The long-anticipated financial statements of U Microfinance Banks (UBank) have finally emerged, albeit with a slight delay. After unveiling the half-yearly report on December 1, 2023, UBank quickly followed up with the financial statements for the nine months ending in September. The recently revealed statements have answered some questions about previous speculations that were making rounds. But on the whole, the statements have sparked intrigue across the financial realm.

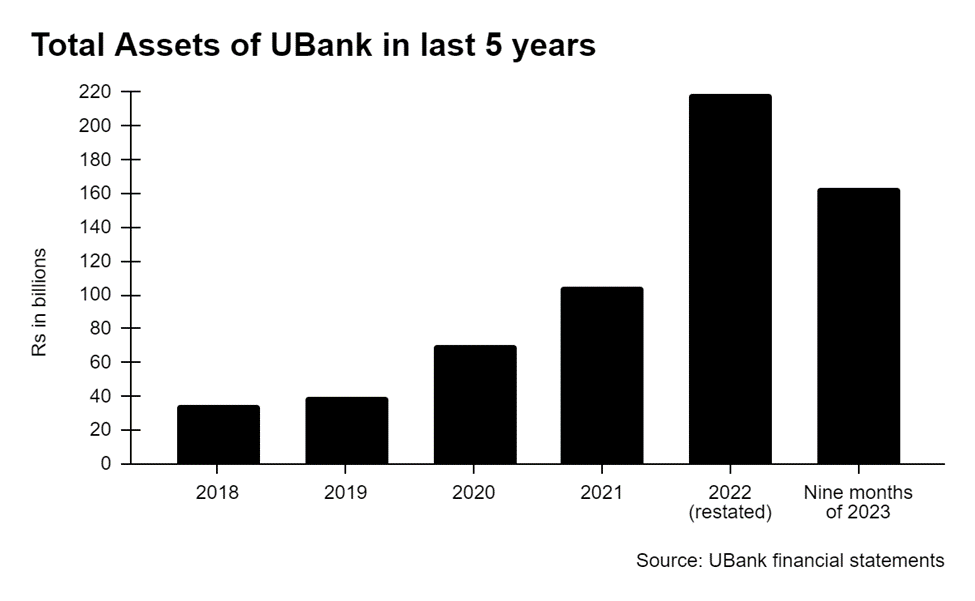

This is because the bank seems to have taken a sharp U-turn from its unconventional approach, labelled as overly aggressive, which led to an astonishing threefold growth in its balance sheet amidst industry turmoil in 2022. Instead, a noticeable change has emerged: the bank has witnessed a sharp decrease in investments in government securities and mutual funds on the asset side and a significant reduction in borrowing on the liabilities side.

More alarmingly, the equity of UBank declined from around Rs 7 billion to Rs 5 billion in these nine months. Is there a possibility that UBank, which was once touted as one of the biggest microfinance banks, might not remain the biggest microfinance bank if its balance sheet continues to shrink?

Profit examines Ubank’s financial statements to make sense of what has changed at the bank.

UBank’s growth strategy

First, to understand why the new statements are such a shock, let’s recap UBank’s previous aggressive strategy.

This approach was spearheaded by Kabeer Naqvi, the chief executive officer at UBank up until October 2023. In an earlier conversation with Profit, he said, “I am building relationships with banks. And over time, they will start lending to me against my advances rather than government-backed securities. One or two banks are already comfortable enough with us to start doing this.”

Read: Has UBank cracked the code to make a microfinance bank profitable?

What did he mean by this?

