On the 1st of March this year, Talal Ahmad Gondal resigned as the CEO of Pakistani fintech startup TAG. The resignation was not a peaceful one. Behind it was a dicey series of events that began with TAG trying to buy a bank, and ended with an explosion of a tampered document, childhood friendships gone wrong, a cloak-and-dagger environment within the startup’s upper management, and the SBP suspending further expansion of TAG’s pilot operations.

How did Talal Ahmad Gondal, whose initials gave the company the name ‘TAG,’ find himself in this situation? Ask him and he will tell you that his co-founder used a serious oversight on his part to orchestrate a coup against him.

Ask Ahsan Khan, Talal’s former childhood friend and the co-founder of TAG, who is now up in arms against him, and he will tell you that Talal was directly involved in forging an official document that was then sent to the SBP, and that his actions were singlehandedly running the entire company to the ground. Meanwhile, high-ranking, board-level official within the company has claimed that Ahsan and Talal were both involved in the oversight that led to the forged documents being sent to the SBP, that both were separately involved in the embezzlement of investor money, and that they have been ousted on the basis of their misconduct.

The truth is somewhere in between. Yes, there was a doctored document. It was a letter that said TAG had entered into a partnership with a Hong Kong based investment firm which had promised $45 million to help TAG buy Samba Bank. It has now been discovered that the Hong Kong firm only expressed interest in joining TAG in buying Samba and never mentioned the $45 million, which is where the tampering is supposed to have happened. Talal does not deny the document and admits that it was his oversight since he was the CEO, but maintains that he did not send it. Instead, the document was sent to SBP by Ahsan via an email, who according to him has been found lying and forging internal documents before as well. He says the letter was then used in a conspiracy to try and oust him from his position.

Right now, Talal does not have an official title at the company but is trying to use his status as 55% majority shareholder to continue exerting control over the company. At the same time, he is under investigation by the SBP. Sources are split on what will become of TAG. Well placed individuals have claimed that the Fintech might get away with the entire fiasco with a slap on the wrist, while others have said the SBP has long had doubts about them and if they decide to take serious action against Talal and TAG, it might prove to be a death knell for the startup.

But why on earth was a fintech startup like TAG trying to buy a commercial bank, and why were they desperate enough to try and tamper with a document being sent to the central bank? At the centre of it is how the business of financial technology works, and why every fintech with enough money would be ready to give an arm and a leg to get a banking licence.

The entire story has a messy trajectory and a colourful cast of characters. Involved also are the well-connected Lt General (r) Muhammad Afzal, the Executive Chairman of TAG, and a third co-founder by the name of Alexandar Lukianchuk. Throw into the mix an inquiry by the central bank, accusations of syphoning company money being hurled indiscriminately by both sides, and open letters being written to investors and you have a recipe for disaster.

In short, it is a train-wreck. It is a dumpster fire. It is a fiery trainwreck rattling around inside an industrial sized dumpster fire. And to understand it, we must go back to the origins of TAG, the fintech startup scene in Pakistan, and why buying a bank is such a game changer.

So you want to buy a bank …

TAG must really have wanted to buy Samba Bank to risk sending a forged document to the SBP. The reality is, if an EMI like TAG manages to get a banking licence it will give them a major advantage over the competition.

And of course, TAG needed that advantage because they had been falling behind their competition, who because of their early start had managed to get full EMI licenses. Initially, TAG had also made a pretty big splash when it first came onto the scene, with investors like Fatima Gobi Ventures part of its $12 million seed round, the largest in Pakistan, and a very early pilot approval from the SBP.

In fact, when TAG got in-principle approval in November 2020, it was one of the earliest EMIs to get pilot approval from the SBP. To the extent that industry insiders said TAG had managed to get pilot approval a little too quickly — almost fishily so.

Rumours began to circulate that Talal had used political connections to get the licence early. You see Talal never quite fit the mould of most Pakistani startup founders. Most founders here are young, American educated, with clipped accents and lofty American ideals.

Talal, on the other hand, has a more desi touch to him. While he is also young and foreign educated, with a degree from Erasmus University in Rotterdam, he is the scion of an old political family from Sargodha. Smart and business savvy, Talal was actually doing pretty well from himself in Europe. He spent a lot of his time in Germany and had a wide network of techie friends, and his first business venture was connecting these techies to recruiters all over the world. He was actually doing pretty well for himself.

But like most startup founders in Pakistan, he had a desire to come back. Except when he returned in 2018, it wasn’t to join the burgeoning startup revolution in Pakistan, it was to run as a candidate for the Punjab Assembly in the upcoming elections. In fact, Talal came back and was briefly awarded the PTI ticket for PP-76 in Sargodha.

With slicked back hair, sporting a sharp black moustache in a shalwar kameez and waistcoat, he was a far-cry from the clean-cut, high-paced, and tech centred men and women of the startup scene. But then, political realities meant Talal’s fledgling career as a politician came to a halt. In Sargodha, Talal had managed to get the ticket through his political connections, but part of it was also that he was fighting for a traditionally PML-N seat, which is why the PTI was willing to try a new candidate like Talal. Very close to the election, the ‘electable’ for that constituency that used to run for the seat switched sides and abandoned the PML-N for the PTI. Talal’s near confirmed ticket for the PP-76 seat went out the window, and he now found himself without a political career for the next few years.

The proud Farzand-e-Sargodha had left his work in Europe for a career and politics and found himself out of the loop. But remember, he still had a network of techie friends all over the world. He spent some time in the United States and then went back to Germany and with their help, the idea for TAG began to take shape in his head.

In his mission he also involved Ahsan Kaleem Khan, a close friend from back when they were schoolboys, as well as Ahsan’s brother Tayyab Kaleem Khan, who Talal was friends with as well. Talal began assembling a highly paid team for TAG, along the way they also hired Lt General (r) Muhammad Afzal, who later served as the governing officer for TAG and came with a long list of connections.

