Over the past couple of years, there has been a visible change in the feminine hygiene products category in Pakistan. For nearly three decades, Procter and Gamble’s global brand of sanitary napkins, ‘Always’ has reigned supreme. With its huge marketing budgets, widespread availability, and global reputation, Always is considered a heritage brand by many Pakistani consumers and strong brand loyalty to the market leader has meant that women don’t switch easily, or if they do, it is based on personal recommendation.

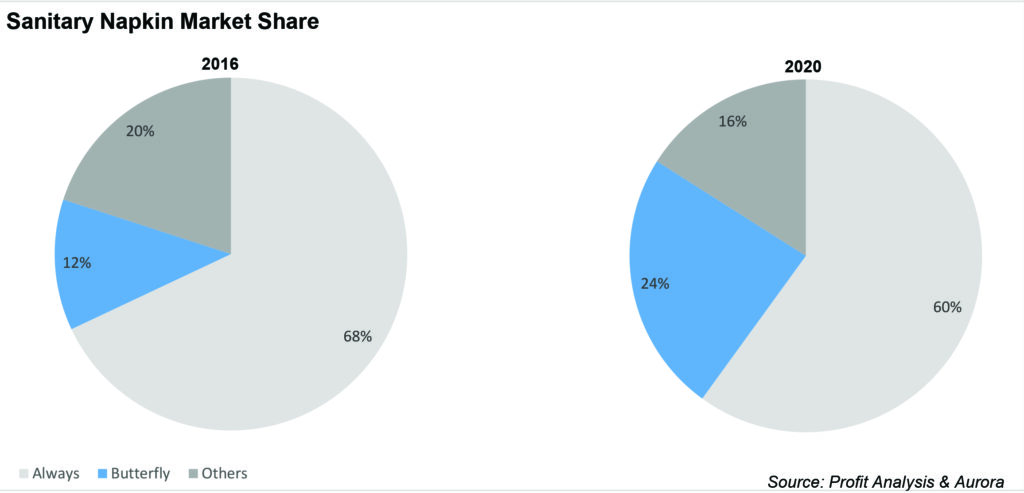

Despite the odds, however, Butterfly, the decades-old local brand of sanitary napkins owned by Santex, is making a comeback. According to an article published in the January-February 2016 issue of Aurora, Always had 68% of the market share while Butterfly was at 12%. But according to new information available with Profit, Always now accounts for 60% of the value share while Butterfly stands at 24% of this Rs 13 billion sanitary napkins category (Source: Foresight Consumer Panel Data, 2020) with smaller players like Trust and other international and local brands making up the rest of the category.

Butterfly was launched by Santex in 1983 and was a pioneer in the category with several innovations to its name. However, with the launch of Always in the mid-1990s and as a result of taking its eye off the ball in terms of marketing and distribution, Butterfly suffered significant losses. The recent revival of the brand is a testament to the parent company’s continued commitment to innovation and quality, along with a renewed focus on digital and traditional marketing. Dione Rodrigues-Almeida, Marketing Manager at Santex, is at the forefront of this shift; Profit sat down with her to understand how Butterfly is changing the game in the sanitary napkins category.

A comeback after decades

“Our vision is to be the brand that is in every second woman’s handbag,” says Almeida. When she joined Santex in mid-2018, the company had already undergone a change in leadership a few years earlier with a young, second generation director coming on-board. Talha Rahman, the current managing partner is a nephew of the first generation of owners and his initiation into the company in 2009 saw an overhaul of the product line.

Prior to this, Butterfly’s product line mainly consisted of straight, stick-on pads without wings which the company launched in 1983. Over time this product was transitioned to a brand called Mother Comforts meant to target a cross section of society, and a Value Range with wings, ultra thin and big saver pads was also introduced, however a conspicuous lack of marketing, deficiencies in the distribution strategy, and Always’ ubiquity meant that consumers were not necessarily aware of these changes or even interested in the brand.

When Rahman came on board, he realized that despite the onslaught from Always, continued innovation was still Butterfly’s cornerstone and this led to the launch of the Butterfly Breathables premium range of sanitary napkins in 2014.

“Breathable pads have a microscopic backsheet which promotes breathability and helps prevent odour, rash, and bacteria buildup,” explains Almeida. Butterfly was the first, and to date remains the only brand to launch this innovation in the country and while Always has a similar breathable product in other markets, it has yet to bring it to Pakistan.

Armed with the USP of being the first and only product of its kind in Pakistan, Almeida and her team used the Breathables range as the launchpad to regain a foothold in the market. But before any marketing was undertaken, the first step was to make the Butterfly Breathables available to the customer through ecommerce.

