The global economic landscape has experienced significant changes in recent decades, resulting in noticeable geopolitical fragmentation. China has emerged as the world’s second-largest economy, playing a crucial role in global growth and industrial supply chains. Additionally, the global south, represented by platforms like BRICS, is consolidating its economic power.

These changes can partly be attributed to some challenges faced by emerging economies, including the economic fallout of Covid-19 pandemic, rising food and energy prices due to the war in Ukraine, and higher interest rates.

As a consequence, these countries are burdened with high levels of debt and are experiencing slow economic growth. However, the funding provided by multilaterals like the International Monetary Fund (IMF) and World Bank has not kept pace with the expanding global economy.

The World Bank acknowledges that debt has become a significant burden for the poorest countries, hindering their ability to invest in vital areas such as public health, education, and the environment. Consequently, these countries are compelled to allocate a substantial portion of their budgets to debt servicing rather than focusing on their pressing developmental needs.

Pakistan’s case is similar to its counterparts in the global south. The country’s economy has been severely affected by a series of exogenous shocks in the past two years, shaking it to its core. The situation has become so critical that the primary goal of successive administrations has been to simply keep the country afloat.

The debt situation

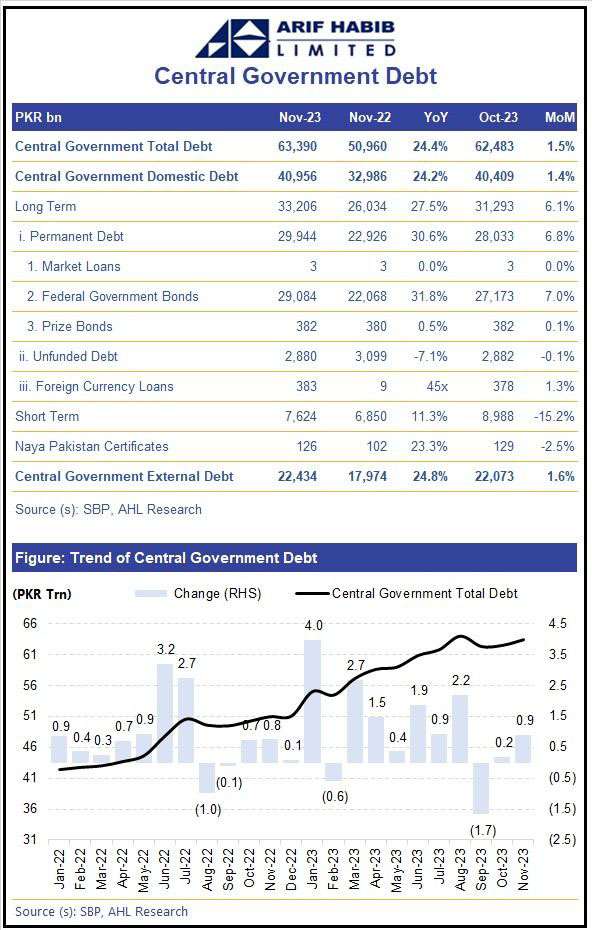

According to the State Bank of Pakistan’s (SBP) latest debt statistics released on January 5, 2024, the central government’s domestic and external debt stocks increased from Rs 62.5 trillion in October 2023 to Rs 63.4 trillion in November 2023. The long-term domestic debt saw a significant increase of 6.1%, reaching Rs 33.2 trillion, while the short-term domestic debt decreased by over 15% to Rs. 7.6 trillion. The central government’s external debt also increased by 1.6% to Rs 22.4 trillion during the same period.

Domestic borrowing represents the largest portion of the overall public debt and, as a result, carries the highest servicing cost. The government’s significant appetite for deficit financing through short-term domestic borrowing, coupled with record high interest rates, has resulted in a dual crisis of elevated interest expenses and short maturity terms. Addtionally, domestic debt servicing consumes over half of the federal budget, resulting in a significant fiscal burden.

Over the past year, the government has strategically focused on borrowing through T-bills and floating PIBs. Both options have led to substantial costs of debt servicing due to the prevailing inverted yield curve over the past year.

Additionally, relying on T-bill borrowings has increased the vulnerability to rollover risk because of their short-term nature. However, to address this issue, it appears that the government is now transitioning towards issuing longer-term bonds, which has been made possible by positive bids from market participants who anticipate forthcoming interest rate reductions.

The external front also presents a challenging situation. The government is facing the daunting task of managing borderline unsustainable debt, along with low SBP reserves, making it difficult to stay financially afloat.

