ISLAMABAD: The Federal Board of Revenue (FBR) has reported a surge in tax revenue collection, reaching Rs. 5,150 trillion from July 2023 to mid-February 2024. This figure marks a 30% growth compared to the same period last fiscal year. Tax refunds also witnessed substantial growth, increasing by more than 28% during the aforementioned period. The feat is being labeled as a spectacular one by the FBR however a detailed look into the numbers presents a different picture.

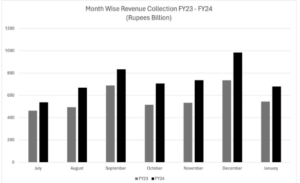

According to the data released by the FBR, the month-wise revenue collection highlights the consistent upward trajectory:

The figures mark an average increase of 29.7% in the monthly tax collection of the first 8 months. But how did the FBR manage to increase these taxes so significantly?

According to FBR data, the growth in domestic taxes has been robust, with an overall increase of around 40%. Meanwhile, import duty and related international taxes also saw a small growth of 16% during the same period.

While domestic taxes are a major subject, let us first look at the foreign/international taxes. The growth in import taxes was somewhat subdued due to downward adjustments in import tariffs over the years. Another major reason was the recent restrictions on import licenses imposed by the State Bank of Pakistan (SBP) to manage foreign exchange constraints.

Nevertheless, efforts such as improved import valuations and intensified anti-smuggling drives have contributed significantly to import tax revenues, which witnessed a remarkable 69% growth compared to the previous fiscal year.

Yet, there remains room for improvement, especially in enhancing anti-smuggling efforts to curb illicit trade activities.

It is also important to note that a 16% growth from FY23 is also not a great feat since a major part of FY23 was spent in a heavy balance of payments, and subsequently a heavy import restriction. This is apparent by the fact that the growth in customs duties fell between FY22 and FY23, showing negative growth. The same figure of growth between FY21 and FY22 stood at above 35%.

There is also a shifting trend in revenue mobilization which needs to be addressed. The domestic tax collection now accounts for over 64% of the total revenues collected during the current financial year. This represents a significant increase from just three years ago when import taxes constituted more than 50% of total revenues.

What does this mean? This means that the brunt of the fiscal burden is being lifted by the domestic economy. Another major reason is the decrease in trade over the past few years owing to bad economic conditions.

A clearer picture is given below in a breakdown of tax-wise collections which reveals the following trends:

| Tax | Up to Jan- 2023

Rs. Billion |

Up to

Jan-2024 Rs. BN |

% Growth | Major Contributors |

| Income Tax | 1,751 | 2,447 | 40 | Banks, POL, Textile, Power, Food, Services |

| Sales Tax | 1,480 | 1,766 |

19 | POL, Power Food, Autos, Iron & Steel, Chemical |

| Federal Excise | 190 | 307 | 61 | Tobacco, Cement,

Beverages, Airlines, Fertilizers, Autos |

| Customs Duty | 552 | 629 | 14 | POL, Autos, Iron & Steel, Electronics, Food |

| Grand Total | 3,973 | 5,150 | 30 |

The major contributors to tax revenues include banks, petroleum and oil companies, power sector, food industry, textile industry and various services. Similarly, industries such as petroleum, power, food, automobiles, iron and steel, and chemicals have significantly contributed to sales tax revenues.

The majority of these industries are categorized in the essential goods and services sector. The table above reveals a number of things, apart from FBR’s heavy reliance on direct taxes on essentials such as power and petroleum, the board has been unable to increase the taxation on customs be it on imports or exports. It showcases the current situation of the country where the country is set to hike the taxes on power once again, overlooking the average citizen’s problems. This begs the question, whether this increase of 30% is a success or not?

Oh dear it is a negative growth after adjusting inflation, when a recission persist whay do you expect in increase in revenue for government even tax leaking will hardly cover tax collected after adjusting from last year.

Taxation on power is causing poor people survival difficult. Moreover it has rendered export business not compatible in the world. Expand taxation base. Have the courage to tax traders, bring in tax net illegal business of tobacco, sanitary manufacturers and other illegal businesses that is cause of concern for genuine manufacturers. Curb smuggling. Reduce expenses/ free facilities and perks to high servicing/ retired govt official. It is the time President/ Prime ministers/ MNA/ MPA/ member senate judges( present/retired) must give up some of their privileges and perks to sacrifice for the welfare of poor people.

FBR should also pay attention to returning the advance on WHT on Profit for amounts kept in Banks, they linger on one pretext or the other.