These connections were very important. While TAG and other fintech players might be doing advanced, tech based work, they are still very much doing it in Pakistan’s regulatory framework. That means you need people with experience and connections to both help navigate the environment and grease the wheels when necessary. Talal already had political clout, and on top of that he also had military connections within his family as well as in his company. That is where the original whispers also arose that TAG used political connections to secure their approvals from the SBP.

And that is where the bank comes in. As we’ve mentioned before, while TAG managed to get their approvals early, in September 2021, Nayapay became the first EMI to be granted a licence by the SBP. TAG had also raised upwards of $12 million in September that year, but Talal quickly began to feel that TAG needed an edge over its competitors to wipe them out early in the game.

The fintech space in Pakistan has taken off quite remarkably in the past few years, and that has given birth to a number of competing startups like Sadapay, Nayapay, and TAG. Most senior executives have been of the opinion that the Pakistani market is big enough for multiple players because of how largely unbanked the country is. Despite this, the competitiveness between fintech startups has always been high intensity and the players involved, TAG included, haven’t always played nice.

TAG felt that if they got a bank in their portfolio, they would be able to use its licence to enhance their product. It is a concept that has existed within Pakistan’s banking industry for a while. HBL, Pakistan’s largest bank, went so far as to say their goal in the near future is to become ‘a technology company with a banking licence.’

TAG thought, as other tech focused startups do, that they already had the technology and just needed approved channels such as a banking licence and the backing of the SBP. Samba Bank has a record of being a clean bank but it is also the smallest bank in Pakistan. While more traditional buyers like Meezan or UBL wanted it to expand their portfolios, an entity like TAG buying it was simply for its licence.

A commercial bank backing a fintech company could be hugely beneficial for that fintech company. The EMIs are allowed to not just facilitate money transfers between two parties but also to store money electronically into their user accounts. But regulations prevent EMIs from lending from their deposits which means that they are only building a payments business. To be able to lend from their deposits, EMIs can either get an NBFC licence or partner with a bank to build credit products and then distribute them through EMIs digital presence. To be clear, the EMI TAG could not buy a bank. It’s the group behind the EMI that would have bought a bank and then used its licence for the benefit of the EMI.

As an EMI, the cost of borrowing funds from partner banks for lending is also high and the EMI needs to make more than the said cost of funds to turn profits. With a bank on the back, that cost of funds drops substantially because the bank can lend from its own deposits and therefore the cost of funds for the EMI is also very low, which can turn into better profits.

Furthermore, there are deposit and withdrawal limits on EMI wallets. In terms of putting money into a digital wallet run by EMI, the cap is Rs 50,000 in a month, which can be increased to Rs 200,000 provided the wallet holder has completed biometric verification. As far as withdrawals are concerned, the limit is Rs 10,000 per day, no matter what level of authentication has been completed. For commercial banks, once biometric verification of a client is done, there is virtually no limit on deposits or withdrawals.

Once the bank is acquired, the EMI can eliminate the hurdle of limits by moving its operations under the banking licence.

The other alternative to this arrangement is getting a digital banking licence to perform the functions of a bank. However, despite regulations being in place, the competition for a digital banking licence is very high with big commercial banks like HBL and foreign entities in the running for the same licence which would be issued to only a limited number by the SBP (5 in this year). So chances that an EMI like TAG would be able to get a digital banking licence quickly are slim while a shot at buying a commercial bank looks more doable..

All of this means that if TAG, or for that matter any other fintech startup, managed to acquire a bank they would be able to use that bank’s licence to give their product a huge edge. Buying Samba Bank would have wiped the floor with the competition. The acquisition, however, was going to be an expensive one, and TAG needed to show that they were good for the money.

Read more: Should the fintech playbook scare the banks?

How the tampering played out

In December 2021, TAG rolled up its sleeves and decided to put up a bid to acquire Saudi Arabia’s largest corporate lender National Commercial Bank’s (NCB) stake in SAMBA Bank. The interested parties would be able to buy the stake in SAMBA Bank at an estimated value of $100 million.

