You must have seen it on the roads. A massive multi-purpose-vehicle (MPV) with a sleek design. The KIA Carnival is a car that fits more categories than it should. The 11 seater monster is essentially a van – not even a soccer-mom minivan but simply a large car meant to transport around a dozen people. Except its front facelift and interior give it the look of a cushy SUV.

The car defies odds and expectations in terms of design. With this one car, KIA has taken aim at a number of different categories of buyers, including families, up-market consumers, and commercial vehicles.

However, what makes the case of the Carnival interesting is not its design or utility – but its pricing, and the way that pricing works. For a completely-built-up (CBU) car, in terms of features provided, it is incomparable in pricing to other ‘luxury’ CBUs. This is all thanks to the way Pakistan’s customs are levied, and perhaps the greatest ingenuity in the automotive industry.

The current Carnival also builds upon its predecessor of having the title of being one of the very few CBUs that could be imported in the midst of the national import ban. To add to its accolades, it was also one of the very few CBUs to have continuously dodge an incumbent government bent on stamping duties on cars. Albeit, neither of the two were due to its own doing but a stroke of sheer luck. Talk about living on a prayer.

What are we on about here? Well let’s start off with the most interesting bit.

The KIA Carnival’s tryst with customs

The crux of the matter relates to how Pakistan’s customs are levied on CBUs. The KIA Carnival has managed to play four-dimensional space chess whilst the rest of the industry was busy playing checkers.

But first, what exactly is a CBU? Well, cars in Pakistan are normally of two varieties; completely-built-up (CBU) units and completely-knocked-down (CKD) ones. The latter are cars that are assembled in Pakistan whereas the latter are imported entirely from abroad. Needless to say, the State incentivizes companies to focus on the latter rather than the former.

How does the government incentivise this? Duties. Customs duties, regulatory duties, federal excise duty, income tax, sales tax. Let’s just say, if they could, they’d ban the import of CBUs altogether. Which they did actually. Our protagonist, however, managed to escape to come out relatively unscatherd. We’ll get to this as well.

Why does the State do this? To conserve forex, promote industrialisation, technology transfer, and a myriad of other reasons. However, there are times when companies simply cannot build some cars in Pakistan. In such situations it is relatively easier to just import the car and sell it with the duties attached if the company believes that there is enough demand for the car.

From a company perspective, what’s important here is that automobile importers have had to perform portfolio gymnastics to understand how to curate their ideal CBU basket to balance duties and price. Until Lucky Motors cracked the code that is.

You see, Pakistan Customs employs a two-round structure to levy duties as they are dependent upon whether an automobile has a combustion engine, is a hybrid electric vehicle (HEV), or an electric vehicle (EV). This much is perhaps common knowledge given Pakistan’s enduring love for the Toyota Prado, and our shopping sprees for the Prius and E-Tron in the past respectively.

However, most of us miss one of the categories within the combustible engines section: commercial vehicles.

Now this may sound odd at first glance as to why we are equating the sleek KIA Carnival with something that we may associate normally with, say e.g. a Suzuki Bolan known as carry dabbas in our vernacular. The interesting part about this is that the KIA Carnival, or at least the one available in Pakistan, has a higher seating capacity than the Bolan and this is where Lucky Motors have worked their magic.

There are two categories of commercial vehicles per Pakistan’s Customs Code; motor vehicles for the transport of goods and motor vehicles for the transport of ten or more passengers, including the driver. Guess how many the Carnival has? 11.

It is this particular nuance that allows the KIA Carnival to be subject to the lowest total tax incidence within the combustible engines section, and overall amongst all CBUs.

The story doesn’t just end there. Imports have been a hot topic for anyone following the economic turmoil over the past few months. The incumbent government, bent on stamping out imports to ‘fix’ the economy, banned imports outright in May. Imported cars in particular took the fall for being one of the major reasons for why Pakistan suffers from chronic balance of payments issues. German automotive companies even complained that the ban would strain bi-lateral relations between Pakistan and the European Union. Talk about not holding back.

But whilst companies and private dealers bemoaned the ban, everyone forgot to properly read the list of banned cars. The government had not included commercial vehicles in the list of banned cars. Now they, like most others, must have thought of the carry dabba or even the local pick-up trucks when they put the ban in-effect and not the KIA Carnival.

