The first thing that hits you is the noise. It grows steadily as one approaches the Abdullah Travels terminal in the middle of Lahore’s Bund Road. But the closer you go the clearer it gets until, finally, the bustling of people, the roaring of engines, and the screaming of both bus conductors and children reaches crescendo.

On the right day, you could romanticise the dusty realities of inter-city bus transport. On most, however, it seems an unglamourous affair. Since as far back as this industry has existed, the Abdullah Travels terminal has been the hub where all small-time bus companies have operated from. From Kohistan Express to Skyways and Hazara Movers, under the shade of the shoddy structure that stands at the terminal one can find any number of bus companies providing different rates and levels of comfort and service.

Yet the star of the show at the terminal is undisputed — Faisal Movers. Founded in 2001, the company has since grown to become one of if not the largest providers of inter-city bus travel in Pakistan. In the two decades since they entered the business, they claim to have grown the biggest fleet in Pakistan, beating back Daewoo, and diversifying their business.

The world of the transport business is cut-throat, to put it politely. It is dirty to put it straight. The people that run it have to be ruthless in their business tactics and guarded in their public personas. Since 1997, the King of Pakistan’s inter-city bus travel has been Daewoo — the originally Korean backed company that first gave an upscale touch to bus travel has been the go to service particularly for the Lahore-Islamabad route. Many challengers came to try and dethrone Daewoo, but most were a flash in the pan.

“We’ve seen a lot of people try to enter the business, all of them have fizzled out. Some of them would come in very strong and grow their fleet to 80 buses or maybe 90 buses, but none of them ever crossed that,” says Shehryar Chishti, Chairman of Daewoo. “But Faisal Movers were different. They have done a good job and they’ve expanded scale where other people were not able to. Nobody had crossed the 100 bus barrier before them.”

Today, Daewoo has a fleet of 350+ intercity buses and operates government contracted intra-city routes in Lahore and Multan with a fleet of 250+ buses. In comparison, Faisal Movers has more than 650 buses catering to 55,000-60,000 travellers every day. They have in many ways bossed Daewoo in the past decade, using cheaper rates with similar services to turn a large number of inter-city travellers from the legacy company to themselves. This is the story of how Faisal Movers managed to break into and conquer one of the toughest businesses in the country.

Humble beginnings

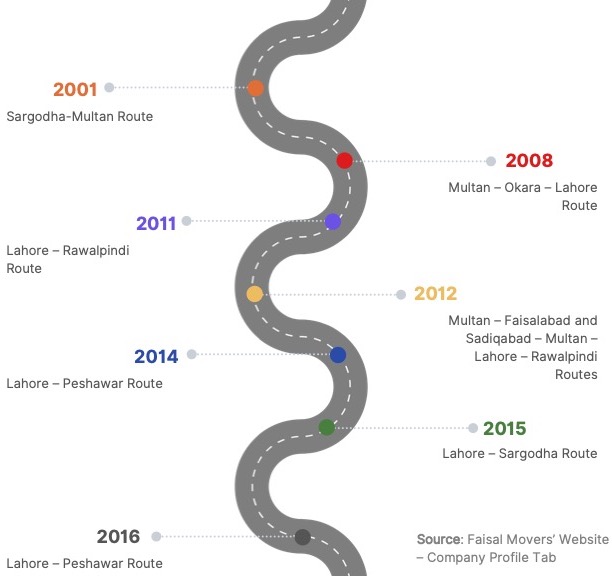

The first voyage came in 2001. It was a simple affair, with the first coach bus running a typical route up-and-down the Punjab from Sargodha to Multan with Faisalabad and other stops in the middle. At the time the inter-city bus business was still evolving and this was an era of hyper-specialisation. On the one hand, Daewoo had spent four years and a good amount of money, investment, and Korean buses into becoming the go to travel option for the urban intelligentia. On the other hand, smaller bus companies fought for scraps amongst themselves.

The transport business is literally as well as figuratively very territorial. And the Sargodha-Multan route was perhaps one of the most competitive and lucrative routes in the region. What compelled Faisal Movers to enter the competition was pragmatism. You see, this was not a new company being formed with the express purpose of entering a market that didn’t already have enough players. It was a question of survival.

Run by five brothers, one of whom is the titular Faisal, the Faisal group has been in the transport business since before 2001. The only difference was that before they started transporting people they were in the trade of transporting cargo.

