It started in May when NetSol Technologies Limited (NETSOL) announced it was going to buy back two million of its outstanding shares. This was followed shortly after by Maple Leaf Cement Limited (MLCF) which announced it would buy back 25 million shares. From here on out there was no looking back.

The rest of the year saw Lucky Cement (LUCK), JDW Sugar Mills (JDWS), Bank Alfalah (BAFL), and most recently ENGRO in December announcing that they were going to buy back their shares.

Since the change in the government in April 2022 this year, the KSE100, which measures the performance of the top 100 stocks in the Pakistan Stock Exchange (PSX), has been on a declining trend. Macroeconomic factors such as political and economic instability have generally made stock market investors wary of the business confidence in the country.

With a lack of buyers for companies’ shares in the PSX, many listed companies have seen their share prices decline significantly. Given that many companies have also faced a dent in their net profits, the Earnings Per Share (EPS) of the companies have also gone down. The EPS is a measure of the net profit earned by one outstanding share, a popular metric to measure the performance of a company for investors.

Declining EPS and affordable share prices have prompted many companies to do something to make their companies look attractive in the eyes of the investors. For some companies, this has come in the form of share buybacks.

However, it is not only the economic instability that has prompted the share buybacks but the relaxation in buyback rules for the listed companies as well. The big debate about buybacks is whether or not they are good for the company, the investors, and the stock market in general.

Buybacks and buybacks rules

Before we try to understand what is happening in the stock market, it’s important to understand what exactly are buybacks.

When companies buy their own shares from the stock market, that is a share buyback. Usually, we only see the corporate insiders such as the board of directors, their family members, or another associated company such as a subsidiary or a parent company, buying the shares of the company. But this is not a share buyback. This is only the occasional and sometimes frequent purchase of shares by corporate insiders.

However, if these purchases are taking place at a time of widespread share buybacks in the stock market, it takes renewed significance. The case of MCB is an example of this where the sponsors bought a 5.49% stake in their bank last month.

Share buybacks are different from trading in the company’s shares by corporate insiders. For one thing, share buybacks are usually bigger than buybacks done by the insiders. Companies also have to fulfill a lot more legal requirements before engaging in buybacks. And while corporate insiders buy the shares from their own pocket money, when companies buy back their shares, they do it from the company’s cash (sometimes to the dismay of shareholders expecting dividends as will be discussed later).

The share buyback rules by listed companies on the stock market are written in the SECP Listed Companies (Buy-back of shares) Regulations 2019, which was most recently amended in September 2022.

In this part, we want to focus on three buyback regulations and compare how the rules of buybacks have changed over the years. This can also help us understand why so many big companies are engaging in share buybacks this year.

The three buyback rules are:

- Listed Companies (buy-back of shares) Regulations, 2016

- Listed Companies (buy-back of shares) Regulations, 2019

- Amendments to Listed Companies (buy-back of shares) Regulations, 2019 (Updated September 2022)

The first buyback rules we will consider are the 2016 rules, followed by the 2019 rules, which were most recently amended in September 2022. The buyback rules being followed currently are the 2019 rules which were amended in September of this year.

The share buy-back rules can be compared across five factors: 1) eligibility, 2) purchase procedure, 3) purchase period, 4) purchase price (through tender or exchange), and 5) buy-back restrictions.

- Eligibility:

The eligibility criteria for the companies to engage in buybacks, according to the 2019 rules, has mostly stayed the same as the 2016 regulations. Companies should be listed for at least three years, they should have minimum paid-up capital requirements after the buy-back of shares is completed, they should have adequate funds to cover the buyback, and there should be no legal cases against the company or ongoing merger/acquisitions being undertaken by the company before the buy-back.

One notable change, however, is that according to the 2016 regulations companies were required to wait at least three months since the last purchase was disapproved by the members before the board could recommend another purchase. The 2019 rules elongated the waiting period for announcing a buyback after it was disapproved the last time to six months from three months.

2. Purchase Procedure:

After the companies are eligible for share buybacks, the BOD makes a recommendation for purchase/buy-backs. This then needs to be approved through a special resolution in the company’s extraordinary general meeting (EGM) of shareholders. This general meeting needs to be held in 45 days (previously 35 days in 2016 regulations) from the date of recommendation by the BOD.

After the special resolution is passed in the general meeting and approval is given for the buy-backs, the public announcement for buy-backs needs to be made in two working days. This is followed by the start of the purchase period within seven days from the date of public announcement which goes on for 180 days. Lastly, the company is supposed to make a public report on buybacks, share it with SECP and also announce it to the PSX.

