ISLAMABAD: The State Bank of Pakistan (SBP) on Monday directed all banks to deduct zakat from saving as well as profit and loss sharing accounts having cash up to 46,329.

According to an official document, the central bank has asked the presidents and chief executives of all banks to deduct zakat at source in respect of saving, profit and loss sharing and similar bank accounts, and deposit collection soon after the date of deduction.

Earlier, the Poverty Alleviation and Social Safety Division had written a letter to the central bank for the deduction of zakat at source.

According to the letter, the Administrator General Zakat had notified the ‘Nisab of zakat’ for the zakat year 1440-41 AH at Rs46,329. “No deduction of zakat at source will be made, in case the amount standing to the credit of an account in respect of assets mentioned in column 2 of serial No 1 of the first schedule of Zakat and Ushr Ordinance, 1980, is less than Rs 46,329 on the first day of Ramadan-ul-Mubarak, 1441 AH.”

The letter further states, “The first day of Ramadan has already been notified as the “deduction date’ that is likely to fall on April 24 or 25, 2020 (subject to the appearance of the moon) for deduction of zakat from Saving Bank Accounts, Profit and Loss Sharing Accounts, and other similar Accounts having credit balance of Rs.46,329.00.”

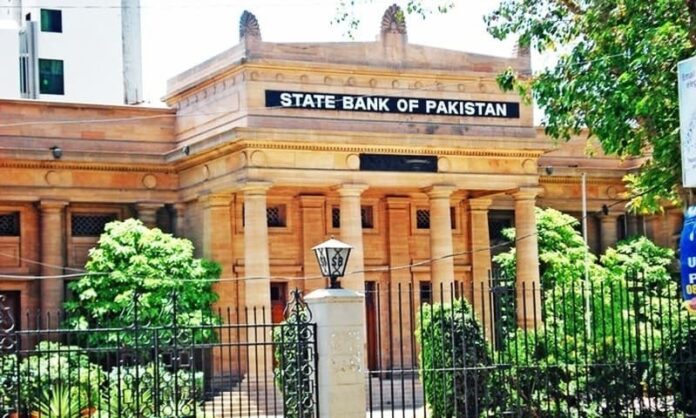

All Zakat Collection Controlling Agencies (ZCCAs) are requested to deduct zakat accordingly. A copy of return of Form CZ-08A may please be provided to this Division immediately after depositing zakat in the Central Zakat Account CZ-08, being maintained with the State Bank of Pakistan, the letter concludes.