That’s all folks. After three years of operating in Pakistan, Airlift Technologies has announced a complete shutdown of its operations from tomorrow (July 13). The company announced the decision of the shutdown in a meeting today with employees.

Earlier, multiple Airlift employees told Profit that there was ravaging anxiety at the startup because of the reports that Airlift had decided on a complete shutdown and an all-staff meeting has been called tonight for some important announcement.

A high-ranking source at Airlift, on the condition of anonymity, told Profit with authority that the startup was wrapping up operations completely and an announcement in this regard will be made soon. “They have decided to give a two-month severance package to employees and shut it down completely,” the source at Airlift said.

Launched in 2019, over the course of its brief presence in Pakistan Airlift fought tooth and nail to first make their mass-transit model fail and later jumped onto the quick commerce bandwagon spending tens of millions of dollars along the way.

So what happened? Briefly, a lot. A global funding crunch, rising inflation, soaring petrol prices, all mean that people are now less willing to pay money for luxuries like immediate grocery delivery. On top of that, because of the global economic downturn, companies like Airlift have had to make these services more expensive. For a very long time, startups have been using VC money to subsidise these luxuries, and as investors pull their purse strings tight during the recession there is a bit of a modern meltdown in progress.

Airlift, like other quick commerce companies, had been working on the belief that if they acquired enough customers they would eventually reach scale and become profitable. The problem was that particularly in a country like Pakistan, where cheap house labour and a culture of extracting favours from places like local kiryana stores exists, people were never going to be happy paying for these services.

That still, however, does not entirely explain why Airlift might be shutting down completely. Startups are built on the concept of solving an existing problem. Perhaps Airlift’s biggest blunder was trying to solve a problem that never really existed.

Where is the shutdown talk coming from?

Airlift employees have been in a veritable state of anxiety for a few weeks now. Over the course of Eid, Airlift’s services were unavailable and warehouses were reportedly being packed up. Already recently stung with 31% of their colleagues having been given the boot, employees began hearing rumours that the startup was making the moves to exit Pakistan entirely.

