The State Bank of Pakistan (SBP) has been in the firing line over the past two years due to its lagging monetary policy stance. This has resulted in record levels of inflation and a consistent erosion of purchasing power, particularly for individuals who rely on fixed income sources such as the salaried class.

The elevated price levels have necessitated the central bank to raise the policy rate to an unprecedented level, which currently stands at 22%. It is, however, believed by experts that the policy rate has finally peaked.

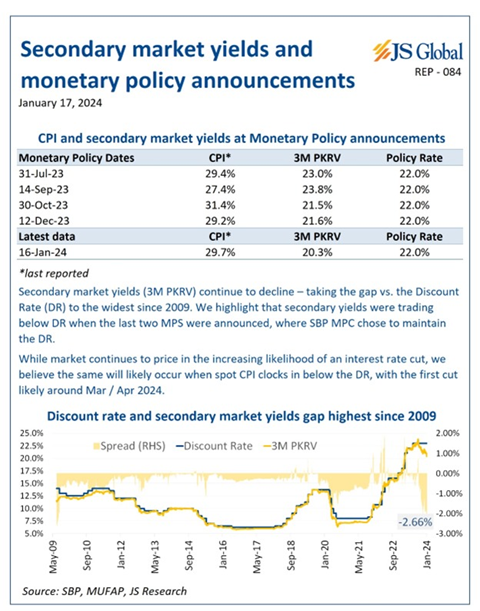

Contributing to this sentiment is the movement in the secondary markets, where yields are on a downward trajectory.

According to an analysis by JS Global, the difference between the policy rate and the secondary market yield is currently at its highest since 2009. The secondary market has already started to factor in the possibility of a rate cut in the near future. As stated in a report titled ‘PSX: The ‘hundred thousand’ question’ by JS Global, yields across various tenors have reduced by 1% since September 2023.

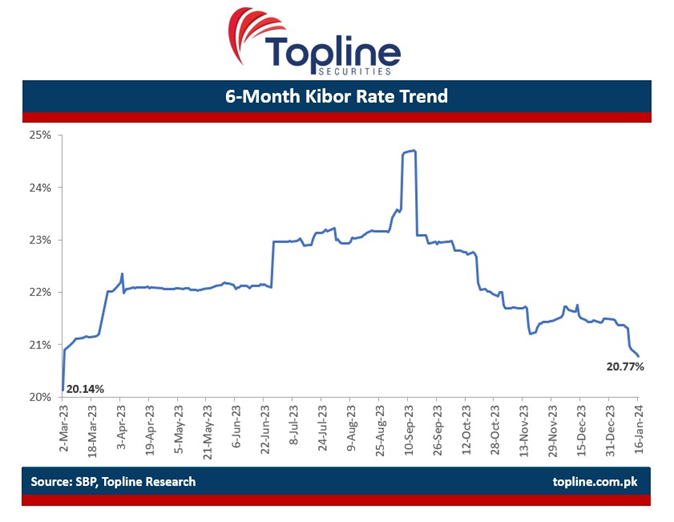

Likewise, the interbank lending rates have also declined. “Interest rates in Pakistan have already dropped by around 4%. The lending benchmark interest rates (6-Month KIBOR) have decreased from their recent peak of 24.7% on September 13, 2023, to 20.8% on January 16, 2024,” tweeted Topline Securities, a Karachi-based brokerage house.

There has been a lot of noise surrounding the potential for upcoming policy rate cuts in light of recent developments. According to Bloomberg, the SBP is expected to begin lowering its policy rate from March 2024 as inflation gradually subsides. Bloomberg has forecasted a cumulative reduction of 7% by the end of 2024.

However, the implementation of rate cuts is contingent upon the ability to control inflation levels, which in turn depends on various factors such as stability in commodity prices, regional security and trade outlook, maintaining fiscal stability and monetary discipline.

So, the question remains: Are we ready to raise a green flag, or is it still too early?

Rate outlook

Analysts anticipate that SBP is likely to maintain the status quo in the upcoming monetary policy meeting at the end of January. However, a rate cut near the end of the first quarter of the calendar year is the prevailing sentiment. “Though SBP has maintained the policy rate at 22% since July 2023, there is a high probability that rates will go down in the coming months,” tweeted Topline Securities.