“We were in the transport sector but not in the bus business. We were in the business of long vehicles” said Nauman Hafeez, Group Head Operations at Faisal Movers, to Profit. “Cargo coming into the country reduced significantly under Pervez Musharraf. We had bank financing available to us and decided to redirect it towards buses because of it.”

It was a simple gamble. The cargo business had slowed down and this was a similar line of work that the family had experience in managing. Faisal Movers did not ‘burst’ onto the scene. There was no mass marketing campaign, no strategic planning to take out Daewoo from the first day but rather just a single-track focus on the basics. And, as was expected, this initial foray was not the runaway success one might imagine.

The expansion story

For the first three years of its existence, Faisal Movers sort of trudged along with the rest of the smaller bus companies scrapping for crumbs of the pie. So what did they do? In 2004, the company changed its approach. They actually looked towards the then industry leader Daewoo for inspiration and took a page from their playbook.

Incumbents in the bussing industry operated, and still do, on either super stop or nonstop services. The former is by far the more cost effective measure, and the one that was more prevalent when Faisal Movers set up shop. The latter was utilised exclusively by Daewoo at the time. Faisal Movers, having found limited success with their super-stop service, replicated Daewoo’s nonstop bus service three years into their operations.

“Another competitor had a monopoly on the Sargodha-Multan route and gave us a pretty tough time,” explains Hafeez. “When we found the classic techniques were not working, we decided to test our nonstop service on two stops with a few cars, and they were successful. Customers had embraced the nonstop service and our fare was lower than Daewoo.”

And that became key. In the years to come, Faisal Movers would not shy away from looking to Daewoo for how to operate. Daewoo was, compared to the rest of the inter-city bus industry, a fine-tuned machine. Faisal Movers simply had to wait and observe. They operated on a model of offering the same services at cheaper rates, providing a relatively similar travel experience at a lower cost.

The company went on to increase their routes. In 2008, barely four years after their initial conquering of the Sargodha-Multan route, they managed to break into the Multan-Okara-Lahore route separately. This was alarming to Daewoo, which had made Lahore its centre of operations having an expensive headquarter and bus terminal at the provincial capital’s famous Kalma Chowk, as well as right on the edge of the motorway at Thokar Niaz Baig. But Faisal Movers kept moving, and in a very patterned timeline within three more years broke into the Lahore-Rawalpindi route in 2011.

The Lahore-Rawalpindi route had been Daewoo’s baby. There is a lot of travel that takes place between the two cities, and it was made much easier by the construction of the M2. Daewoo dominated the motorway up until this point and in many ways still does. But Faisal Movers foray into this route not only gave Daewoo competition, but also galvanised other smaller companies.

From here on in Faisal Movers continued to grow. They expanded to include the Multan – Faisalabad and Sadiqabad – Multan – Lahore – Rawalpindi route in 2012, the Lahore – Peshawar route in 2014, the Lahore – Sargodha route in 2015, and the Lahore – Faisalabad route in 2016. Within a decade, Faisal Movers had not just flexed their muscles and taken up a lot more space on the roads, but had also made Lahore, which was once the fiefdom of Daewoo, their playground.

In the meantime, Faisal Movers preyed on some of the smaller companies trying to make it. You see from 2011 onwards, there was a definite sense of there being too many options available almost at bus terminals in Lahore. At the Abdullah Travels terminal on Bund Road where our story begins, a litany of options presented themselves. Watching the rise of Faisal Movers, other smaller companies figured they would do the same and try to beat Faisal Movers at their own game (while Faisal Movers’ game was, funnily enough, to try and beat Daewoo at their own game).

But that is where Faisal swooped in and expanded. They went on to buy many of its competitors as well. They acquired Shuja Royal Express in 2019, Ali Express in 2020, and Bilal Travels in 2022. The companies were rebranded as Sania Express, Silk Line, and FMBT respectively. Not only did Faisal wipe away the names of these old companies, instead of including them all under the ‘Faisal’ fleet they decided to run them as separate companies becoming a conglomerate in the process.

More importantly than that, they now have four different ‘brands’ that compete with each other on rates. And if your companies are competing with each other, that means you are holding all the cards and new entrants are going to have a harder time breaking into the business than ever before.

