In the midst of economic challenges, Shezan International Limited, a prominent player in Pakistan’s food and beverage sector, released their quarterly report ending in September 2023. The company appears to be navigating through a transformative phase, as it has seen an upward trajectory in its sales. However, it has been facing challenges in maintaining a robust net profit due to a notable increase in indirect costs, particularly finance costs. Why is that the case? Profit finds out.

First, some quick history: established in 1964 as a joint venture between the Shahnawaz Group in Pakistan and the Alliance Industrial Development Corporation in the United States, Shezan International Limited has evolved into a recognized food brand celebrated for its quality. Headquartered in Lahore, Pakistan, and belonging to the Shahnawaz Group, Shezan stands as a prominent figure in the country’s food and beverage sector, publicly traded on the Pakistan Stock Exchange.

The company is renowned for its flagship product, the ‘Shezan Mango’ juice, which is an impulse buy at schools, canteens, and markets. Shezan expanded operations in 1981 with a unit in Karachi, established a bottle filling plant in 1983, and opened an independent Tetra Brik plant in 1987. In 1990, the company inaugurated a juice factory in Hattar, Khyber Pakhtunkhwa, reinforcing its commitment to meeting both domestic and international market demands.

Shezan then diversified its product range to include soft drinks, juices, ketchups, and jams. Notably, Shezan holds the distinction of being Pakistan’s largest mango grower, with an impactful workforce of around 1,000 individuals.

The annual figures

As outlined in its annual report for the year 2023, Shezan has faced economic downturns, regulatory changes such as the imposition of excise duty, and inflationary trends.