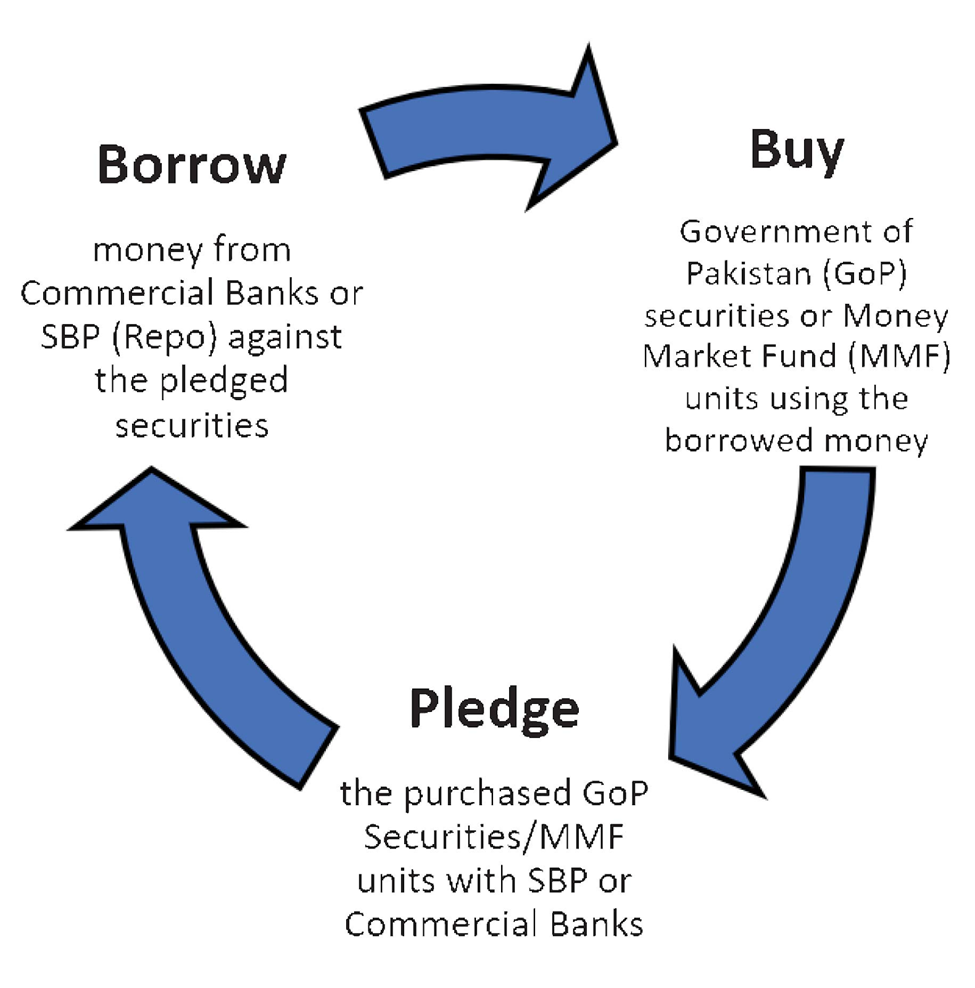

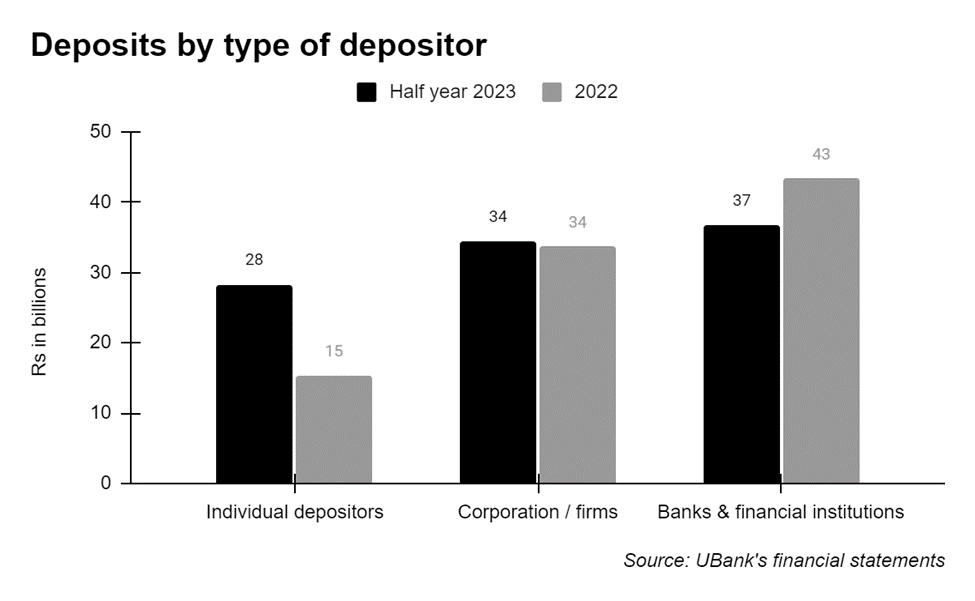

UBank essentially increased the size of its balance sheet using a quid pro quo arrangement. The financial statements of 2022 reveal that a major chunk of deposits was from banks and other financial institutions. These deposits were in a sort of give-and-take arrangement, where any funds received from a financial institution were funnelled right back into the same institution or its associated asset management company. Furthermore, these deposited funds were heavily concentrated, ranging from 25% to a staggering 77% of the fund’s assets.

Read: A sneak peek into the deposit growth of U Microfinance Bank

While UBank’s credit rating flagged this concentration risk, it did not acknowledge UBank as the primary investor in these funds. So what was happening?

Financial institutions such as Faysal Asset Management, NBP Funds, and Allied Bank Limited seemed to orchestrate a method to inflate their balance sheets and consequently UBank’s. This involved a complex process of depositing funds, purchasing securities, and pledging these securities back to the same banks or third-party entities, effectively allowing UBank to borrow more against these treasury bills (T-bills) and perpetuate the cycle.