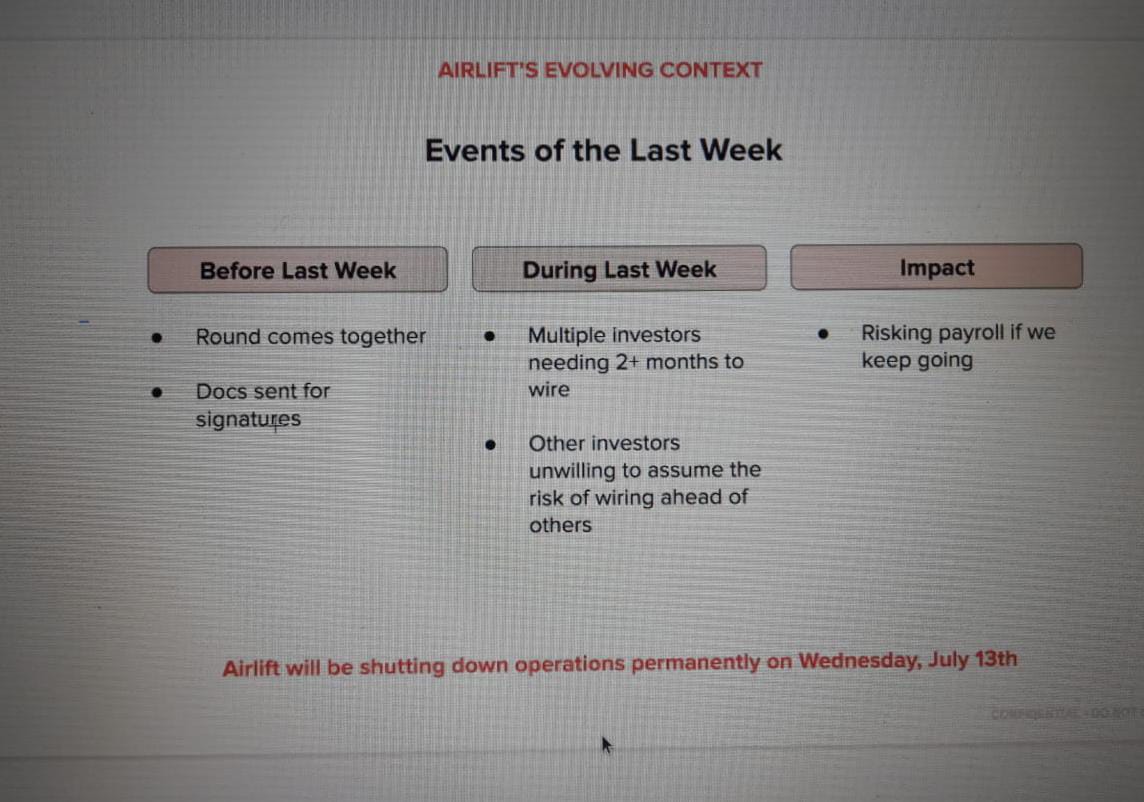

Another employee told Profit that the startup was going for a complete shutdown because of fundraising difficulties that saw investors, without specifying who, backing out from investing from the $20 million round. “The company is wrapping up stock at its warehouses and there is considerable uncertainty around the future of the employees,” said a source at the startup.

The source also affirmed that no official announcement regarding the closure of the company has yet been made internally, but anticipate clarity in the coming few days.

Profit reached out to Airlift CEO Usman Gul and multiple other high-ranking executives for an official response to reports regarding the company shutdown. Not a single response has been received till the filing of this report.

On its Twitter handle, Airlift has said that their services were temporarily suspended, without positively denying rumors of a total shutdown. In response to a Twitter post which asserted that Airlift will be shutting down completely, Airlift said that it was currently undergoing restructuring in response to the global downturn. “We are adapting to the changing economic conditions but we are still committed to providing hassle-free services to all our customers. Our services are temporarily unavailable,” Airlift wrote further in response.

But multiple high-ranking sources at Airlift have confirmed that the startup is in-fact opting for a complete shutdown because of funding woes that have been compounded in the presence of the downturn in investments. In a recent update, Airlift employees have been called for a session tonight. The material of the discussion in the meeting was not disclosed to us.

What went wrong?

Quick commerce is on the ropes everywhere. The delivery in 30-minutes model gained great fame and investor confidence during the early pandemic but has since been faced with harsh criticism over its feasibility. Airlift not only put all its chips on the quick-commerce bandwagon, but had done so after already failing to make an earlier mass-transit business model work.

Despite an $85 million investment in Series-B round last year co-led by Harry Stebbings of the 20VC fame, and Buckley Ventures, the cash-burning models have led Airlift here. The startup’s existence has been a series of fake hype and has focused more on inflating investor confidence than focusing on good business fundamentals.

The company had earlier pumped up the rumour mill with claims that Airlift had raised $200 million. Prior to a meeting with former prime minister Imran Khan and in the office of former commerce minister Razzaq Dawood in January this year, Airlift co-founder Ahmed Ayub told a group of startup founders and commerce ministry officials that the company had completed a $200 million raise.

While no official announcement of the $200 million round was made, the startup’s funding woes had begun with increased investor scrutiny of numbers. In the follow-on act, Airlift has been in the process of completing a $20 million bridge round raise, amid news on May 25 that Airlift was cutting down operations, shutting down completely in South Africa and retaining operations in Karachi, Lahore and Islamabad only in Pakistan. Airlift further announced laying off 31% of its workforce, citing concerns around fundraising in a bear market, as investors shun the ‘growth at all costs’ model.

The startup has been in the process of raising a $20 million bridge round from existing investors, of which $10 million was reportedly being provided by Ali Mukhtar of Fatima Gobi Ventures. Ali Mukhtar has not confirmed his participation in Airlift’s recent round, in a question asked by Profit.

Sources say that another prominent investor in Airlift, Aatif Awan of Indus Valley Capital, has also backed out from investing in Airlift anymore, which hints at the dire straits Airlift is in. Awan neither confirmed nor denied these claims when approached by Profit.

Reportedly Ali Mukhtar backed out only after Aatif Awan backed out. When investors back out, it is not an assumption that the business they supported all along, does not hold promise anymore. The down round, which saw Airlift’s valuation slashed substantially, was earlier reported to have been completed, which would have provided Airlift the much-needed lifeline to get through the downturn peacefully.

Airlift’s restructuring, which included shutting down South Africa and smaller cities in Pakistan, was part of the company’s strategy to be self-sustainable, to be self-reliant when funding was running dry. To be self-reliant, Airlift had to generate cash from its own operations, which in the retail quick commerce business, does not look doable.

What is the quick commerce model?