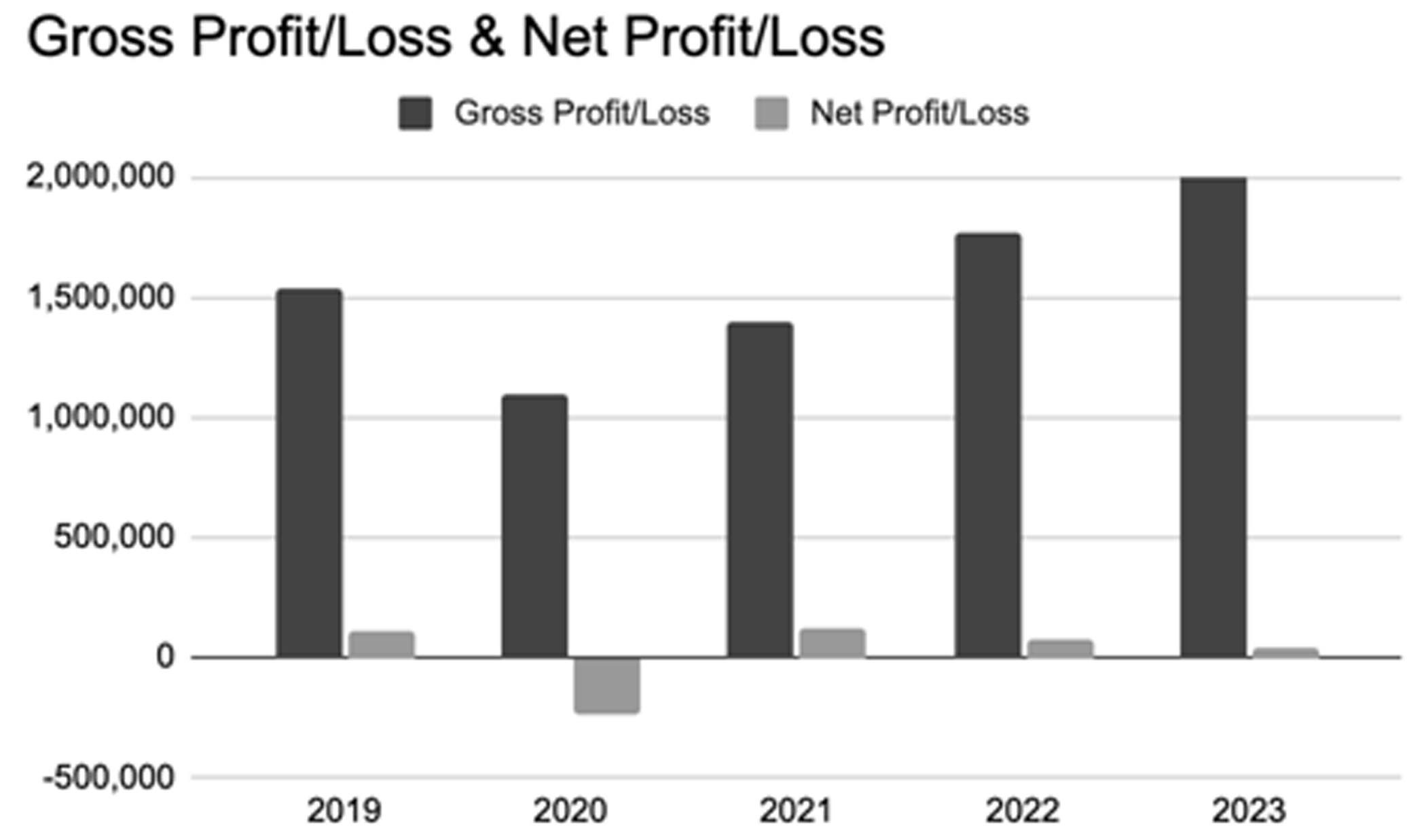

The annual sales trajectory reflects a positive trend, standing at Rs 7.7 billion in 2019 with a slight dip to Rs 6.6 billion in 2021, and then rising to Rs 8.7 billion in 2023. Notably, the gross profit increased from Rs 1.5 billion in 2019 to Rs 2 billion in 2023.

The gross profit margin has improved over the years, from 19.9% in 2019 to 23.8% in 2023. The operating profit doubled from Rs 220 million to Rs 450 million during the same period, demonstrating improved control over administrative and sales costs, leading to an increased operating profit margin from 2.86% to 5.16%.

However, the concerning aspect arises from the net profit. The company saw a profit of Rs 113 million in 2019, but then experienced a significant downturn in 2020, resulting in a loss of Rs 235 million. While recovery was witnessed in 2021 and 2022 with Rs 123 million and Rs 80 million respectively, there still seems to be a low net profit of Rs 38 million in 2023.

