It’s finally happening. For years there has been a constant struggle for the privatisation of Pakistan International Airlines. Three successive governments over the past decade have introduced plans to privatise PIA, they have claimed they were committed to the process, and everytime the plans have fallen through either to politicisation, bureaucratic red taping, or governmental hubris.

The process has never gotten this far. Now that it has, the fate of every single Pakistani airline hangs finely in the balance.

Last month, at least eight bidders submitted qualification statements to express their interest in acquiring the airline from the government. This month, two of those initial bids were rejected. No single known company or individual stands out because all eight bids were placed by newly formed consortiums.

At least four different Pakistani airlines including Fly Jinnah, AirSial, Serene Air, and Air Blue were all part of these eight consortiums. For the airlines this is a matter of survival. PIA currently has the largest fleet and the largest domestic and international network in Pakistan. The national flag carrier is the market leader in Pakistan’s airline industry, and control of it means having a significant advantage over other airlines.

One of two things could happen. The first is that a conglomerate with an airline involved could take over and automatically become the market leader. The other option would be a conglomerate without any airline involvement to take over and a new entity is born and PIA’s position stays the same. In either case, the changes will shake up Pakistani aviation.

Who are the challengers vying for PIA? Members of these consortiums include four different airlines, power producers, chemical manufacturers, and real estate developers. And as the process goes on, many of those involved in these multiple consortiums may well drop out and the composition of these consortiums could also change along the way.

The only question is, who are the people behind these consortiums wanting to buy PIA, and just how uphill is the task that faces them if they get what they want.

The bidders

In the initial qualification statements, eight different consortiums stepped up to the plate.

The leaders of these eight consortiums are Fly Jinnah, Air Blue, Arif Habib, Gerry’s International, Sardar Ashraf D Baluch Builders, Gerry’s International, YB Holdings, Pak Ethanol, and Blue World City. Of these eight, through the initial vetting process, Sardar Ashraf D Baluch Builders and Gerry’s International have been disqualified from the bidding process for different reasons. Of the remaining ones, the consortium led by Fly Jinnah, Pak Ethanol, and YB Holdings are the top runners, but Air Blue, Blue World City, and Arif Habib are still very much in the running.

What you have here for all intents and purposes is a battle between different Pakistani airlines vying to get control of PIA, with some secondary players in the background also throwing their hat in the ring. On the one hand you have Fly Jinnah, which has

Fly Jinnah-Air Arabia Consortium

This is the powerhouse contender in the bidding for PIA. The party taking the lead is Fly Jinnah, which embarked on its maiden flight in Pakistan in October 2022 when a red-emblazoned plane carried passengers from Karachi to Islamabad at a bargain ticket price of Rs 13,999. Fly Jinnah entered Pakistan’s market at a time when the aviation industry was struggling. They presented themselves as a low-cost carrier that allows you to pick and choose whether you want meals on flights and just how expensive your ticket is going to be. Over time, Fly Jinnah’s position as a low-cost carrier has come into question, but the new airline has fast been making inroads.

And why would it not? They have some powerful backers. In Pakistan, Fly Jinnah was the brainchild of the Lakson Group, one of the largest and oldest conglomerates in Pakistan. Founded in 1954 by the Lakhani family, the group first made its money in the tobacco business before selling it to Phillip Morris, which runs the business to date. The company is also the owner of McDonalds in Pakistan and also has interests in FMCG in the shape of Colgate-Palmolive, as well as in tech in the form of companies such as Stormfiber. They are also in the media business, running and operating the Express Group which has a news channel, an entertainment channel, as well as an Urdu and an English daily to boot.

The other partner in this partnership is Air Arabia, the UAE based low-cost airline. During the pandemic, Air Arabia was lobbying heavily with the UAE government to be allowed additional international flights to Pakistan but failed to do so. So what did they do instead? They decided to enter an alliance with the Lakson Group to form Fly Jinnah. And the response from within Pakistan’s aviation industry was not particularly welcoming. In fact, it was PIA that was most up in arms.

So much so that the then Chief Executive of PIA, Air Marshal (R) Arshad Malik, penned a missive to the government, imploring them to prohibit Fly Jinnah from taking flight. The letter contended that green-lighting Fly Jinnah would enable Air Arabia to monopolise the local market and circumvent the country’s aviation policy, under which Air Arabia was barred from further rights to operate in Pakistan. Moreover, the letter revealed that Serene Air and Airsial had approached PIA to address the issue as well. The matter was also a topic of heated debate in the Senate’s Standing Committee on Aviation.

The fear amongst these airlines is that Fly Jinnah would serve as a conduit for Air Arabia, who would then whisk them off to other destinations. And the fear might be able to materialise. In 2023, after completing one year of domestic flights, Fly Jinnah can now operate internationally as well and launched their first flight to Sharjah in February this year.

Now, it seems Air Arabia is in the mood for complete dominance. You see, the consortium bidding for PIA is between Fly Jinnah and Air Arabia. This gives Air Arabia a lot of control since they already have a 45% stake in Fly Jinnah and completely own their UAE airline. Ownership of PIA will give them access to a lot more international flights and routes that they can coordinate with Air Arabia and Fly Jinnah.

