LAHORE: The dollar lost further ground against the rupee, shaving off Rs0.85 in the inter-bank market on Tuesday to end trading at Rs124.188.

The dollar touched a low of Rs122.4 against the rupee on Monday before ultimately settling at Rs125.0425 at end of trading.

An analyst said, “The rupees continuing ascend against the dollar is unsustainable, considering the bleak situation on the external front and is only a blip in a radar that would resultantly erode after a short period of time.”

However, a statement by the US Secretary of State Michael R. Pompeo on Monday said any potential IMF bailout for Pakistan’s incoming government should not provide funds to pay off Chinese lenders.

This would accentuate fears and roil the already precarious financial challenges facing Pakistan, where sliding foreign exchange reserves, rising twin trade and current account deficits are major challenges for the incoming PTI government.

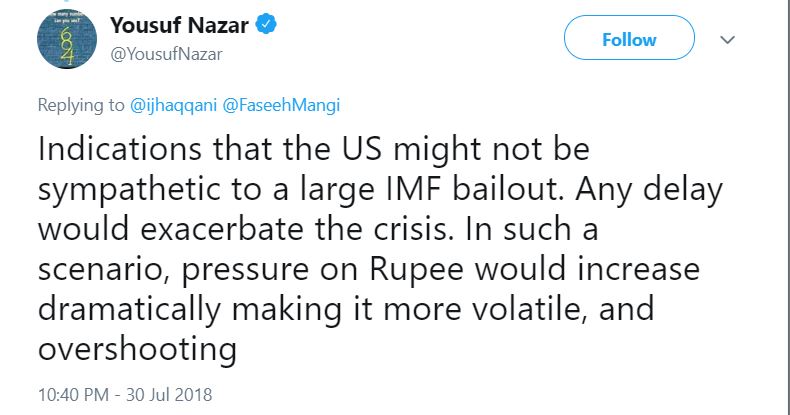

On the currency front, former head of global emerging markets Citigroup Yousuf Nazar in a tweet said:

Furthermore, while talking about the US not being supportive of a large IMF bailout, Nazar stated:

The rally has been supported by the curbs imposed by the State Bank Of Pakistan on the inland movement of foreign currency including the US dollar, which lessened the demand and stoked the supply of the greenback in the kerb market.

Those hoarding dollars in anticipation of a further devaluation went on a selling spree, causing the greenback’s value to nosedive Rs7.6 in the kerb market this past weekend.

As a result, the dollar plunged against the rupee in the inter-bank market on Monday, with the local currency gaining Rs5.86 during trading, touching Rs122 and shedding 4.6 percent of its value.

Also, news of a $2 billion loan sanctioned by China and enabling of $4.5 billion facility by IDB for oil imports for Pakistan over the weekend stimulated the appreciation of the rupee against the dollar since local currency touched an all-time low of Rs130 earlier this month on account of the devaluation a week before the elections.

However, the dollar clawed back to gain Rs3 against the rupee before closing at Rs125.0425 in the inter-bank market on Monday.

While talking to Profit on Monday regarding the sustainability of this policy to let the rupee appreciate against the greenback, Head of Research Arif Habib Limited Samilullah Tariq said,”I don’t think the PKR appreciation is going to continue as this will hurt exports, however, the excessive depreciation will stop as inflows are expected.”

The rupee had closed at Rs127.86 against the greenback in the inter-bank market on Friday.

Pakistan has been facing a crisis on the external front, with burgeoning trade & current account deficits and depleting foreign exchange reserves.

Also, the next government will face a massive challenge of arranging its external financing needs of $11 billion as repayments on maturing bonds become due in existing FY19 to avoid a balance of payment crisis.