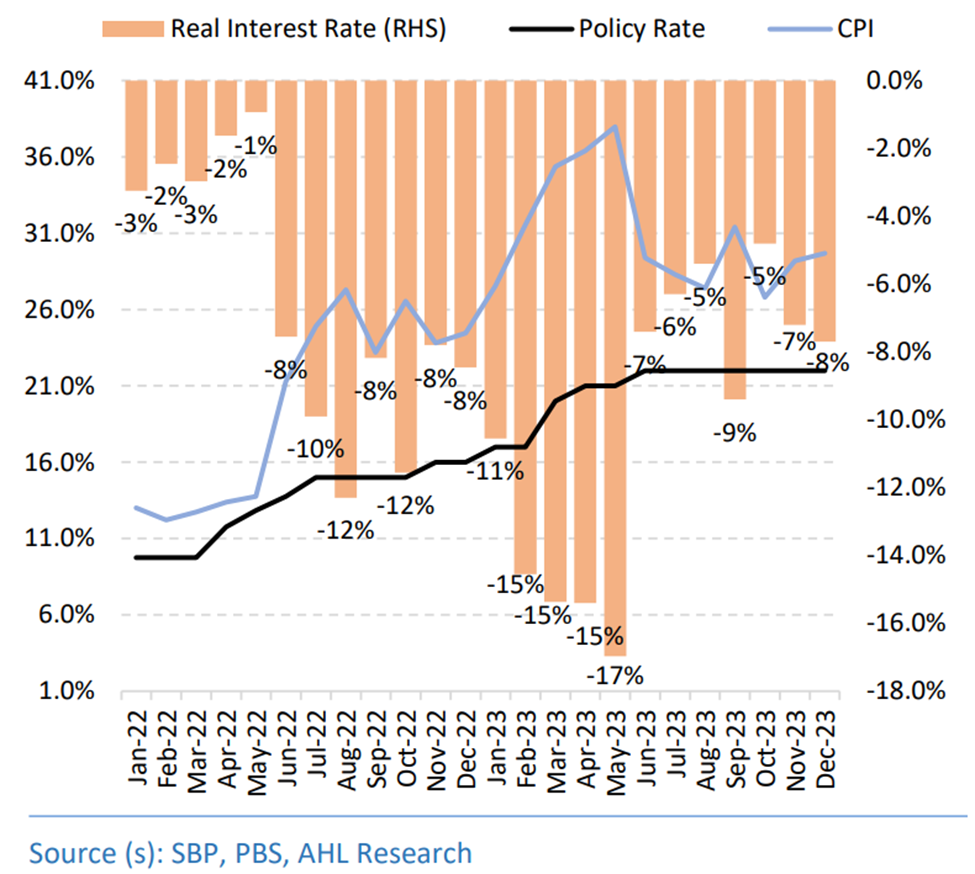

The rationale behind the expected monetary easing stems from the anticipated disinflation trend projections. As explained in JS Global Capital’s report, “PSX: The hundred thousand question”, with recent inflation trends displaying relatively lower growth rates (excluding the impact of gas prices in November 2023) and the impending high base effect, it is anticipated that the first rate cut will occur once the country’s real effective interest rates enter the green zone on a spot basis, which is projected by March 2024.

Inflation outlook

While the analysts predict disinflation, the optimism surrounding the policy rate cut is tempered by concerns about potential exogenous shocks. “Even though rates should start to decline from March onwards, calling a 7% rate cut is premature because Pakistan’s macroeconomic stability is vulnerable to factors that are not in our control like commodity prices and IMF targets. These variables could create problems on the external account and push the inflation outlook higher than expected,” commented Mustafa Pasha, chief investment officer at Lakson Investments.

Pasha also warned that the inflation rate may not decline smoothly, as there are geopolitical risks and IMF conditions to consider. “As far as inflation rates are concerned a gradual decline should occur but we also need to consider the geopolitical situation. Potential shocks in commodity prices pose risks to Pakistan’s inflation outlook. Moreover, as Pakistan will have to negotiate a new IMF Program, further increases in taxes, gas and electricity prices cannot be ruled out which could push the inflation higher than expected”, added Pasha.

The fallout of irresponsible power sector planning is likely to have a significant impact on the price levels in the coming months.