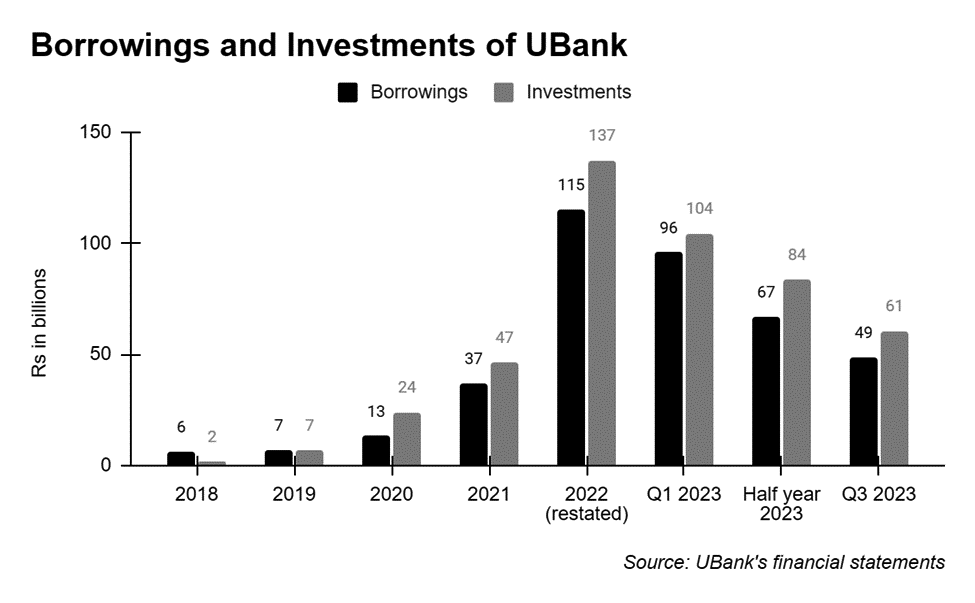

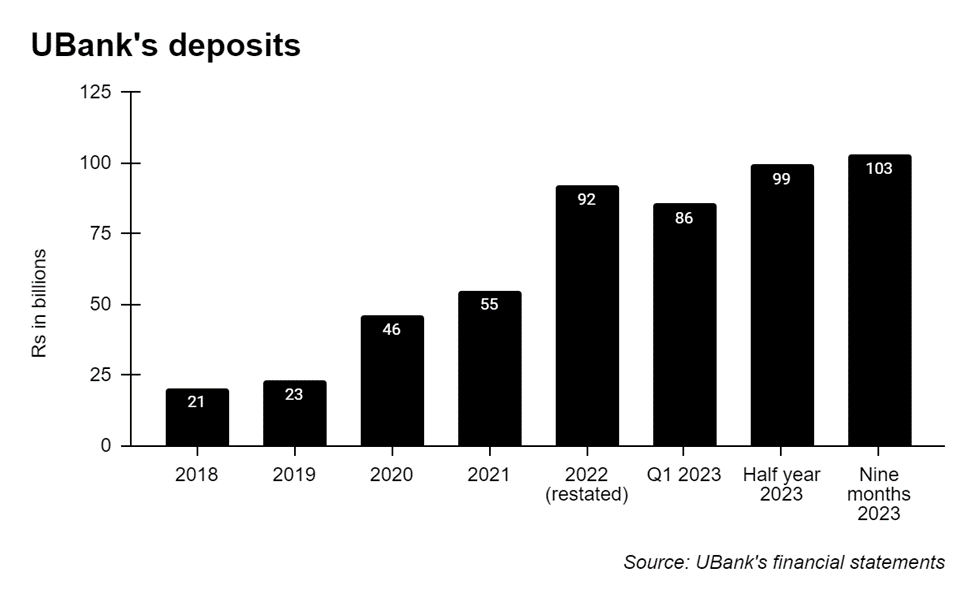

This cycle continued, spinning a web of financial manoeuvring that enabled the size of the balance sheet to grow by a factor of three. Investments increased to Rs 137 billion (Rs 13,733 crore) from Rs 46.5 billion. At the same time, UBank’s borrowings increased from 36.8 billion in 2021 to Rs 115 billion (restated). And deposits increased from Rs 55 billion to Rs 92 billion.

Naqvi clarified UBank’s investment approach, emphasising the utilisation of shorter-term instruments to capitalise on increasing interest rates. By borrowing at a fixed rate for a longer duration and investing in shorter-tenor instruments, they aimed to leverage interest rate fluctuations to their advantage.

UBank’s method, while aggressive and unique in the microfinance banking sector, aimed to mitigate advance book risks by borrowing heavily from banks and actively managing their necessary investments.

And even if the bank made some loss on treasury operations due to unforeseen economic circumstances, for example, the logic was that his board and shareholders should still be happy as he was successfully securing the bank against a liquidity crisis.

Sharp U-turn

A significant shift occurred in UBank’s strategy in the nine months of 2023. The bank seemingly reversed its highly leveraged approach, experiencing a substantial decline in both investments and borrowings, impacting its future profitability.

The sharp decline in both investments and borrowings is almost matched 1 to 1. Borrowings have decreased by 58% from Rs 115 billion to Rs 49 billion. Similarly, investments have decreased by 56% from Rs 137 billion to Rs 61 billion. This means that the growth engine ((leveraged investment portfolio) is being unwound at a fast pace.