In the world of quick commerce, very high growth comes from serving a large number of customers and very very quickly. So if a 15-minute or even a 30-minute delivery promise, which serves the purpose of the existence of quick commerce business, is to be met, a startup like Airlift needs to make its logistics operations super fast to enable such deliveries. Under the quick commerce model, that is done through setting up a network of warehouses or dark stores which are only used for holding inventory and fulfillment of orders.

If such operations are to be scaled to serve a big number of customers or the masses, these warehouses need to be opened up at a large number of locations to ensure that the startup is able to serve customers from any neighborhood it serves. Setting up this network of warehouses and the fulfillment costs associated with such deliveries makes quick commerce a very costly affair, according to an expert on quick commerce, who chose to comment anonymously.

Quick commerce startups further entice customers through heavy discounts on products and deliveries. The startup has to forego its own margins to be able to attract as many orders as possible to increase GMV numbers and raise subsequent funding rounds at higher valuations. That had been the game during the great Pakistani startup funding pump of 2021 which saw $381 million invested into Pakistan (tiny by global standards). It had been about pumping money and getting to those explosive growth numbers, without testing the sustainability in absence of VC funding.

Airlift had been able to do that really well. According to the numbers available to us, Airlift’s revenue growth had been impressive. From $1.4 million in Q1 2021, Airlift reached $16.9 million in gross revenue in the last quarter of the year, clocking in at $33 million in gross revenue for the entire year.

But it’s a retail play, ladies and gentlemen! You can only earn as much as the manufacturers you sell products of allow you margins. These margins are very tiny at the beginning and swell as the company grows bigger, and sells good volumes to convince manufacturers to give them better margins.

The problem with Airlift’s numbers

Airlift had been recently making some tall claims to its investors. From the numbers available to us, Airlift was trying to give this confidence to investors that it would be able to turn those profits that investors were looking for. For starters, these numbers do not inspire confidence because of the way retail works and the macroeconomic doom in Pakistan.

Gross revenue looks impressive at Airlift, net revenue does not. For the first quarter of 2021, Airlift’s net revenue was only $100,000. It grew to $300,000 in the next quarter, was zero in the third quarter, and was only $400,000 in the last quarter of 2021. As a percentage of gross revenue, it’s a very low margin which is the nature of retail businesses such as FMCG retail. For instance, Airlift’s gross margin for Q4 2021 was only 2.36%. After further subtracting costs, Airlift reported a negative $5.8 million adjusted EBITDA during the last quarter alone of 2021.

That’s $5.8 million burnt in cash before even adding marketing and central services and general administration cost in the case of Airlift.

In retail, however, if you have substantial volumes, manufacturers might allow you higher margins. Airlift has thereafter reported higher revenue numbers and better margins. For the first quarter of 2022, Airlift reported gross revenue of $21.9 million with net revenue of $900,000, translating into a 4% margin, and a $5.3 million cash burn at the adjusted EBITDA level. For the next quarter (Q2 ’22), however, Airlift forecasted its revenue at $23.8 million, with a gross margin of 13% and adjusted EBITDA falling a big number to negative $3.1 million for the quarter. At the EBITDA level, Airlift is tracking positive numbers and in the third quarter of the ongoing year, Airlift claimed to investors that it will be earning a 20% margin which will turn its EBITDA to a positive $400,000, proving the company’s financial stability.

This is all based on an assumption, however, that Airlift would be able to secure 20% gross margins in the retail industry. First of all, its growth is questionable to negotiate those margins.

Airlift has already shut down its operations in smaller cities in Pakistan where it was not able to grow in the first place because of low purchasing power in these cities. Secondly, it would not be able to grow as significantly if it has already scaled down operations and would not be thinking of expanding in the absence of funding.

More importantly, however, rising food, fuel, and electricity costs in Pakistan because of the consistent surge in inflation have waned purchasing powers in the top-tier cities like Karachi, Lahore, and Islamabad, which, Airlift claimed in a recent announcement, formed 90% of the company’s operations. To add to the confusion, Airlift claimed to investors that all of Pakistan, which included smaller cities like Sialkot, Faisalabad, Gujranwala, Peshawar, and Hyderabad, besides Karachi, Lahore, and Islamabad, constituted 90% of its total operations.

Airlift has not responded to Profit’s query as to which of the above statements is true. The lack of transparency casts a shadow on actual Airlift growth numbers in Pakistan, as well as prospects of growth in Karachi, Lahore, and Islamabad where it operates now. So if Airlift is not able to grow because purchasing power has waned and because it does not operate in other cities anymore, it would not be able to negotiate a 20% margin with manufacturers, which is already high to claim. The retail industry, especially FMCG retail, operates on thin margins. A source in the FMCG retail industry told Profit that big retailers like Metro operate at margins of around 15% and Airlift claiming margins of 20% is unrealistic.

