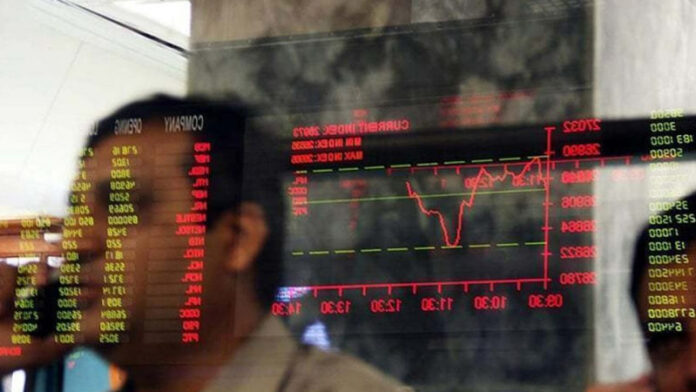

KARACHI: Investors of the Pakistan Stock Exchange (PSX) witnessed a volatile session on Wednesday, with the benchmark KSE-100 Index dropping over 350 points intraday amid profit booking.

Foreign investors remained net sellers on Tuesday, registering a net outflow of $2.94 million.

According to an Arif Habib Ltd report, the market today saw profit booking across the board ahead of Eid holidays and the long weekend.

“Although international crude oil prices remained high overnight, local investors paid little heed to that, given the long gap from Friday till Thursday next, which can cause the underlying prices to move in any direction,” the report stated. “Also, Moody’s notification of considering Pakistani banks for rating downgrade caused a stir among local investors, resulting in the negative price performance of the banking sector.”

The KSE-100 Index started the day on a positive note, gaining 65.60 points to touch its intraday high at 34,224.15. However, the index failed to maintain its flight and slipped 371.59 points to mark its intraday low at 33,786.96. It finally closed lower by 225.74 points at 33,932.81.

Among other indices, the KMI-30 Index plunged 549.42 points to end at 55,296.00 while the KSE All Share Index dropped 107.34 points, settling at 24,370.17. The advancers to decliners ratio stood at 114 to 183.

The overall market volumes shrunk from 247.63 million shares in the last session to 165.09 million shares. Average traded value followed suit, declining from $65.3 million to $42.7 million (-35pc). Hum Network Limited (HUMNL -9.43pc), Hascol Petroleum Limited (HASCOL -1.99pc) and TRG Pakistan Limited (TRG -2.32pc) topped the volume chart, exchanging 11.72 million, 11.30 million and 9.50 million shares, respectively.

Sectors that drove the benchmark index south included oil & gas exploration (-73.81 points), fertilizer (-65.95 points) and banking (-42.87 points). Among the companies, Engro Corporation Limited (ENGRO -28.81 points), Fauji Fertilizer Company Limited (FFC -28.09 points) and Pak Petroleum Limited (PPL -27.77 points) dented the index the most.

The pharmaceutical sector lost 2.26pc in its cumulative market capitalization, with Searle Company Limited (SEARL -3.81pc), GlaxoSmithKline Consumer Healthcare Limited (GSKCH -2.52pc), Ferozsons Laboratories Limited (FEROZ -7.50pc) and AGP Limited (AGP -4.49pc) closing in the red.

Meanwhile, Shell Pakistan Limited (SHEL -1.52pc) announced its financial performance for the first quarter of FY20. The company’s gross profit margin fell from 7pc to 1pc, whereas it registered a net loss of Rs4.33 billion. The company’s earnings per share fell from Rs2.40 last year to Rs-40.49.