Terminal wellness

At the Lahore terminal where we started our story, the buses stand under a gaudy, massive sign that one might expect to find at a Vegas wedding chapel. On one end it reads ‘ABDULLAH TRAVELS’ and on the other ‘FAISAL MOVERS.’ Yet aside from the sign, there is very little marking the terminal as belonging to Faisal Movers. Buses of all colours and brands have a pretty equitable share of the place, and different rate lists — some printed, some written by hand — point out different bus services and the routes they are travelling. For the less-discerning eye, Faisal Movers seems to be just one of the many companies hustling for space at one of Lahore’s oldest and most important bus terminals.

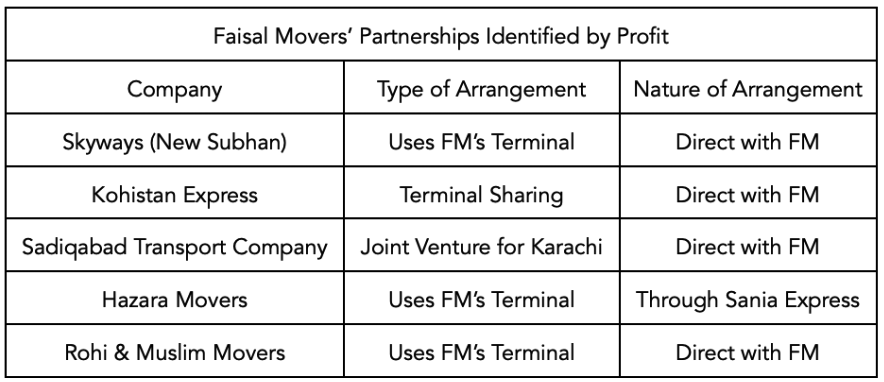

Even for those that know Sania Express, the Silk Line, and the FMBT are owned by Faisal Movers would still see a lot of other companies nesting at the terminal. Names like Roohi, Kohistan and Hazara are all there operating on very specific routes at times. Their presence is very much by design, and a critical ingredient to the success of Faisal Movers.

You see, the answer to the question of how Faisal Movers did it is quite simple. Daewoo did nothing and Faisal Movers operated on frugally and persistently. In more detailed terms, Faisal Movers adopted the nonstop service model for the low-cost segment and not just broke away some of Daewoo’s clientele but captured an entirely new base of customers. This was pivotal.

The model was synonymous with Daewoo. Daewoo’s continued successes increased the model’s appeal with only one caveat; the price Daewoo charged. “There was a vacuum. Daewoo was operating at its limit. People had nothing similar to travel in the affordable segments. We filled that vacuum by reducing our prices,” says Hafeez.

In a manner, Daewoo actually subsidised Faisal Movers’ success. However, there’s more to the story than perfectly executed mimicry. There were also a lot of savvy moves. Perhaps the biggest stroke of genius in terms of going toe-to-toe with Daewoo was Faisal Movers’ terminal economics. Daewoo had long included nice terminals as part of the package they offered. They chose prime real estate, only their buses operated out of these terminals, and they made air-conditioned lounges with comfortable seating and little shops. Faisal Movers, since they were providing the budget option, decided that people would wait a few minutes or go through the hassle of going to a place like Bund road rather than paying a premium and avoiding it.

They decided to buy their own terminals eventually, and they also own the one on Bund road, but continued to operate them on a sharing basis. And there is a reason why they’re sharing the terminal to begin with. “When we were building up, we hit our capacity. Obviously everyone has a limited capacity. You can’t reach all places. Joint ventures allowed us to avoid chaos and work with other companies.” said Khawaja Daniyal Shahzad, a Director at Faisal Movers, to Profit.

So Faisal Movers has two kinds of agreements with other companies, joint ventures and bus stand arrangements. Let’s start with the former. “For example, we couldn’t reach Karachi, so we only entered a joint venture (with Sadiqabad Transport Company) there so that they could handle that end and we would handle this end,” said Shahzad.

“Then there is the other end of this. We have a terminal here, we did not have one in Faisalabad. We had entered an arrangement where we would half of our and half of their buses. We would use their terminal in Faisalabad and they would use our terminal in Lahore.” said Shahzad. Within this terminal sharing arrangement, quite a few companies just operate out of Faisal Movers’ terminal by paying a fee.

Now Profit speculates that these have, and continue, to play a big part in Faisal Movers’ success. We speculate because Faisal Movers was not the most open about this. Many of the partners Profit identified were down to just spotting them at the Terminal and asking Faisal Movers about them. There may be more but that would necessitate bird watching for a while. Profit is not sure why Faisal Movers does not boast about this model because, franky, it’s brilliant.

