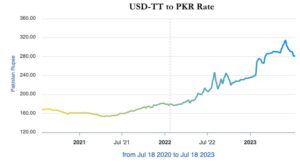

In a first of its kind, the International Monetary Fund (IMF) has stipulated a condition on the parity between the open market and interbank rate for the Pakistani Rupee as part of the current Stand-By Agreement (SBA).

The interbank and open market rates of the dollar have regularly had a gap in Pakistan where different governments have tried to manage the value of the rupee. This gap has become pronounced over the past year or so in which Pakistan came close to default.

The average premium between the two rates has been mandated to be no more than 1.25% during any consecutive 5-business-day period. With the current open market rate hovering around $1 to Rs 290, the differential equates to approximately Rs 4.

So what is going on?

Is there a reason for why the IMF might have done this?

“The IMF is now exhibiting little to no tolerance for Pakistan’s exchange rate practices and implicit interventions,” explains Naveed Vakil, COO at AKD Securities. What does Vakil mean?

The open market rate and the interbank rate are two distinct rates utilised in currency exchange. The open market rate is determined by supply and demand forces in the open market, while the interbank rate is established by banks buying and selling currencies from each other.

The interbank rate is generally only accessible to the largest and most creditworthy financial institutions. In contrast, the open market rate is the rate that customers can typically expect to receive when exchanging currency at a local currency exchange or other retail foreign exchange provider. These two rates have been divergent in the recent past to varying extremities.

Profit has covered the reasons for why these differences arose in a more detailed article.

Read more: Strong Rupee! Grape!

“This is not something recent that has suddenly occurred after the SBA. This has been happening since June. At that time, there were rumours that the IMF wanted the spread between the two rates to be 2%, but now they’ve moved the difference forward to just 1.25%,” explains Fahad Rauf, Head of Research at Ismail Iqbal Securities. “This could one of the reasons that could explain the recent depreciation which has led to the open-market, and inter-market rates converging to a large extent,” Rauf adds.

Why does the IMF care?

“Regrettably, in the past, these interventions have snowballed beyond crisis and depleted the country’s reserve position,” Vakil states. “While the IMF does not set absolute levels regarding parity, the introduction of policy guidelines and measures aims to ensure consistent stability in foreign exchange markets,” he adds. “The goal is to achieve a reflective parity that supports and protects the overall reserve position, as well as the trend in remittances,” adds Vakil.

But let’s get real for a second. How serious is the IMF about implementing these changes?

“Structural benchmarks or conditionalities are not mere suggestions,” avows Rauf. “They are the standards that the IMF mandates you to adhere to. Some of them are time-bound, whilst others are perpetual. This one is a perpetual benchmark.”

“To ensure compliance, it’s not difficult to ascertain the gap between the interbank and the open market rates,” Rauf explains. “Both rates are published on a regular basis. I’m confident that the IMF can scrutinise those rates for any five business days, and they obviously have their own resident representative in Pakistan as well who can communicate if there is any significant deviation.”

“Moreover, you also have your scheduled reviews,” Rauf continues. “There are two reviews as part of this SBA. The IMF can address it with the authorities then.”

The initial review is slated for December and will be predicated on September’s figures. The subsequent one is scheduled for March and will be based on December’s data. Pakistan has only received the inaugural tranche of funds as part of the SBA. The remaining two tranches are contingent upon the success of these two reviews. All in all, there are four opportunities for the IMF to raise concerns. Since it is a continuous benchmark, the IMF can still broach the subject in December if there was a breach immediately after September.

Could the Government still game the system?

Theoretically, yes. Would the government want to do so is another matter entirely.

“While the intentions are clear, the implications may not be, given the existence of a parallel grey market and the need to reduce the spread relative to official rates,” explains Vakil.

“Fixing a band between open market and interbank rates will inevitably lead to a greater premium in the shadow currency market,” asserts macroeconomist Ammar Habib Khan. He explains that “the open market rates can be restricted through the enforcement of transaction limits, to keep them within the prescribed band of the interbank rate.” However, Khan warns that “due to the presence of these transaction limits, demand for foreign currency will eventually gravitate towards the shadow market, resulting in higher demand and, ultimately, a higher premium.” He concludes by stating that “this will further strengthen the shadow market as an unintended consequence.”

“Although we have previously transgressed IMF stipulations without derailing the program, the recent stern stance of the IMF may result in more severe consequences this time around. This particular point has been a primary focus of the ongoing negotiations,” elucidates Rauf.

He adds, “Given that the government’s term is drawing to an early close in August, I doubt that either the government or the State Bank would be inclined to violate these conditions, considering how little time remains in their tenure.” Rauf further muses, “A caretaker government would be unlikely to contravene the IMF’s conditions, as it lacks any significant political motivations. I anticipate that this benchmark will be adhered to.”

An end to the rumours of the Rupee appreciating in value?

“By removing much of the uncertainty from the exchange market, a sense of stability is restored,” Rauf explains. “The Finance Minister and the Chairman of the Exchange Companies Association of Pakistan have been touting the PKR to have a fair value of Rs 250 against the USD. However, when considering the reel effective exchange rate and the IMF’s guidelines, it seems that the interbank rate will continue to shadow the open market rate.”

Rauf continues, “Moreover, it does not appear that the open market rate will experience any significant appreciation. With a sizeable demand for foreign exchange already present, and an anticipated increase as the economy opens up, it is improbable that we will see the PKR appreciate to the rates being quoted by the aforementioned individuals.”

Hopefully the economic recession can soon be overcome. I’m so tired of this situation