Talk about dodging a bullet. But as they say, when it rains, it pours. The Government revoked the import with Miftah Ismail saying “So, the choice is simple; we either use that money to buy cars or wheat. That we buy mobile phones or grain, or home appliances, microwaves and air conditioners as opposed to edible oil.” Furthermore, Ismail stated that he would levy the “maximum amount of permissible regulatory duties.” However, at this point, you’d think someone might have actually visited a KIA showroom. We say this because the Carnival escaped this as well.

Let’s take a breather and catch up. We’ll need it. To summarise, the government imposed an import ban that was not applicable on commercial vehicles which is the customs category for the KIA Carnival so it was never banned. The Government then revoked the ban with a sweeping set of duties to discourage the purchase of CBUs. What were the duties?

Well, the FBR issued two notifications. The first one slapped a 100% regulatory duty on all luxury vehicles whereas the second one slapped an additional 35% customs duty of 35% for luxury vehicles. Now, what did the government define as a luxury vehicle? Well, everything above 1000cc. Our protagonist comes in at a nice 3,470cc.

We’ll give this to the government. They came close. They slapped a flat 7% additional customs duty as a sweeping measure across vehicles. However, where they missed again was Carnival’s variety of commercial vehicles. The Carnival sits at a 6% regulatory duty that the government levied back in June, and then completely forgot about the category.

These episodes of luck are a movie on their own. However, what they realistically translate into is a much significantly more affordable vehicle than would otherwise be possible.

How much would the Carnival cost otherwise?

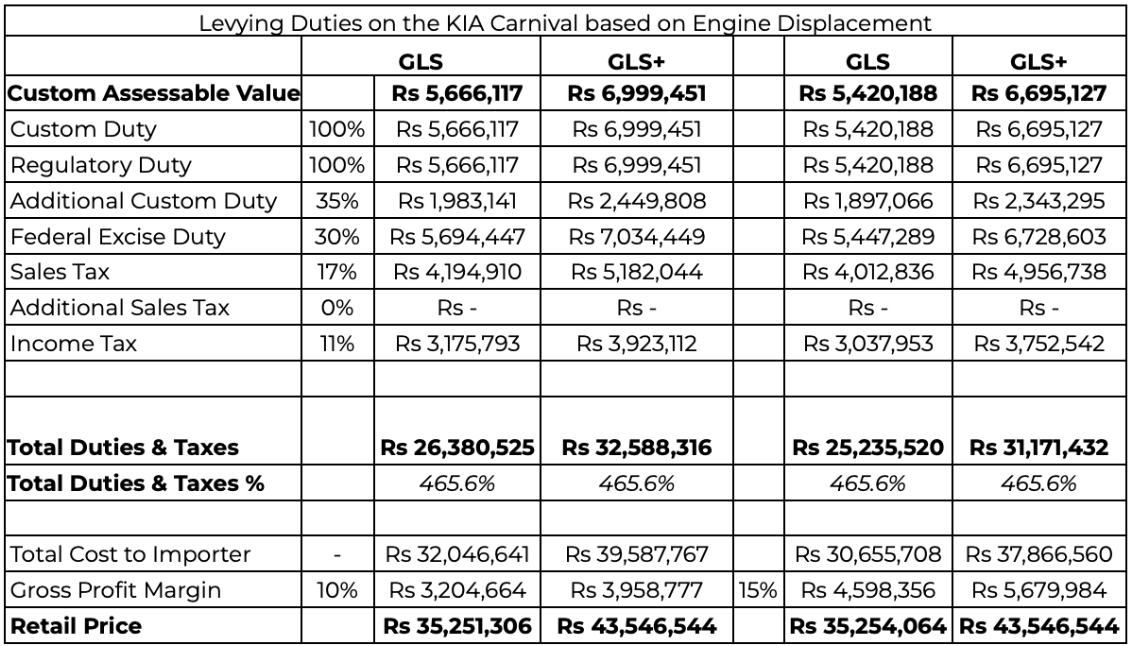

What would be the price of a KIA Carnival if it ditched the last row of seats and was levied duties based on its engine displacement?

Profit looked at the Pakistan’s Customs’ Code and the Federal Bureau of Revenue’s (FBR) WeBOC platform to understand the mathematics behind the KIA Carnival’s escapades.

