The announcement by Lucky Motors Corporation that they were slashing the price of their subcompact crossover SUV, the KIA Stonic, by over Rs 15 lakhs was nothing short of a declaration of war.

After all, they weren’t supposed to.

The government of Pakistan had announced in March this year they were increasing the tax on cars with a factory price of more than Rs 40 lakhs. One might have expected cars like the Toyota Yaris, the Suzuki Swift, or the Honda City to cut their prices by a few lakhs to take advantage of the lower tax.

What wasn’t expected was that the KIA Stonic, priced at Rs 62.8 lakhs after tax, would drop its after tax price by 24% down to Rs 47.67 lakhs overnight. The response has not been disappointing. Buyers made a beeline towards KIA showrooms and conservative estimates confirmed by KIA’s management to Profit claim the company sold over 700 cars in three days.

KIA had to close bookings over the weekend and now plan to open them up again on Monday or Tuesday. As of now, the company has taken bookings for up until September and it seems the KIA Stonic might be the car of this summer season. And it isn’t just customers that have had to jump out of their seats for the Stonic.

As expected, Toyota and Honda had decreased their prices when the new tax on cars above Rs 40 lakh were announced. But almost immediately after KIA reduced the price of Stonic, Suzuki had to approve a 13% drop in the price of its top variant to Rs 47.2 lakhs, down from Rs 54.3 lakhs. The price adjustments by Honda and Toyota have been less drastic, but both have also knocked a few lakh rupees off their prices.

KIA had made the challenge very clear: They were here to take on the Big Three’s prized price segment, even if they had to reduce their margins to do so.

But this does raise questions. For starters, if KIA was able to reduce the price of the Stonic by 24%, what kind of margins were they charging on it before? Why did it take so long for KIA to get to what is clearly the right price on this car? What effect will this have on cars like the Toyota Yaris, the Honda City, and the Suzuki Swift now that a new car has entered this price range? And is it wishful thinking to wonder if this could mean a cascade effect for the rest of the industry?

Over the past few weeks, Profit has had exclusive access to and studied KIA’s financial statements. Interviews with the company’s CEO, Muhammad Faisal, and other sources within the car market have shown that KIA not only had the margins to make the price cut happen, but also to make other players follow suit.

KIA’s magic trick

Up until a few months ago, KIA was dead in its tracks. It was a pretty big fall from grace considering the shockwaves the Korean car manufacturer had caused in Pakistan just a few years ago.

It wouldn’t be inaccurate to say that KIA changed the landscape of how we view cars in Pakistan entirely. And the vehicle of this success for KIA was their flagship car, the Sportage. Between August 2019 and August 2021 the KIA Sportage sold over 25,000 units at more than 1,000 cars a month.

