LAHORE: A report released by the Institute of International Finance (IIF) on Thursday revealed that the Pakistani rupee has depreciated by 22% in real terms since 2017, putting their estimate for the current account at a slight surplus and the local currency being close to fair value.

According to IIF’s fair value model, the Pakistani Rupee has followed a different trajectory, falling substantially in recent years, including in 2020.

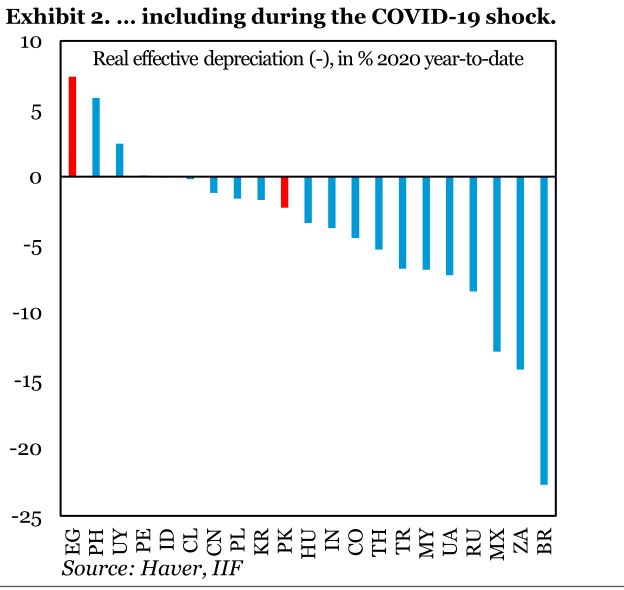

As per IIF data, the Pakistani rupee has depreciated by less than 5% during 2020 which factored in the impact of the COVID-19 shock as well.

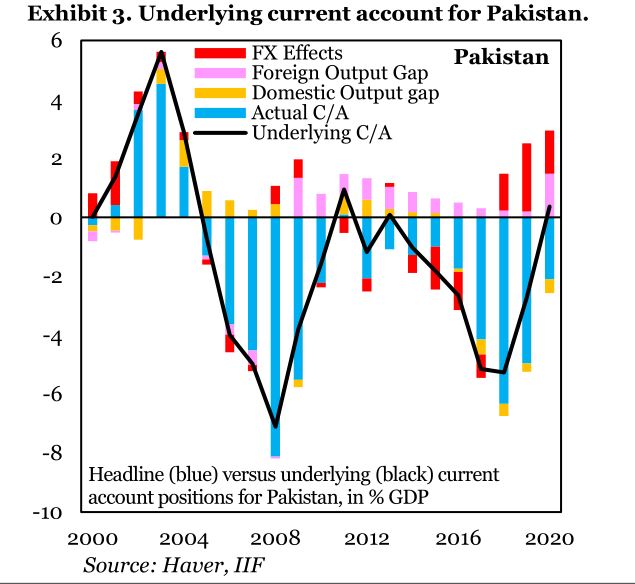

“Our fair value model looks at these exchange rate moves through the lens of the current account. We adjust for the cyclical picture, closing domestic and trade-weighted foreign output gaps, and bring forward effects from real exchange rate fluctuations that are still feeding into export and import volumes with a lag.

This yields estimates for underlying current account balances, which we see as similar to core inflation, i.e. a better gauge of true inflation trends than headline inflation, which can be noisy and misleading,” it explained.

It noted that Pakistan’s underlying current account is in small surplus courtesy being helped along by the positive depreciation efforts.

Talking about the rupee, the recession and emerging markets, Robin Brooks, Managing Director & Chief Economist IIF told Profit, “One of the mechanisms we see across emerging markets is that recession leads to compression in import volumes, as the fall in demand reduces the flow of goods coming into the country.

That is unpleasant obviously, but it does mean that the balance of payments stabilizes and the demand for dollars abates.”

“We expect that this force will help stabilize currencies across EM at this stage, including in Pakistan, which is why our valuation signal for the rupee is broadly neutral at this stage,” shared Mr Brooks.

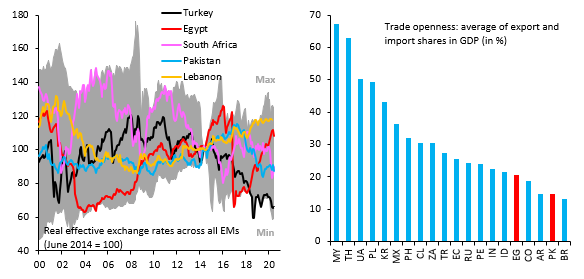

In a tweet, Robin Brooks, Managing Director & Chief Economist IIF on Sunday said, “The rupee is among the more flexible exchange rates in EM and doesn’t look stretched (lhs, blue). At the same time, Pakistan is quite closed to trade, almost to the point of Brazil (rhs).”