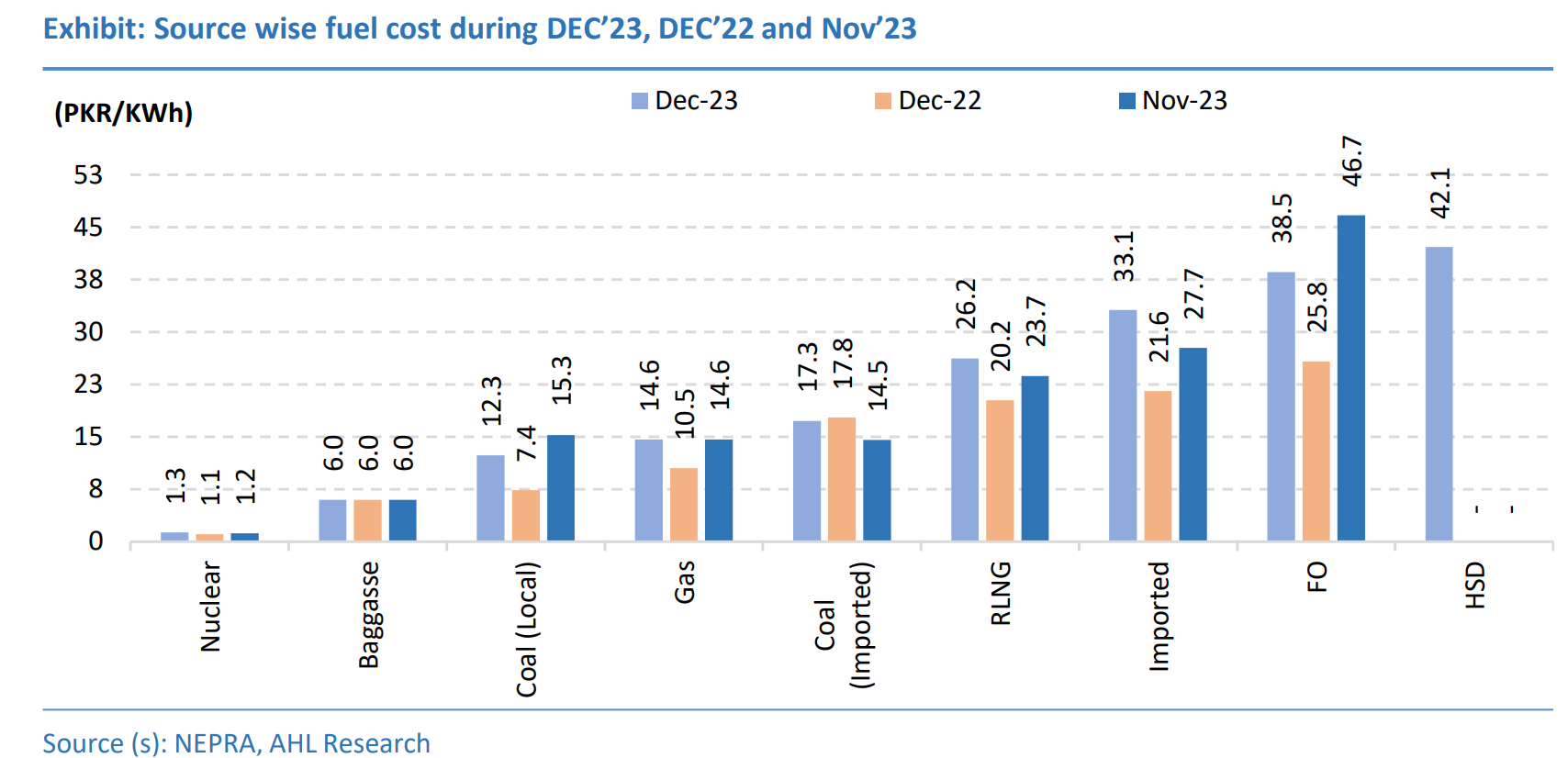

“The cost of power generation arrived at PKR 10.13/KWh during Dec’23 while including transmission losses and previous adjustments, the fuel cost grew to PKR 11.02/KWh. As a result of this, there is a projected rise of PKR 5.62/KWh in fuel charge adjustment which will be charged from customers with the Feb’23 bills,” read an analysis report by Arif Habib Limited (ARHL).

The World Bank’s 2023 Commodity Market Outlook has also highlighted the potential threat posed by geopolitical risks, particularly to the oil market. The report emphasized that the ongoing escalation in the Middle East has raised geopolitical risks for commodity markets, as this region represents a significant portion of the world’s seaborne oil trade. According to the report, Brent prices have been experiencing instability due to the potential impact of the conflict on supply and concerns about global economic growth slowing down.

