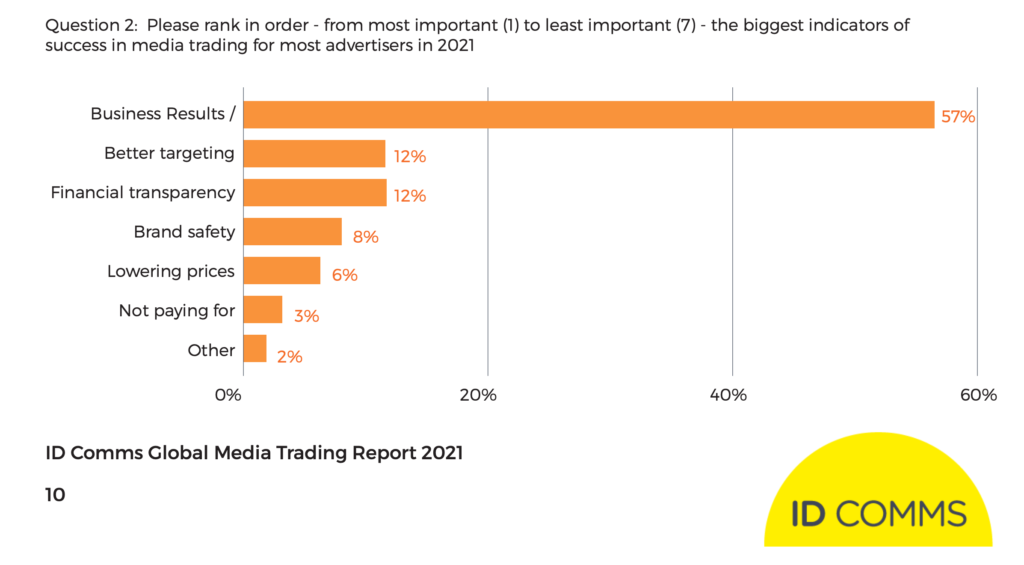

For advertisers with advanced mindsets, the quest to race to the bottom on media pricing is over and leaders in procurement teams have agreed to shift away from commoditizing media, preferring quality media. No, this isn’t from an alternative timeline, it’s just what the latest Global Trading Survey for 2021 by ID Comms claims, which suggests a dramatic shift in favour of quality buys over commodity buys in the three years since the survey was last conducted.