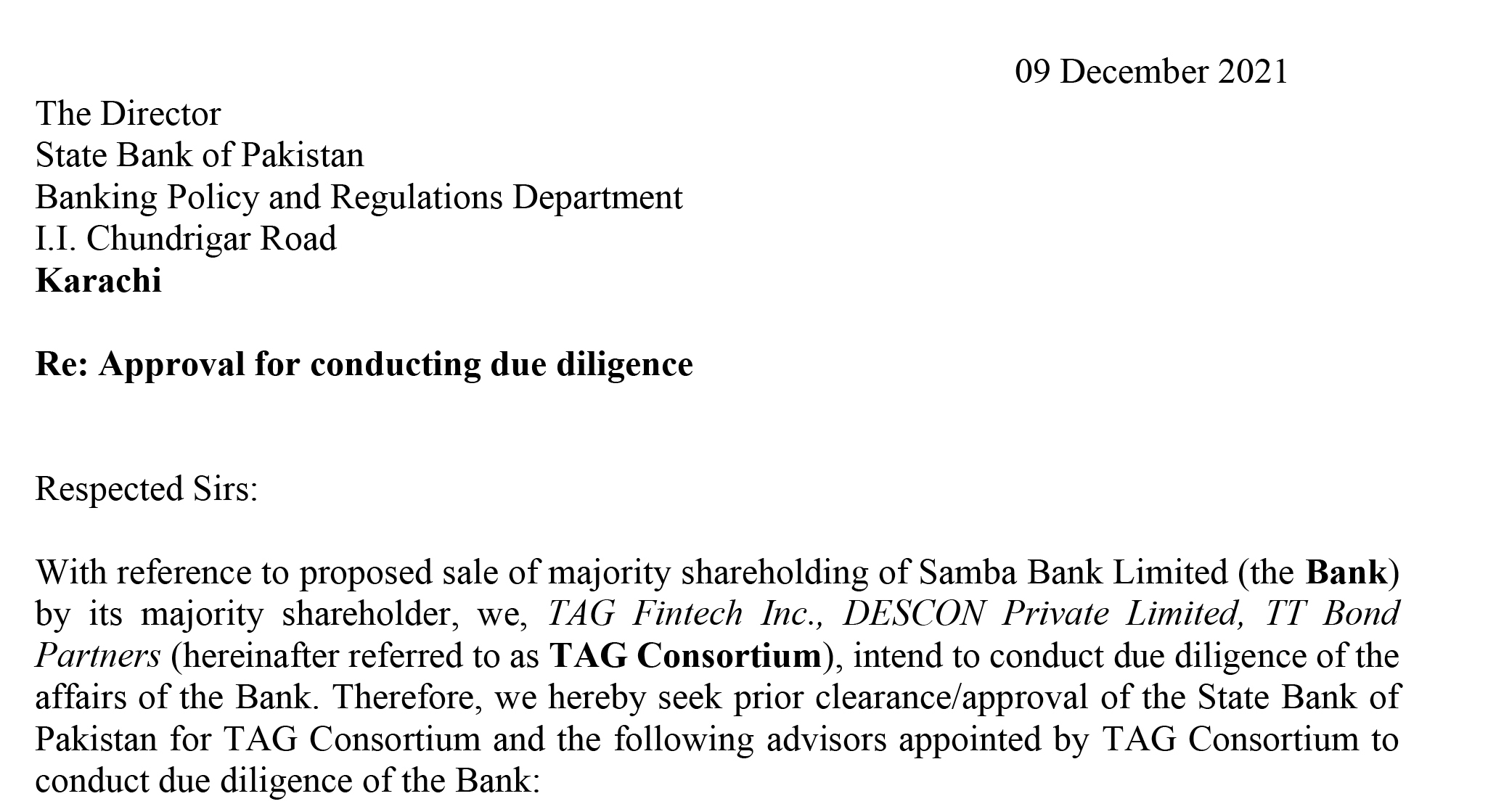

The problem was TAG did not have enough money on its own to buy the bank, despite their recent seed round. That is when TAG decided they would form a consortium to buy Samba Bank. On the 9th of December 2021, Talal sent an email to the SBP saying that TAG Fintech along with its potential consortium partners intend to conduct due diligence for acquiring a majority stake in Samba Bank. There are two important things here. The first is that TAG Fintech is the Delaware registered holding company that owns TAG Innovation which is the operating company based in Pakistan. The second is TTB Partners — a Hong Kong Based investment firm was part of their consortium. The original letter, which was later not sent, was signed by Talal from TAG (who signed it as CEO of both TAG Fintech and TAG Innovations), and by Chris Scoular of TTB Partners.

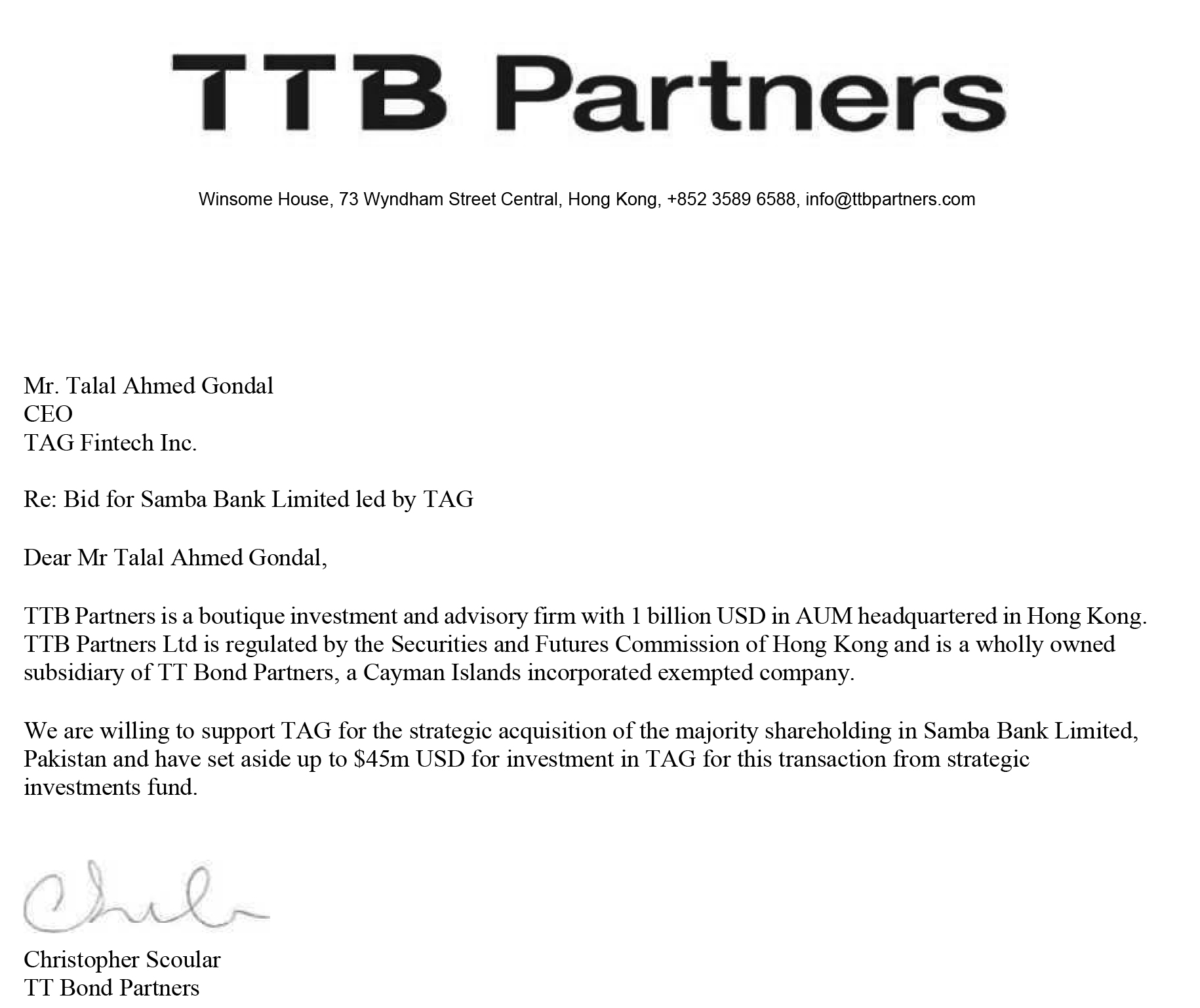

To prove to the SBP that they were in fact a serious buyer, on the 23rd of February 2022, just in time to meet the deadline to submit the supporting documents, TAG sent SBP a letter written by Hong Kong-based investment firm TTB Partners, and signed by TTB partner Christopher Scoular. “We are willing to support TAG for the strategic acquisition of the majority shareholding in Samba Bank Limited, Pakistan and have set aside up to $45m USD for investment in TAG for this transaction from the strategic investments fund,” reads the letter.