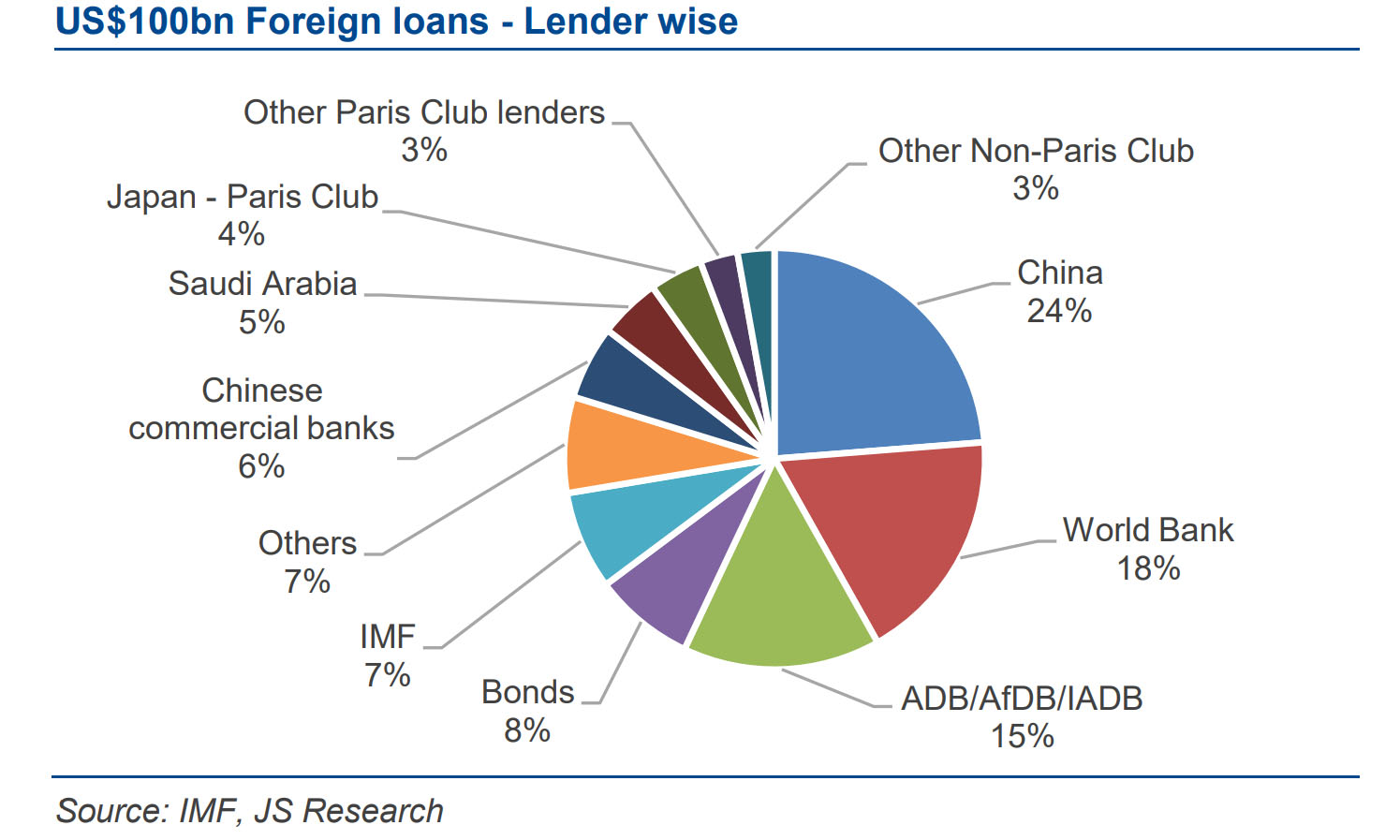

According to a report by JS Global Capital, “Recent external flows post IMF’s fresh program addressed investor’s concerns on piling external debt and its servicing. Where Pakistan’s external debt has reached 21% of GDP, its servicing is at 2.8x of outstanding SBP reserves. These levels have remained at ~1x historically, while increasing to 7.5x in Jan-2023. A key factor for Pakistan’s external debt is its lender composition. The majority share of the pie is contributed by China and its lenders, followed by bilateral/multilateral lending agencies and Middle East countries.”

Hence, the composition of Pakistan’s external commitments indicates that the prospects for debt relief are dim. This reality has been acknowledged by Shahmshad Akhtar, the caretaker finance minister, who, in her recent media interactions, reiterated that the majority of Pakistan’s external debt is held by multilateral agencies, which cannot be rescheduled due to their “preferred creditor” status.