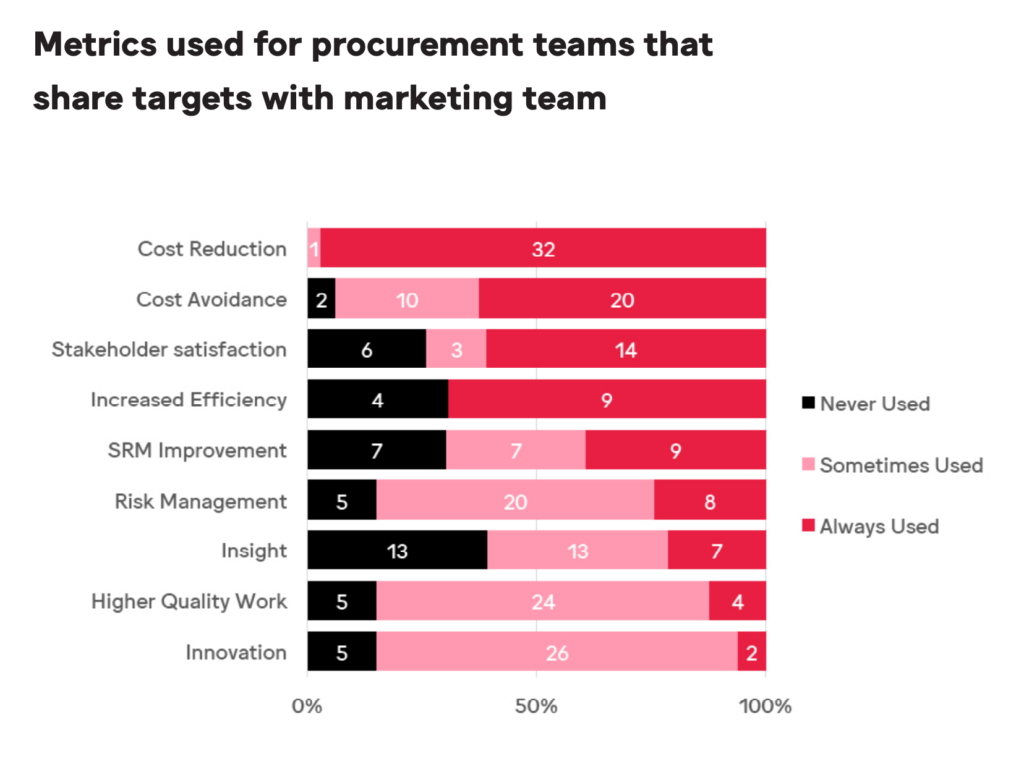

The outcome of the ID Comms research comes mere months after the World Federation of Advertisers published an ultimate guide for value-based procurement as part of its Project Spring initiative, which intends to evolve perceptions in order to bring out a revolution in marketing procurement. The initiative requires that marketers change the way procurement works with its stakeholders by evolving to procurement processes, building new performance KPIs beyond just savings, and involving external partners to ensure a true perspective.

“Media is this intangible commodity where in theory somebody can also supply it cheaper than the next person,” said Tom Denford, CEO of ID Comms Group. “Because you are procuring media inventory impressions from a third party – typically through a media agency – and they are buying them from somebody else. Media agencies are using their nouse, leverage, or skills to constantly negotiate better prices. As soon as those prices get a bit difficult to deliver then, of course, the quality of media impressions then starts to erode.”

Quoting Seth Godin, Denford said that in the race to the bottom no one wins, with advertisers seeing weaker commercial outcomes against cheap media buys, which further erodes the perspective that media inventory is an essential asset for driving commercial outcomes – which can be improved through quality media buys. By agreeing to the race to the bottom, even the media agency loses ultimately due to commoditization which only makes winning new clients or retaining existing clients even more difficult.

“The pressure on lower and lower prices arguably has caused the amazing flourishing success of fraudulent or counterfeit advertising,” said Denford. “So when things become impossible to deliver for the price, you then tend to get fake versions of that thing and so historically the marketers or the advertisers’ obsession with lowering the cost of media, making it a commodity, has actually resulted in a gigantic, fraudulent, counterfeit, impression industry.”

Much like how Muslim Pro sold user data to any willing buyer – even the US Army – because the app was free, advertisers who choose to view media as a commodity or choose to take advantage of their media agency by paying a low retainer or expect a low agency commission will, in turn, become the product. In contrast, the Daily Muslim app by YouTube sensation The Meaning of Islam is a subscription-based habit-forming product that charges the user, hence does not sell user data to third parties. In doing so, the app is the product, not the user.

By not paying for the actual skill set at a media agency, advertisers in Pakistan are willfully setting themselves up for failure and the erosion of brand equity. The latter of which is more troubling and the pandemic ought to have imprinted the message that inelastic demand will remain for brands that have built a reputation around precision and consistency, even in media.

Every technology-first company in the world – where agile mindsets thrive and the culture thrives on optimization with continuous innovation – is a testament to this best practice.

“Why should we evolve?” – everyone in Pakistan

In Pakistan however, nothing much has changed. In the four years, this scribe has been covering the media & advertising industry of Pakistan, one of the most common questions from readers is this: why is the media market in Pakistan the way that it is? For nearly four years, the answer has been more or less the same: everyone knows exactly what they are doing and if something looks off rest assured that they are all in on it.

“Whether it be a creative, media, or digital review, in the beginning, both marketers and procurement executives talk a big game about strategy and innovation, but when you’re in the final stages of the selection process, the reverse auction comes out,” said a seasoned media leader with one of the large network agencies in Pakistan. “This practice – led by marketing and procurement executives – encourages participating advertising agencies to undercut each other.”

In Pakistan, by and large, advertising is viewed as a cost and not as an investment. This is the root of the problem, piled on by marketing professors at leading universities who lack an iota of practical working experience in demand generation, coupled with glorified dinosaurs in the boardroom who declare ‘this is how we have always done things’ as if this is a mindset one ought to be proud of. There are companies in the world, led by agile mindsets that break old ways of work for new ways of doing things, and those companies on their own are worth more than every company in Pakistan combined.

At the start of the 20th century, the media industry in Pakistan experienced exponential growth, which made room for specialized outlets offering media planning services. These media agencies are expected to help clients reach the right audience and for marketers that have no performance targets tied to commercial outcomes, this means selecting a media agency based on the lowest pricing possible.