Here’s the catch however — that letter was doctored. TTB had apparently never committed an amount and had only shown commitment in joining the SAMBA acquisition bid. The not-so-little $45 million detail had been added to the letter later. Whether it was out of the last minute pressure to meet the SBP’s requirements or the desire to stay ahead of the others, someone from TAG had forged the letter. At the moment the thought was that the TTB would come around and when it did the whole matter would be buried under paperwork, except the lie was caught out.

Here’s the catch however — that letter was doctored. TTB had apparently never committed an amount and had only shown commitment in joining the SAMBA acquisition bid. The not-so-little $45 million detail had been added to the letter later. Whether it was out of the last minute pressure to meet the SBP’s requirements or the desire to stay ahead of the others, someone from TAG had forged the letter. At the moment the thought was that the TTB would come around and when it did the whole matter would be buried under paperwork, except the lie was caught out.

TTB Partners has not responded to Profit’s request for comments.

Suddenly TAG was in trouble, and both of its Pakistani founders were caught in the middle. The forged document had been sent on Talal’s watch as CEO and had been sent through Ahsan’s email account as COO of the company. What seemed in a moment like one small mistake was about to uproot the startup’s entire existence. Falling behind their competitors in the fintech race, TAG had pinned a lot of their hopes on adding a licensed bank to their portfolio — something that would give them a massive edge over other fintech startups. The document was submitted in what was a bit of a desperate attempt to to accelerate the Samba Bank deal.

Apparently the SBP did not notice the forgery at first, but Talal’s co-founders and board members did. Ahsan Khan claims that he confronted Talal over the forged document. On the 1st of March, Ahsan made Talal sign a written affidavit admitting to the massive mess-up which also served as Talal’s resignation. In the attested and signed statement seen by Profit, Talal admitted responsibility for these actions and declared that it was solely his own responsibility. He did not, however, admit to any forgery, or to sending the letter himself, he simply admitted that as CEO it was his oversight and he was taking responsibility for his unintentional negligence as a leader. That is where a very tumultuous month for TAG began.

Oh you weren’t supposed to do that …

This is where it gets really messy — the fallout. Because let’s be real, the move was an incredibly stupid one. Talal has at different points blamed his advisors and partner Ahsan for the lack of due dilligence and admitted that it was a major oversight on his part but has denied malice.

Two of the advisors have denied involvement in whatever happened at TAG, and one even wrote a letter to the State Bank saying that they were never officially appointed by TAG. In fact, both these advisors, in background conversations with Profit, vouch even for each other that they were not involved in this fiasco in any way. Later, Talal acknowledged that the advisor in question was never appointed.

What happened within the TAG management, however, caused a month of major confusion in the company. On the 1st of March, Talal had already resigned in the affidavit. According to Talal, the understanding between him and Ahsan was that this was a fail safe measure. He claims the affidavit was signed so that in case the SBP found out about the tampering, TAG would be able to say that it was a human mistake over which their CEO had already resigned. Talal was under the impression that the SBP would not find out and he would be back in the CEO’s chair within a couple weeks without anyone being the wiser.