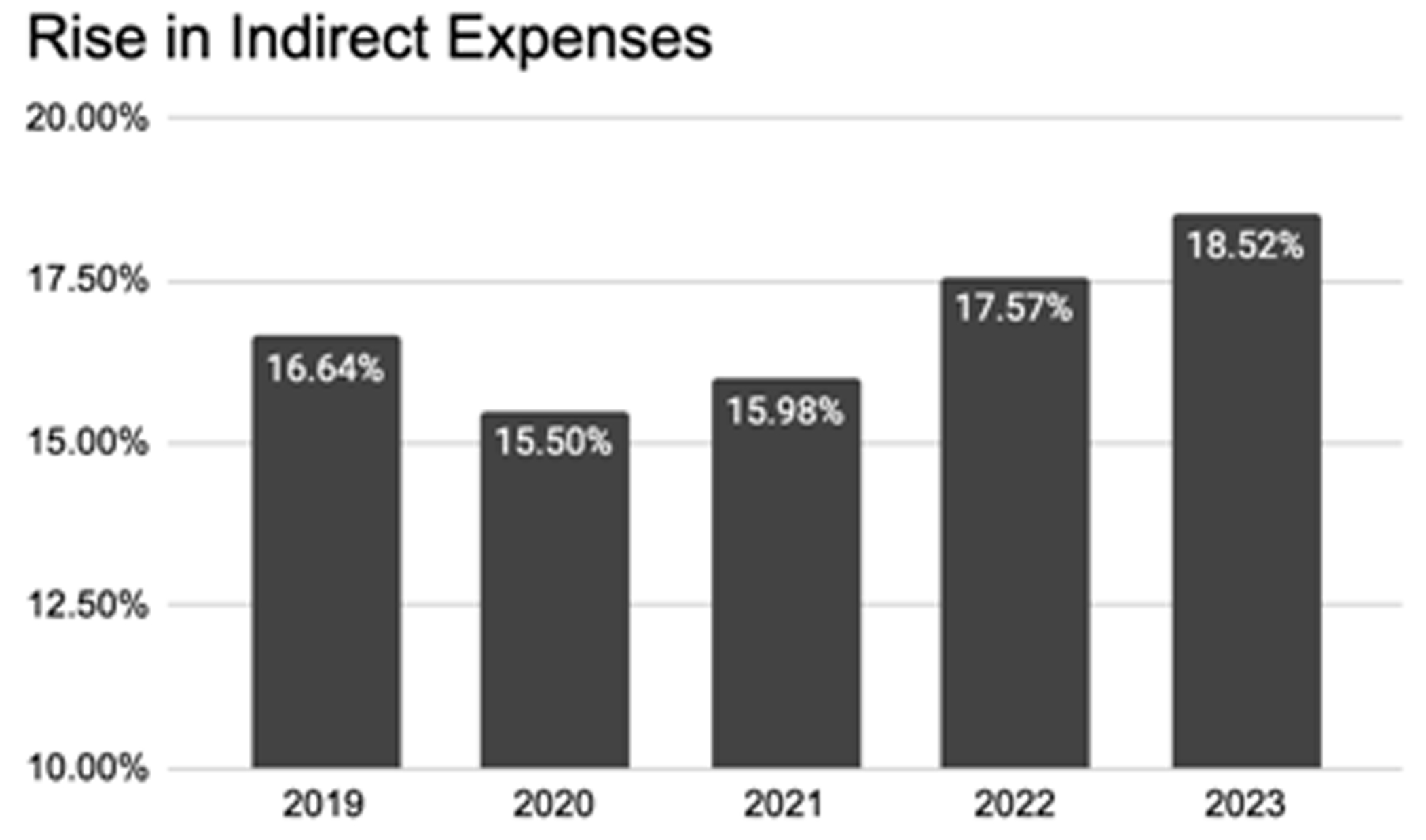

The finance cost continues to be a pressing issue, with costs increasing every year from Rs 68 million in 2019 to Rs 280 million by 2023. The net profit margin dwindled from 1.5% in 2019 to 0.4% in 2023, which indicates the adverse impact of rising finance costs on overall profitability.

In order to address the challenge of increasing finance costs and ensure sustained profitability, Shezan needs to control indirect costs, which is the total of administration costs and the distribution expenses, particularly those that cannot be recovered from sales.

According to the director’s report, the fiscal year 2023 was a challenging one which contributed to the low net profit and sales. “Pakistan faced import restrictions, rupee devaluation, higher financing costs, expensive energy, and domestic economic and political instability contributed to this downturn. The imposition of a 10% Federal Excise Duty on sugary fruit juices, later increased to 20%, raised concerns about its impact on consumer purchasing power and the potential shutdown of juice manufacturing companies. The finance cost of the working capital component surged due to an 825 basis point upward revision in policy rates, reaching a cumulative 2200 basis points.”

Not only that, the nationa’s average inflation rate hit 30%, which affects consumer buying power. Various factors, including market slowness, increased prices of key raw materials, high payroll expenses, flooding, and rising costs of fuel and utilities, negatively impacted profitability.

To mitigate the impact of this, the company was forced to enforce price rationalization – which means the rationalization of business costs, as the reduction in artificially inflated prices leads to lower input costs for the business – negatively affecting sales volumes