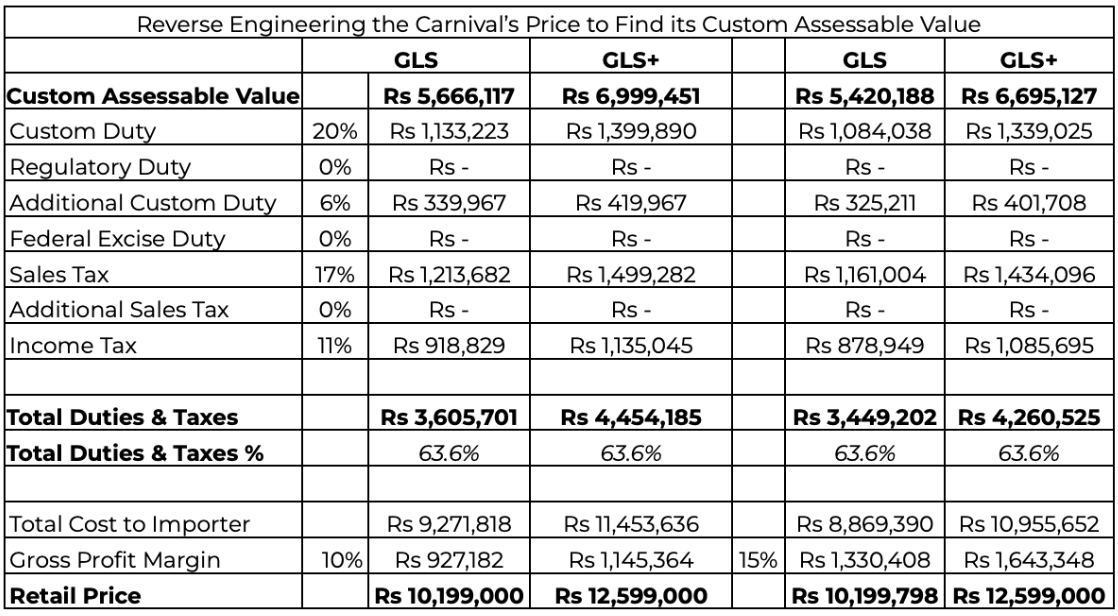

Profit reversed engineered the prices of the GLS and GLS+ variants to understand the mathematics behind the KIA Carnival’s escapades. The GLS and GLS+ Variants retail for Rs 10.2 million and Rs 12.6 million respectively. Profit incorporated a gross profit margin of 10-15% when doing the maths. We chose the specific values for the range because we had been told earlier by Muhammad Faisal, President of the Automotible Division at Lucky Motors, that 15% was a hefty margin. However, at the same time, we had been told by another industry executive that 15% was the margin that automotive assemblers aimed for.

In looking at the duties levied we utilised the Pakistan’s Customs’ Code and the Federal Bureau of Revenue’s (FBR) WeBOC platform. Profit found that the customs assessable value of the GLS could range from Rs 5.4 million to Rs 5.67 million depending upon the profit margin. Whereas the GLS+ ranged from Rs 6.7 million to Rs 7 million.

What is the customs assessable value? This is the price of the car that is declared for the KIA Carnival, or any car for that matter, at the port after which Pakistan Customs levies duties.

After obtaining the custom assessable value, we then levied the duties that are applicable on cars that have engine displacements exceeding 3000cc. This has a 3500cc engine for context, but we’ll get to that later. Levying the new duties increases the total incident of taxation on the KIA Carnival from 63.6 to 465.6%.

The prices for the GLS and GLS+ would be Rs 35 million and Rs 43 million respectively, if duties were levied upon its engine displacement and not its seats.

The difference, as you can see, is not just big. It’s huge. Lucky Motors have perhaps pulled the jugaar of ages with the KIA Carnival. Now none of this is illegal. It’s just smart business and Lucky Motors were able to pull this off, where others failed, because they had tested the waters with Carnival’s previous iteration.

The only thing different this time around is that, whereas the previous (Grand) Carnival was perhaps simply a utilitarian vehicle. The Carnival is now an MPV in SUV clothing.

Welcome to the Carnival

In 2018 KIA was trying to make its third entry into Pakistan – this time with Lucky Cement. This time, however, they came in with a blitzkrieg strategy of flooding the market with affordable cars. What was the first car they brought in? The Grand Carnival. It was a CBU that came with an extensive feature list, a seating capacity of 11, a 3,300cc engine, and an entry price of PKR 3.99 million.

