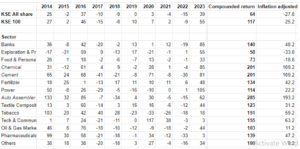

As the year ends, it can be said that this was one of the better years in the Pakistan Stock Exchange. The market yielded a rate of return of 55 percent which is the most for the last 10 years seen in the market. The second best year was 2016 with a return of 46 percent. After that the returns fell to 27 percent in 2014. These returns include dividends which might have been distributed by the companies which constitute the KSE-100 index.

Before you start calling up your favourite broker and ask for a tip on an investment to be made, this performance needs to be put into some context.

The stock market consists of boom and bust cycles. The period between 2016 and 2023, the best years, the market actually saw a negative return of -13 percent from 2017 through to 2022. This means that even if you had before 2016, you would have seen a rise of 46 percent and then seen your portfolio lose value on a daily basis.

Many investors who invest in the stock market locally are looking for a quick return and do not have the patience to wait for their investment to turn good. Many investors would have sold their holdings between the period of the two peak years making up 6 years as their portfolio would have been stagnant or even given them a lower return they could have earned if they sold in 2016.

The keywords while investing in stock market, doing comedy and batting are three things. Timing, timing, timing. The need to know when to get on the roller coaster and when to get off. This is vital. That is one part of the strategy. It is sometimes even seen as collecting pennies in front of the bulldozer. The decision to get into the market and then get out is crucial or an investor can end up making a loss.

But this is only one side of the coin. The other side is to buy a stock and hold for a long time. The goal of this strategy is to be able to buy good stocks which have consistently shown performance and might even give dividends to its shareholders. In case that strategy was followed, it can be seen that based on the returns of the last 10 years, they would have earned a compounded return of 117 percent. This spans a period of 10 years and would have meant a steady return of 11.7 percent per year over the investment horizon.

So the point is to either look to follow a strategy of trading on a daily basis and try to time your decisions right or choose a good portfolio of stocks and then forget to ever follow their rates. In order to do so, an investor can buy the stocks in the same ratio and proportion as the KSE-100 index itself.

There are murmurs that can be heard. What about inflation? Wouldn’t inflation eat away at much of these returns? Yes, that objection is justified. Once inflation is accounted for, it was seen that over the last 10 years, compounded inflation was around 91.8 percent. This means that the stock market earned an inflation adjusted return of 25 percent for the 10 years considered. This dampens the per year return to 2.52 percent.

Has that made you lose some of the enthusiasm in investing in the stock market? Well let’s compare it to what a bank deposit would have earned for the same period.

Taking the base rate as a proxy, we can see that interest rates or more appropriately, bank deposits would have yielded a compounded return of 100 percent. If this amount is adjusted for inflation, the adjusted return comes down to 8 percent and an yearly return of less than 1 percent.

Can I see you picking up that phone again? Well put it down. Noone and absolutely noone in this world is so perfect that they will be able to earn the return stated above. I know the research department of your favourite brokerage is the best and their analysis is always spot on. Noone can predict the best time to buy a stock and sell it. It will be a fools’ errand in trying to perfect your timing.

For people who do not want to buy a part in the whole index, the next best thing is to consider sectors which are making up the index in the first place. Now it is understood that the index is a weighted average of some key sectors and shares listed in the stock market. This could mean that if you select the right sector, you can earn better returns compared to the index on the whole. Similarly, you can also make worse returns than the index so that is one risk that is being taken when a sector is being selected.

Out of the 14 sectors categorised in the market, the best sector to perform was the autoassembler sector giving compounded returns of more than 285 percent followed by cement and chemical each giving a return of 201 percent. This simply means that if an investor had invested in either of these sectors, their Rs. 100 would be Rs 200 by now. Once these amounts are adjusted for inflation, the returns fall to 193 percent for auto assemblers and 109 each for chemical and cement respectively.

Just like you could have doubled your money, in the auto sector, you could have made a smaller gain in other sectors. The top three worst performing sectors for the last 10 years were oil and gas exploration companies yielding a return of 58 percent, food and personal earning a return of 73 percent and miscellaneous shares which gave a return of 100 percent. Adjusted for inflation, these become -34 percent for oil and gas exploration, -19 percent for food and personal and 8 percent return for miscellaneous stocks.

So if you are still interested in investing in the stock market, either be actively involved in it to earn a good return and make the market everything in your life. Or take a more distant approach and invest in the market for the long haul. Choose companies with good track records and then sit back and relax and watch your investments grow.

thanks for sharing your analysis, can we say that “inflation adjusted” may be also be well considered, while exploring the future options ?

MY PERSONAL EXPERIENCE ON LOST CRYPTO RECOVERY!

I read so many stories about bitcoin loss to scams. I will like to start by saying the agencies responsible for bitcoin security has really done nothing to help locate stolen or lost coins. In my situation my MacBook was hacked by someone that had access to my emails, i immediately contacted blockchain and they only wasted my time, after which i worked towards getting help else where, i was referred to consult a bitcoin expert who helped track and retrieved my 3.3 btc, for an agreed fee. I was more than grateful and willing to pay more after the job was done. Thankful i didn’t fall victim and would like to recommend ( MORRIS GRAY 830 @ G maiL . COM )