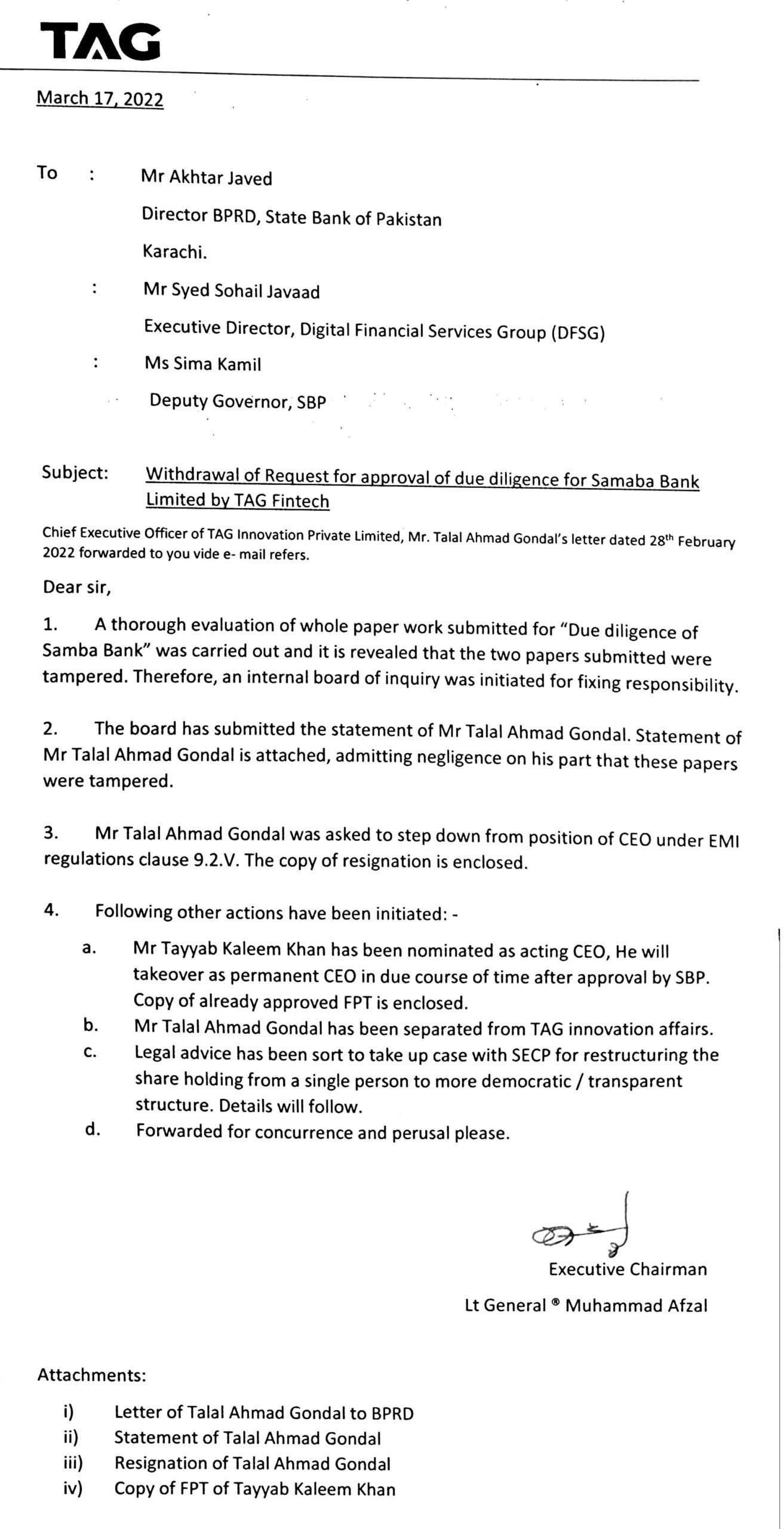

According to sources close to Ahsan, after taking over as interim CEO, Tayyab and his brother Ahsan began to worry about the danger of the SBP finding out and coming out against TAG, all guns blazing. With Talal out of the picture, Ahsan and General Afzal began discussing prudent measures to get out of the problem. Both of them felt that instead of risking the SBP finding out, they should come clean to the central bank and let them know what Talal had done — sacrificing him in the process. Talal does not agree with this account.

UPDATE: After the publishing of this story, Profit has received fresh information from a senior official and board member at TAG Innovation, regarding what went down at the startup. Read on here: New revelations shed fresh light on happenings within troubled fintech startup TAG

On the 17th of March, Lt General (r) Muhammad Afzal in his capacity as Executive Chairman of TAG wrote a letter to the SBP in which TAG withdrew its request to acquire Samba Bank. This was a follow-up to the original withdrawal letter written by Talal to try and stave off the wrath of the SBP. In the letter, he explained to the SBP that a tampered document had been shared with the central bank, and upon discovery of this a board inquiry had followed as a result of which their CEO Talal Gondal had resigned. A new CEO had been appointed — Ahsan Khan’s brother Tayyab. Meanwhile, Ahsan Khan would continue to serve as COO.

Talal’s great return

To recap, TAG had sent a tampered letter to the SBP, after which an internal decision within major company officials had ended in Talal Gondal resigning. Then, the new management went to the SBP and tattled on Talal. On the one hand, Ahsan seemed to be flanked by the extremely influential Lt General (r) Muhammad Afzal who was the company’s governing officer. At the same time, Ahsan and Talal also had a third co-founder — the German CTO of TAG Alexander Lukianchuk. Alexander sided with Talal, and things at TAG were far from settled.

Both sides had a point here. On the one hand, Talal claimed that the resignation was an internal matter and that there was no need to send the detailed letter to SBP as they might never have found out what had exactly happened and that Ahsan went back on their agreement. This was plausible, since Talal had already withdrawn from the Samba bank bid much earlier through a letter he had sent to the SBP on 28th Feb. On the other hand, it seems Ahsan and General Afzal still felt that they would be risking the entire company by not sending a more detailed letter.

After telling the SBP what had happened, Ahsan began to work towards ridding TAG of Talal entirely. Ahsan approached Talal to try and have him give up his shareholding in the company. In an effort to dilute Talal’s majority ownership, he was asked to give up 10% of his equity in the company and the said shares will be distributed towards company employees under ESOP (employee stock option plans). This would mean Talal would no longer be able to run the show as the majority shareholder.

Up until this point, Talal had not thought there would be any question of him being thrown out of his own company. But he was not ready to go down. Remember, he still owned a 55% share in TAG Fintech, which is the Delaware based holding company that owns TAG Innovations which operates in Pakistan. Sensing his opponents were on the attack, Talal countered. He lobbied heavily through his family connections and eventually regained the support of General Afzal as well.

Suddenly, Ahsan’s brief revolution was over. On the 1st of April, exactly a month after Talal had resigned as CEO, Ahsan was removed as COO of TAG. His brother, who never really took over as CEO, was also replaced by General Afzal as the CEO of TAG Innovation. Meanwhile, Talal let Alexander take over as CEO of TAG Fintech in Delaware. While Talal does not have an official title at TAG other than founder and majority shareholder, he seems to be now back in the driving seat while Ahsan has been kicked to the curb alone.

In conversations with Profit, Talal has expressed that he was taken out of his role as CEO for something that could have been investigated and resolved within the company itself. There is a clear indication that he feels scapegoated over the forged document. There is a certain degree of truth to this, particularly since Ahsan and General Afzal did consolidate control over TAG in the immediate aftermath of Talal’s exit, and Talal had to claw his way back into the company that bears his initials as its name.

However, at the end of the day a mistake was made. Remember Samba Bank was still up for sale and the SBP was keeping a close eye on it. Had they discovered the discrepancy on their own, it would have been a landmine for TAG. Instead, Ahsan and General Afzal decided to go to the SBP, admitted to Talal’s involvement in tampering and then reiterated their decison to withdraw from the race to buy Samba Bank, which according to them was the only prudent thing to do.