Why the business model works

This model enables Faisal Movers to reduce their overheads, benefit from their partners’ advertising, fixate themselves on growth, and ultimately increase their passenger volume. It’s pretty likely that a passenger on-board their partners’ vehicle may just sample them directly for another prospective journey. If nothing else, it provides Faisal Movers with a list of possible candidates to add to their acquisitions.

“These are transport ideas. They are attributable to those people that work at general bus stands.” said Hafeez when asked for how Faisal Movers was able to come up with these ideas. Now this might sound rudimentary to many reading this. It is most definitely for many of the people headed to Bund Road to catch a bus. However, the thing is that this practice is a staple of just the affordable segment. Anyone looking to brand themselves as upmarket could not leverage them.

Daewoo had to deviate from this and create their own separate terminals because they targeted middle and upper-middle income passengers. Daewoo did find their success in that model but that also means that Daewoo likely has higher operating costs than Faisal Movers.

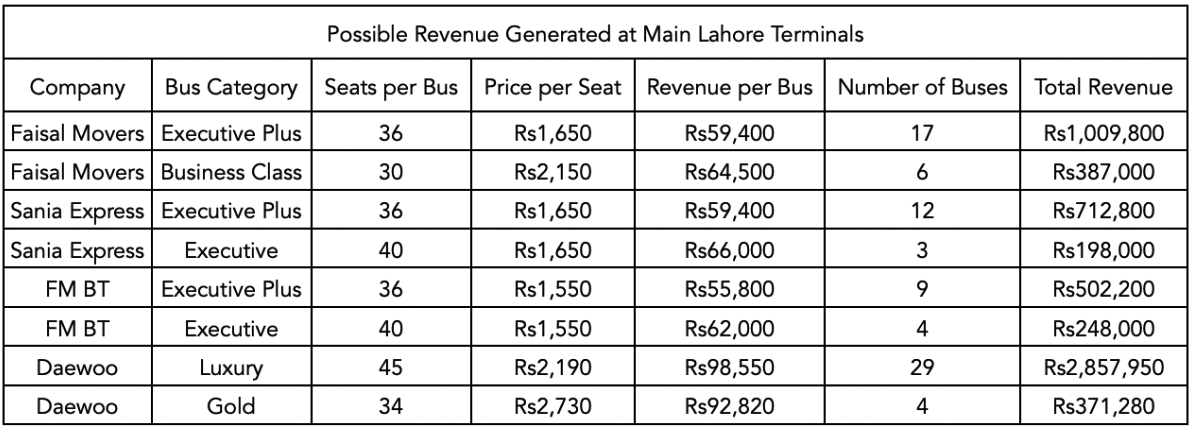

So Profit did the maths to present a clearer picture of what’s going in. Faisal Movers head office at Bund Road and Daewoo’s head office at Kalma Chowk also serve as bus terminals. Talk about utilising every last bit of space. Profit looked at the number of outbound bus journeys from Lahore to Rawalpindi/Islamabad (Main) to see which of the two generates more revenue per day. A classic and very populous route in our opinion.

In doing the maths, we utilised the proprietary online booking system for both. Daewoo’s website and Bookkaru for Faisal Motors. We looked at all the trips one may find over the course of any day in the week. In terms of the prices we used the advertised prices, the base prices in particular. We opted to not use discounted prices wherever found for greater accuracy. Seats per bus were the ones that were listed on the respective system for each listed ticket.

Based on our findings, if both terminals operated at full capacity, then Daewoo resoundingly beats Faisal Movers both alone and alongside Faisal Movers sister companies. However, the difference between both stands amounts to Rs 171,430 per day.

‘Adda’ politics

Theoretically, Daewoo would have Faisal Movers beat. But that’s probably Faisal Movers’ exact advantage. Daewoo has to incur the entire cost of wherever it operates. Now Profit is cognizant of the fact that Daewoo has more than one terminal in Lahore, but Profit is also cognizant of how Daewoo needs to build on prime property to maintain its brand value and attract its target market. All of which increases its costs even more so.

How much more so? Well, they refuse to tell us but let’s just say it’s probably more expensive to operate in DHA Phase 5 than Bund Road. All of this information is, of course, very Lahore centric — but that is also the city that both of these behemoths have made their addas.

