KARACHI: In a surprising turn of events, on October 18, it was announced that Kabeer Naqvi, CEO of U Microfinance Bank (U Bank) had resigned. The next day on October 19, according to a press release by the bank, Mohamed Essa Al Taheri was announced as the acting President and CEO of U Bank.

Al Taheri has been associated with U Bank as a member of the Board of Directors and worked with e& Group as the Group EVP Financial Policies and Systems. He holds a master’s degree in International Business from the University of Wollongong, Dubai, and brings over 20 years of professional experience from working with HSBC Bank, Dubai Commercial Bank, and the Development Board of Dubai Government.

The appointment of Essa Al Taheri comes soon after the resignation of Kabeer Naqvi, who earlier held the position of President and CEO of U Bank. He had been associated with U Bank since 2015.

However, according to multiple sources in the microfinance industry, Naqvi was forced to resign. They claim, U Bank’s board of directors had also asked the upper management to resign as well, due to concerns over the CEO’s aggressive expansion strategy and alleged artificial growth tactics. However, a source privy to the industry, disclosed that the resignations were later retracted on the announcement of the new management.

When Profit contacted Naqvi for a comment, he said he “was leaving on his own accord” and that he “will be joining his family in Chicago.”

Profit reached out to Misbah Naqvi, a member of the board of directors of the bank but she declined to comment. Profit also reached out to other members of the senior management but received no response.

Delay in publication of financial statements

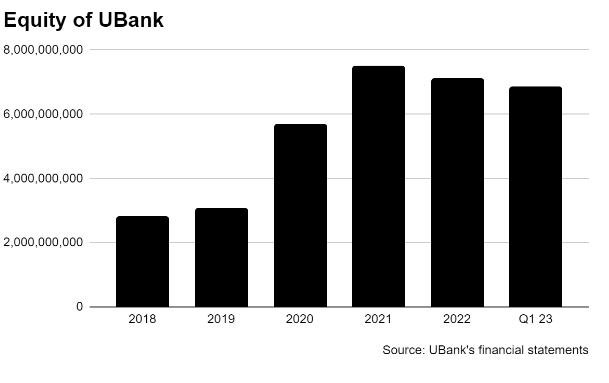

The latest period for which the financial statements of U Bank are available is the first quarter of the calendar year 2023 during which it made a profit of around Rs36 crores.

Following this report, no financial statement have been released. Usually, banks release first-quarter reports of January to March in late April or early May, half-yearly reports of January to June in late August or early September and third-quarter reports of July to September in late October or early November. Annual reports are usually released three months after the accounting year’s end, as the reports need to be audited which takes some time. Sometimes, banks do not release their reports according to these timelines if there have been excessive losses.

In fact, U Bank has a history of delaying releasing financial statements. The 2023’s first-quarter reports were released in July. The annual report 2017 was released in June 2018, six months after the accounting year ended. The third quarter report for 2022 was released in November, a little over the normal timeframe.

Since the microfinance bank has not released the reports for the second quarter of 2023, and now it is time to release the third quarter’s report, there is speculation amongst the microfinance industry that the bank has experienced significant losses.

According to a source in the microfinance banking sector, U bank’s financials presented an overly optimistic picture of the company’s performance. One example, as quoted by a source privy to the matter, was regarding the implementation of IFRS-9. The bank classified a significant portion of its Covid-era rescheduled portfolio under stage one of the expected credit loss model which implies that there was no significant decline in credit quality. However, according to source, the classification was erroneous as the recoverability of these loans was contentious and the management was aware of the fact.

U Bank’s strategy

Unlike other big telecom-based microfinance banks (Telenor Microfinance Bank and Mobilink Microfinance Bank) that had set their sights on branchless banking, U Bank took a more conventional brick-and-mortar strategy.

Naqvi had been spearheading an ambitious campaign to open new branches in urban cities like Karachi, Lahore and Islamabad. In a previous interview with Profit in June 2023, Naqvi said, “We did not try to turn it into a telecom company. We said that this is a bank, and its mission is microfinance. Just like a bank, its balance sheet will grow. It will have liquidity, strong cash reserves, a treasury function, Islamic banking, digital banking, and even conventional microfinance. It will also have an urban unit responsible for deposit mobilisation. If all these elements are in place, (only then) will this institution thrive and last for the next hundred years”. These new branches were essentially to bring in low-cost deposits.

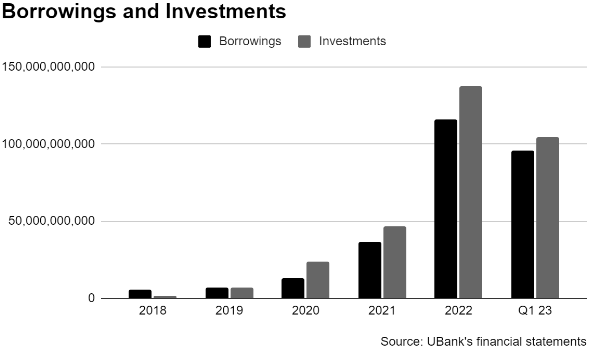

The deposits did increase but the bank mostly attracted high-cost deposits from other banks and firms. These deposits are not sticky.