Even if Ahsan had not gone to the SBP, the central bank might have sniffed out the forgery. Forgery is a serious offence that the SBP, being a regulator, would never overlook. Especially since the SBP has been keeping a very keen eye on every single move being made by fintech startups. In a statement in December 2021, then central bank governor Reza Baqir had also pointed towards this.

“I want to emphasise the market conduct of new tech companies venturing into the payments space in Pakistan, especially with regards to market assessment and practices. We have observed that due to increased competition and to access venture capital funding, some companies enter into malpractices and behaviour that would not be becoming of them,” he said, going on to emphasise that this area because “it is one of the areas that we have been reviewing carefully and is a concern for us.”

On top of this, in his ambition Talal may have forgotten that the SBP would have an extra close on him and his startup, since Talal did not have a clean history with disclosing investments and what he told to investors. In fact, an earlier article by Profit into TAG’s realities was discussed at length in official SBP meetings.

In fact the State Bank on its own also verified with TTB Partners the authenticity of the document and learned directly as well that it was not what TTB had committed.

With all of this going on, it was no surprise that the SBP took exception to the forging attempt and on April 11th stopped TAG from growing it’s EMI pilot operations any further. This, at a time when TAG’s competitors such as Sadapay and Nayapay have gotten their full licences and are scaling their operations.

It was obvious that TAG had messed up, and that if no action was taken, it could look bad on the governance at TAG Pakistan which could compromise the chances of getting the EMI licence for TAG. And if the person responsible for the act was not identified and sidelined from the company, it would look bad overall on the entire management and the company itself. Talal was chosen to be that person.

So from Ahsan’s viewpoint, it was either save the company in which millions of dollars had been pumped and get the long-awaited commercial licence, or save the person he alleges to be responsible for forging the document. Because if the responsibility is fixed, the board and the management acted prudently and the SBP would then look kindly to the startup for the licence.

Honey, not in front of the investors …

Another recap: After resigning as CEO, Talal Ahmad Gondal began to feel that his childhood friend and partner Ahsan Khan was trying to force him out of the company he owned and had thus accused Talal and informed the SBP. Talal retaliated and ousted Ahsan from his position as COO in the company, but it was too late.

The SBP responded by issuing a show cause notice and also suspending further expansion in TAG’s pilot operations. While Talal had initially agreed to stay away from TAG, realsing the new situation, he went back on his word. Even though he may not have the title of CEO and Director, Talal has still managed to bounce back and now has all the power as majority shareholder. Talal’s decision to put up a fight became a major sticking point in an already messy situation for TAG. Not only does he want to maintain his control over TAG, along with Alexander he wants to take Ahsan to task for trying to orchestrate a coup against him. So if you are in Ahsan Khan’s position, what do you do? You go to the investors.

This is where the infamous letter comes in. Yes, if you’re keyed into the startup or fintech ecosystem in Pakistan, you will already have received it on Whatsapp by now. On June 16th, Ahsan Khan decided to write a letter to investors to appraise them of TAG’s situation, and give them the bad news that TAG’s pilot operations had been suspended by the SBP. And that the central character who was single handedly running his own company to the ground was Talal Ahmed Gondal.

In the letter, Ahsan spilled the beans to all of TAG’s investors. He explained how Talal had allegedly submitted a forged document to the SBP affirming that TAG had the backing of TTB Partners which had committed $45 million to acquire Samba. He also told them that Talal had agreed to step down, but had backtracked on the agreement.

According to the letter written to investors and available to us, Ahsan alleges that both Talal and Alexander together conspired against him in an attempt to oust him as stockholder in TAG Fintech, and illegally acted to cancel his shareholding, which according to Talal is only 12%, on fabricated grounds.

The grounds on which Talal and Alexander are acting against Ahsan is that Ahsan misappropriated funds from the company, a charge that Ahsan denies stating that only Talal was the sole operator of TAG Fintech bank accounts and for TAG Innovation, he had the authorisation to authorise payments as per operational requirements of the company such as disbursement of salaries. On the other hand, Ahsan alleges in the letter that it was actually Talal who misappropriated investor funds in the company and transferred them into his own account.

According to the letter, On March 1, on the day Talal resigned, and on March 2, by virtue of him being the sole operator of bank accounts, Talal withdrew investor money illegally in excess of $599,000 from the bank account of TAG Fintech and transferred the same to his personal account. “It is an alarming state of affairs indeed that, to date, Talal Ahmed Gondal took out $1,000,000+ in the aggregate,” Ahsan wrote in the letter to investors.

Similarly, Ahsan claims that an amount of $150,000 was withdrawn by Talal from operating company TAG Innovation Private Limited “without a bonafide purpose or reason.” Profit has not been provided any documentary proof to back both of these allegations.