{Editor’s note: The urdu word ‘adda’ has been added here with an express purpose. In the transport business, particularly the routes stretching through Punjab, transporters are famously territorial. A breach of a person’s adda is considered a personal affront at times. In a more lawless time, blood has been shed over less and the stories of Tippu Truckanwala and Goggi Butt are still whispered off at tandoors and barber shops in Lahore. The world of inter-city bus travel is more sophisticated (which isn’t saying much) but at the end of the day some of this is a fight over who will get to call Lahore their ‘adda.’}

So what does Faisal Movers’ do with all their cost savings? Other than expand to have 600+ buses and a list of partners they don’t actively advertise? Well for starters, they offer a pretty good deal for customers to be honest.

Looking at the same Lahore to Rawalpindi/Islamabad route.Faisal Movers charges Rs 2,150 for its Business Class ticket and Rs 1,650 for its Executive Plus ticket, whereas Daewoo charges Rs 2,190 and Rs 2,730 for its comparable offering. That’s a 30% saving right there, and this is before you realise that your ride is a bit more spacious as well.

Faisal Movers breaks from an industry norm and actually reduces the seating capacity of its buses, so as to increase the space available to customers. Whereas Daewoo’s buses seat 45 and 36 passengers on their Luxury and Gold offerings, Faisal Movers accommodates 36 and 30 passengers respectively on their aforementioned offerings.

Finally, there’s also low wait times between buses which translates to additional ease of hopping onto another bus in case you miss your original one or have a change of plans.

Profit looked at all the available time slots and found that the average wait time between Fasail Movers’ buses departing was 1 hour and 1 minute. In comparison Daewoo had an average wait time of 47 times but in accordance with the theme of this article, the situation changes when you incorporate Faisal Movers’ other companies. Accounting for both Sania Express and FMBT, the wait times between departures falls to 27 minutes.

This particular feature is also by design. “Our telephonic bookings are low compared to other companies. We rely on walk-in passengers. We gained our customers’ trust by ensuring that we could accommodate them whenever they came.” said Hafeez. The catch is Faisal Movers promises to put you on a bus, a bus they own, but does it matter if you happen to go on one of their sister companies to the same destination?

This final trait also ensures that they operate as close to full capacity as possible to get as close as possible to the numbers Profit crunched. And well, let’s just say Bund Road has a lot of people. A lot.

To wrap it up, you’re getting a more affordable trip with more space, and no actual need to make a booking in advance. Should competitors be worried? Yes. Is the industry’s other big player worried? Somewhat but it’s complicated.

Faisal’s future

This is the segue to the question we just asked but it’s also necessary that we end with our main theme. So we’ve covered Faisal Movers’ past, and their present. Logically, the question then is what is the company going to do going forward?

Based on Profit’s conversation with them, they’ll just continue expanding. The aforementioned Sania Express, Silkline, and FMBT are all part of Faisal Movers’ corporate strategy to increase their synergies even further. Faisal seeks to differentiate Silkline, FMBT, Saania Express, and Faisal Movers based on price. In that particular order from low to high end so as to capture as much of the market as possible. In accordance with this price discrimenation, they are planning to launch an entirely new category in their bus offerings to take Daewoo by the horns.

For all its hype, Faisal Movers may still not have had their place in the sun as there’s likely more growth on the horizon. Whenever they do have it, Daewoo will likely benefit from it as much as customers will.

The wild card – Pakistan railways

This much should at least be conceded to Daewoo — despite the stiff competition they have held their own. It is easy to be King with no enemies. We mentioned earlier that Daewoo did not do anything in response to the rapid expansion of Faisal Movers. That is not entirely true. While they did not make any major swings against Faisal, they did maintain their quality of service and focused on their own fundamentals rather than sweating the competition too much. That is why, perhaps, the execs at Daewoo don’t seem to particularly mind having a competitor.

“Competition is not all negative, right? Because what happens is that you go from a 100% market share of a small segment to a smaller market share, but you’re still number one in a much larger segment.” said Chishti. “Our market share has gone down but we’re still number one, and volume is still much bigger than it was 15 years ago because the market has grown,” he continued. “Having a good number two, number three player is not a bad thing rather than just being a solo and then 20 very small companies.”

That is a surprisingly mature response, but is it perhaps a little too measured? Should Daewoo actually be quite concerned rather than this calm? This is where we enter the realm of possibility. The thing is you could take either a Faisal Movers or Daewoo bus to Islamabad/Rawalpindi and take the one you did not on your return journey. At the end of the day, Faisal Movers and Daewoo will probably eat up many more smaller competitors before they take a chunk out of the other. However, what if there was someone who could, rather than a chunk, just bite an arm off entirely?