Moreover, in 2022, U Bank’s balance sheet increased by three times. U Bank used its deposits to purchase money market mutual funds (MMFs) or government securities (T-bills). Then, it pledged those very PIBs to the same banks or even a third-party bank, allowing U Bank to borrow additional funds through repurchase agreements with a small margin. With the borrowed money in hand, U Bank repeated the process of purchasing more Tbills. This cycle continued, spinning a web of financial maneuvering so much so that while the size of assets increased from Rs 10,458 crore in 2021 to Rs 22,130 crore in 2022, net assets have declined from Rs 749 crore in 2021 to around Rs 709 crore in 2022, a decrease of Rs 40 crore.

In other words, it became a highly leveraged bank, as it had accumulated a lot of government securities. In case of change in interest rates, the bank could have incurred significant mark-to-market losses. According to a source, the board had concerns over the aggressive expansion strategy and alleged artificial growth tactics.

To conclude, it can be stated that the forceful resignation of Mr. Kabeer & Miss. Ambreen Malik can be called the repayment of their actions. The lady was known as the only decision maker of the banks HR policies & staffs hiring & firing based at her personal likes and dislikes.

Waiting for another harsh decision about Salman Akhtar & Arif Hussain who treated the people as their slaves and personal property.

in the end it is a crystal clear capturing of Mukafaat, e Amal and Allaah Ki Lathi

Salman Akhtar, Arif Hussain and Shahzad Naeem have ruined the careers of many employees wanting to work with dignity and honesty. Also they were not only creater and defenders of corrupt and malpractices but are also part of it. I am agree that they should also be accountable but if management would come to know about what they have been doing.

Credible sources are quoting that another lady at the top who was Naqvi’s closest ally and de facto ruler of the bank has also been made to resign. Can anyone confirm?

It is a right decision by Board but to show artificial growth, bogus loans are being disbursed to adjust Covid 19 deffered portfolio in every Branch particularly in Central Punjab and South Punjab. All the Cluster Heads, Regional Heads and Area Managers are part of this bloody game. Portfolio due diligence must be carried out by third party to identify the gaps.

I have 30 million deposit in this bank…I hope u microfinance bank wont declare defaulter.

apko branch to loan deti ni itni hard requirements hai..k government services Wala ni ho Bhai phir kis ko.loan dete ho

loan ki keya requirements hai AP clear btyn

Where you shall see Nadeem Hussain and his offspring – the fabeled blued eyed boys; you shall only see plunder and despair in their aftermath. Accountability should be called upon to investigate Tameer and Telenor, TCS and U Microfinance Bank.

There was wide circulation in the industry that commerical banks used these microfinance banks (especially U-Bank) to balance their ADR ratio by lending the money to them at discounted price (escape taxation for non maintenance) and in turn, Microfinance Banks placed those funds at higher rate in the market.

Artificial movement of funds by both commercial and microfinance banks.

U Bank,s lower management specially RBH Lahore is the universal master of #WINDOW_DRESSING.

He always used to linger on the COVID Portfolio default by childish tactics of MORATORIUM Submissions. The King Of Moratorium is Mr. Salman Akhtar Who shows a huge defaulted portfolio as profit which he bluntly knew unrecoverable/LOSS. To achieve this illegal ugly goal he used his chair and autocratic approach towards all his reported branches.

Praise to Salman who remains successful for a long time to Dodge the Board and superiors.

What a Performance ….

RBH سلمان اختر

چٹا رنگ تے چھوٹا قد

کم پایا اے سب توں ودھ

Compliance, Audit and risk heads are sleeping wealthily also accountable.

Yes, that’s my point why audit, risk and compliance are not accountable? They must be brought to frontline helpers of the looters and fascists of the banking industry. It looks everyone was sleeping but why?

Looks like the bank got too big for our Arab friends to not have control. I have first hand knowledge of the fact that our Arab partners could not stomach that Ubank was the only profitable entity in their Pakistan portfolio. Sad day for banking in Pakistan. Arabs must be held accountable.

Unlike other big telecom-based microfinance banks (Telenor Microfinance Bank and Mobilink Microfinance Bank) that had set their sights on branchless banking, U Bank took a more conventional brick-and-mortar strategy.

a long awaited thing happened. Nothing surprising in the microfinance industry because everyone knew that the balloon would surely burst.

What about the controversy of love story of two big already resigned? Any update?

@sana sherry one has left for USA and other one is planning to go.

@HUMEE no one left for US or Planning, What about non bor-n? and still have a room booked in hotel. 🙁

@HUMEE boys are there who are evident of few love incidents, clean shaved came from US and and again had bear, dress designs and shoes design suggestions? All of the Bank old guys know are evident. S-x edicts left or forced to left.

@sana sherry The beard guy is in USA. The lady Ambreen is planning to leave. That’s confirmed.

I m sure you are talking about them.

Merhaba, Siz Pakistanlıları her konuda çok başarılı buluyorum. Tebrikler

Pakistan halkı çalışkan ve dürüst bir halk, Pakistandaki girişimler çok başarılı.

Bloğunuzda yazan yazılar çok bilgilendirici ve akıcı. Sizi tebrik ederim.

Çok değerli içerik ve bilgilerin olduğu harika bir blog sayfanız var.

Son Dakika Haberler Son Dakika Haberleri, Güncel Haberler, Gündem Haberler, İstanbul Haberleri, Ankara Haberleri, Tarafsız Ve Bağımsız İnternet Haber Sitesi