Quarterly sales

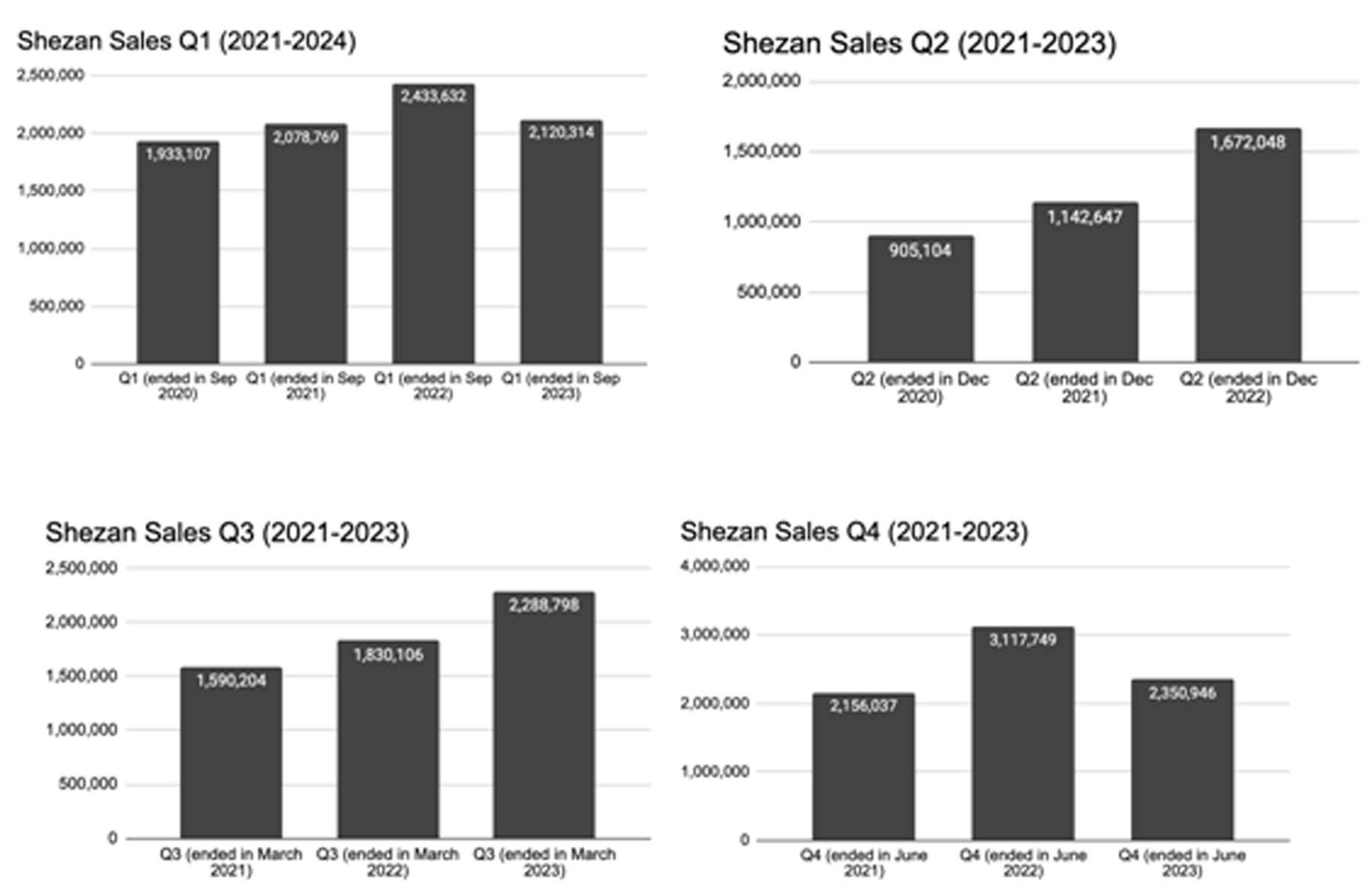

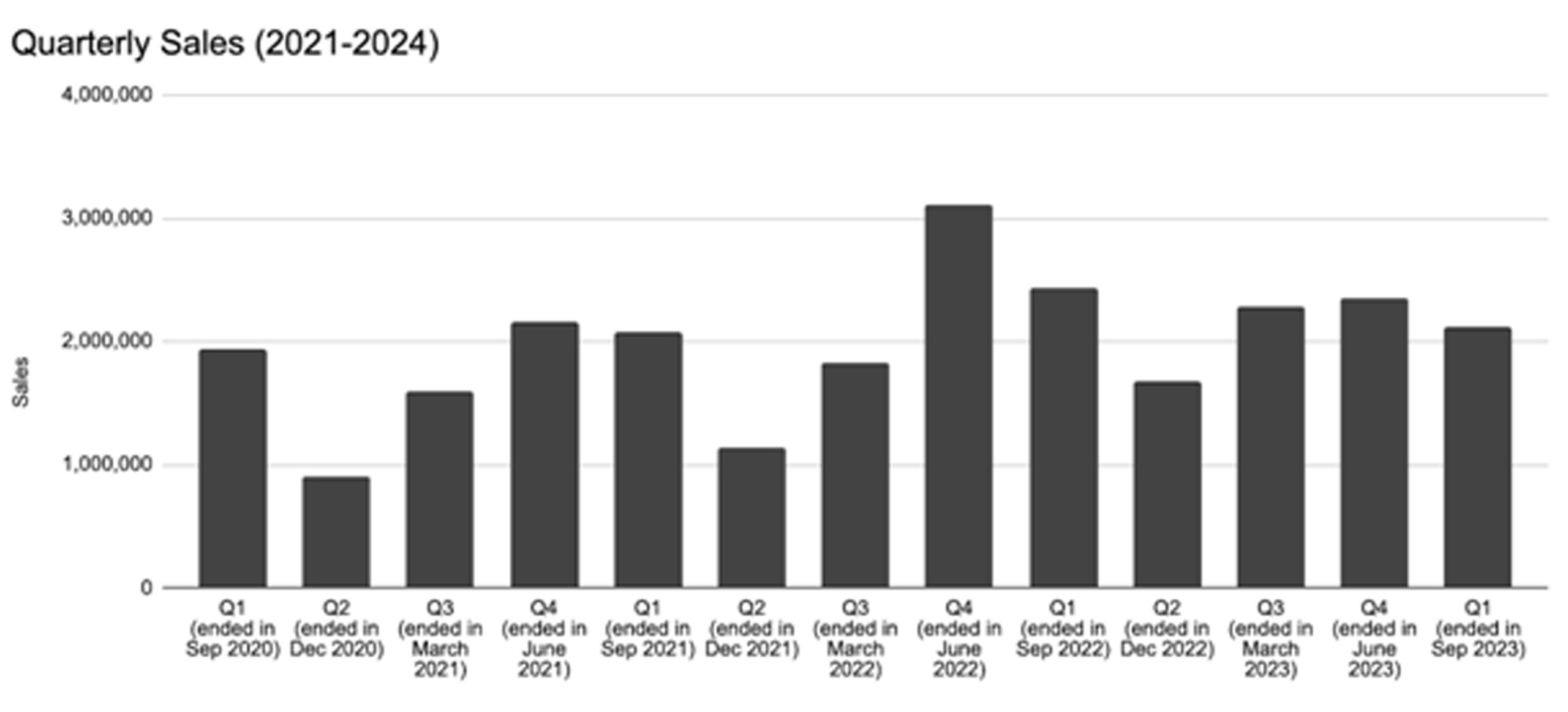

Between 2021 to 2023, Shezan International Limited experienced a notable decrease in sales during the second quarters, ending in December. This pattern is attributed to the winter season when their popular selling products, such as bottled juices and tetrapaks, witness a decline in consumer demand as people tend to purchase these items less frequently in colder weather.

Conversely, during the quarters ending in March, June, and to some extent in September, there is an observable upward trend in sales. This uptick can be attributed to more favorable weather conditions, which tend to stimulate demand for Shezan’s products, showcasing a correlation between seasonal variations and consumer purchasing patterns.

This further reveals the cyclical nature of Shezan’s sales, with the fourth quarter of 2022 (ending June 2022) boasting the highest sales at Rs 3.1 billion, and the second quarter of 2021 (ending December 2020) recording the lowest at Rs 905 million.

The most recent quarter ending in September 2023 saw sales of Rs 2.1 billion, indicating a consistent pattern of sales increase in the third and fourth quarter, followed by a decline in the first quarter and the lowest point in the second quarter.

The company had the lowest gross profit in the second quarter of 2021 of around Rs 161 million, and the highest in the last quarter of 2022 in June with Rs 674 million. Still, the company made an overall loss in these quarters, because of an increase in indirect expenses. The losses were Rs 45 million in 2021 and Rs 1 million in 2022.

Similarly in the recent quarterly report, the company made an overall loss of around Rs 28 million due to a decrease in sales of Rs 2.1 billion, as compared to the previous quarter of Rs 2.4 billion.

In order to maintain a noticeable net profit, the company needs to maintain a gross profit margin of about 24% or above, and decrease indirect expenses.

The company in their report has also expressed a keen interest in expanding its presence in the global market, with a specific emphasis on export growth. The company’s products, including juices, are identified as having growth potential in countries such as the United Arab Emirates, United Kingdom, Saudi Arabia, and the United States of America.

As Shezan strives to secure a stable financial footing amid economic downturns and regulatory changes, the road ahead demands strategic decisions. While the company has witnessed positive trends in annual sales and profitability, the impact of rising finance costs poses a significant challenge. The cyclicality of Shezan’s sales, influenced by seasonal variations, emphasizes the need for adaptive strategies.

Thanks for sharing this amazing and informative post. keep sharing with us.

No.

The Article is excellent and spot on. much appreciated.

The unprecedented imposition of 20 percent FED has been proved the last nail in the coffin.

This was an anti juice business step by the Government. Strongly condemned and should be reversed. As due to increase of juice prices, a quality juice has gone out of reach of kids and a common men.

Shezan is one of the pride of Pakistan.