ISLAMABAD: State Bank of Pakistan Governor Reza Baqir on Thursday said new schemes for the small and medium-sized enterprises (SME) sector would accelerate the credit uptake ratio of smaller businesses by approximately up to 30 per cent during three years.

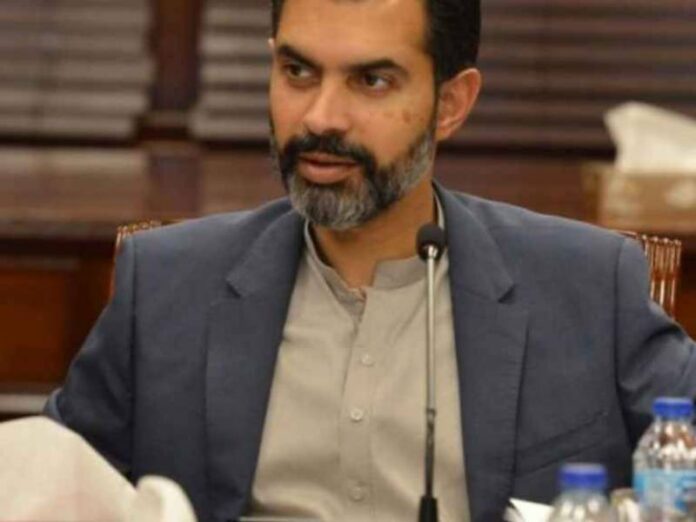

He was briefing Federal Minister for Finance and Revenue, Shaukat Tarin, through video link during his meeting with Minister for Industries and Production, Makhdoom Khusroo Bakhtiyar. Special Assistant to the Prime Minister (SAPM) on Finance and Revenue, Dr Waqar Masood also participated in the meeting.

The meeting was convened to discuss the features of a new credit scheme for the SME sector, according to press statement issued by the finance ministry.

The governor shared that, at present, there were around a hundred thousand small businesses availing the SME credit facilities provided by the commercial banks.

He briefed the finance minister on the proposal for the provision of funds for the small businesses without collateral for a tenure up to three years through the network of commercial banks.

“Banks would design innovative products to reach out to the smaller businesses whereas the government would provide risk sharing facility to the banks,” he added.

Tarin lauded the scheme and affirmed to provide the seed money for the scheme.

“The provision of micro-credit would create employment opportunities at the local level and in turn, enhance gross domestic product growth and would help in achieving sustainable and robust economic growth,” the finance minister concluded.

Very informative article! Thanks for discussing this topic. you’ve really covered up almost all the possible info. I truly appreciate the time and effort you put into this post and in-depth information you offer. Great work!