The commercial debt, which forms a smaller portion of the external debt, is also challenging to restructure due to the involvement of multiple stakeholders and a cumbersome process.

Bilateral debt constitutes almost one-third of the external debt, and as per the Finance Minister, the government has already availed itself of the payment moratorium under the G-20 debt relief initiative following the COVID-19 pandemic.

Furthermore, any debt negotiations would require China’s stamp of approval, as the country holds around 30% of Pakistan’s external public debt. This condition itself poses a major hindrance to initiating debt relief discussions.

Regarding domestic restructuring, the country lacks the capacity to effectively manage the economic consequences of such an event.

Economic analyst Ammar Habib Khan told Profit that the chances of domestic debt restructuring remain low. Instead, he expressed the view that the government will be content with inflating away the debt due to gradually reducing the real value of domestic borrowing through the impact of high inflation.

Khan emphasized that the primary challenge lies not in the current debt, but rather in the pressing need for liquidity to bolster reserves and support economic growth.

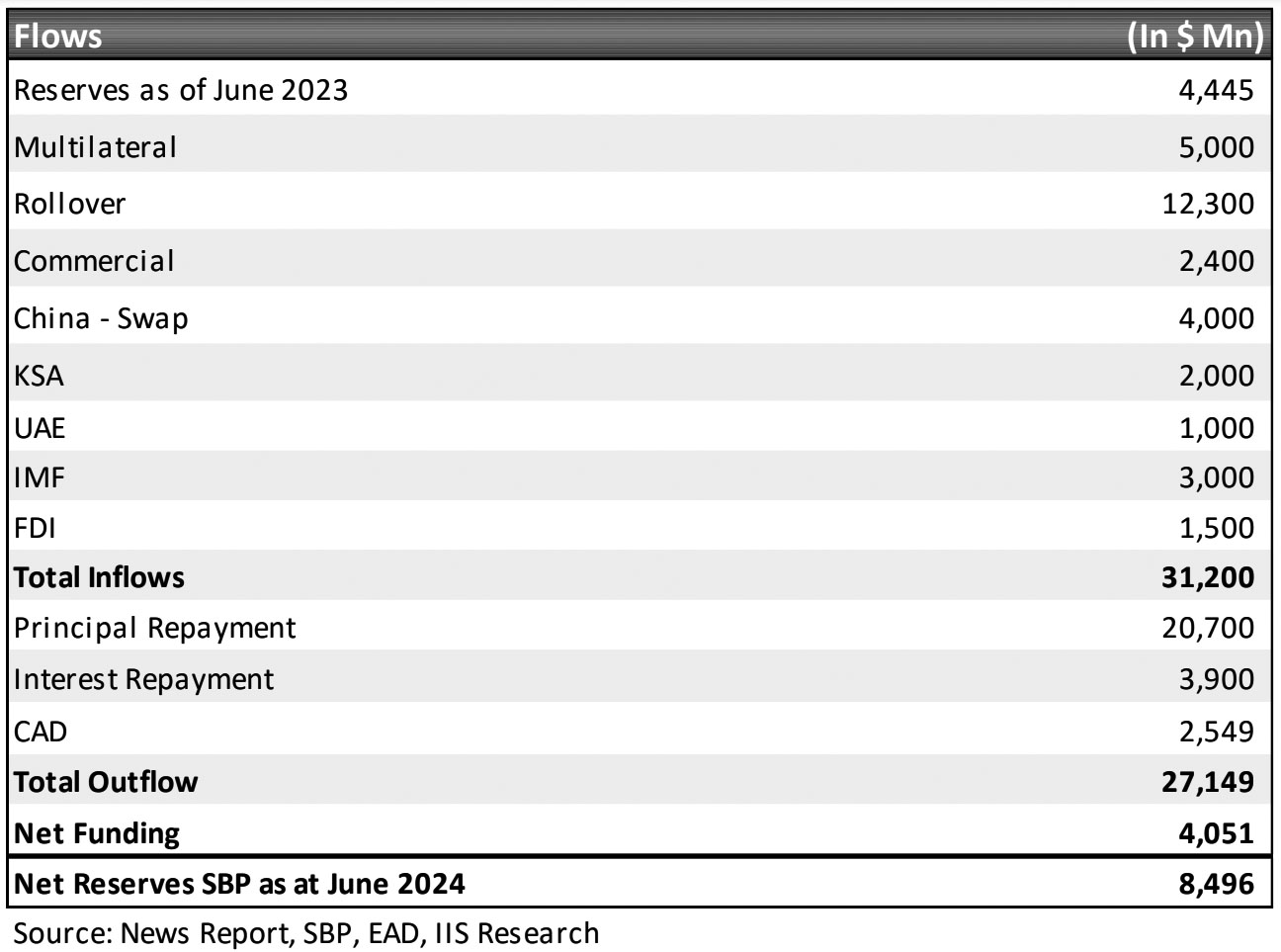

“Pakistan’s external debt obligation for FY24 is $24.6 billion with $20.7 billion principal repayment and $3.9 billion interest payment. Out of this, $5.4 billion has already been paid. Following these repayments, the remaining debt stands at $19.2 billion. Out of this amount, $12.4 billion is expected to be rolled over by creditors, leaving a net repayment of $6.8 billion for the rest of the fiscal year. This net repayment includes $ 4.3 billion of principal and $2.5 billion of interest,” read a report by Ismail Iqbal Securities.

China’s Role

When examining Pakistan’s debt dynamics, it is crucial to consider the role of China, which is heavily invested in the country. However, it is worth noting that Beijing is currently grappling with a domestic banking crisis of its own. Additionally, it has experienced setbacks due to a series of defaults by borrower nations.