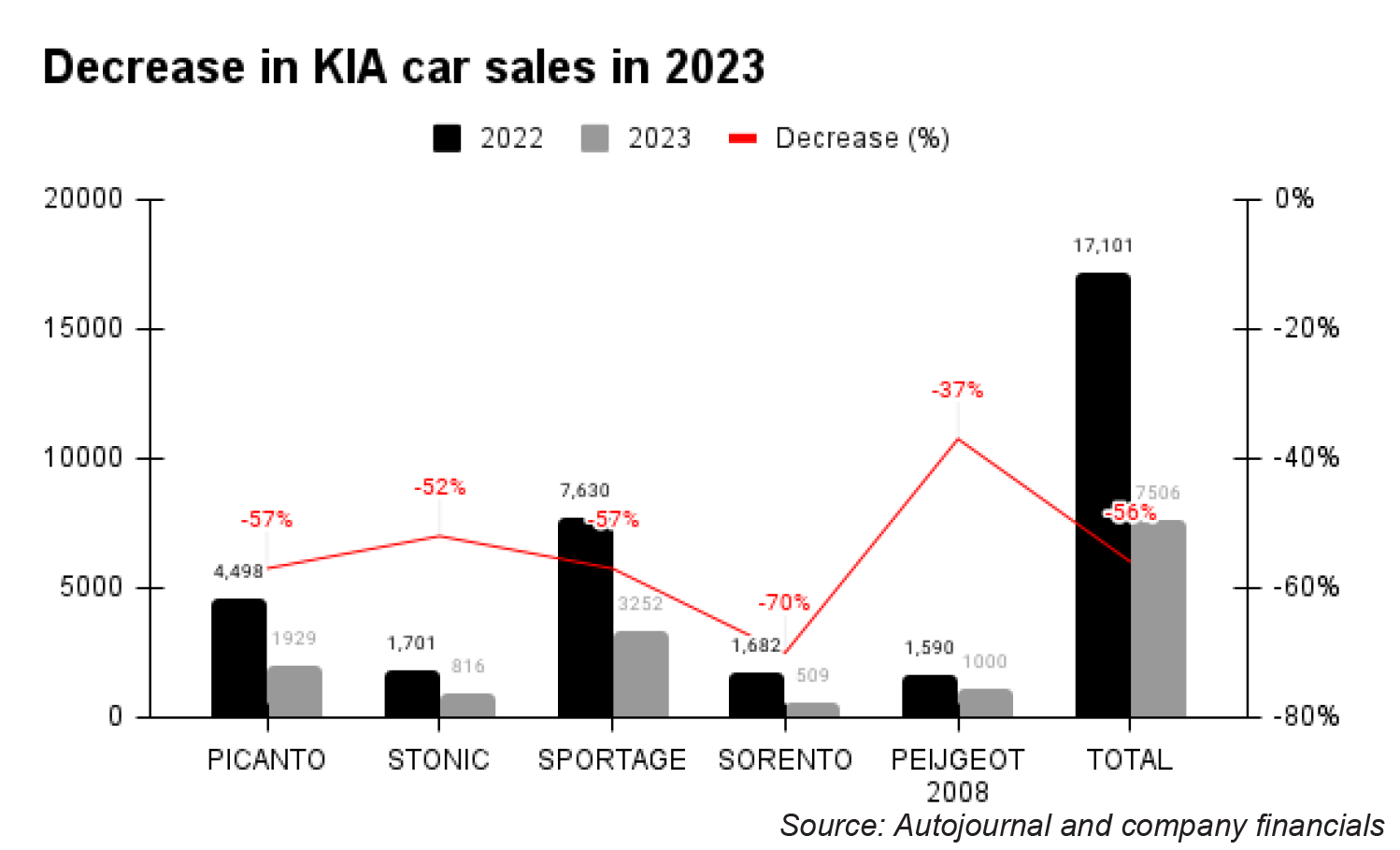

Since then things haven’t been quite so good for the Sportage. Even though it is their most in-demand car, in 2022 the Sportage sold over 7,300 units. This number fell by more than half to only 3,200 units in 2023. The steep fall in sales was natural. Since 2021 the entire car market has seen prices skyrocket and sales plummet as a result. But the initial success of the Sportage, and its entrenchment in Pakistan’s car market as a mainstay, was very simple.

KIA priced the car brilliantly.

When it was first launched in 2019, the KIA Sportage came out at a tag price of just over Rs 45 lakhs. This was a massive shakeup. Back in 2019, the main SUV being offered was the Toyota Fortuner, which was priced at around Rs 75 lakhs. Similarly, when the Tucson was later introduced by Hyundai, it was also priced at around Rs 70 lakh. That is now the price of the Sportage in 2024.

In the Rs 45 lakh to Rs 50 lakh range, the Sportage was competing not with these SUVs but rather with the Toyota Corolla and the Honda Civic, both of which are sedans. The KIA Sportage provided a quality SUV in the same price as a sedan and people absolutely lapped it up. The car was the latest shape (something neither the Toyota Corolla or the Honda Civic could claim at the time) and offered a bucketload of features (by Pakistani standards) that made it an incredibly good deal. That is why the KIA Sportage worked, it allowed other competitors to be braver, and it outsold the Toyota Corolla.

It was like KIA had done some sort of magic trick. Different auto companies had been trying for years to break the hold of the Big Three car manufacturers and somehow KIA came in and did everything right. But it wasn’t like the existing players were going down without a fight. And that is where the story of the KIA Stonic actually begins, with KIA’s first real mistake.

One trick pony?

The Big Three weren’t exactly going to sit around and watch KIA demolish their market. They had for years known exactly what was wrong with their product line and knew how to fix it too. It was just that because there was no competition, they felt no urgency to do so.

Toyota was the first to clap back with the launch of the Toyota Yaris. Essentially, they discontinued the cheaper variants of the Toyota Corolla with 1300cc engines, and launched a new car from scratch that was cheaper. Now, people could either buy a Toyota Corolla in the Rs 3.5 – 4 million range, or a Toyota Yaris in the Rs 2.5 – 3 million range. Essentially, Toyota did to the sedan exactly what KIA did with the SUV. KIA offered an SUV at a comparable price to a sedan and people went crazy for it. Toyota offered a sedan at just a little over the price of a hatchback.

