As of the 15th of January 2021, Snapchat has acquired 5 million daily active users (DAU) and 12.5 million monthly active users (MAU) in Pakistan. According to Sensor Tower, the American multimedia messaging app developed by Snap Inc. has ranked in the top five most downloaded social media apps in Pakistan since October 2020, beating Facebook, TikTok, and Instagram.

“The spike coincides with the final nail in the coffin for similar apps of Chinese origin being banned in India,” said Danish Ayub, CEO of MWM Studioz, an eCommerce agency. “When creators in India lost access to TikTok, SnackVideo, and LIKEE, they turned to Snapchat as did their followers, a sizable amount of which originate from Pakistan.”

As predicted by Profit, die-hard audiences will follow their favourite creators wherever they may go, with the above example illustrating that when Indian creators lost access to the likes of TikTok, SnackVideo, and LIKEE, they chose Snapchat as did their audiences.

This was also around the same time that Snapchat, in a bid to capitalize on the removal of apps of Chinese origin from the Indian market, launched features which amplify new content into viral sensations, creating overnight celebrities. This change, called Spotlight, helped public profile audiences gain traction in the social media content creator (SMCC) category, which eventually leads to branded content deals, the bread & butter of influencers.

The Spotlight initiative by Snapchat also offered creators over the age of 16 up to $1 million per day in total as a means of rewarding creativity, which is code for rewarding new and original user generated content. This was coupled with the rise of subscription-based social media service OnlyFans, whose creator network largely uses Snapchat as a means of creating awareness around their adult entertainment products, as reported by CNBC.

It’s worth pointing out that another reason Snapchat is the number one most downloaded social media app in Pakistan could be that Facebook, instagram, and TikTok may be reaching the upper threshold on the maximum downloads they can attain in the Pakistani market. That said, Snapchat has a growing user base, a consistent stream of advertisers flocking to it, no controversial bans to date around vulgar content, and is considered the R&D lab for Facebook.  “I am actually shocked to know about the numbers because I actually thought people have stopped using Snapchat,” said Yamnah Khan, assistant marketing manager at AK Marketing. “Snapchat had its time but since Instagram updated, it has become easier for people to have the same features and a lot more in just one app. As an advertiser I would spend money where I get more options in the same amount than spend it on each app separately.”

“I am actually shocked to know about the numbers because I actually thought people have stopped using Snapchat,” said Yamnah Khan, assistant marketing manager at AK Marketing. “Snapchat had its time but since Instagram updated, it has become easier for people to have the same features and a lot more in just one app. As an advertiser I would spend money where I get more options in the same amount than spend it on each app separately.”

According to a Snapchat pitch deck from InMobi, the DAU of the multimedia messaging app opens it 25 times per day, spending an average of 30 minutes per day, and creates on average 20 snaps per day. Campaigns can be measured on impressions, video views, swipes to learn more, and app installs. Demographically men and women make up 58% and 42% of the Pakistan user base respectively, primarily through the Apple devices, an indicator of affluence.

So why aren’t advertisers and agencies flocking to an app which has a growing user base, high staying power, consistent brand safety guidelines, and user experience that trumps Facebook? To understand, Profit spoke to the key decision makers between Snapchat and advertisers: media agency executives.

Lack of market orientation

Dr. Mark Ritson is a brand consultant and former marketing professor. He has a PhD in marketing and has taught the subject at leading business schools including London Business School and the Massachusetts Institute of Technology. The first lesson he teaches his students is about market orientation. Simply put: you are not the customer.

He says that when marketers think that they are the customer, they assume many things without looking at the data or the market research. They play mental gymnastics to reach conclusions such as: if I don’t use that app, no one does. Another example: if my wife loves cooking that means all women love cooking. It’s the sort of malarkey that leads to advertising pundit Ad Mad Dude roasting television commercials and giving the creatives a sounding board.

“In my opinion [advertisers and agencies ignore Snapchat] because unlike [Facebook, YouTube], the brand managers and media planners are themselves not on Snapchat,” said Jawwad Jafri, founder of JVentures, a technology firm specialising in augmented reality. “Secondly, Snapchat’s growth has been pretty recent, so planners are still getting to terms with what’s happening to the platform.”

In speaking with key media professionals at the leading digital agencies in Pakistan on the subject, Profit was told that they ‘felt’ Snapchat had lost its appeal in the market. When asked to back this with any research report or data, they were unable to.

“We don’t need to conduct any research or look at any data, our clients know what they want and what they want is backed by their own commission research,” said a senior media planner.

