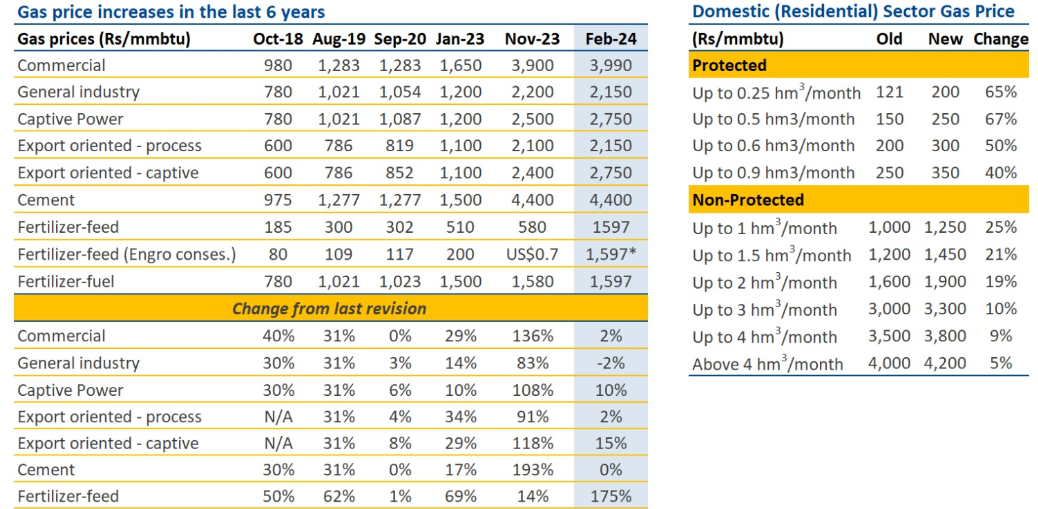

Something strange is happening in Pakistan’s fertiliser industry. On the 15th of February the caretaker government announced a massive increase in the prices of gas, both for domestic and industrial consumers. The increase was part of an IMF mandated move to rationalise gas prices in the country and end the complex web of cross subsidies that the government provides to different industries through cheap gas.

As part of the increase, the price of gas to the fertiliser sector was increased from Rs 580 per mmbtu to Rs 1597 per mmbtu marking a sudden jump of over 175%. One would assume that the fertiliser industry, like most others, would be opposed to such a measure. After all, natural gas is the single biggest input cost for producing fertiliser, and increasing the price will without any doubt increase the price of Urea and DAP in Pakistan — the two major fertiliser products that are vital to Pakistan’s agricultural output.

In reality, most players in Pakistan’s fertiliser industry have long been calling for increasing the prices of gas and removing the subsidies that the industry receives from the government through discounted gas prices. Since the increase, Engro has gone as far as releasing a press statement commending the increase saying the policy shift offers an opportunity for the sector to demonstrate global competitiveness without reliance on government subsidies. The government of Pakistan is also expected to save Rs 150 billion as a result. (Editor’s note: Don’t be fooled into thinking that Engro does not want any kind of government subsidy. It is just that they want the money to be spent more smartly.)

But there is a catch here. Right now two different realities exist for different fertiliser plants across the country. You see gas comes from two different sources to fertiliser plants. One is through the Sui Southern Gas Company (SSGC). The other is directly from the Mari gas fields through Mari Petroleum. The problem is that the increase in price has only been notified to the SSGC, meaning Mari is providing gas at the same subsidised rate as before.

And that means there are some that are getting more benefit from this arrangement than the others.

Why gas is important

There are a few things to understand here about the fertiliser business. For starters, gas is a major input. In fact around 80% of the cost of making fertiliser is the cost of gas. This means that the price of fertiliser on the market is directly dependent on the price of gas that the company is receiving.

Most of the gas that fertiliser companies get is indigenous. It is also low grade gas that would be unusable for domestic consumers. For a very long time this gas has been provided to the sector at a subsidised rate. The idea was that to promote farming in the country, a subsidy should be given directly to fertiliser manufacturers so they could then pass on this price cut to farmers. Now remember, the demand for fertiliser does not grow with the population as happens with the demand for food. Instead, the fertiliser industry is dependent on how much land is under cultivation in a country.

This means that within the fertiliser business there is really only one way to make money: Efficiency. If all companies are being provided the inputs (mainly gas) at the same price, then it is a question of which company can use the least amount of gas to make the most fertiliser. They can do this with latest production techniques, updating their machinery, and finding the right experts. All of that is irrelevant. The point is that a fertiliser company’s success depends on how well they can make and market their product. But for this ideal situation to be in place, there has to be a level playing field.