Marketing change up

Selling via e-commerce was a logical first step because Breathables targets young women between the ages of 18-35 from socio-economic segments A and B. But there was more to it than just that. “Butterfly wanted to start getting a piece of the pie from Always, so we had to start hitting the Always consumer in whatever way we could and the best way to do that was through digital,” says Almeida.

Instead of relying solely on third party ecommerce websites, Butterfly also decided to start its own dot com. The first six months were slow but as Covid-19 lockdowns began, people increasingly turned to ecommerce for their shopping needs and brands were clamoring to set up an online presence. Butterfly Breathables was ahead of the game… it really was a case of being in the right place at the right time. Eventually the company also decided to add its Value and Mother Comforts range to the ecommerce portal.

While there was a significant uptake in online sales and this touchpoint continues to grow, Almeida admits that it only accounts for 1% of overall sales and therefore it was essential to overhaul the distribution strategy on the ground. To this end, she explains, “To attain large scale reach we revamped our traditional sales and distribution strategy nationwide. We also focused on a modern trade strategy whereby our in-store placements and product range have improved our share of shelf.”

Alongside these efforts, the brand decided to get maximum mileage from its limited marketing resources by “creating noise about the breathability aspect” of the premium range with the launch of the Let’s Talk campaign. A DVC with a doctor doing a ‘breathability’ test on the product got plenty of likes but no comments or discussion was forthcoming, highlighting the fact that in a conservative society like Pakistan, women were not comfortable talking about menstruation and sanitary products openly. The brand then targeted female influencers on Instagram and on Facebook and got them to post on closed women’s only groups like Soul Sisters and others and the comments, says Almeida were, “eye-opening. We saw what the issues were and what women were going through.”

As luck or serendipity would have it, Butterfly’s efforts were going to pay off in a totally different and unexpected way. In late 2019, certain posts started doing the rounds on closed women’s groups that Always pads, despite claims of quality, caused serious rashes. This wasn’t just a local concern; allegations that Always Maxi Pads cause contact dermatitis were also making international headlines, especially in Africa. (P&G did not respond to repeated requests for comment.) As more and more women gave firsthand accounts of their experiences, Butterfly used the unforeseen but tailor-made opportunity to promote Breathables and build further on the Let’s Talk campaign.

Consumer specific challenges

Butterfly’s strategy of marketing Breathables helped to put the brand back on the map as a serious contender in the feminine care category. Apart from generating interest and talkability, it has also helped the brand improve its market share. However, Pakistani consumers present their own unique set of challenges that Butterfly had to contend with.

Many Pakistan women, even those in the large cities, use branded sanitary napkins in conjunction with homemade cloth pads, and even though brand penetration is high overall, the category is witnessing only single digit growth each year. Collectively, these factors imply that Butterfly not only has to supply consumers with a great experience so they will consider switching brands, but also has to continually invest in awareness and education activities to convert cloth consumers to pads.

Efforts are already underway to this end through what Almeida calls the company’s ‘outreach program’. As part of this program, Butterfly is working with social development organizations and schools to talk to women and girls across socio-economic classes about good period hygiene, period related myths, and explaining how women can talk to their daughters about menstruation. The ultimate goal of these activities is to convert women to Butterfly pads and here Almeida feels that the brand has a huge advantage because “we have a value proposition for every consumer across the different SECs, which means we can target them based on their needs with a lower priced product or a premium one.”

With more international brands such as Sincere by Ontex and others officially entering the Pakistani feminine care market, Butterfly will need to be more focused than ever to achieve its vision. Almeida is cognizant of this saying the idea is to “delve further into the category and gain greater market share.” Although the brand has massively relied on very functional communication to achieve this so far, last year a new TVC, DVC and radio campaign called ‘Butterfly Hero’ was launched depicting women helping each other in stressful period situations. The campaign was based on the insight that conservative Pakistani consumers do not want to see a pad in a TVC or other communication especially when they are sitting with their fathers and brothers and therefore the brand decided to create a story around a situation that most women will identify with.

Although the path to becoming ‘the pad in every other woman’s handbag’ is a long one, there is evidence, according to Almeida, that the market leader has noticed Butterfly’s initiatives. “We have had a lot of firsts in digital – first in this category to do blogger campaigns, the first to have a dot com, and the first brand to use the word, ‘period’ – and we have noticed that they started re-activating their Daraz store and started an Instagram account after this.” Whether these moves are a response to Butterfly’s marketing or simply an attempt to stay relevant to changing consumer needs, ultimately, as Almeida puts it, “it is healthy to have competition, it builds up the category.”

If You talk about there Sales Department.they Said to there workers that Company can’t afford your Expenses.LOL 😂😂😂😂😂😂😂