Whether it be NutriCo Morinaga moving its $2.5m media account to Starcom, Reckitt Benckiser (RB) moving its $7.5m media account to Blitz Advertising, or Packages Limited moving its $1.5m media account to Brainchild Communications Pakistan, sources across the board told Profit that the race to the bottom played a role in determining the winning agency. When the decision-maker on the client side chooses the deal where a media agency seemingly makes no money, he will be played behind the scenes whether his Big Four auditor figures it out or not.

For the media industry in Pakistan, one of the silver linings for the disparity and lack of incentive alignment between the Pakistan Broadcasters Association (PBA) and the Pakistan Advertisers Society is that no attempts have been made to fund a media transparency study, akin to the 2016 report produced by K2 Intelligence for The Association of National Advertisers.

In the specific context of media buying, non-transparent business practice is one in which an advertiser does not have full access to the information necessary to assess the value of media purchase and the associated margin. Illustrative and non-comprehensive examples include:

Existence of incentives such as discounts or rebates offered by suppliers to agencies to buy certain media even if other media have high-quality inventory or better rates

- Whether or how an advertiser benefits from these incentives, should they exist

- Whether the agency or holding company incentivizes its media planners or media buyers to purchase certain media eg if the agency is also a reseller for Google or Facebook

- The underlying cost of media and the agency margin, which is usually 15%

- The existence of and degree of any markup on non-media costs

- The existence of commercial arrangements or partnerships with media suppliers that have the potential to influence media buying choices, such as upfronts,

- The quality of the media and all relevant information about the audience it is meant to target.

Given the state of the media industry in Pakistan, a similar study conducted by either PAS or the Marketing Association of Pakistan (MAP) may have concluded that there are numerous opaque or non-transparent business practices taking place regularly, often with the full working knowledge of the marketer on the client side who is in on it. This includes cash rebates to media agencies, which unsurprisingly find their way to clients in one form or another, such as rigging a lucky prize draw for a car or admitting the clients’ children in a prestigious grammar school.

The root cause behind the commoditization of advertising services

“In all honesty, this is a Pakistan problem – anybody sitting on a powerful position or in any capacity of power – they will treat their most vilified as the subservient one. Because that will give them a different hard-on about their power position and that can be any gender,” said Syed Yawar Iqbal, executive creative director at JWT Grey, during an interview with advertising industry pundit Ad Mad Dude. “I have known ABMs who were in a position of power to make decisions and they will just go against you because they have the power. It’s not just the seth, it’s your biggest multinational, your biggest telcos – they are so cocky because they know this is a short stint. In that short stint, they have to embrace the power, find the next possible gig, make enough khaancha from out of home, below the line, hoarding, talent – anything to make as much money as possible, otherwise how else will they drive an Audi?”

This mindset culminates in a situation where advertisers not only want the lowest possible price to reach audiences – without evaluating the quality of the reach itself – but also want the media agencies bidding for its business to play a lose-lose auction to see which media agency will charge the lowest media commission, which ranges between 3% and 15% depending on who you ask. To play devil’s advocate, if a media agency has to accept a 3% commission for an assigned budget – which barely covers salaries – it will then close back door deals with media owners – including digital, print, out-of-home, and television – to make ends meet.

The advertiser and his quest for the lowest possible pricing – without considering the quality of audience reached – are to blame. Not to mention supporting news or entertainment channels which air questionable content that may break all the rules of brand safety while fueling toxic mindsets and extremist behavior.

Even without a regulator or an industry body conducting a study to determine the extent to which the media ad buying ecosystem is nontransparent, advertisers have always had the option to conduct media audits on their own dime. When an advertiser is complicit in the less than ethical actions of his client, media audits are avoided.

In some cases, to appease procurement or compliance teams, media audits are conducted but at the expense of the media agency being investigated, which gets to pick its auditor, often one of the Big Four firms – which have no experience in media fraud. When the auditor is picked by and paid for by the media agency, guess what the auditors are incentivized to do if they find any discrepancies? If you guessed ‘make the discrepancies go away’, yeh water cooler aap ka hua.

As such, when both the demand side and the supply side of the media ad buying ecosystem are relaxed about the state of affairs, there is no room for improvement while plenty of blame to go around. And this is why, when either side is caught red-handed, not only is no one surprised by the allegations but everyone wonders what the actual reasons are behind the apprehension since they are all doing the exact same practices as the accused.

Action Plan

The need to build a transparent media supply chain across viewability, measurement, ad fraud, transparency, and harmful content is ever-present, with a need for leaders at MAP, the PBA, PEMRA, and PAS needing to come together and create tangible change while ending the decades of lip service around making marketers a positive economic and social force.