Different players different rules

Let’s take a small break from the fertiliser business and look instead at Pakistan’s gas supply. We don’t have a lot of it and we use it like we do. The reason the IMF wants to address the issue of gas prices is that Pakistan is using its natural gas in very unproductive ways. For example we provide gas to domestic consumers who use it to heat their water and cook their food. In the winter months when the domestic demand increases, the government scrambles to find ways to provide it because not doing so would hurt their vote bank. It is a populist curse.

What the IMF wants and what the government is begrudgingly trying to do is find the best use for every molecule of gas we have. And the general consensus is that it should be provided to industries such as the textile industry or the fertiliser industry that can either boost exports or food production. Now even within industrialists and commercial users there are different categories and webs of cross subsidies that are sometimes difficult to understand.

As we’ve mentioned, the fertiliser industry was getting gas at Rs 580 per mmbtu which has now been increased to Rs 1597 per mmbtu. But it hasn’t been done across the entire industry. You see 80% of the gas that comes to fertiliser plants comes from the Mari Gas fields. While the source is the same, there are two different pipeline networks through which this gas is provided to the fertiliser plants. One is the network of the Sui companies and the other is Mari’s own network.

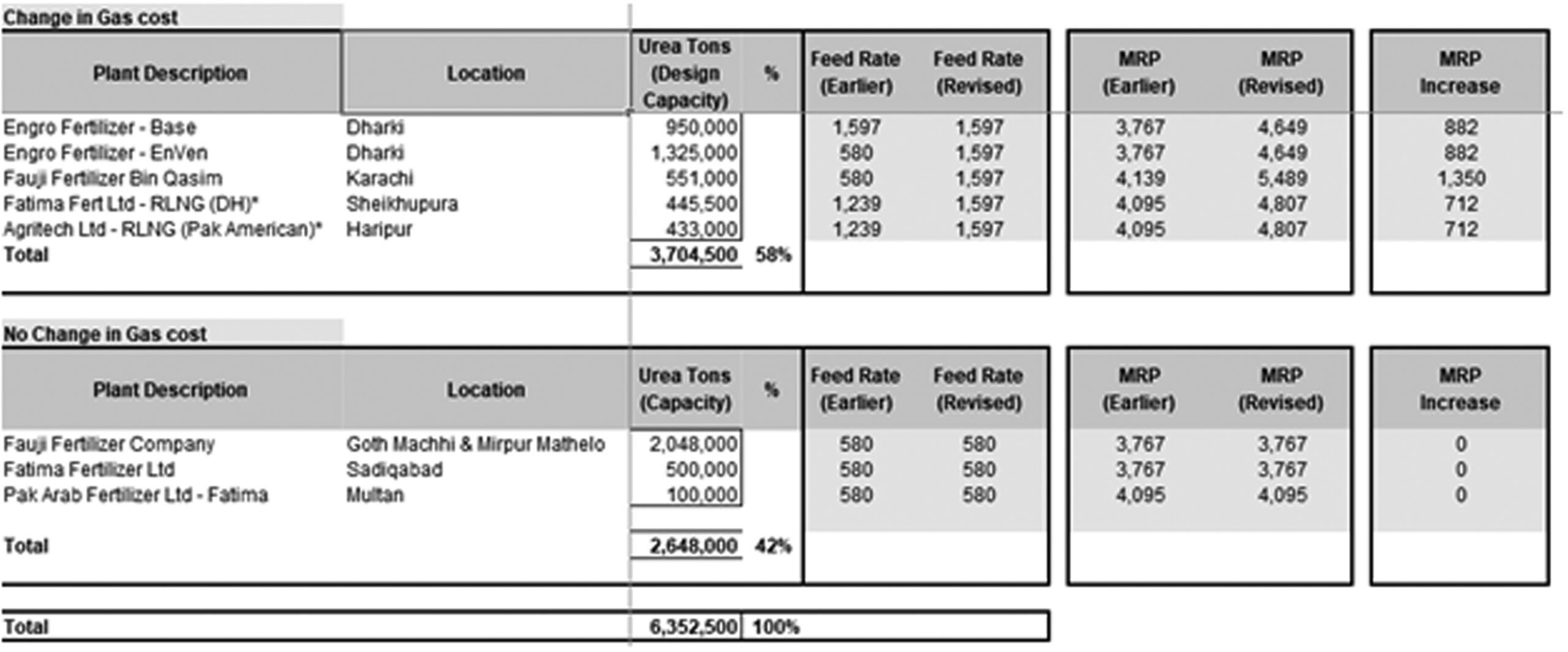

There are currently ten fertiliser plants in Pakistan. Out of these, six of them receive dedicated supplies from Mari’s network. The remaining four are provided gas through the network of SSGC. Of these six fertiliser plants receiving a dedicated supply from the Mari network, a majority belong to Fauji Fertiliser. Back in December 2023, some of this was rationalised when the price for three of these plants was increased from Rs 580 mmbtu to Rs 1580 mmbtu.

