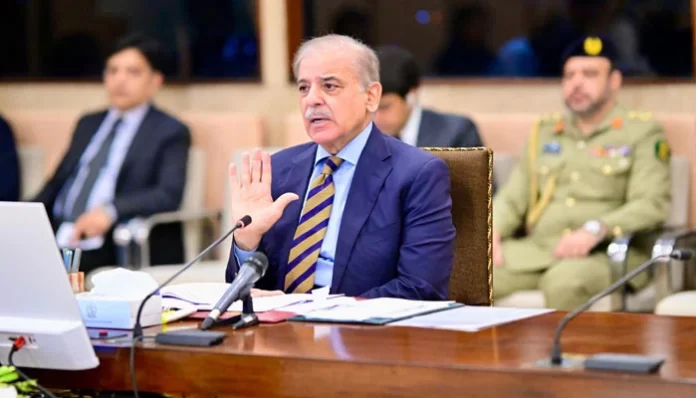

Prime Minister Shehbaz Sharif was briefed on Tuesday about a new digital initiative aimed at tackling sales tax evasion and smuggling in Pakistan through real-time tracking and AI-powered monitoring systems.

Chairing a high-level review meeting on the Federal Board of Revenue’s (FBR) operations and reform efforts, the prime minister was informed that a National Targeting System is being launched. This system will enable authorities to track goods transport vehicles using e-tags and digital devices, according to a statement issued by the Prime Minister’s Office (PMO).

The initiative includes the rollout of an e-Bilty system, which will be fully integrated with the FBR’s digital infrastructure. Furthermore, digital monitoring checkpoints are set to be installed on major highways and at the entry points of cities to monitor the movement of goods.

The aim, officials noted, is to crack down on smuggling and sales tax evasion, minimise public inconvenience, reduce delays, and promote broader digitisation of the economy. This, in turn, is expected to lead to a significant boost in government revenue.

In addition to land-based monitoring, a Customs Targeting System is being introduced at ports and airports to automate the surveillance of both imports and exports. This system will be powered by artificial intelligence and linked with domestic and international databases, strengthening efforts to detect smuggling and fraudulent tax activity.

Prime Minister Shehbaz Sharif stressed the urgency of reforming the tax system, stating that decades of mismanagement—spanning over 70 years—must now be addressed head-on. He emphasized that while honest taxpayers and businesses would receive maximum facilitation, those involved in tax evasion would face strict legal consequences without exception.