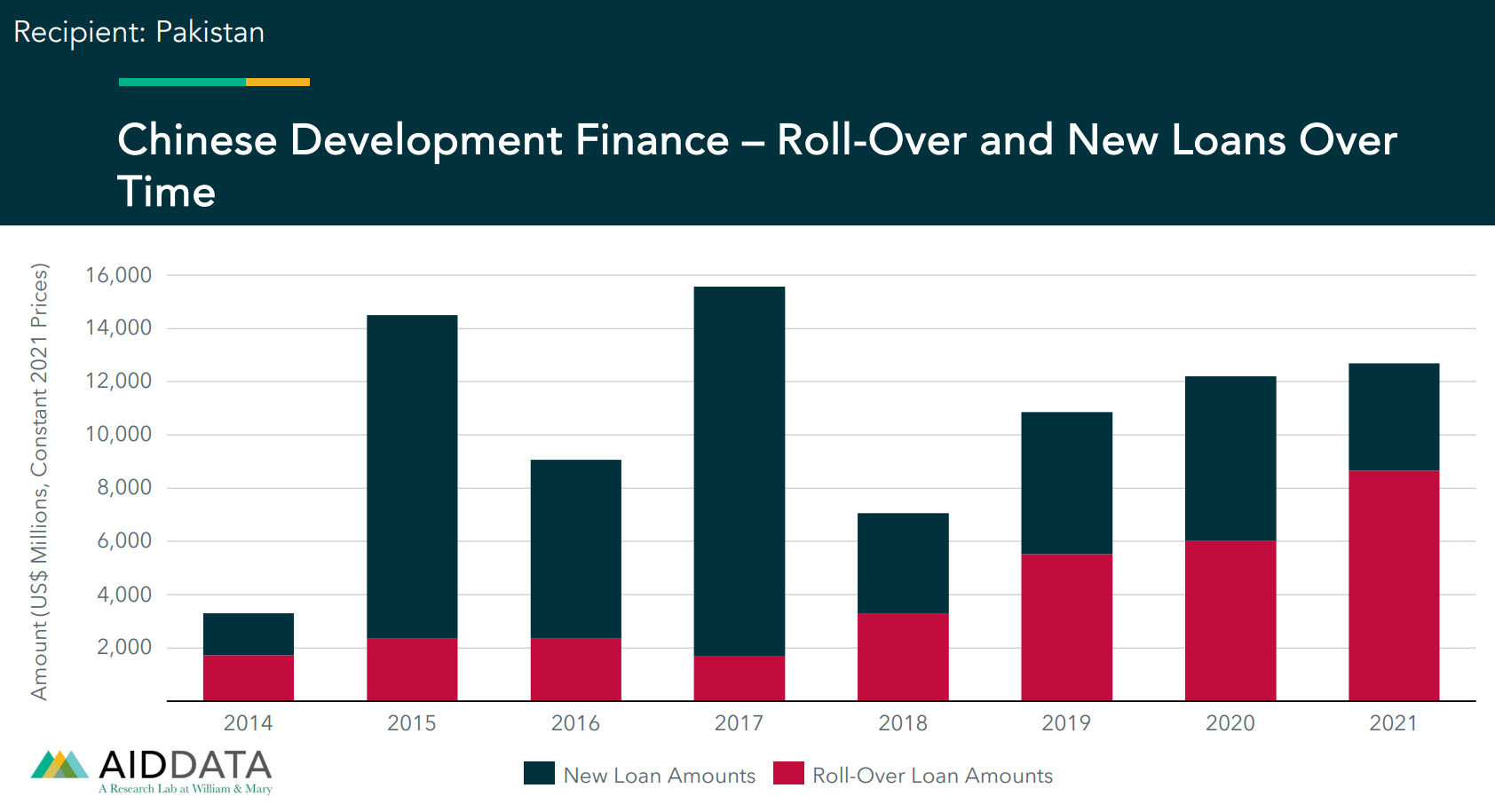

As per research lab AidData’s recent findings, China is faced with the challenge of navigating an unfamiliar and uncomfortable role as the world’s largest official debt collector. A significant portion – around 55% – of its loans to low-and middle-income countries have already entered their principal repayment periods, and this percentage is projected to increase to 75% by 2030.

The total outstanding debt, which includes principal but excludes interest, owed by developing countries to China is estimated to be at least $1.1 trillion.

According to AidData, approximately 80% of China’s overseas lending portfolio in the developing world is currently supporting financially distressed countries. Furthermore, overdue repayments to China are on the rise, both in absolute terms and as a proportion of total overdue loan repayments to official creditors, such as bilateral and multilateral institutions.

Pakistan is a major contributor to this statistic. “With 161 loans worth $68.92 billion, Pakistan is China’s 3rd largest country-level loan portfolio anywhere in the world, after Russia and Venezuela. At $28.13 billion, rescue lending to Pakistan originating in China is the highest in the world, followed by Argentina, Ecuador, and Venezuela – pointing to the particularly close “all-weather friendship” between the two countries,” reads the AidData report released in November of last year.

The Chinese strategy of rolling over payments that are due is expected to persist, as Beijing has a vested interest in ensuring Pakistan’s stability. However, those in Islamabad who anticipate China to provide a smooth resolution to Pakistan’s debt crisis may be in for a harsh awakening.

While speaking on Tabadlab’s platform, a Pakistan-based think tank, Dr. Ammar A. Malik, senior research scientist at AidData stated, “Chinese companies operating in Pakistan prioritize commercial objectives and are primarily accountable to their shareholders for profitability. While it is in their best interest to ensure Pakistan remains financially stable, the likelihood of significant debt relief in collaboration with the West seems improbable.”

All roads lead to the IMF

Pakistan’s economic stability is now contingent on securing a long-term agreement with the IMF once the current Stand-by Agreement expires in March 2024. The situation is further complicated by the fact that the country is expected to hold general elections just one month prior, in February.