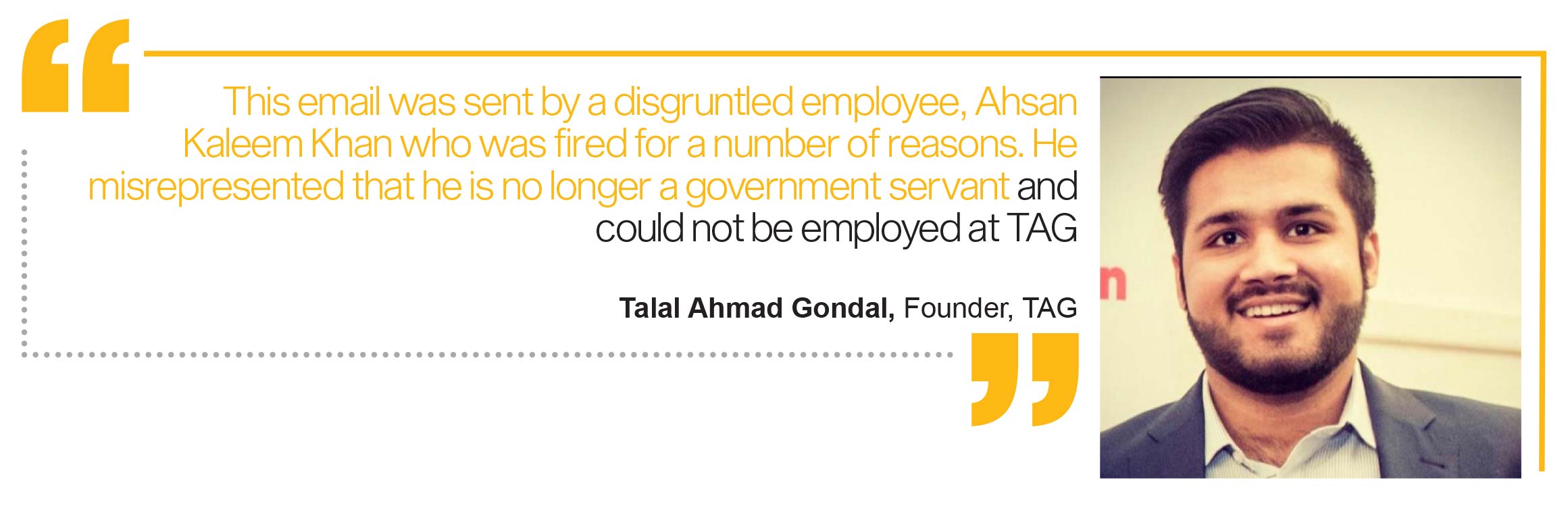

In response, Talal also went directly to the investors just as Ahsan had. In his detailed communication, Talal says that all the allegations and the supporting documents provided by Ahsan are mostly fake documents — ironic considering the biggest issue in all of this was a fake document. Talal alleged that besides forging Talal’s signatures on a fake board resolution authorising Ahsan as a bank signatory and later using it to misappropriate Rs 39 million from company funds, Ahsan also misrepresented that he was no longer a government employee, which explained his lack of commitment to TAG, and was one of the reasons that he was fired from TAG.

“He was given an opportunity to return the funds and when he did not on time, upon advice of our counsel, Ahsan’s shareholding was suspended and cancelled,” Talal wrote to investors in response to Ahsan’s letter. “This email was sent by a disgruntled employee, Ahsan Kaleem Khan who was fired for a number of reasons. He misrepresented that he is no longer a government servant and could not be employed at TAG. He is back at his public sector job. This surfaced in the audit. This also explained his lack of commitment to TAG. He also made unauthorised withdrawals from the company accounts.”

What next …

As things stand, TAG is still operational. According to officials from TAG, the SBP has already conducted an audit which has come out clear and that they are on track to get their EMI licence. While it has not caused any immediate lasting damage to the financials of TAG, the entire incident will leave a bad impression on investors.

According to Talal, well, besides one rogue employee, all is well. That the company is burning only $350,000-400,000 per month and they have enough money to last for more than a year. That the company is making advancements on the product and technology side and it is only the SBP approval that they are awaiting.

Talal Gondal still controls the majority shares in TAG Innovate Pakistan’s holding company TAG Fintech, and even though he is not the CEO he can still exercise the most degree of control on the company as the majority shareholder. Ahsan has allegedly made overtures towards acquiring Talal’s shares but have been rebuffed. At the same time, Ahsan has been fired from his position as COO and instead now Talal has cancelled his shareholding in the company to compensate for the alleged unauthorized withdrawals. With letters and emails going back and forth directly to investors, things might not be a complete disaster at TAG but the situation is less than ideal and conducive to focusing on the product.

While the big dogs at TAG fight it out, the company and its financials will suffer in the meatime. As of now, it is mainly Talal Gondal that is under serious scrutiny by the SBP. However, he is still steering the ship even if he is no longer officially the captain because, well, he owns the ship.

It is unlikely, however, that in the middle of all of this TAG’s operations will not be affected. While sources close to TAG claim that things have settled down now, and SBP after imposing a fine, will grant TAG the full licence within the next few weeks, this entire episode will leave a bitter aftertaste not just for the SBP, but also for TAG’s investors who have gotten a front seat to the row between Talal and Ahsan. What this will mean in the long run is anybody’s guess. The final verdict on the extent of damage to TAG from this is going to be given by the SBP, which as of this point in time, is still in the process of deciding on TAG’s future and that of Talal.

The SBP has not disclosed details about TAG in request for comments by Profit.

Publishing Editor’s note: An earlier version of this story had erroneously claimed that TAG indulged in misrepresentation regarding a US-based VC fund; that TAG had claimed was amongst its investors, whereas it was actually one of the partners in the fund, who had done so independently, in a personal capacity. It has come to Profit’s knowledge that the said VC had, in fact, invested in TAG directly.

Also, the earlier version mentioned that Descon (pvt) Limited was also part of the TAG Consortium. However, after the publication of this article, Profit received a clarification from Descon denying being part of the final TAG consortium. Descon’s denial comes after Profit published a copy of a letter addressed to the SBP in the article which identified Descon as part of the TAG consortium seeking SBP’s permission to undertake due diligence of SAMBA Bank.

The letter shared with Profit by Talal carried signatures of Talal Ahmed Gondal and Chris Scoular, partner at TTB Partners. Signatures of Faisal Dawood, board member at Descon, were missing. Following the denial from Descon Private Limited that they did not agree to be a part of the consortium and had no knowledge of TAG’s letter to the SBP, Talal has shared a new letter with Profit, explaining that the letter originally shared with Profit was only to show that TTB Partners were infact part of the consortium, but this letter was not the one that was sent to the SBP. He also says that nowhere had he claimed that Descon were part of the TAG consortium.

In the letter that was later sent to the SBP neither Descon, nor TTB Partners were mentioned as consortium partners for conducting due diligence of Samba Bank.

The errors are deeply regretted.

Additional reporting by Abdullah Niazi & Babar Nizami

Bloody scam! This and airlift will sink the tech ecosystem in Pakistan. Aatif Awan Is responsible for this bloody scammer.

Dear Taimoor, was ticket officially given by

PTI and did he contest the elections. If not putting party Chairman’s picture on timeline of events is not appropriate.