Gross margins of 20% are possible on certain categories of products but are unrealistic to be margins overall for a business. Airlift further claimed to its investors that it had negotiated product margins with Unilever from 10% to 34.5%, which is again an unrealistic claim unless Airlift negotiated this margin on one or two products and not the overall basket of goods from Unilever. According to a source in the FMCG industry, the margins from Unilever for retail stores can go as high as 15-18% but 34.5% overall was not possible. Another source said that even for products on which 34.5% margins are available, they can only be achieved if a certain sales volume is achieved on those products. Most of the time, those targets are not achieved because they are very high, the source said.

On the other hand, FMCG companies are also under pressure, having increased prices because of the recent surge in inflation which would decrease their own sales but the margins are likely to have shrunk because of the increase in costs. Fewer sales mean pressure on margins for everyone including manufacturers, distributors, retailers, and digital retailers like Airlift.

This casts doubt on the future prospects of profitability of Airlift’s quick commerce business. Its claims of revenue are unrealistic because the margins are unrealistic and not available to anyone in the industry. While these are margins of the FMCG industry we are talking about, Airlift has been selling electronic products such as phones as well, which are again a low margin product, nowhere near to the 20% margin as claimed.

In questions posted by Profit, Airlift has not disclosed how much of its business comes from FMCG products.

The delivery fee equation is equally messed up

The overwhelming majority of Airlift’s revenue comes from product margins that they have estimated at 20%, for the third quarter of 2022, which will drive them a positive adjusted EBITDA value. The next source of revenue is the delivery fee, which Airlift plans to raise to 2% of the revenue. This metric would again be under pressure because of the rising fuel costs.

Delivering orders to customers has become more expensive, and on the other hand, consumers would be unwilling to pay delivery fees because of the fall in their own disposable income. In fact, Airlift would have to increase delivery fees by more than 2% of revenues to keep up with the rising fuel costs but would be in a situation where it would lose orders if it did.

So the situation for Airlift looks something like this: it needs to generate its own money to be sustainable but would not be able to do so because of the industry it operates in; the great margins they are seeking are not possible while its own costs of delivering quick commerce orders have increased. In short, it does not look like a business that would be able to generate its own money and become sustainable. And in times during which VC money is chasing sustainable businesses, it doesn’t sound unbelievable that investors backed out from investing further.

It could be possible that Airlift would have tried to seek buyers and sell it to them, even if it’s for peanuts. Over $100 million have been pumped into Airlift since 2019 so completely shutting it down means that nobody gets anything against the investment they made, except for some proceeds from selling inventory and office equipment. But could Airlift have gotten acquired by other players in the industry to consolidate their position in the market? Airlift’s $20 million round was being raised at a $50-100 million valuation, while its earlier Series-C round (rumored to have been completed at $200 million) was being raised at a $275 million valuation.

Airlift has already seen its valuation slashed quite substantially because of the downturn in investments, and as we have argued, quick commerce is not an attractive business that can be made sustainable anytime soon. “The valuations are random numbers. They are not actual valuations so for any potential buyer, extensive due diligence would be required to ascertain the actual worth of the company and it might actually be very less,” said a source in the industry.

Then Airlift has credibility problems, with questions raised over the authenticity of its numbers. Going to a potential buyer would require thorough audits which might reveal that the company was never as strong as it purported itself to be.

By far the biggest company that could have acquired Airlift is foodpanda. The problem, however, is foodpanda’s parent company is also suffering from the effects of the investment downturn and has seen its valuation slashed on the public market.

“It is not ideally a market these days where you would find buyers. Companies don’t have money for acquisitions right now and the financial heft for acquisitions is particularly missing in Pakistan,” the source said.

Like everything else lot of start up in Pakistan is nothing but fudge numbers……raising $ 85 millions without any experienced battle hardened management team was a disaster in making….unfortunately all these funds raised last year are going to dogs….!!!!

A very valid point you have raised regarding experienced teams. I personally went through their hiring process earlier this year and beleive it was something that as if I am applying for a postion based on Mars. I was first interviewed by a call, then after 2 days I received an email from them in which they had given me a case study to solve, then after solving and subimission, I was interviewed again this time it was online, then after 1 day I was once again given another case study to solve, after solving and submission, I was once again interviewed again online by the same person who had taken my first online interview and you wouldn’t beleive it, i was once again given another case study to solve, this time i drew the line, i emailed them and told them to keep their job i don’t want it.