If regional conflicts remain under control, the current trends in commodities indicate a positive outlook. Average oil prices have declined from $94/bbl in September 2023 to $78/bbl in December 2023. This decrease can be attributed to weak global economic activity, increased output from the United States, and consistent production and exports from Russia. The World Bank projects that oil prices will further decline to $81/bbl in 2024 and gradually moderate to $83/bbl in 2025.

Sufficient grounds for a rate cut?

The aggressive monetary stance of the SBP has been influenced, at least in part, by the conditions set by the International Monetary Fund (IMF). These conditions require the implementation of an appropriately tight monetary policy, aimed at curbing the price riding levels.

Following the approval of the first review of the stand-by arrangement on 11 January 2023, the Fund expressed concerns about Pakistan’s economic situation, highlighting that average consumer price index (CPI)-based inflation of 24% is anticipated in the fiscal year 2023-24.

However, the IMF also expected a decreasing trend in inflation going forward, projecting it to reach 18.5% by the end of June 2024. The Fund emphasized the importance for Pakistan to maintain a strict monetary policy and adhere to a market-based exchange rate in order to effectively manage these pressures.

Additionally, the private sector has consistently exerted pressure to lower the policy rate, as the high interest rates of the past 18 months have restricted their access to credit markets. According to data from the State Bank of Pakistan, the advances-to-deposits ratio, which measures lending to the private sector, decreased to 44% in December 2023 from 53% in December 2022. Meanwhile, the investment-to-deposit ratio, which measures investment in government securities, increased to 91% in December 2023.

Furthermore, a significant portion of domestic debt held by the government is at a floating rate. Therefore, maintaining a high policy rate also contributes to a higher fiscal deficit and creates a cycle of acquiring more debt to meet servicing obligations.

As previously explained and also highlighted by the IMF, a decrease in the inflation rate is the prerequisite for reducing the policy rate.

The powers that be acknowledge this fact, and recent news flow indicates that the Special Investment Facilitation Council (SIFC) has intervened to mediate in a disagreement between the Pakistan Bureau of Statistics and the Ministry of Energy regarding the calculation of gas price hikes.

Experts have observed that energy prices have a considerable impact on inflation rates, and any alterations in the accounting methodology can potentially manipulate the final inflation figure.

It is worth noting that in the last monetary policy meeting, the SBP maintained status quo citing that the decision took into consideration the impact of the surge in gas prices in November 2023, which exceeded the MPC’s initial projections for inflation.

While there is a sense of urgency to lower rates, it is important to consider the potential repercussions that may arise from an abrupt policy change.

“Pakistan’s 2023-24 budget aims for a primary surplus of 0.4% of GDP (as per the IMF’s conditions to achieve fiscal consolidation and ensure budget stability), but rising interest payments are likely to result in a deficit. The government has imposed more tax measures, decreased spending, and lifted import restrictions, but the budget deficit is anticipated to remain significant,” remarked Nida Gulzar Siddiqui, economist at KTrade Securities Limited.

“The government intends to streamline taxation for small businesses. Furthermore, market forecasts indicate the possibility of an interest rate cut of 700bps (7%) in 2024. This development would likely incentivize the private sector to increase its borrowing and capital provision, thereby fostering expansions and ultimately stimulating economic activity. In its entirety, this interest rate reduction will alleviate the government’s debt obligations,” she added.

Balancing between the monetary stance and fiscal objectives remains imperative for an economic recovery. As per senior economist, Ahmed Jamal Pirzada, “The current stability hinges critically on containing current account deficits and continues securing rollovers to meet exorbitantly high external debt servicing burden. Any change in monetary policy stance must consider these facts.”

“A premature decrease in the policy rate can once again increase the current account deficit which the country cannot finance given its precarious financial condition. This will result in the exchange rate coming under pressure and higher inflation persisting for even longer. The current monetary policy stance is reasonable. However, the fiscal authorities must use this space to restore external debt sustainability. Only then the monetary policy stance should return to business as usual,” he emphasized.

The projections are based on multiple variables, and it is essential to acknowledge that any significant changes in domestic or international circumstances can potentially disrupt these projections. An example of this can be seen in Iran’s recent misadventure in Balochistan, which highlights the importance of stability in both security and political fronts for Islamabad’s economic revival plan.