NEW YORK: As crisis stalks the traditional world of stocks and bonds, bitcoin is suddenly looking like a safe haven.

The infamously volatile cryptocurrency seems positively hale and hearty, just as a banking meltdown drives markets into the arms of a recession.

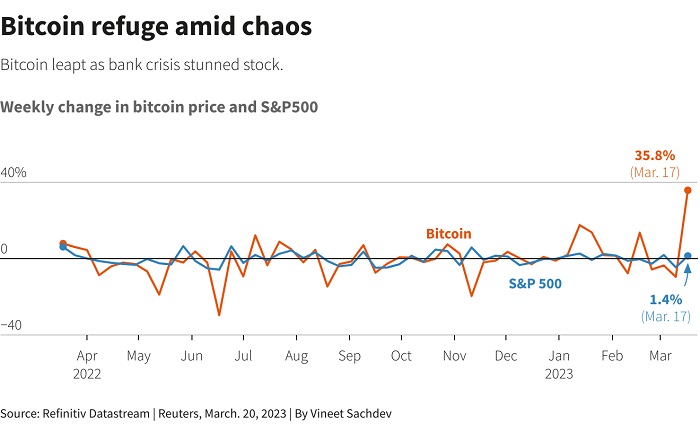

Bitcoin has risen 21% this month, while a choppy S&P 500 has lost 1.4% and gold has gained 8%.

“If you were going to describe an environment where there were successive bank runs because central banks are trying to fight inflation with fast rate increases, that is pretty close to as spot-on a thesis for owning bitcoin as you’ve ever heard,” said Stéphane Ouellette, CEO at digital asset investment platform FRNT Financial.

The cryptocurrency has, for now, severed its ties with stocks and bonds and tagged on to a rally in gold, fulfilling at least one part of creator Satoshi Nakamoto’s dream – that bitcoin can serve as a refuge for suffering investors.

Bitcoin’s 30-day correlation with the S&P 500 has slid to negative 0.12 over the past week, where a measure of 1 indicates the two assets are moving in lockstep.

A selloff in banks has wiped out hundreds of billions of dollars in market value and forced US regulators to launch emergency measures. The past couple of weeks have seen Silicon Valley Bank and crypto lender Silvergate go under, while Credit Suisse has teetered on the brink.

‘Return to core ethos’

Let’s not be carried away, though. This is bitcoin.

“The bearish argument would be that these dynamics are temporary, and ultimately this rally is not going to sustain,” said Ouellette.

It remains to be seen if bitcoin’s bullishness will endure as attention shifts to the Federal Reserve’s policy meeting this week where the U.S. central bank must walk a fine line as it fights inflation and bank stresses.

Furthermore, the cryptocurrency’s allure hasn’t all been about safety.

The rapid price rise has forced some short-sellers to cut their bets and buy coins back. Data from Coinglass shows traders liquidated $300 million worth of crypto positions on Monday, with most of that total – $178.5 million – short positions.

Nonetheless, bitcoin is resurgent.

It now commands nearly 43% of the total crypto market, its highest share since last June, according to CoinMarketCap data, while the total cryptocurrency market’s capitalization has jumped 23% to $1.1 billion since March 10.

“We’re seeing a return to bitcoin’s core ethos, that of a financial asset independent from the opacity and meddling of the centralized financial system,” said Henry Elder, head of decentralized finance (DeFi) at digital asset investment manager Wave Digital Assets.

The mainstream bank crisis has also fueled some interest in DeFi, with the total value of tokens linked to such platforms rising to $49 billion from $43 billion over the past week, according to DappRadar.

Bitcoin in a bank crisis

Not all areas of the digital world have been immune to the banking fallout, though. The no. 2 stablecoin Circle USD or USDC lost its 1:1 peg to the dollar after disclosing its reserves were parked at the shuttered Silicon Valley Bank.

As worries spread over USDC’s ability to maintain its peg, its market cap slid to $36.8 billion last Friday from $43.8 billion a week earlier, even as leading stablecoin Tether gained around $4 billion.

Market participants said some USDC withdrawals were likely reinvested in bitcoin as well, helping fuel the rally.

“It’s too soon to say that bitcoin has proven the narrative that it’s an alternative in a banking crisis,” cautioned Ed Hindi, Chief Investment Officer at Tyr Capital in Geneva.