Though derided by some as highly unfashionable, it was the Swiss army knife of vehicles. It was a people hauler, cargo carrier, mobile campsite, and could even improvise as a work vehicle for when a utility van was unavailable. It also drove more like a car than it’s SUV and pickup segment counterparts, making it easier for some drivers to live with.

“The Carnival was a good decision because of the improvements in road infrastructure. We saw a lot of people avoid air travel during Covid and a lot of people with larger families preferred using the Carnival instead for inter-city travel. Many were buying the Carnival because of its comfort, its luxury, and its capacity,” recounted Faisal when asked about the Grand Carnival.

Faisal’s statement about the Grand Carnival’s success is likely to be true as Lucky Motors introduced its successors, and our protagonist, the Carnival in 2021. The update was in line with KIA international introducing the fourth generation of the line. The new automobile brought with it a host of features that may have enticed Lucky Motors to import the unit directly as a CBU. These meticulous updates included an SUV-esque redesign, 3,470cc engine, cooled seats (foresight given our current heatwave), and a host of other features.

“The Carnival is a product for mass commute. It is a different category. It’s not like a Landcruiser, Prado, Audi, or BMW.” said Faisal. Notwithstanding the utilitarian nature of the KIA Carnival as a commercial vehicle – it probably is used by many for the intended purpose – the Carnival is more comparable to the aforementioned competitors than Lucky Motors would like to admit.

Let’s take the example of Prado and the Toyota Fortuner. The Carnival is wider, longer, has greater seating capacity, and even has worse mileage that is comparable to a certain elder sibling of the Toyota SUVs. Hint, it’s the Landcruiser. For all intents and purposes, it allows customers to feel like a Chaudhry Sb without breaking the bank like one.

The thing is that it’s not just Lucky Motors that thought they could take aim at the SUV segment with the Carnival; KIA Motors International thought so as well. The Carnival comes in various more premium configurations such as e.g. a 6 seat variant. These more premium models have had some success globally with a popular subculture for premium MPVs.

However, understanding the pricing elucidates upon both the ingenuity of Lucky Motors and their constraints. It’s almost as if they are suffering from success with this move. They too know that they may never be able to import the other variants of the KIA Carnival that may benefit from the 11-seat models’ vanguard efforts. As a result of this, the Carnival will remain a minivan in disguise and will have to continue operating within a niche.

Were all of the hoops that Lucky Motors went through to bring the Carnival into Pakistan worth it in terms of sales is thus the question.

Third time’s the charm?

The thing with the KIA Carnival is that it stays true to its MPV moniker in terms of determining whether or not it’s a success. What do we mean by that? Well, it’s all over the place in terms of any benchmark that could classify whether the KIA Carnival is a success or not.

Firstly, no one can really make a verdict on it other than Lucky Motors because there are no sales figures available for it. Lucky Motors is not a part of the Pakistan Automotive Manufacturers Association’s (PAMA) and is thus not bound to release sales figures. When asked about this, Lucky Motors told Profit that it is their company policy to not disclose sales figures.

It is because of this that we have to employ creativity to ascertain the success of the KIA Carnival.

One barometer for an automobiles’ success in Pakistan are wait times, and another is the on-money attached to it. For the uninitiated, these are characteristics that are associated with automobiles that are so high in demand that supply cannot keep pace. The applicability to CBUs, however, is usually difficult. They have to be imported, and subsequently do have wait times. Usually multiple months at times.

The Toyota Hiace for e.g., a competitor to the Carnival in the sense of a commercial vehicle, has a wait time of 3 months. However, it also does not have any on-premium attached to it. The wait time is simply the time it will take for Toyota Indus Motor Company (IMC) to import the Hiace to and deliver it via any of their dealerships.

Profit called their local KIA dealership and found that this is also the case with the KIA Carnival. Dealerships are now taking orders for deliveries that will arrive by 2023. However, this was not always the case. The KIA Carnival was widely available over the course of the summer. A senior official at Profit purchased their own Carnival in March and recounting their purchase experience cited neither of the two to be present then as well. This was the case for the KIA Carnival from roughly November till earlier last month in August. So what gives?

There is one thing. The KIA Carnival has seen a price increase from Rs 9.19 million and Rs 9.99 million to the aforementioned Rs 10.2 million and PKR 12.6 million respectively from the end of last year till now. The importance of this in the local Pakistani automobile market is that price increases are a sign of an automobile actually doing well.