When presented with data from Sensor Tower showing that since October 2020 Snapchat has ranked in the top five most downloaded social media apps in Pakistan and was the number one most downloaded social media app during the first half of January 2021, all respondents unanimously were shocked.

Lack of experimentation

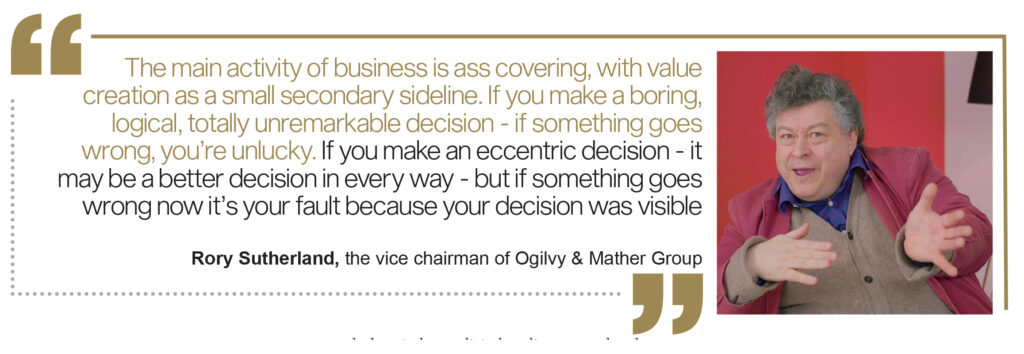

Rory Sutherland, the vice chairman of Ogilvy & Mather Group and a leading name in the field of practical behavioural economics, posits that the reason people don’t make unique decisions and prefer making the same mundane decisions is rooted in blame dispersal theory.

“The main activity of business is ass covering, with value creation as a small secondary sideline,” said Sutherland, during his keynote address at the CMO Insight Summit. “If you make a boring, logical, totally unremarkable decision – if something goes wrong, you’re unlucky. If you make an eccentric decision – it may be a better decision in every way – but if something goes wrong now it’s your fault because your decision was visible.”

He gave the example that most people will appoint PwC and EY for auditing work and if anything goes wrong, they blame can fall on the large safe bet firm. But if someone picks a small boutique firm – which may be better in every way – and something goes wrong, the contract decision maker gets all the blame.

This line of thinking also explains why advertisers in Pakistan are obsessed with repeating the same tired formula over and over with inserting item numbers in television commercials without any context or copy-pasting the Coke Studio music platform. Notable examples of the latter are Nescafe Basement, Velo Sound Station, and more recently Bisconni Music.

“Snapchat’s metrics require a long-term approach to media spending, which most clients aren’t yet prepared for,” said Sehar Raothar, group strategy manager at BrandLogics Group. “Some advertisers will say the changes don’t let them calculate the return on ad spend, which is different from tracking return on investment. This limitation could be a drawback for brands hoping to measure the quality and value of the sale alongside the lifetime value of a customer.”

Lack of self serve platform

For an internet company with a widely acclaimed digital user experience, Snap Inc has dropped the ball on its business strategy in emerging markets where it easily dominates. Since 2013, advertisers interested to sponsor branded augmented reality filters and place other types of media have had to grow through intermediaries in emerging markets where the multimedia messaging app had no direct representation.

“Snapchat is being utilised by multinational companies for advertising but like Twitter it doesn’t have ad precision targeting, this is costly for small businesses and lacks support,” said Asma Abdurraoof, CEO at Prizm Public Relations. “Whereas TikTok shows adverts to everyone, has regional support and has introduced analytics for business accounts so it has a potential in precision targeting.”

In the Pakistani market, advertisers and agencies access Snapchat for campaigns by working through their regional media agencies in Singapore, the United States, or from the United Arab Emirates. Another alternative is routing campaigns through InMobi which has a partnership team consisting of performance marketing specialists that run conversion campaigns on networks such as Snapchat for advertisers that lack an in-house digital media team or that do not have access to a platform such as Snapchat.

While in Pakistan, TikTok has Jack of Digital and Facebook has Dial Zero, the reseller arrangements do not stop advertisers and agencies from engaging with the apps themselves for ad placement, the accessibility of which works in everyone’s favour. By limiting its customer base to deal with one reseller, Snapchat’s revenue growth in Pakistan is limited by the number of sales representatives employed with the local partner agency or firm.

