ISLAMABAD: Omni group, an industrial, agricultural and service oriented group in Pakistan established in 1999, has claimed that it is being politically victimised trough discriminatory treatment meted out by banks and State Bank of Pakistan regarding rescheduling of loans.

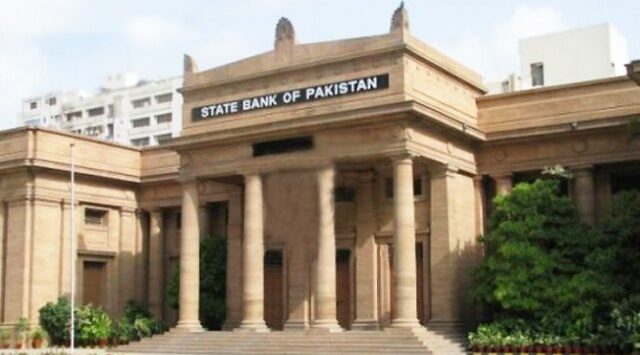

Briefing Senate’ committee on Finance, Revenue, Economic Affairs and Narcotics Control, Omni Group Chief Operating Officer Khawaja Salman claimed that the company was being forcefully declared as classified defaulters by the banks without any justification. “Unlike 25 to 26 other companies, which we have checked, we are separately being treated by the banks and SBP. The rescheduling of loan criteria and mechanism set by SBP should be similar to all firms. Unfortunately, when we approach the banks, we are told that they are bond to follow instruction of SBP,” he said adding that why are other firms who rescheduling their loans not being classified as defaulters.

“We are at the risk of complete shutdown badly affecting around 50,000 people directly or indirectly associated with Omni Group. We are being politically victimised. There must be difference between restructuring and rescheduling of loan,” said Omni Group Barrister Jamshed Malik while briefing the committee. “The banks, as per direction of SBP, ask us to fulfill many things which others are not asked for. Even if the banks are ready for rescheduling loans, they are asked not go far until the demands and criterion are met,” he said.

SBP Deputy Governor Jamil Ahmed, however, rejected the impression saying that criterion set for rescheduling loan, originally made to safeguard the banks, is same for all companies. “We being a national institution treat the banks and borrowers equally,” he said. SBP has not stopped any bank to schedule loans to Omni or other firm. Banks only issue loan on the basis of history of repayment.

His replies however could not convince the members of the committee and Omni Group’s officials. “Why is SBP interfering into matters between banks and their borrowers?” Chairman of the committee Saleem Mandviwalla said. “You know how the word “classified” defaulter is damaging for a growing company, companies collapse by such unwise attitude of banks and SBP,” he added.

As per Khwaja Salman, his company has the liability of Rs 37 billion against Rs 40 billion of assets. Omni Group has paid Rs 15 billion mark up to the government and it has injected Rs 7 billion equity. “The issue is that the banks have frozen our lines by putting us in classified category despite the fact that we have been the best customer for payment of mark ups and instalments of loans. We by investing huge amounts in 1999 have revived many sick units in Sindh providing job opportunities to 12,000 people,” he said adding that the group has never been defaulter.

The committee, later, asked SBP to avoid unjustified attitude towards Omni adding that the central bank should facilitate the firms.

Latter talking to media, Khawaja refuted the impression that Asif Zardari or other political figures have interests in Omni Group. He however those personal relations of people could not be linked with business of the firms.