3. Purchase period:

The share purchasing period runs for a period of 180 days from the day the approval is given in the general meeting or whatever date when the buyback is completed, whichever is earlier. Previously, the purchase duration was for 90 days in the 2019 regulations but this was changed in the September 2022 amendment.

4. Purchase Price:

In 2016 and 2019, companies could determine the share price for buy-backs either through tender or the spot/current market price. In 2016, the purchase price through tender offer was the price recommended by the BoD and approved through special resolutions, but it could not be less than the weighted average price of the last 30 days of the share. In 2019, the tender offer price was made much easier as it was not less than the average of the preceding 5 days. A previous article by Profit in 2019 made the case against companies determining their share price on their own.

But after the September 2022 amendments, companies cannot recommend or set a price itself for the buybacks so the share price through the tender option is gone. Now, the companies can only purchase back their shares at the spot / current market price which can be considered as an improvement in the laws.

5. Restrictions on the company

In the 2016 and even in the 2019 regulations, the buyback rules prohibited companies from voluntarily delisting or voluntary wind up within 12 months after the buyback period was completed. But in the latest amendments, this time period has been increased to 2 years, which can again be considered as an improvement.

In the 2016 regulations, the corporate insiders were not allowed to trade in the shares of the company from the date of recommendation by BOD till the COMMENCEMENT of the purchase period. But in 2019, this was made more stringent as corporate insiders were not allowed to trade in the shares of their own company from the date of recommendation by BOD until the end of the purchasing period. This is another positive amendment.

A second buyback can’t happen for a year until the report of its buyback is sent to commission, but if free float is above 25% then the company can do another buyback in the 1 year after.

The following two previous restrictions were also lifted for the companies: 1) the purchasing company shall deposit the consideration payable in the designated clearing bank account at least one day before the settlement date, 2) In case of purchase through securities exchange, report to the securities exchange the number of shares purchased on daily basis for public dissemination.

Buy-backs in 2022

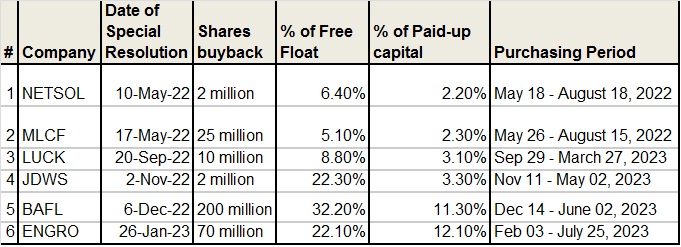

There have been six official buybacks (completed, ongoing, and announced) in the year. The table below shows the details of the buybacks announced by the six companies.

All companies, with the exception of NETSOL, have said that they will cancel their shares after the buyback. The companies expect that these buybacks will eventually improve the EPS and dividends of the company.

We can also see from the table that the buybacks of NETSOL and MLCF are completed and were only there for a period of three months. This is because these buybacks happened before the September 2022 amendment to the buyback rules which increased the buyback purchasing period from three months to six months. For the remaining four companies, their buyback periods will go up till the second quarter of 2023.

Different metrics will indicate different companies as doing the biggest buyback. If we only consider the absolute value of the shares, then the biggest buy-back of the year is most probably going to be that of ENGRO with 70 million shares at an average price of 260 which comes down to approximately PKR 18.2 billion!

But perhaps what is more important to note than which buy-back is the biggest is to focus on the reasons behind these buy-backs and what they mean for not only the stock market in general but for the companies and investors in particular.

The big debate

There is a big debate about whether or not buybacks are a good use of the company’s cash flow. Generally, when companies announce buybacks, they say that it will help improve the Earnings Per Share (EPS) of the company. Now, if EPS is considered as an important enough indicator in a market, the increase in EPS post-buyback can indicate that the stock is worth buying.

But where do the companies find the cash to fund such buybacks? They do it by using their free cash flow (FCF). The FCF is an excellent indicator signifying the actual cash available to the firm for distribution. It is calculated by subtracting the capital expenditures from the operating cash flow (which is the amount of actual cash earned by the company in a year). The FCF can then be used to either make capital investments, make other financial investments, or pay dividends to the shareholders.

More generally, as a previous Profit article explained, buy-backs are only one of the five ways that a company can utilize its free cash flow. The other four ways are:

- Spending on capital expenditures

- Buying other companies or investments

- Saving it for a rainy day

- Pay it out as dividends

Given that spending on capital expenditures or buying other companies are expansionary plans which can provide great returns in the future, the only reason these two options might not be a great idea at any time is if there are less investment opportunities available to the company. This might make the other three options more suitable for companies.

