it has introduced ‘Big Minor Model change in Toyota Corolla’ with the best in class safety and luxury features standardizing Dual SRS Airbags across the entire Corolla range, which will result in considerable benefits for the next fiscal year.

There is discernible hunger in the market for new models, which is always what consumers prefer when going for a new four-wheeler, the analyst said, adding, the Civic euphoria will continue for a while and if City’s demand slows down, Honda will launch its new model, which will jack up its demand again.

“The last three months data is clear indication that Honda has consumed IMC’s market share,” Hanif said. “IMC has not officially notified yet, but the market grapevine suggests the company is planning to replace Corolla Xli and Gli with Yaris or Vios to recapture its market share and contest with the new Honda City, expected to be launched in the first quarter of calendar year 2019,” he added.

“Honda has announced to launch new City model in the first quarter of 2019, but they can launch it any time if the intent was to further dent Corolla’s market,” Hanif said.

Toyota ’s response to competition, a 1000cc Sedan; who should worry more, Honda or Suzuki?

The GDP growth purportedly is the highest in over a decade and is forecast to grow at 6% for the financial year 2017-18 as government is set to go on a spending spree ahead of 2018 general elections, providing further fillip to already high-demand levels.

The automobile market continues to exhibit strong growth and is forecasted to achieve a level of half a million units by the year 2025, according to IMC – the number was 213,000 units in FY17, not counting 59,000 used or refurbished cars landed in the country under various schemes last year – no wonder auto financing soared to 54.3% in total consumer financing (Rs70.5 billion) during the period, thanks in part, to the introduction of new models of passenger cars and increasing popularity of ride-hailing services that played a significant role in its uptick.

It was also in the last couple of years, Pak Suzuki, IMC and Honda booked their highest-ever sales. And analysts predict, they will better their previous best the next year.

However, the market presently lacks choices from local auto-assemblers and demand continues to strip supply, as reflected in all three auto manufacturer’s rather longish waiting lists across almost all brands. Therefore, IMC’s move to launch a 1000cc Sedan next year may cause quite stir in the market, especially for Pak Suzuki, the dominant player in 1000cc segment.

“Given the engine’s significance in determining the price, it seems like Toyota will hit Rs1.5 million price tag,” says Omer Arshad, a blogger at Ecarpak.wordpress.com who also runs a Youtube channel focussed on auto reviews.

Explaining the car enthusiast said with that price range, IMC can target both City’s lowest 1300 cc (manual) model and Swift’s top-of-the-line 1300 cc variant. “If they also launch the auto version, they could also target City’s 1300cc auto variant,” he said. He, however, said the sedan may not affect Suzuki’s hatchbacks market where Cultus and WagonR are the runaway favourites.

The variant under discussion, Vios, Arshad said is a successor of Belta, which was the only Sedan available in 1000cc engine capacity and was internationally discontinued in 2013.

It may be recalled that the test vehicles imported by IMC were Vios 1500cc and Yaris 1200cc but the company, according to our sources, is going for 1000cc – after the outdated Belta, a 1000cc sedan was not available in any of the regional markets we checked. In other words, IMC will be replacing an underpowered 1300cc sedan with yet another underpowered 1000cc sedan, or at least this is how Arshad interprets the move.

Based on weight-to-engine ratio, the sedan in a 1000cc capacity will be underpowered, the analyst said. Asked if IMC is taking a risk by introducing this variant to replace its largest selling brand, Arshad said, it would sell like a hot cake just like the underpowered 1300 cc sedans Xli and Gli because of the brand Toyota. He also disagreed with analysts thinking IMC won’t risk that, saying not a single Toyota car has ever failed in Pakistan – Vitz, Passo and even Cuore, which was produced by its subsidiary Daihatsu.

“We grew up listening agar gadha gari pe bhi Toyota ka logo laga do tu we be bike gi [even if you place a Toyota logo on a donkey-cart, it will sell],” he said. Would it continue to be that way in the months and years to come, it remains to be seen. But one thing is self-evident: Toyota’s leadership in the Pakistani market is not going to wither away just because its competition made some suave moves to dent it for the short term. For, as the vernacular market quip suggests, Toyota for a very large part continues to hold sway over the people’s imagination.

1.0 sedan and 1.3 hatchback….are you sure, one will be underpowered like corolla 1.3 and other will be heavy on fuel like Swift

Toyota is popular of course;

But don’t forget the fact that Pakistani Awam (bechare, aajiz & bebus) don’t have any option else.

All this is because of the “BEGHERAT” Government.

They don’t allow the other investors (other reputed car manufacturers) to enter. Because, the Government officials having their own interests, their commissions, etc.etc.

Arshad (donkey’s cart) is saying such (referred above), due to the facts highlighted above.

Proudness is a very huge sin.

really this model of toyoto is very small & smart, i love it

Toyota has been leader in auto industry due to lack of lack of competitive and pressure government not to allow other car manufactures local in the market.

Toyota has been leader in auto industry due to lack of competitive environment and pressuring government not to allow other car manufactures to setup in local market.

toyota captures mostly uneducated Pakistani segment of society. HO does not focus on Comfort, luxury, and safety. There only focus is Durability (specially suspension), availability of mechanic in every town and village and definitely there subconscious minds which has been resonating with the word of Toyota.

Profit’s investigation is right and makes sense for Toyota to compete more in 1000cc and small car segments rather than just focusing on competing with Honda in Sedan market. The main reason for Honda’s spectacular rise in market share is launch of new shape of Honda Civic in 2016. That model due to its beautiful sporty curvers is a huge hit in Pakistan’s market, where there are very few options as car with that good looks are very expensive. Toyota Corolla cannot compete with Civic’s outstanding shape and hence their numbers are stagnant. So realistic strategy for them is to eat away Suzuki market share as they can easily tap more market share there.

Comments are closed.