In the recent price increase, however, the remaining three Mari network plants are continuing to get gas at the older rate of Rs 580 mmbtu. These three plants belong to Fauji and Fatima Fertiliser, while Engro has entirely been shifted to the Rs 1597 mmbtu price.

This means that while gas prices for SSGC and SNGPL network have increased by around 200 percent, the manufacturers on Mari network (FFC and Fatima) are still receiving gas on the subsidised price of PKR 580/mmbtu.

“This discriminatory gas pricing in the industry has led to multiple prices in the market and will not help the government achieve its fiscal objectives,” said Engro Fertiliser’s CFO Ali Rathore in a recent media interaction in Karachi.

But why the discrepancy? “All suppliers have their own cost of gas purchases which is to be fully recovered from consumers,” explains one senior government official. “For SSGC/SNGPL it is Rs. 1597/mmbtu. For MPCL, there are two gas costs i.e. Rs. 555/mmbtu and $5.6/mmbtu. Recently price for SSGC/SNGPL based plants has been revised to Rs. 1597/mmbtu i.e, Fauji Bin Qasim (w.e.f 01.02.24), Engro Enven (w.e.f 01.03.24), FatimaFert and Agritech Rs. 1597/mmbtu w.e.f 01.04.24. The gas price for 4 plants i.e FFC I to III and Fatima Fertilizer was revised to Rs. 580/mmbtu feed and Rs. 1580 for fuel on October 23 but its lower than Rs. 1597 price. Engro (base plant) and PakrArab Plants have signed contracts for purchase of gas at $5.6/mmbtu. If the government decides to designate one gas supplier for all plants then one gas price concept can be worked out.”

What does this mean for the industry?

The effect has been obvious.The urea prices of FFBL, Engro Fertilisers and Fauji Fertilizer Company Ltd now stand at Rs 5,489 per bag, Rs 4,649 per bag and Rs 3,767 per bag, respectively. This price discrepancy has created an opportunity for the middlemen to profiteer by Rs 80 to Rs 100 billion. A homogenous gas price will create a level-playing field for all fertiliser manufacturers in terms of input costs and help stabilise urea prices in the country.

Of course, the private industry is trying to find solutions to this problem. Major fertiliser manufacturers are investing around $300 million in Gas Pressure Enhancement Facilities (PEF) project from Mari network to sustain domestic urea production levels and safeguard the food security of Pakistan.

But as things stand, by not having the same gas price for all fertiliser manufacturers, the government will not be able to achieve its objectives of reducing national debt and providing stability in urea prices to the farmers. Instead, this discrepancy will cause huge instability in the fertiliser market, resulting in excessive profiteering, hoarding and frustration for the farmer. In addition, the government will lose out on collecting between Rs 80 to 100 billion.

You see, with a rationalisation of gas prices, the government will collect more revenue which can then be spent on agriculture in different provinces. Gas is actually subject to the Natural Gas (Development Surcharge), Ordinance, 1967 which sets the Gas Development Surcharge. The GDS is complicated to understand but what is important to know is that once it is collected it is distributed to the provinces through the NFC award. That means the money goes to the provinces which can then spend them on improving agriculture.

As things stand, there is a very clear discrimination where 40% of fertiliser manufacturers on the Mari network are charged a lower price. It is important to understand that the companies getting the gas from the Mari Network will find it difficult to benefit from this as well. The fertiliser industry works in a way that companies do not sell directly to farmers but do it through middlemen. The running fear is that these middlemen might buy fertiliser in bulk from the companies getting gas from Mari at a cheaper rate, and then sell that fertiliser at the same price as the fertiliser being produced through the Sui network.

There is little the companies can do in terms of increasing their production because fertiliser plants in the country are all already working at complete capacity. There are currently two different rules for different players in the fertilise industry. While the increase of gas prices is the correct decision for the country in the long run, the just call must also be made by notifying an increase in prices for the Mari Network. After all, there can be no competition in a market when there isn’t a level playing field.

Let the #Faujis run the country to the ground, others be damned.

It will effect the industry badly.