That someone would be the Pakistan Railways.

“I think Pakistan has an overall very good motorway network. Certainly much better depth, breath, and quality of road infrastructure than frankly even India and other countries with similar per capita income.” said Chishti.

Pakistan has indeed made leaps in terms of our road infrastructure. The very first motorway, the M2, was made in 1997. 1997 is also serendipitously the year Daewoo began its operations. Makes you wonder. The intercity bus business in Pakistan, however, is largely what it is because of the difference in the quality between our motorways and our rail network.

There are currently eleven fully operational Motorways in Pakistan. Four more are currently under construction or planned as future projects. Then, there is one that is partially operational whilst being under construction. “With Hyderabad-Sukkur motorway being complete we’ll have Karachi all the way to Peshawar and Islamabad” said Chishti. With more of the planned motorways coming online, volume on intercity buses will increase. However, Pakistan’s situation is not normal.

Railways remain the preferred method of transportation for passengers and freight globally. Successive federal governments have understood this. They just have not taken the requisite measures to improve the railway, until recently that is.

As part of the China-Pakistan Economic Corridor (CPEC), Main Line 1 (ML-1) is set to be upgraded. When will the improvements come through? Well, as early as this December. ML-1 caters to 70% of Pakistan’s rail needs so the upgradation alone should cause significant numbers of passengers and amounts of cargo to switch to cargo. However, as part of CPEC, more rail projects are still in the pipeline.

You would imagine that intercity bus companies would have a plan for long term sustenance amidst these seismic changes, right? Surprisingly, not really.

“I think first, the government needs to recognise that transport is an actual industry, and treat it as such from an access to financing, proper regulation, nationwide regulatory structure. It’s still being operated at a local level and provincial level. Maybe the industry needs to be more active to press for its issues” said Chishti when asked by Profit about the bus industry’s relationship with the State.

Chishti’s final words may allude to why Daewoo is not at a complete loss because of Faisal Movers’ success. Two large formal business entities rather than the wild west of an industry makes exerting pressure on the Government for pressing issues easier. It’s like adding pressure on one particular point rather than slightly stinging someone all over.

“If you have the emergence of a couple of strong players who are big enough then you can ask for a more well regulated, more transparently regulated business” said Chishti when probed about the prospect of having larger formal players in the sector.

Is there anything else that might be on the agenda for intercity bus companies other than a possible revival of the Pakistan Railways? The usual really, fuel costs, possible tariff breaks on bus imports, taxation etc. There is one that does stand out. At least for Faisal Movers.

General bus stands. These are bus stands that are operated directly by the government through district administration in accordance with Provincial Motor Vehicle Ordinance (1965) and Motor Vehicle Rules, 1969. They exist to serve all buses that seek to use them. Neither Faisal Movers nor Daewoo can viably use these because of their dilapidated states. However, that is not to say that they would completely be averse to using them.

General bus stands are on average larger than their private stand counterparts. They are also on-average in far more populous areas. This point alone makes it suitable to Faisal Movers’ model if not Daewoo’s. However, the problem with this is that, again, they are for all bus companies to use them and are operated by the Government. Any incentives provided at the Stand would be for all companies there, and there exists no way for them to be made non-excludable.

Legislation aimed at allowing exclusive use of just some parts of these stands, if not the outright sale of them, or legislation to improve their management to levels comparable to private stands would be beneficial to our aforementioned protagonists. The government would indeed have to take note if the Stands they have for multiple companies are just being used by two, right?

Conclusion

The rise of Faisal Movers has been phenomenal and well deserved. It has been a story of quiet pragmatism, savvy business moves, and a case of really understanding the true business fundamentals behind the industry. In response, Daewoo has been a gracious competitor and has welcomed the challenge, perhaps because in the long-run they may benefit from it.

All of that said, this is a business that has been built because of the decay of the railway system. If that were to ever factor in again, all of these companies would be under existential threat — a fact they are acutely aware of. Whether that eventuality ever happens or not is to be seen for another day. For now, they will slug it out amongst themselves.

Excellent Keep up the good work.

Good read

Regardless – both bus services are crappy in their own sense.

Faisal movers failed to encash the elite market by not even attempting to set up shop at Kalma chowk and Daewoo keeps running their crappy service from Kalma chowk due to the location advantage.

I’m truly impressed with your blog article, such extraordinary and valuable data you referenced here.

사설 카지노

j9korea.com