Honda and Suzuki took different approaches but still had to do something. Suzuki pushed the new design of the Swift, a hatchback with a 1.2 litre engine. Honda decided they would relaunch the City in its new shape and market that heavily and price it in the same category as the Toyota Yaris. The KIA Sportage had come in to try and break the market for the Corolla and the Civic by being in the same price range. Suzuki, Honda, and Toyota suddenly launched cars that were newer and cheaper than the Sportage and their sedans, suddenly opening up a whole new market.

So while KIA dominated the market from 2019-21, the Toyota Yaris emerged as Pakistan’s hottest car after this. In its first 14 months, the car sold nearly 30,000 units. In 2022, the car continued this trend and sold around 22,000 units. In 2023, when prices increased drastically, they weren’t even able to sell an exact 10,000 cars. But by this point all manufacturers were facing the heat. Honda City sold around 5900 units in 2023.

With this new challenge, KIA also decided it was time to launch a new car and compete with the Yaris and its ilk. For this they decided to follow the Sportage model in all but their pricing. They introduced the KIA Stonic, a subcompact SUV which is a sort of cross between a hatchback and an SUV. They offered the car in its latest global shape and it immediately hit the markets. The only problem was the pricing.

Pricing themselves out

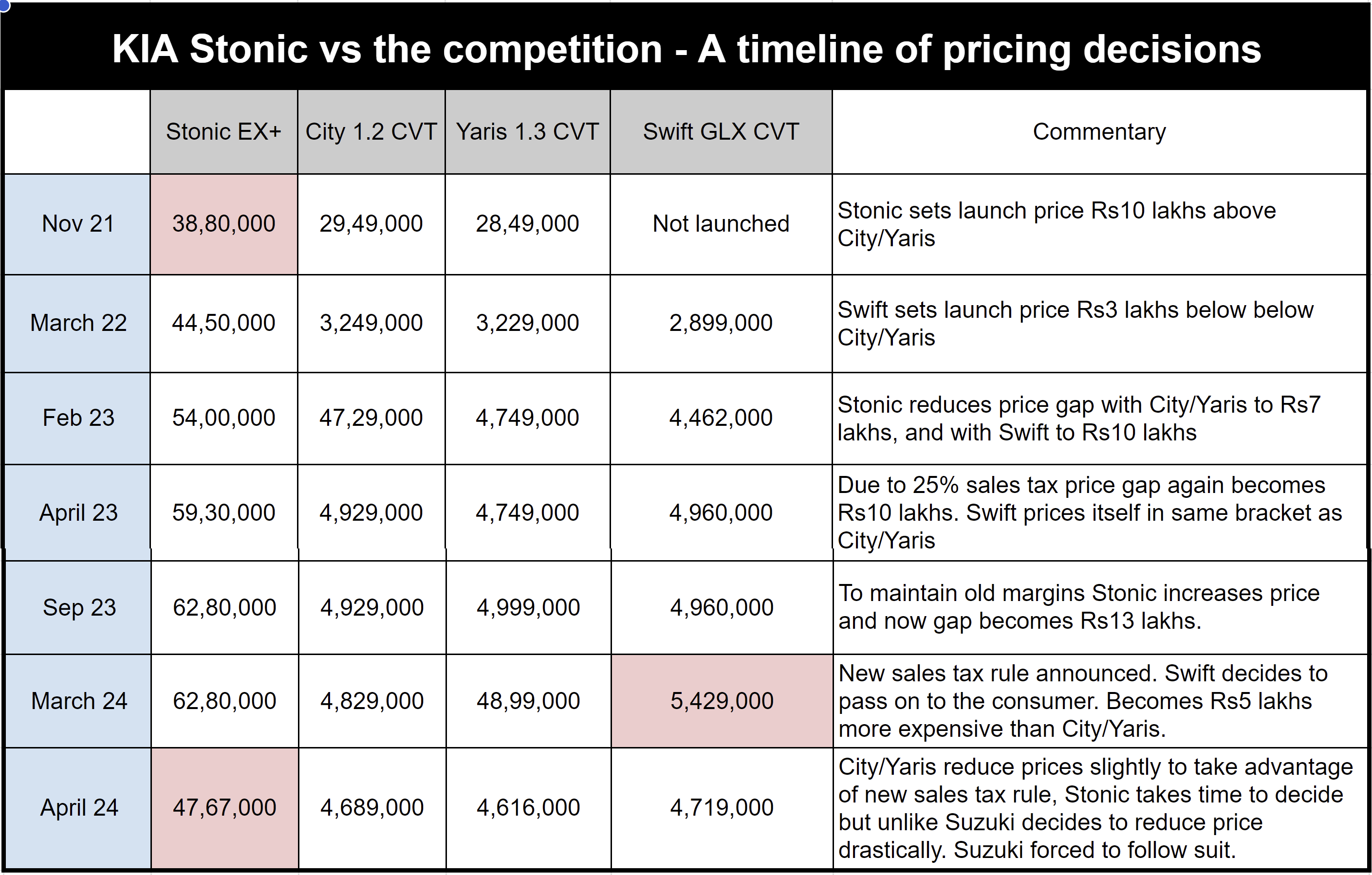

This is a pretty straightforward system. KIA messed up the price. When they launched the car in November 2021, KIA brought it out at a price of Rs 38.8 lakh. This was almost 10 lakh more expensive than both the Honda City 1.2 CVT and the Toyota Yaris 1.3 CVT. The Suzuki Swift had not been launched at this point.

By the time the Suzuki Swift came out in March 2022, the prices of the City and the Yaris had risen to over Rs 32 lakhs. The Swift was launched at a price of over Rs 28 lakh to compete with these cars. The Stonic, on the other hand, was at Rs 44.5 lakh, making it nearly 40% more expensive than the City and the Yaris, and around 43% more expensive than the Swift.

The prices between the cars closed a little around July 2022 when Toyota and Honda hiked prices up by as much as 10 lakhs. At the same time Suzuki only increased their prices to around 32 lakhs which made this an attractive time to buy the Swift. The Stonic was now around Rs 8 lakh more expensive than the Toyota Yaris. By January 2023, the prices of the Yaris had gone up to Rs 45 lakhs but the Stonic had also crossed the Rs 52 lakh mark. Over time, this trend continued. Even the Suzuki Swift kept catching up.

