The anticipated approval of the $7 billion Extended Fund Facility (EFF) by the International Monetary Fund (IMF) board later this month is expected to boost investor confidence in Pakistan’s equity market, alongside ongoing monetary easing and improvements in the country’s credit rating, according to a note by the brokerage firm AKD Research.

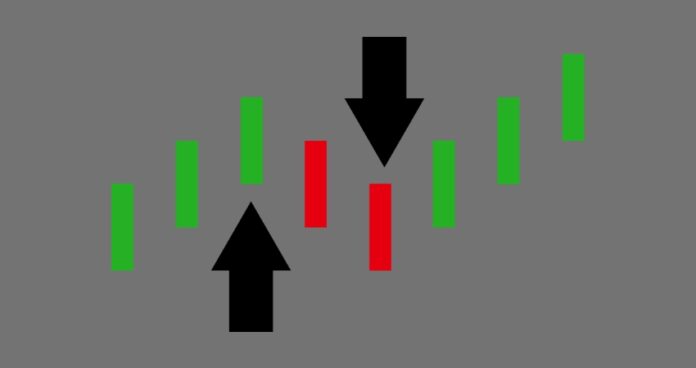

In August 2024, the KSE-100 index posted a modest 0.8% month-on-month (MoM) return as investors awaited the IMF board’s decision. Market liquidity showed signs of improvement, with average trading volumes increasing by 33% MoM to 730 million shares. The traded value also saw a slight uptick.

AKD Research said that the country’s rating upgrade by global credit rating, driven by better prospects of external financing arrangements and a high probability of an IMF program, has kept foreign investors interested in local equities.

Foreign buying in equities reached $9.3 million in August, bringing the cumulative year-to-date (CYTD) buying to $102.9 million. The highest inflows during the month were recorded in the Exploration and Production (E&P) sector ($3.8 million), followed by Technology ($3 million) and Food & Personal Care ($2.7 million). However, foreign investors reduced their exposure to Cement, Fertilizers, and Oil Marketing Companies (OMCs).

On the other hand, local institutions remained sellers in equities to secure higher yields in fixed-income instruments, anticipating continued monetary easing due to falling inflation and improving external account position, the brokerage house added.

Institutions offloaded $32.6 million worth of shares in August, with significant sales from Mutual Funds, Insurance, and Banks. However, individual investors supported the market with a net buying of $20.3 million during the month.

Pharmaceuticals and E&P sectors were the top performers in August, with gains of 11.4% MoM and 8.9% MoM, respectively.

The rally in Pharmaceuticals was fueled by expectations of a drug price hike, while E&P stocks benefited from anticipated improvements in cash flows amid challenging production conditions. The Technology, Chemical, and Fertilizer sectors also posted positive returns, while the Banks, Textile, and Cement sectors experienced declines.

AKD Research forecasted that the IMF board’s approval, coupled with ongoing monetary easing, is expected to keep equities in the spotlight. However, market volatility may persist due to concerns over the external account position and potential political noise.

While the index could retest its September 23rd high, the reclassification of Pakistan’s small holdings in the FTSE Emerging Market Index to Frontier status by the end of the month may lead to outflows.

In light of these developments, sector and stock selection will be crucial. Analysts suggest a cautious approach, focusing on rising cyclicals and structural reforms.