But he added: “The rally we are currently witnessing in bitcoin will be looked back at as the point in time where its main property as a decentralized non-sovereign asset was stress tested.”

Many are still ignorant of how these Crypto Ponzi scammers work. I was impatient to carry out the necessary research about crypto trading. I just kept investing and earning because I was super excited after my first investment tripled in one hour. Unfortunately, I invested 258,000 USDT and ETH with this fraudulent company. I didn’t realize I was dealing with a dubious company until I tried to make an attempt to withdraw. I made a withdrawal request and noticed that my account was suddenly blocked for no reason. I was requested to pay some charges to perfect the withdrawal which I always did but they always come for more. I needed my money back at all costs since I could not afford to let it go. I did a lot of research for help and tried to see if other people had similar experiences. I discovered a forum where people mentioned that they had been through the same process and were able to recover their lost cryptocurrency funds with the help of an Ethical hacker. I hired this ethical hacker to solve my predicament and they were able to help me get back all my lost funds within 24 hours. I felt indebted to them and apart from trying to express my gratitude to him once again using this medium, I will recommend anyone who wants to recover or fix anything digital currency-related, Binary FX scammers, online romance scams, phone hacks, private investigation, and more, reach out to (cybergenie (@) cyberservices (.) com ) WHATSAPP (+ 1,2,5,2,5,1,2,0,3,9,1)… for assistance..

We are still waiting for the Bull ran of 2023. I think the bull run will start in August 2023. There are many new coins like BLV and Sand that will boost in this bull run. Let’s wait and see what will happen this year.

Do not take any Bonus offer from your broker or your manager, do not allow your broker manager trade on your behalf. That is how they manipulate traders funds. If you need assistance with retrieving your lost fund from your broker or Your account has been manipulated by your broker manager or maybe you are having challenges with withdrawals due to your account been manipulated. Kindly get in touch with at ROTTGENRAPHAEL AT GMAIL . COM / and he will guide you on simple and effective steps to take in getting your entire fund back.

YES It is possible to recover what you lost to scam brokers but most people don’t know this because they are either not informed or they have been conned by a recovery expert. Truth is there are only a few people who can pull this off and i was lucky to meet with one of them. If you need help with this i suggest to send a mail “EASYRECOUP130 AT GEE MALE DOT COM”

101 N BRAND BLVD.

11TH FLOOR GLENDALE CA 91203

This is best and informative article. And B Love Network is new crypto staking app. You can earn online money everyday by using this app.

How do I start this review? honestly I do not enjoy writing much, but I have to let the world know about this genius that helped me. Seriously I needed a home for my family, but I couldn’t get one because of the evictions, two late payments from 2020 on a credit card, charge off on my record and 540 TransUnion, I read many good reviews about Aaron Swartz online. 3 days after I contacted, He increased my score to 802 and improved my credit profile by removing the evictions, charge off, late payments and other negatives, I sincerely acknowledge their relentless efforts and urge you to contact them for any credit related issue via Mail reclaimcryptoagent1 @ g mail . com wats app; +1 [559 481 1601

WSJ today published a report about informing the General public that, It has been Approved and Confirmed by Us that ( HQRECOVERY22 at GMAIL dot COM ) is a Certified and 100% Efficient Fund Recovery Expert. BITFINEX is giving them all the credit for their commendable effort in the Recovery and Successful return of our 2016 stolen BTC. We want to Recommend their services, And the General public is Safe to do business with them. And Pleas Note; They do not receive any Upfront Payment.

Contact their support team for further assistance:

HQRECOVERY22 at GMAIL dot COM

Thank me later.

I lost my investment capital and profits trading online, they kept on requesting for extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund through the help of Gavin ray a recovery specialist, I contacted his email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back. Contact his email:gavinray78@ gmail com or whatsapp +1 352 322 2096

Recovering your stolen or lost cryptocurrency is always an extremely tedious and technical procedure. There is never an easy way out. Trying to go through these steps almost led me into depression. I am ultimately glad I found a solution though. I was introduced to a professional recovery agent who specialize in online scam recovery and reimbursement of victims among other things. Recovery is very possible as long as you make use of a very good professional company. Cyber Asset Recovery are qualified experts who can help you recover your lost funds. You can contact them via mail at: Cyberassetrecovery@ protonmail . com or Telegram +1 501 725 1653