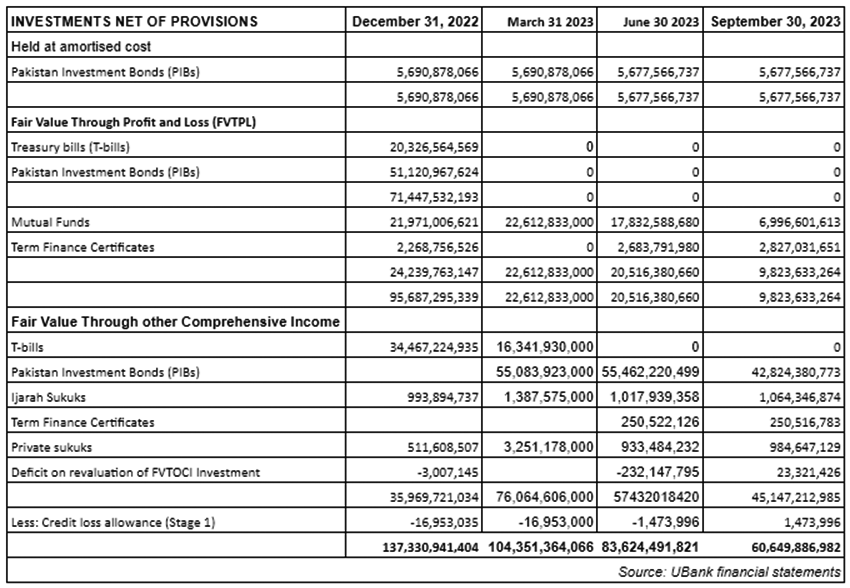

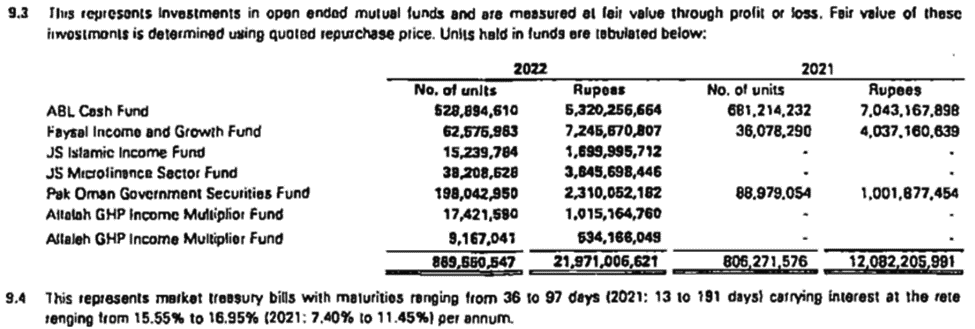

Notes in the financial statements reveal that UBank has sold off all T-bills valued at around Rs 55 billion at the end of December 2022 in its possession. Moreover, investments in mutual funds have also declined from around Rs 22 billion in December 2022, to around Rs 7 billion at the end of September 2023.

According to the annual report of 2022, UBank held mutual funds with Allied Bank Limited.

On the borrowing side, the biggest drop is in borrowings from MCB Bank Limited (MCB): from Rs30 billion in 2022 to zero at the end of June 2023. According to notes in financial statements, these borrowings were secured against mutual funds units and Pakistan investment bond (PIB) or T-bills to be kept in an investor portfolio securities account maintained with MCB.

Borrowings from Allied Bank Limited (ABL) have also declined by around Rs15 billion. This loan was again secured against ABL asset management units and PIBs or T-bills kept in IPS account managed with ABL. Both MCB and ABL are old banks that are considered to be more risk-averse.

Borrowings from Meezan Bank also witnessed a decline of around Rs3 billion, which were again secured against government securities.

Repo borrowing has declined by a whopping 85%, from approximately Rs 30 billion in 2022 to around Rs 4.5 billion at the end of September 2023.

Interestingly, while other banks were withdrawing their finances, JS Bank extended a term finance facility of around Rs 2 billion. When asked for comments, the bank responded that the finance facility from the bank is still intact but from the asset management company (AMC) side has been withdrawn. Interestingly, UBank had only borrowed funds from the bank – so what AMC funds is this source talking about?

According to the VIS credit report of March 31, 2023, UBank had a high concentration risk. The top five depositors are asset managers NBP Financial Sector Income Fund (NBP FSIF), Faysal Income and Growth Fund (Faysal IGF), JS Microfinance Fund (MICR), followed by the two banks Habib Bank Limited (HBL) and Faysal Bank. They comprise 38% of the Rs 92 billion deposit base, meaning that Rs 35 billion are deposited by these five financial institutions. That would translate into an average of Rs 7 billion per institution.

The VIS report highlighted that MICR is one of the biggest depositors of UBank. In other words, JS funds are the largest depositors of UBank, and UBank is the largest investor in JS Funds.

At least that was the case until March 2023. However, as per the source’s comments, the funds have been withdrawn from the AMC side which means that JS funds have (possibly) withdrawn their deposits. UBank’s investment in mutual funds has also decreased which could mean that UBank has also withdrawn its investments.

As per the September 2023 financial statement, the deposits have increased, but the report does not specifically mention which deposits have increased. However, the half-yearly reports of 2023 reveal a noteworthy shift in deposit trends. While deposits from banks and financial institutions still hold a significant part of the total deposits, individual deposits have surged impressively by approximately 87%, soaring from Rs 15 billion to Rs 28 billion. This surge has substantially increased the share of individual deposits within UBank’s portfolio, climbing from 16% to a substantial 28%. Meanwhile, deposits from banks and financial institutions have slightly dropped by around 14%, decreasing from Rs 43 billion to Rs 37 billion during the initial half of 2023.