But the real game changing moment came in March 2023. In that month, the government made a notification announcing that all cars that were either above 1400cc or categorised as SUVs in Pakistan would have a 25% sales tax on them instead of the previous 18%. Even though Stonic’s engine size was slightly below the 1400cc threshold, this was a hit for the Stonic since it billed itself as an SUV. As a result, the price of the Stonic in March 2023 went up to nearly Rs 60 lakhs in April 2023. KIA was having to pass down this new tax to its customers. Meanwhile, the price of the Honda City and the Toyota Yaris remained absolutely stable throughout this period with the exception of one Rs 2 lakh increase by Toyota.

By September 2023, the Stonic was Rs 62.8 lakhs. In comparison, the Toyota Yaris was Rs 49.3 lakhs and the Honda City was Rs 49.9 lakhs. The price gap between KIA Stonic and its sedan competitors had gone up to Rs 13 lakhs. Surprisingly, the Suzuki Swift had also increased its price to Rs 49.6 lakhs, now billing itself in the same league as Toyota Yaris and Honda City.

At this point market dynamics had been established. The Toyota Yaris was at the top, the Honda City was next, and the KIA Stonic’s sales were in the absolute dumps. But KIA had persisted with their pricing strategy. They believed their product was better, had a higher value, and was more upmarket than the cars it was competing with. It was also more highly taxed.

Insiders have told Profit that the tax had been levied after extensive lobbying on the part of one of the Big Three companies. The source told us the name of the company but requested it be kept anonymous for reasons of confidentiality. The March 2023 notification hurt the Stonic even more than its original pricing had. That is why KIA also put on its lobbying shoes and went to the government. They tried to explain that the car was not a luxury SUV and hence should be exempt from the tax. All of their efforts led to another notification in March 2024, but even this one had the influence of other players. The new notification held that any car that was priced over Rs 40 lakh (before tax) would be charged 25% sales tax. This meant the Stonic still had the same old problem, unless they chose to drastically reduce their price.

A little point of order here. Back in March 2023, only the Stonic had been affected because it was an SUV while the Yaris, City, and Swift were not and had engines below 1400cc. But the March 2024 notification changed this. The price excluding tax of all of these cars was over Rs 40 lakhs, which meant they would now be subject to 25% sales tax instead of the previous 18%. When the price of a car is brought down to just a rupee under Rs 40 lakh, then with the 18% tax rate the price goes up to Rs 47.7 lakhs. This was an easy decision for Toyota and Honda as they only had to decrease their prices slightly to bring them under the Rs 47.7 lakhs threshold.