The significance of being under the IMF’s umbrella is amplified due to its implications on bilateral cooperation. “In terms of Pakistan’s short term loan repayment risk, the IMF holds the key. China’s position is that it would only provide rescue lending to countries that remain in good standing with the IMF,” remarked Malik.

Pakistan’s other major bilateral partner, Saudi Arabia, also has a similar stance. At the January 2023 World Economic Forum in Davos, the Saudi Finance Minister Mohammed al-Jadaa pointed towards a shift in the approach of giving direct grants and deposits without any conditions attached. He mentioned that Saudi Arabia is strongly advocating for recipient countries to undertake reforms. Emphasizing the need for reforms, he highlighted that while Saudi Arabia is imposing taxes on its own people, it also expects other countries to make similar efforts.

However, analysts believe that there are no significant obstacles hindering Pakistan’s ability to secure another IMF program, as all factions of the state are aligned towards this common objective.

Yet many analysts, including Dr. Vaqar Ahmed, joint executive director at the Sustainable Development Policy Institute, are of the opinion that while short-term measures like rollovers and borrowing from China and Gulf countries might offer temporary relief, a comprehensive debt restructuring plan is necessary.

In his analysis for UNDP’s Development Advocate October – November 2023, Ahmed highlights the significance of the incoming government, after the 2024 elections, conducting a thorough evaluation of debt management options. The IMF has emphasized the importance of developing a sustainable program facility. For Pakistan to maintain solvency, it is crucial to have a functional economy that generates favorable foreign currency inflows through exports, foreign investments, and remittances.

Therefore, addressing the root causes of public finance mismanagement is crucial, including fostering transparency, accountability, and efficiency in financial procedures. Implementing tax reforms, enforcing stricter budget controls, and strengthening fiscal responsibility are vital steps towards improving revenue collection and preventing reckless borrowing.

Encouraging domestic savings, attracting foreign direct investment, and seeking public-private partnerships can help reduce reliance on external borrowing in the long run.

I am not sure if it has already exploded but if it has not, it can any time. The sooner it explodes, the better because we shall not learn till we are shaken. My greater worry still is that we shall never learn because we as a nation were not born for learning.