Remember how we said only Lucky Motors could pass the verdict on the Carnival? Well this is why.

Companies increase prices when they believe the customer is willing to pay the extra cost. Doubling down on this particular metric, Lucky Motors’ price increases for the GLS+ variant have equaled the increase in the value of the USD. At least from 1st December to 19th July, which is when the last KIA price increase came. The GLS, however, only increased in value by 10% over the same time period in comparison to the 26% of the USD and the GLS+. However, this is where the fact that the KIA Carnival lacked on-payments and queues actually comes to the rescue.

But before that. Let’s do a recap on CBU imports to catch up. CBU’s are imported into a country either through a private importer. Thus, necessarily it takes time for the buyer to actually receive their car. It has to actually be shipped from its point of origin towards Pakistan after all. But then one might ask how some people are able to get their imported cars immediately, say one from a nice fancy German showroom? Well, that’s because companies are able to predict demand in-advance at times and thus have inventory on-hand. Remember, how the KIA Carnival was always available throughout the time period that Profit found?

Unless Lucky Motors has hacked global shipping, the likely explanation is that they anticipated our current economic turmoil. In particular, they probably anticipated the Rupee to depreciate against the USD, and decided to have buffer stock for the KIA Carnival to hedge against forex risk. Now Lucky Motors is no stranger to having buffer stock. It’s practically the pillar of their production policy that sets them apart from the industry. Profit speculates that they ordered a lot of KIA Carnivals.

So, when they did order them, they may have been able to meet most of their demand through their buffer stock alone. If we were to assume that any amount of buffer stock lasted into the months that Lucky Motors did increase their prices, then Lucky Motors would have absorbed the increase as pure profit. This would have brought them closer to the aforementioned 15% desired gross margin, if not push them even further above it.

This is unless of course they had perhaps the single best demand modelling on the planet from November till August, and have somehow suddenly lost that ability for some reason.

In discussing the Carnival, it would be remiss to not talk about the Toyota Hiace and the Hyundai Staria. The other two premium commercial vehicles available. These two are afflicted by the same problems that inhibit the KIA Carnival from becoming mainstream. The Staria and Hiace are more reminiscent of the conventional notion of what a commercial vehicle looks like. Think van. In such a direct comparison, the KIA Carnival is actually very successful.

Taking a shot at the KIA Carnival wanting to break out of the conventional MPV category would perhaps be unfair. The category is not the most dynamic, even globally, and everyone wants to increase their margins on any product. This is also likely why the KIA Carnival has picked up more traction in Pakistan, and why it sought to appeal to variegated sets of customers.

However much the KIA Carnival may bejewel itself like an SUV, the matter remains that it is not one. Lucky Motors is also explicitly clear on the matter. It has certainly tried to play the part to attract additional customers. Its aesthetic does equate to bringing a gun to a knife fight when compared against the aforementioned vehicles in the same customs category,but it neither enjoys the sales figures nor the Pakistani automobile barometers of success akin to the Fortuner. It also lacks the cultural status in Pakistan of the Toyota Prado and Landcruisers, at least for now.

The story is somewhat similar against other competitors that the KIA Carnival supposedly does not take aim at. Even with our best guess this may be due to the fact that the Carnival is just not SUV enough amongst Pakistani consumers to warrant the hefty sums they pay. It remains on the precipice of the definition of what Pakistani’s would classify as a “bari gaari”. Maybe it’s the Carnival’s height?

Not having a seat on the German and Japanese up-market table is neither a success nor a failure for the Carnival, depending upon how you look at it. The KIA Carnival is clearly the biggest fish in a small pond, but it’s unable to enter the far larger petrol-guzzling pond it wants to for additional sales volume.

The Carnival may need its own version of automobile bournvita for the additional height to add to its SUV-esque allure given how it seeks to conquer both the up-market and commercial vehicle category in Pakistan. However, whilst we say this, Lucky Motors has gone on to double down on the base that they have created by announcing an even more up-market variant of the Carnival. Lucky Motors will likely be playing catch me if you can with Pakistan Customs till they likely introduce one that can finally cement itself as the ultimate SUV replacement in Pakistan. Third time’s the charm?

I’m truly impressed with your blog article, such extraordinary and valuable data you referenced here.

사설 카지노

j9korea.com