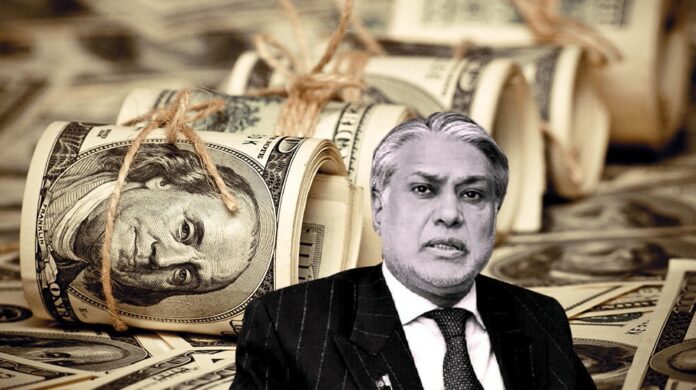

ISLAMABAD: Pakistan’s Finance Minister, Ishaq Dar, has canceled his trip to the United States where he was scheduled to meet with the International Monetary Fund (IMF) management for the removal of bottlenecks in the staff-level agreement regarding the revival of the stalled bailout package.

Dar was also set to attend the spring meetings of the World Bank-IMF in Washington from April 10 to 16. Highly placed sources have revealed that the minister will not be attending the meetings due to the prevailing political uncertainty and developing judicial crisis in Pakistan.

The finance minister had planned to address the concerns of the financial and political worlds regarding the continuity of the government, future economic plans, and bridging the trust deficit with the multilateral lenders. However, the deepening political uncertainty and developing judicial crisis have reportedly led to the cancellation of his trip to Washington.

The cancellation of Dar’s trip might also lead to the cancellation of meetings with his counterparts in Saudi Arabia and the UK state minister for development. Minister for Economic Affairs, Sardar Ayaz Sadiq, who usually represents Pakistan at the World Bank, will also not be going to the United States due to the prevailing uncertain political conditions.

Finance Secretary Hamed Yaqoob Sheikh and Economic Affairs Secretary Kazim Niaz will now represent the government at the WB-IMF spring meetings. While a secretary is considered equal to a deputy minister, it remains unclear if they will be able to meet with high-ranking foreign officials.

Special Assistant to the Prime Minister on Finance, Tariq Bajwa, may replace Dar. However, diplomatic protocol issues may prevent Bajwa from meeting with the presidents of various multilateral institutions and finance ministers of different countries.

Dar had scheduled meetings with the presidents of the World Bank, Asian Development Bank, and Asian Infrastructure Investment Bank – the three multilateral creditors crucial to Pakistan’s plans to raise $6 billion in additional loans to meet the last IMF condition. He also had a confirmed meeting with IMF Deputy Managing Director, Antoinette Monsio Sayeh, next Thursday, but Managing Director Ms. Kristalina Georgieva did not give time for the meeting.

IMF Resident Representative Esther Perez stated, “The Pakistan delegation will have a high-level meeting during the spring meetings with IMF’s deputy managing director Ms. Sayeh, who follows Pakistan closely.”

Dar was scheduled to begin his trip with an opening meeting with the IMF’s Mission Chief to Pakistan, Nathan Porter, on Monday. However, Pakistan and the IMF were no longer actively negotiating after the government’s sudden fiscally irresponsible move of announcing petrol subsidies. Although the government claimed that the petrol subsidy would not affect the budget, it did not apparently guarantee that.

Janet Yellen, the Treasury Secretary, also had not given an appointment, nor did Waly Adeyemo, the Treasury Deputy Secretary. Similarly, Samantha Power, the USAID administrator, was also not available for the meeting, but a meeting had been scheduled with the assistant administrator of the USAID to South Asia.

Jihad Azour, the director of the Middle East and Central Asia Department of the IMF, was also scheduled to meet with the finance minister. The sources said that a meeting had also been planned with the IMF fiscal affairs department aimed at discussing issues like a whopping Rs 276 billion shortfall in tax collection during the first nine months of the fiscal year.

Additionally, the finance minister was set to meet with the representatives of the three international credit rating agencies that had downgraded Pakistan, temporarily closing the doors for borrowing from international capital markets. The finance ministry had also lined up meetings with the representatives of foreign commercial banks, aimed at convincing them to provide commercial loans to meet the external financing requirements.