Speaking to Profit, Mr Brooks said “On the openness to trade, if you are an open economy, the exchange rate needs to move less than in a relatively closed economy. An example is Turkey versus Argentina, with the former being about twice as open to trade as the latter.”

“That means that devaluation in the exchange rate is twice as powerful in Turkey because the export base is already up and running.

But for Pakistan at this point, we factor all this in and the relatively closed nature of the economy is reflected in our fair value assessment,” he shared.

Meanwhile, Mr Brooks believes that the opening of economies takes time, especially in a world where global trade has taken a massive hit due to COVID-19.

“So what’s needed is for the rupee to stay at current levels for some time, i.e. avoid appreciation, so that resources can be steered towards export sectors,” he highlighted.

Last month, the rupee had exhibited volatility against the greenback and remained under constant pressure, skirting with all-time lows reached at the end of March when it traded at Rs169.50.

However, the downward slide in the rupee in June reversed thanks to timely inflows of around $3 billion received by the State Bank of Pakistan (SBP) in the last week of June which helped the currency to stabilize and trade around Rs166-167 levels against the greenback since then.

During recently concluded fiscal year (FY) 2019-20, the rupee depreciated 4.8% year-on-year (YoY) against the 24% experienced in FY19.

Since 2001, the rupee has on average depreciated 5.4% YoY and since July 2017 it has cumulatively depreciated by around 58% against the greenback.

The rupee is expected to remain under duress during the ongoing FY21 against the greenback as the coronavirus pandemic rages on and impacts the economy including exports and remittances from overseas Pakistani’s.

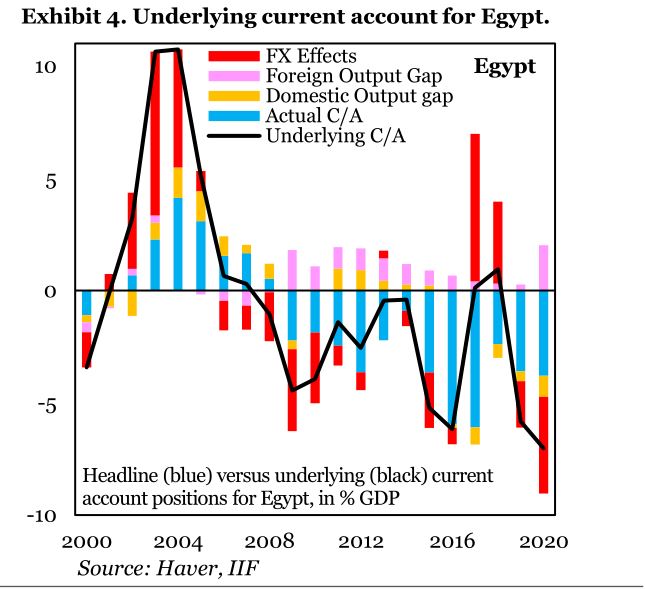

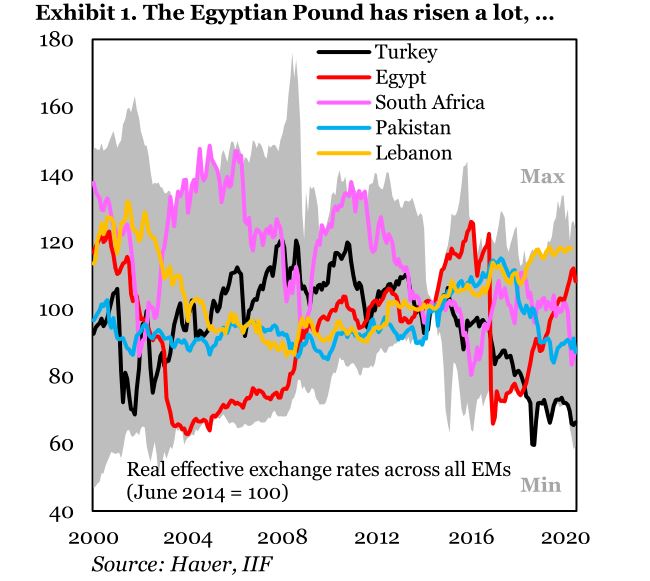

In comparison, the Egyptian Pound has appreciated by around 50% in the aforementioned period, which the IIF said put its current account on a deteriorating path.

It projected a 15% overvaluation for the Egyptian Pound although it warned, “Of course, exchange rate valuation is at best a murky business and our analysis is subject to many caveats. As a result, we see any signal as pointing to elevated risk, not a definitive or preordained outcome.”

“Meanwhile, our estimate for the underlying current account of Egypt is in substantial deficit, given that the real effective appreciation of the Pound is exacerbating the picture,” it added.

Let’s hope the best for Pakistani rupees.

In sha ALLAH! Everything will be fine ..

Comments are closed.