—‘Purpose of this scheme is not revenue generation; rather it focuses on documentation of economy’

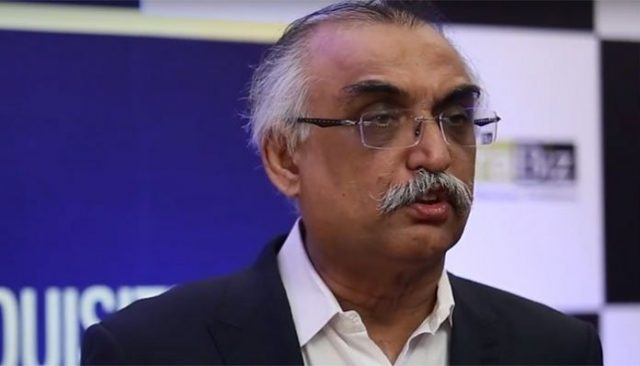

ISLAMABAD: More than 95,000 people have registered their undeclared assets so far with the Federal Board of Revenue (FBR) by availing the Assets Declaration Scheme, the deadline of which is ending on Wednesday, July 3, Federal Board of Revenue (FBR) Chairman Syed Shabbar Ziadi told APP on Tuesday.

“The Asset Declaration Scheme provides a golden chance to the people to declare their undeclared assets by paying a little amount in taxes,” the chairman said.

He was of the view that tax filing was the responsibility of every citizen, as “only this could ensure growth and development of the country”.

He said through new initiatives, the government has been able to eliminate the concept of non-filer in the tax system and henceforth “it would be hard for any citizen to remain out to tax loop now”.

The FBR chairman was optimistic about the success of the Asset Declaration Scheme. However, he clarified that the deadline for the scheme would not be extended further.

“The purpose of this scheme is not revenue generation; rather it focuses more on the documentation of the economy, which is among the top priorities of the incumbent government.”

He said that FBR has already obtained the data of properties and assets of people and the same was also uploaded on the FBR web portal, which could be accessed by any interested person.

Replying to a question regarding reforms in FBR, he said the government wanted institutional reforms in the board and a strategy has already been devised to modernise the functions of FBR.

“We want to change the whole structure of FBR in order to improve the taxation system and to broaden the tax base,” the chairman remarked. “The FBR has introduced reforms in tax law and tax administration by adopting the best international practices in order to enhance its operational capacity. The board also plans to hire experts and consultants in this regard.”

Replying to another question, he said that tax revenue target for the fiscal year 2019-20 was rational and the country’s economy has the potential to generate these revenues.

Ziadi said that automation in FBR was the need of the hour and the government wanted less human inference in the taxation system and more utilization of modern technology, as that would strengthen the board’s transparency and accountability system.

He said that the revenue board was a national institution, having pivotal role in country’s economic development.