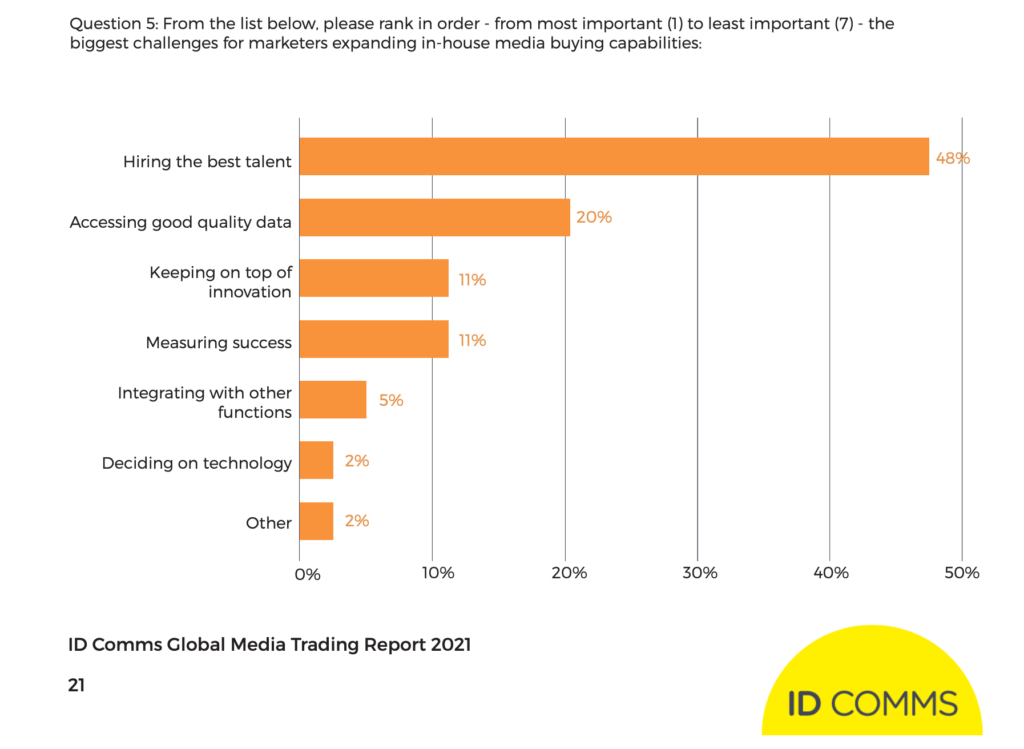

Learning from 15 ways white-collar criminals are fleecing advertisers in Pakistan report by Profit and the outcomes of the K2 report, it should be reiterated that advertisers’ efforts to drive down agency fees are a reason why media agencies are seeking additional sources of revenue beyond commissions. This needs to change as does the upskilling of marketers to understand the increasing complexity of the media-buying landscape, which was a key talking point during a Media Buoyz panel discussion featuring media leads of Nestle and RB.

In addition, the path forward is one where the media audit is normalized given that the outcome of such activity often results in insights on media optimization which in turn improves the returns on investment pertaining to media. For more advertisers, the sum of money spent on airtime is the single largest purchase on their list and a media audit can help them optimize the cost or efficiency of their media agency.

These checks and balances go a long way for all stakeholders in the industry due to media audits seeking to understand the procedures being adopted by the agency, including whether outcomes line up with or exceed those defined in the contract. When a target has been exceeded, the benchmark and subsequent goal post need also be readjusted, which only challenges planners to declutter the brand presence across each stage of the buyer decision journey.

As evidenced by a recent episode of Media Buoyz regarding the top media auditor in Pakistan, whenever marketers and their media agencies hear the word audit they assume it’s an accountability exercise under the International Financial Reporting Standards (IFRS) and we all know how much Pakistanis yearn for accountability.

For those unaware, the media audit is merely a basic practice that seeks to assess whether the processes and practices are in compliance with the media contract which is signed between the agency and the client.

Verifying the utility of each and every rupee spent on a campaign according to the predetermined KPIs in the contract, the media audit is a specialized function, the increased frequency of which can avoid – in the case of government-led projects – millions of rupees loss to the national exchequer. What will you choose, prevention or cure?

Interesting article and read, just want to share a few insights from my end as well

https://courtingthelaw.com/2016/05/18/commentary/digital-supply-chain-copyrights-patents-and-the-legal-implication/