Lack of prestige

Google has a digital garage, Facebook has a blueprint, and Snapchat has Snap Focus. Before COVID-19, both Google and Facebook would hold advanced versions of the training courses for senior marketers and media planners, creating a sense of community and giving attendees a superiority complex on being among the invited few. Snapchat has never engaged its advertisers in a similar program or made a big deal out of one.

“This is Pakistan, deep down people want shashka, they need to brag,” said a business director with a WPP media agency. “Give them something to feel special about and they’ll reward you with media budgets. Just look at the clearly paid business awards industry.”

Snapchat would also need to create the illusion that it takes a special type of person to understand how best to place ads on Snapchat, how targeting works, how segmentation can be curated, case studies pertaining to campaign types, are just a few of the additional reasons behind advertiser hesitance with platform engagement.

With Facebook and YouTube for instance, when decision-makers are already users of the platforms themselves and are then asked if they want to place ads on them, they can immediately understand the value proposition. Snapchat, as told to Profit, is positioned for a niche market that is distinctly separate from the worldview of media decision-makers, impacting platform familiarity.

“As innovative as Snapchat is viewed among advertisers, it is still a footnote on many media plans,” said Raothar. “[Advertisers] still want more effectiveness from the app’s ads before they buy more of them. Snapchat has advanced, but acknowledged that it’s been hard for buyers to keep up. It went from only offering four measurement tools to advertisers to having more to pick from now.”

Lack of kickbacks

Executives at Publicis media agencies told Profit that they cannot sustain their businesses by charging clients between 3% and 15% in media fees, so media platforms such as Google and Facebook along with the entire media ecosystem award them with rebates in the double digits depending on how much money is funnelled.

When media executives are unclear on the types of rebates and commissions Snapchat and its Pakistan representatives will offer them for engaging it, a barrier is created between the platform and all the advertisers it could potentially work with.

With large media agencies reluctant to work with resellers they are unfamiliar with and eagerly waiting for the self-serve platform to open in Pakistan, Profit is told that a commission-based model or a rebate structure akin to those offered by Facebook and Google in Pakistan is the only way forward if Snapchat wants digital media budgets sent its way.

Industry suggestions

Snapchat needs to open self-serve advertising for the Pakistan market and tap into SMB advertisers that are experiencing diminishing returns from targeting the same audiences on the traditional social and digital platforms. As advertisers around the country grapple with digital advertising fraud for the first time or the prospect of losing their Facebook business account.

The camera and social media company needs to decide which layer of the buyer decision journey it positions its multimedia messaging app in, with the gap in the Pakistan market being with a brand sentiment lifting touchpoint. Although this is mentioned in the pitch deck, it is not known to planners as a top of mind reference, and so Snap Inc needs to ramp up with educational programs for media agencies in the country.

“Snapchat is gaining traction in the younger generation but not much with the adult population,” said Abdurraoof. “Snapchat’s key demographics are 13 to 29-year olds with 69% of 13 to 17-year-olds using the app and 62% of 18 to 29-year-olds using it. The lack of diversified audiences and strong foothold in the Pakistani market is a reason for lack of interest in marketeers currently.”

She suggested that the camera and social media company target multiple demographics including those over the age of 30 and offer economical, targeted ads with technical support.

Even with a small audience size compared to Facebook, Instagram, and TikTok, Snapchat benefits with having a niche and targeted audience, with analytics showing that the app has the target market for fashion & apparel companies.

Data from Sensor Tower and pitch decks clearly indicate that the majority of Snapchat users in Pakistan use an Apple device, which is an indicator of affluence. While these strengths are revealed after going through the campaign planning process, it should be outwardly communicated in form of reports akin to how Think with Google operates.

Raothar told Profit that advertisers cannot get unduplicated reach and frequency across multiple campaigns or a specific time frame. As a result, measurement teams on the agency side cannot calculate the reach, and therefore do not recommend Snapchat as a digital marketing medium, adding that it is more of a platform showcasing lifestyle trends on a personal level.

Finally, the company needs to identify the large media agencies in the country – prominently GroupM Pakistan, Z2C Limited, Omnicom Media Group, Adcom Media, Synergy Dentsu, and Oktopus Group to name a few – and engage them with regards to the quid pro quo relationship and subsequent incentives Snapchat is prepared to award.

It then needs to decide how the rebates will be routed, either through a back office in the Middle East or East Asia. This is the approach used by the incumbents, which both lack a financial office in Pakistan.

To limit the ire of the Federal Investigation Agency, it is recommended that Snap Inc set up a local team and a financial office in Pakistan, routing rebates and commissions through this team as well as using this base to engage decision makers in the realm of branded training sessions and in influencing public policy around its business.