From the perspective of shareholders (especially minority shareholders), it is normally considered good if the company uses its excess cash to pay back high dividends to the shareholders for their investment in the company. In the case where the company does not have any investment opportunities available, paying high dividends to the existing shareholders can also generate increased public interest in the company. This can lead to more demand for the company’s stock which can then increase the valuation of the company.

Ali Farid Khwaja, co-founder and chairman of Ktrade Securities, says, “Buyback means that companies don’t have any other opportunities to invest in, the return in buying back shares of a company rather than investing in its growth is more. Typically, if you’re going for growth, which means that the company want to raise money in the market and invest that in expanding the company. Buybacks are linked to maturity, because mature companies have little investment opportunities, so either their dividend will be high or they can use the cash to buyback. So the debate is if you have cash but don’t have investment opportunities, you can return the cash to investors.”

“Dividends are a better way of returning the cash so that the minority shareholders can decide themselves what to do with the cash. But when you buyback, you make the decision for minority shareholders too which might not be the minority shareholders want with that cash,” he continues.

“In Pakistan, buy-backs make sense from the company’s perspective because the economy is slowing down, companies don’t have investment opportunities and the valuations are cheap, they wouldn’t be buying back their shares if the valuations were high. But they’re also making a decision for the minority shareholders because they are not just using their own cash but also the cash of the minority shareholders to buy back the shares.”

In the short-term, it might not be good for minority shareholders if their companies are doing buybacks because they would prefer the dividends. But in the short-term, it offers a good deal to the companies who now have attractive valuations of their stocks. In the long-term, however, the decrease in outstanding shares after the buybacks can result in higher dividends for those shareholders who hold the company’s stocks because the supply of the company’s stock will decrease and company’s can give lesser total dividends while still giving a higher dividends per share.

Farooq Tirmizi, CEO of Elphinstone, also believes that buy-backs are not a good thing for the PSX in particular and for the country in general. “There should be no permission in the law for any buybacks. We are already in a situation where we have a miniscule free-float in Pakistani stocks, and the managements of large companies have clearly struggled to come up with ways to invest in their companies’ growth. Allowing for buybacks will both reduce the number of shares available for the general public to invest in, and it will incentivise CEOs to not come up with ways to expand the productive capacity of their companies – and by extension that of the country”, he says.

There is no doubt that in Pakistan the majority of the listed companies have small free float and are mostly majority family-controlled businesses. Minority investors generally do not have a lot of say in the companies they have invested in (not that they should have too much voice because that can halt the everyday running of the businesses as well). Nevertheless, just because a company has a small free float and is majority controlled by families does not mean that the company does not take care of its minority investors. A healthy balance is necessary.

Generally, however, most companies which are engaging in buybacks believe that the share buybacks will help to raise the EPS of the company and the future dividends.

From the point of view of companies, the September 2022 amendments have made it easier for companies to buy back their own shares. As Mohammad Sohail, CEO of Topline Securities, says, “Recent changes in buy back rules are compelling for companies to buy their own stocks. Considering the attractive valuations, we think more companies will come to buy their own shares in the future.”

This suggests that the six buybacks so far in 2022 might not be the end of the buyback trend. We may see even more such buybacks in the near future, especially considering the political and economic instability in the country is expected to continue for a few more months.

Conclusion

2022 has been the year of buybacks. The share prices of many profitable and established companies have taken a huge hit. This has made their valuations attractive in the eyes of investors. But due to a lack of institutional and foreign investors in the market, the sponsors of these companies have decided to take advantage of the decline in share prices and buy back their own companies’ shares.

The buybacks are being funded from the free cash flows of the company. These cash reserves can alternatively also be used by the company to pay back higher dividends or for more capital or financial investments. But given the lack of investment opportunities available in the country, the companies have decided to buy back their own shares. In the long-run, this move is expected to raise the share prices and EPS of the company. The relaxation in buyback rules after the September 2022 amendment have also made buybacks favorable to the listed companies.

With the ongoing political and economic instability expected for a few more months, the ENGRO buyback announcement might not be the last of it in the current buyback spree of the PSX. it might even be the case that the buybacks have only just started, and next year in 2023 we may see even more buybacks than the ones we saw in 2022. Time will tell.

plagiarism checker : Plagiarism checker by SmallSeoTools, 100% free online tool that check plagiarism with quick and accurate results. Best online plagiarism detector for you.

Packers and Movers Bill is the official website that regenerates your packers and movers bill in case you have lost your relocation invoice. So if you want to claim the original GST-approved packers and movers bill then you can contact us.

It’s very good. Thank you. It’s easy to understand, easy to read, and very knowledgeable.

온라인 카지노

j9korea.com

thanks for sharing