This is where KIA had a decision to make. They could either continue keeping the manufacturing of the Stonic down and keep it at its price, or reduce it significantly. Toyota and Honda had already brought their prices down to around the same level with the difference of less than a lakh. KIA chose the latter, bringing it down by an astonishing 24% to Rs 47.67 lakhs after tax at the end of April 2024, just last week. The real hit was the Suzuki Swift. In March when the notification came, Suzuki had decided to initially pass on the price to the consumers and the car’s price rose to a staggering Rs 54.3 lakhs — more than Toyota Yaris and Honda City. Amongst the three, the car that had started as the cheapest was now the most expensive, and that too by a margin. So when KIA decided to slash the Stonic’s asking rate, Suzuki had to eat humble pie and go back on the increase within a month and bring their price back down to Rs 47.2 lakhs.

That pesky margins question

There were plenty of theories going around when KIA first announced that the Stonic was going to have a fourth cut off from its final price. Most people initially thought this meant that the car was being discontinued. That the sales had been bad enough for KIA to call it quits and this was an attempt to get rid of existing stock. This has been proven wrong because KIA is taking advanced bookings as well and clearly intends to keep making the car. There was another theory that KIA might be having capacity issues. But as we’ll get into a little later, KIA is well within their capacity capabilities. If anything they are pretty underused. There was also speculation that perhaps KIA knew something about the dollar going down and wanted to get a head start on downgrading their pricing. That seems more of a wishful thinking than anything else.

That really only leaves the room for one possibility. That KIA always had enough of a margin on the Stonic to reduce the price and still make a decent profit. And the margins are what it all comes down to.

This is the crux of all business. Go to a roadside vendor and try to haggle with them and they’ll give you the same old spiel.

“Itna toh mere laga hai iss par koi munafa nahi rakh raha”

Consumers like to buy products with low margins. They went to get it for as close to the cost it took to produce the product as possible because they don’t want to value or pay for the manufacturing, the overheads and the profits. And those selling want to increase this margin as much as possible because, well, because they want to make money.

The auto industry would also like to pretend that they work on small margins. But if the KIA Stonic and now the Suzuki Swift prove anything, it is that this assumption is incorrect. “The company has taken a very bold step. The car is still contribution positive. We’re not going to be making much money on this because that we would have done at the previous price. But we did feel there was an opportunity with this particular car at this price point. And the recovery of our fixed costs will also be better if we achieved the volumes” says KIA’s CEO Muhammad Faisal.

The reduction in the Stonic’s price is 24%. Of course, we have been talking about the after tax price up until now. To understand this, remember that the price of Rs 62.8 lakhs has two components — the sales tax and the factory price. The government’s notification held that any car over Rs 40 lakh factory price would have 25% sales tax on it. The factory price of the Stonic was around Rs 49 lakhs, on top of which 25% tax gave it the price of Rs 62.8 lakhs. The final price adjustment of 15 lakhs has a reduction of both tax and factory price. KIA essentially reduced the price by 9.75 lakhs on the factory price bringing it just under 40 lakhs. This was around a 20% deduction in the price. Now that it was less than 40 lakhs, the sales tax was also reduced by a little over 5 lakhs bringing the price of the car to Rs 47.67 lakhs. That means we can safely assume the contribution margin KIA was charging for the Stonic was greater than 20%.

The reduction of Rs 9 lakh from their production cost means KIA was producing the car for even less money. In fact, as the company’s CEO Muhammad Faisal has told Profit, the price of the car is still contribution positive.

It is something that becomes clearer from KIA’s 2023 financial results. In the document available with Profit, the company reports its sale at Rs 82 billion. Their total cost of sales in comparison are Rs 73 billion. However, around Rs 6.1 billion of these costs are overheads, so the actual variable production costs come out to around Rs 16 billion. This amounts to a margin of around 20%. In the case of the KIA Stonic, as displayed above, we can assume the margin was even higher than this.

This isn’t the only detail that can be gleaned from KIA’s financials. It is telling of the state of affairs in Pakistan’s car market. KIA currently has the production capacity for 50,000-60,000 units. In 2023, they only utilised 21,984 units from this capacity. This figure fell by more than half in 2023 to 10,264.