These things were hyped as next Microsoft type company but these guys lack company ethics. Sad to hear your response on the interview processes.

Mjhe ye sun Kar axha NH lga me airlift company khareedna chahta hn

Mainain suna hai k Ministers ne inse Rishwat Jo k Inho ne denay se Mana krdi.?

Very bad news for Pakistani market. They had set very high expectation for tech industry.

Very bad news for Pakistani market. They had set very high expectation for tech industry.

Tamioor Hassan, You are a genuine investigative journalist. Waiting for next investigative report from your side.

Keep it up Bro !

Tamioor Hassan, You are a genuine investigative journalist. Waiting for next investigative report from your side.

Keep it up Bro !

Tamioor Hassan, You are a genuine investigative journalist. Waiting for next investigative report from your side.

Keep it up Bro !

Great article with numbers. Amazing read.

Bad news indeed

Sad to hear the news.

Exactly!!!! That’s why quick commerce isn’t feasible in Pakistan

Can be feasible if managed properly. Pakistan has a huge potential for ecommerce as the majority of upper-middle class is scatered througout the country.

Quick commerce won’t work in markets with high unemployment rates, I can easily walk to buy my groceries lol save money and get occupied.

Sad to hear. They were providing good services. Anyway good article, keep it up brother.

Finally a good venture comes to an end ..

Seems Sad ending ..

Finally a good venture comes to an end ..

Seems Sad ending .. no

Unfortunately nothing productive and facilitating can last here due to our public mentality and the nasty principle of shortcuts. Airlift has left a mark with all it’s supposed follies too but it reached out to many who couldn’t move in the crammed streets of Karachi. I am sad!!

Great article with numbers, Amazing read…

Such an informative read! Came here to learn whether the rumours about Airlift shutting down are true and am leaving with surprising facts and lots of information. Great post.

Great article with numbers, Amazing read.

Very bad news for Pakistani market. They had set very high expectation for tech industry…

Taimoor, it’s a great written and well-explained article. A truth of dreaming of a business without understanding a ground reality.

Making a profit is not a piece of cake. A lot of hard work and experience is required with a greater extent of business knowledge.

What an ammazing article I read. Keep up the good work, would love to read more about other startups. Bravo!

The article data very informative for retail business.

Are these investors blinds and not see the true pictures.

That was not un expected due to Airlift Business Model, which was not a viable one How a free delivery can be managed on 500/- pkr shopping? Attractive & papular for customers but not for the business effectiveness.

If you take a look at the profiles of top executives, directors and co founders of Airlift, You won’t find any e-commerce experience.

I have money in my wallet. What the hell is this? How can i retrieve that?

Article is right on the money when pointed it out that the problem airlift ventured to solve actually never existed. With grocery stores literally present on every single road, the scope was always limited for Airlift.

And then in top of it, it lacked the experience at the leadership level.

Still a big setback for nascent start-ups ecosystem.

Hopefully the episode will help everyone in the start-ups ecosystem learn the right lessons one of which is that along with scalability one has to be mindful of profitability and sustainability. That means developing a strong business model with proper risk assessment to achieve twin objectives of profit and sustainability

I read your article about Airlift’s numbers not adding up back in December. Everyone was full of praises for them then bit you were into something. Thank you for factual reporting then and now!

Bad news for Pakistani market but impressive write up and analysis.

Hope we see good profitable and successful ventures coming up in Pakistan soon

It was really worthy to read this article and the research which was conducted is truly awesome and waiting for more in future. Great work keep it up.

It seems they weren’t able to keep up with their business / investment plan or did not have one in place.

Ridiculously High Salaries drawn by top management

Fancy Bonuses and Perks

Burning Investors money with no remorse

A typical story of Startup Fall in Pakistan

Excellent article, really enjoyed reading it.

The pace with which the raised funds clearly showed the founder and the team was greedy and they never were interested in long term sustainability of the company. They enjoyed hefty packages by banking on the VCs money which is unfortunate for the upcoming startups because they will face the brunt of it.

Very good informative Post. Do subscribe me for future such posts. Thanks

Was excited at launch, but, after a bad experience with the second order, abandoned it. Feedback was neglected as usual. Why can’t these companies manage the inventory these days is beyond belief. Almost every retail item has bar codes and other codes can be added easily for internal control(s).