Equity

What’s intriguing in these newly released financial statements is the restating of UBank’s year-end figures for the concluded year of 2022. The statements offer surprising insights.

The equity figure stood at Rs 5.3 billion at the end of June 2023, which increased to around Rs 5.8 billion at the end of September 2023. For context, microfinance banks are supposed to maintain a minimum capital of Rs 1 billion as mandated by the State Bank of Pakistan (SBP). The equity figure stands at five times the required amount, showcasing a significant surplus in comparison to the mandated threshold. Moreover, the bank reported an impressive Rs 1.7 billion in profit after tax in the first nine months of 2023.

The SBP had concerns regarding the treatment of rescheduled loans under the expected credit loss (ECL) model of the IFRS-9 and directed the Board of the Bank to take certain corrective measures including aligning the matters relating to the implementation of IFRS 9, and adjusting retrospectively the financial position as at December 31, 2022 and directing further that in case of shortfall in related statutory requirements, capital to be injected by the sponsors of the bank.

Consequently, the 2022 financials were restated, which resulted in net profit of 2022 of Rs 2.25 billion, turning into a loss of Rs 539 million. Adjustments were also made to the balance sheet. Moreover, the PTCL group injected Rs 1.6 billion into UBank post the balance sheet date, to meet the shortfall in statutory capital.

Read: UBank puts speculations to rest with healthy Rs5bn equity

Profitability

During the initial nine months of 2023, the bank managed to maintain its profitability, recording a profit after tax of Rs 1.7 billion. This achievement is noteworthy as it occurred despite a decrease in interest income derived from government securities. Simultaneously, there was a reduction in interest expenses linked to borrowings.

As per the deposit rate sheet of UBank, markup on deposits ranged between 5% and 24%, while earnings on markup ranged between 30% and 50% on the advance book. On average, this implies the bank maintains a spread of about 25%.

Despite the decrease in government securities during the first three quarters, the net markup income has consistently fallen within the range of Rs 1.6 billion to Rs 2 billion. This suggests that even if the bank were to reverse its growth strategy, it might not significantly impact its profitability. However, a substantial credit loss on the advance book could indeed have a considerable impact on the bank’s profitability.

The current situation

These statements paint a picture up until September 30, 2023. This possibly means that at this moment only the internal stakeholders were aware of the microfinance bank’s issues.

The speculations about the microfinance bank’s financial health began in October when the leadership of the bank suddenly changed. On October 18, it was announced that Kabeer Naqvi, CEO of UBank had resigned. The next day on October 19, according to a press release by the bank, Mohamed Essa Al Taheri was announced as the acting President and CEO of UBank.

This sudden change in leadership led to viral online conjectures about the financial stability of both UBank and UPaisa, with claims of their capital reserves teetering into the negative. Social media rumours exacerbated the situation, prompting depositors to withdraw their funds.

Consequently, in a press release issued on October 23, the PTCL Group vehemently dismissed all allegations and speculations surrounding the financial well-being of its wholly-owned subsidiary, UBank. The leading ICT services provider in Pakistan reiterated that UBank possessed a resilient capital base and that PTCL group would support UBank in meeting any future growth requirements – which it did, as stated in the recent financial statements.

Future outlook

This means that any loss or major change that led to a leadership shuffle and capital injection would be reflected in the audited yearly financial statements. There is a possibility that UBank, which was once touted as one of the biggest microfinance banks, might not remain the biggest microfinance bank as its size of balance sheet continues to shrink, as evidenced by the equity of UBank that has declined from around Rs 7 billion to Rs 5 billion in these nine months.

There’s a looming possibility that UBank’s deposits, especially the ones from banks and financial institutions, could decrease significantly. At the same time, there is also a possibility that by year-end, PTCL Group will restore confidence in UBank, and any deposits that left the bank might return.

For now, the future of UBank remains shrouded in mystery. The position will become clearer as the institution releases its yearly report. Thus we will have to wait till next year, when the year-end 2023 audited accounts of UBank are published, to see what happened.