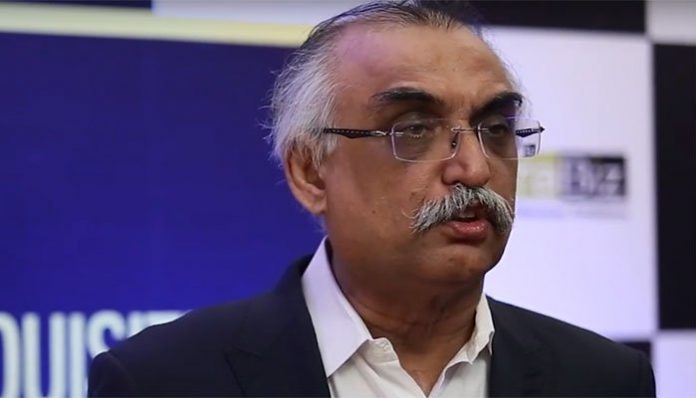

- ‘My aim is to document the undocumented economy, as doing that will automatically increase the tax base’

Federal Board of Revenue (FBR) Chairman Shabbar Zaidi on Friday devised a mechanism to freeze bank accounts in case of a dispute, directing authorities against freezing accounts without his prior approval and notice to the account holder, a private media outlet reported.

In his first order as the FBR chairman, Zaidi directed all chief commissioners of inland revenue to inform the accountholders 24 hours prior to freezing their accounts if they must do so.

“No bank account attachment unless the taxpayer’s CEO or principal officer or owner is informed at least 24 hours prior to attachment and the chairman FBR’s approval is obtained,” read the board’s notification.

Talking to reporters, Zaidi explained that there is already a provision for freezing of a bank account as the last recourse in case of a dispute between the account holder and institutions.

“My intention and aim is to document the undocumented economy,” he said, answering a question regarding tax reforms. “The documentation of the undocumented economy will automatically increase the tax base.”

He said no one can estimate the (volume of) parallel economy. “Some people say it amounts to 30pc of the economy, some say it is 40pc, my opinion is that it would be more than 30pc.”

Earlier in the day, Zaidi addressed officers of the FBR soon after taking charge. The chairman shared his vision to revamp the tax system and machinery and discussed broader problem areas affecting the institution, according to a press release.

Zaidi during the meeting stressed the need to shift from manual to a completely automated system to facilitate taxpayers.

He took the FBR officers into confidence and assured them that the issues being faced by the FBR employees would be addressed under his leadership. He sought the support of all the officers to work as a team for the betterment of the institution and the country.

Zaidi, a private sector tax expert, is a Karachi-based partner in the chartered accounting firm A.F. Ferguson. The establishment division notified him as the new FBR chairman on an honorary basis on Thursday.

We have blind trust in this highly educated and impartial FBR Chief. Inshallah he will set things right. A major overhaul is what we need. Tax payers keep receiving fake notices from FBR. Black market deep inside FBR must go and the whole process should be made so simple that connivance of consultants, lawyers and FBR clerical staff be ended. Good luck Shabbar Zaidi.

I am astonished that what for are we feeding the Bloody White Elephants of Bureaucracy?

They failed in every field of life & destroyed every institution they stepped in. All efforts of the Assemblies should;now be to improve these white elephant s;or reform this whole the Colonial System of Bloody Black Khusra Babus!

New FBR Chairman must be aware that scores of FBR Officials are also running their private tax consultancy firms, which have been resulting in the same scenario as the govt school teachers are offering private tuitions to their students against extra money & turn the dunce students into A graders.

Besides, some genuine tax payers are also duped to pay extra money. Alternatively, they are subjected to needless arm twisting. Example being of random audit selections.

I hope and request to tabdeeli govt and new FBR chairman to increase the number of tax payers.

To Increase tax rate on already paid people and salaried persons is not justice and totally against policy of Tabdeeli govt.

The biggest thieves are politicians who are involved in corrupt practices such as land grabbing, water and transport mafia, illegal construction, import without payment of duties, expensive vehicles imported without duty payment, dry port operators involved in non payment of correct duties on used cars.

The other thieves are the provisional secretaries who have been caught time and again.

The Multinational companies are involved in transfer pricing malpractice.

Doctors/beauty parlours/ restaurants who operate on cash basis only also avoid paying true taxes.