Funny that Airlift became the very thing at the end that it mocked in its own ads!

Kuch jgga pa ap ka infrastructure manegment ka b kasoor ha un ka name Faheem Lahore johrtown Imran Islamabad Mubasher Islamabad and also ya material ma sa comession lyta tah or material naqas qisam ka lagwata or bill acha material ka lyta tah

This bad news for employee and Pakistan because these company provided fresh and young people give chance so unluckily company band. Government of Pakistan please help this company financially and continue this operation. Thanjs

It surprises me that no one is talking about the major factor behind this: the 2 year lockdown. It devastated startups, and small and medium sized businesses.

Yeah they run away with riders money 💰💲 making fool of riders ass whole company

It seems the writer completely forgot that the major jolt for Airlift sustainability was CoVid factor which destroyed their business forecasting model.

Corporate businesses needs risk management consultant to secure there business.

In this case they forget to calculate inflation, targeted customers, purchasing power & services expenditure.

Really a good venture comes to an end ..

Seems Sad ending ..

A big facility close.. Sad

Sad to hear the news, it was imminent however. But I really like the article. Kuddos to the writer.

Airlift didn’t deserve the 85 million funding and my heart goes out those who put money into this scheme.

Was the simple sign that they gave up on their mass transit model not an indication they weren’t ones to solve problems?

Did a company that struggled to break to profitability after 85m funding deserve 500 million?

They were often out of a lot of products which meant they weren’t gonna be the one stop shop and had spent excessively on marketing (I would see their ad on facebook about 18 times a day). Were they learning on the job or have no real experience?

Bad news for the budding tech sector of Pakistan but an awesome read with good numbers and analysis…

Keep it up good job…

Copy/paste idea without checking Pakistani market fundamentals. In Pakistan where people don’t have many business options ( kiryana shop ) is the most easy and economical with small amount. Our market is flooded with these shops and they even provide home delivery free.

Some big store Metro, emporirum, Imtiaz and many others are easily accessible and its a picnic for small family. So practically idea was not good for Pakistan. But some how they manage to get huge funding and Airlift was the buzzword in Pakistan.

I belong to tech industry and I knew how much they burnt on hiring people. They just destroyed the local market salary slabs. Hired people with multiple x offers. Overall their strategy was just to hire best talent at any cost, with such unsustainable business model so much spending makes no sense.

Overall bad management or lock of experience caused this damaged. Very bad for pakistani startup market.

BAD NEWS FOR TECH START-UPS

I am really sad now. Pakistan has become a banana republic. There is no rule of law, no justice and we have disbelieve is our social system. Sharif & Zardari have looted Pakistan for so long. There is no hope for poor.

Many startup companies are shutting down their operations in Pakistan. These so called imported Govt has ruined our economy. Dollar just hit 225. Dua hi kar sakte hain bhai.

Reading you comments, you are non hireable.

bad news

bad news for us

bad news for pakistan . God help those who help them selves

Great Info

Very nice post and blog, I found it very explanatory and informative, thank you very much for sharing your knowledge and wisdom with us.

Good article, very interesting read for an ex-customer. A few basic fundamentals were totally ignored, and worked contrary to what the org was trying to achieve:

1) Stock replenishment, was dismal. Basic necessities were always out of stock.

2) Delivery boys were freelancers, looking for daily wages. So the rudeness, lack of change, and common courtesy was expected.

3) No oversight on how deliveries were made, in an adhoc fuel & time wasting manner.

4) Customer care was non existent.

5) “30 mins delivery” was a just an empty promise. Min time was 50mins.

All of the above, points towards an incompetent team leading the org. Basic fundamental issues like these, when ignored, indicate that “operations” was not a priority.

Only people I feel sorry for in this fiasco, are the mid level employees. Hope The Almighty provides them with better jobs.

Thanks for the good information, I like it very much. Nothing is really impossible for you. your article is very good.

사설 카지노

j9korea.com

Welcome to Versatile Coupons, the final location for getting a versatile deal on your internet-based buys. Our central goal is to assist customers with enjoying you find the best arrangements and limits on the items you love. We comprehend that setting aside cash can be intense, particularly while shopping on the web. That is the reason we’ve made it our objective to present to you the best-in-class coupons and markdown codes from top retailers. Whether you’re looking for garments, gadgets, or home merchandise, we take care of you.