Despite this, KIA made a profit of over Rs 9 billion in 2023. In comparison, their profit for the year 2022 had been Rs 9.5 billion. Despite production being cut by more than half, profits only really fell by 5.2%. At the same time, during its worst year, the company made a profit of Rs 9 billion with an equity of Rs 33 billion, giving it an ROE value of 27%. Not bad at a time when the company is doing poorly.

That is because the company earns in other ways too. The deposits that they receive from customers that are waiting for their cars are stored in short-term investments and interest bearing bank accounts and they make a steady revenue off them. Assuming that for the 700 plus Stonic cars that have been booked right now, the average delivery will be in August. And assuming 50% advance amount on these bookings, and the latest 3 month T-bill rate of 21.6%, KIA will make an additional Rs 125,000 on each Stonic sold.

In 2023, at a time when KIA was not making so many bookings, they made Rs 1.8 billion off such income by investing such money. This was more than enough to cover for all non-manufacturing overheads, including administrative, marketing, and even finance costs for the year 2023. This means the company made a Rs 9 billion gross profit, and was able to make the same Rs 9 billion in profit after tax.

What does it all boil down to

We are now at a situation where there is essentially a new entrant in the mid-market price segment. The Toyota Yaris, the Honda City, and the Suzuki Swift have been joined by the KIA Stonic. This means that the market will now be split. Already the Stonic has made some headway, but the method to their madness is relying on volumes over margins.

“It is a volume game now. The company has brought the car into a price segment where there are already three cars. It is a bold step but we have done our working and the company feels there is great potential in this move,” explains Faisal. “This is a strategic decision that probably only a group like Lucky could take, and we will definitely take a hit on our profits and losses but it is a no brainer for the customer as in this price segment Stonic is superior.”

And that isn’t all. There are other moves that KIA plans on making. There are already very reliable reports that KIA is planning on launching new cars in addition to their current line of products. Such a move would diversify the market and perhaps bolsters consumers that have felt a semblance of excitement and desire to buy after some years. The past few years have proven to be taxing on the auto sector largely because buyers have refused to agree to the pricing on behalf of the auto manufacturers.

The decision by KIA to reduce the price of the Stonic might have broken that mould. On top of the possibility of more cars bringing in diversity, KIA might also follow up on their current move and change up their pricing on other cars as well. Maybe not to the extent they did in the case of Stonic, as there is no sales tax incentive in their other product lineup. But if they have been charging margins of over 20% on their cars, they have the capacity to reduce prices on some of their other cars as well. At the same time, their production capacity is far higher than their production numbers. So if they decided to focus on volumes over the margins then KIA will not only increase their sales, but also manage to force the rest of the industry to play catch up.

Honda and Toyota will take some solace in the fact that they can decrease their prices further if need be without being as much of a cut as KIA had to make. So if their margins were as high as KIA’s, they would be able to make more money. But losing out on customers is still losing out on customers. In particular one of the pain points will be Suzuki, which has been outclassed when it comes to the Suzuki Swfit. A hatchback competing with sedans at the same price was strange enough, it cannot now also hope to compete with a subcompact SUV as well. KIA will also have a perception advantage in all of this. Since its launch, KIA has priced Stonic well above the cars it is now competing with. If nothing else, the customer perception might be that the Stonic is much better than the rest of these cars if not worth more. This will also help them make sales.

But there is a catch to all of this. We are assuming that Toyota and Honda are losing out on customers. What we’re not acknowledging yet is that KIA has just created customers. Up until this point, car sales were dead in their tracks. All cars except the Haval Hybrid had seen their fortunes take huge dips. The new price of the Stonic has pumped some much needed adrenaline into the car market. Buyers have gone out because of the new option and it has also changed the dynamics of the second hand market which was fast becoming nearly as unaffordable as the original market.

The only question that remains to be answered is how far the tremors of this shakeup will carry. Already, Suzuki having to adjust the price of the Swift is a sign. Similarly, news has already come in that Changan has reduced the price of their SUV, Oshan X7 by Rs 4 lakh, which interestingly is not even in the Stonic league.

The move by KIA was a risky one but it has clearly paid off. Will other car assemblers try and replicate this success? KIA already has tasted some success with this strategy before. They have taken the first steps to replicating it with the KIA Stonic, and they might not stop here. In fact, without elaborating much, this is how Faisal chose to end his interview, “this player is capable of doing anything that you can’t even think of.”

It is yet to be seen how the rest of the industry will respond. After all, the Big Three had an answer last time. And they are more than okay going blow for blow.