So who acquired Samba?

That’s the best part. Samba later changed its mind and decided not to sell.

Our start up eco system is as fake & dirty as our political system!!!!

Makes me wonder; is there anything going good in Pak?

Would you invest your hard earned and halal money in Pak?

Looking to countries like Vietnam and their development I get very sad

I absolutely do not understand why the article refers to a “fraud” as a “mistake”consistently. The company committed fraud to seriously advance its business and some in the company got cold feet after that and tried to save themselves from potential consequences. Such scams are ruinous for investors and for the ecosystem, especially in the financial services space. Giving a license to them would be akin to giving a license of financial manipulation.

This is way too long to read

Thank you for this nice post and wonderful read!

Length of the article should have been trimmed.

So many repetitions.

Editor’s attention invited.

These founders should be ashamed. They will even sell their mothers for money. As i read this saga, i feel their parents raised them to do fraud. Who can teach these kids – kitna khao gai? Pesa kha kai kidar jao gai end mai tau marna hai bhaiyo.

And there’s me thinking of getting into that Pak tech scene : ( the country is rotten to the core

This article is too long to read. Please cut it shot for us to give us a better reading experience. I have read your other articles. They are precise and comprehensive but this one is too long. Thank you!

A big part of Talal’s personal story is missing that should help explain this further; I have known him personally and he is very capable of committing a fraud.

Paid Content; publicity of a fraudster who has been rightly called out his co-founder and facing the hell now. BEst wishes to Ahsan and that he stays strong to bring this fraudster to justice who has destroyed the image of Pakistani startup ecosystem.

Startled to see how you have portrayed imaged of a fraudster as innocent.

No mention of humble background of Talal and that he is good at impersonation.

Can he name any “political scion” of his own family and not of Sargodha. Good at name dropping, at one point he claimed he had the Army Chief’s son in his pocket who is named the Legal advisor in his fraud Samba Bank deal.

he is at best, a good hustler and fraudster.

I’m utterly disgusted by Ahsan Kaleem Khan CTP 46 actions, in his jealousy of his sugar daddy and to compensate his overly mediocre brother Tayyab Kaleem Khan he sold his conscious to the devil and that devil kicked both there butts out in his own greed. Now he is whining like a little bitch and in process of throwing tantrum he destroyed the hand that fed him, his family and 100 other families who were relying on TAG. He himself is back on his job as assistant commissioner fbr bored to death on his desk typing lies all day. Pretending to be a Messiah of a company which was destroyed by petty actions and comfortably forgetting the fact that he is the criminal of Pakistan government as you’re not supposed to moonlight as a bureaucrat. He’s a lame keyboard warrior with too much time on his hand who forged his way at TAG and now accusing the same

In the jealousy of his friend Ahsan forged and broke the trust of someone who considered him his brother, tsk tsk tsk

In his greed Ahsan slaughtered the goose that was laying golden eggs.. tsk tsk tsk

In his pride of being a bureaucrat and family of bureaucracy, Ahsan knocked down the livelihood of 100 families.. tsk tsk tsk

In his lust for power Ahsan made the company his plaything and in process turned it into rotten to the core.. tsk tsk

In order to seek gainful employment for his sloth brother Ahsan threw away the blood and sweat everyone had put in the company..tsk tsk

Ahsan’s gluttony meant that he stole from the ship that he was co-captain of and after jumping ship, he wrecked that ship.

As Ahsan had no techie friends of his own, he realized what a waste he is and he brought wrath upon the tech company that was built around him..tsk tsk

Ahsan has defrauded investors, his partners and stolen money from the company. He had a unique breed of greed and is nothing but a fake. I am sure after defrauding and stealing millions – he is already planning his next fraud.

He is a bloody criminal and if you meet him you’ll be able to tell this this is a type of guy who sells his wife and sisters for money to feed his belly – which is getting bigger with all the haram

Seems like Talal is using the investor money in Media campaigns; to cover his poor background, no real family standing and all of a sudden gets the limelight. What a thankless creature he is. Also, he is a proud Ahmadi;

who is willing to sell everyone for his own gains. It usually happens when you rise quickly from a poor background. Money cant buy you family background and standing.

Talal should be ashamed; fired from Amazon, Fyber and even Trivago as an intern. He is even lying about the university he went to. Cant believe, this man be trusted with people’s money. What a shameless guy he is.

Ahsan is as ‘Afsar Babu’ as they come he treated the company as his plaything and would even expense his fruit and groceries (learnings from his rich and bureaucratic background), Sources close to Ahsan say he had a glimmer of humanity before he got married, after that it was all downhill. In other words he is very gullible. Ahsan could never get the limelight because he wasn’t willing to commit to the company or give up his government job but his puppet masters told him you deserve all that Talal has.

Also, even supposedly being educated abroad he visits random peer babas to do ‘taveez ganda’ and doesn’t take a step without consulting his murshad baba.

does anyone else feel like it is tallal and ahsan commenting themselves above one after the other? lol

Thanks for the good information, I like it very much. Nothing is really impossible for you. your article is very good.

사설 카지노

j9korea.com

Ketika seorang yang bermain judi slot online mendapatkan banyak uang atau jackpot maka orang itu akan disebut sedang gacor. Jadi begitu ya, penjelasan kenapa muncul istilah-istilah seperti slot gacor dan lainnya. Situs slot gacor

Welcome to Versatile Coupons, the final location for getting a versatile deal on your internet-based buys. Our central goal is to assist customers with enjoying you find the best arrangements and limits on the items you love. We comprehend that setting aside cash can be intense, particularly while shopping on the web. That is the reason we’ve made it our objective to present to you the best-in-class coupons and markdown codes from top retailers. Whether you’re looking for garments, gadgets, or home merchandise, we take care of you.

tch tch

If you want to learn how to crack software legally, the fun and easy way like playing a computer game, then this course is for you.

Get nordvpn premium accounts for free without any ads from nordvpnmodapk.com