The privatisation of PIA, which was their harshest critic when they first showed up on the scene, offers them the chance to completely take over. But they aren’t alone in this desire. In fact, they aren’t even the only new airline in Pakistan vying for PIA, and the toughest competition may come from AirSial and Serene Air.

Pak Ethanol-Air Sial-Serene Air-Liberty Daharki Power Consortium

When Fly Jinnah burst onto the scene in 2022, they began an aggressive attempt to undercut its competitors, with prices dipping to a staggering 3% to 26% of what others demanded. This strategy didn’t work for long, because their competitors were not slow to get into a pricing war. And over time, Fly Jinnah is no longer the cheapest choice.

Two of the main competitors Fly Jinnah was taking on were AirSial and Serene Air. Before Fly Jinnah, these two were the new kids on the block. Serene Air was launched in 2016 while AirSial took off in 2020. Out of the two, AirSial has been an impressive enterprise. An endeavour of the Sialkot business community, specifically the roughly 400 family-owned businesses that form the core of the Sialkot Chamber of Commerce and Industry (SCCI). It is a story of enterprising business families banding together and building an airport to keep their city connected domestically and internationally.

These two airlines are now part of a consortium that is bidding for the ownership of PIA. This will be very important in particular for AirSial. By January 2024, Fly Jinnah had succeeded in completely ousting PIA and AirSial from domestic routes. With the launch of their international flights, AirSial needs a boost.

Interestingly enough, the leader of this consortium is neither of the two airlines. The consortium’s lead is Pak-Ethanol, which is a major producer of ethanol in the country. The company was incorporated in 2010 and is one of Pakistan’s largest ethanol producers and are also exporters. Another part of the consortium, as reported in the media, is Liberty Daharki Power Plant, which is owned by the Mukathay family.

An earlier report in The News International also claimed that the consortium’s international contingent includes Swiss Aviation Group AG from Switzerland, Airport Competence from Austria, Pearl Asset Management PTY Limited from Australia, and Capital A Consultancy (Air Asia Aviation Group) from Malaysia, as outlined in a press statement released by Pak Ethanol.

Another reported investor is AsiaPak Investments. This is a company that has been in the headlines recently. Owned by Sheharyar Chishty, who also owns Daewoo buses in Pakistan, recently led AsiaPak in its purchase of K-Electric in the Cayman Islands, which the group is now trying to get management control of . All in all, while this consortium is not a pure aviation led, it is a very strong contender.

Younus Brother Holdings (Private) Limited-Pioneer Cement Limited Consortium

This is the third major contender that has a good shot but they don’t have any aviation experience in their wings. This is also the second major conglomerate interested in buying PIA. The first, as we discussed earlier, was the Lakson Group through Fly Jinnah. YBH has been around since 1962 when the foundation of a trading house was laid. The establishment of the fabric trading business house, which turned into one of the largest business groups of Pakistan in a period spanning five decades.

Among its subsidiaries, the group counts Lucky Cement.

They have partnered with another cement company, Pioneer Cement, which was incorporated in 1986 and has a Paid up Capital of 227.1 million shares of Rs. 10/= each. Artistic Milliners Limited, a textile company, ANS Capital Private Limited, an investment firm, and Metro Ventures Private Limited, a real estate company are also involved in the consortium. While the group does not have any aviation experience, they will have some financial heft.

Other consortiums

The Privatisation Commission also pre-qualified Airblue Limited; a Pakistani low-cost airline, Arif Habib Corporation Limited; a leading financial services firm, and Blue World City; a real estate developer, with its consortium including Blue World Aviation and IRIS Communication Limited.

Out of these three, Blue World’s bid is quite interesting. Blue World City rose to fame as a mega project in Chakri on the outskirts of Islamabad. Owned by Chaudhry Saad Nazir, it was launched as one of many contenders in the Chakri area. Since 2018, however, it has started appearing as a big name. Having presumably collected a decent amount from initial sales of files, they went on a massive marketing campaign that used classic real estate techniques. They even roped in Engin Altan, the Turkish actor that plays the lead role in the Ertugrul Resurrection drama series that has become a phenomenon in Pakistan, to be their brand ambassador.

Since those early high flying days when Blue City became one of the hottest names in the Chakri real estate market, things have gone south. The society still does not have approval from the RDA and the land authority says it is not planning to give its approval any time soon. In fact, on recommendation of the RDA, Blue City is being investigated by the National Accountability Bureau (NAB), and has not bought a fraction of the land they claim to already be in possession of. This is how it all happened.

They have been covered earlier by Profit, in a story titled Chakri’s Gang Wars.

The rejected consortiums

Initially, eight different consortiums had submitted their qualification bids. he consortium of Sardar Ashraf D Baluch Construction Company-Shanxi Construction Engineering Group Co Ltd (China) and Gerry’s International were disqualified from bidding. Gerry’s International was rejected due to a weak financial position, while Sardar Ashraf D Baluch Construction company was barred due to a lack of independent verification of its Chinese partner.

The challenge facing potential buyers

There is a very clear list of contenders for PIA at the moment. Four different airlines, two together, have become part of different consortiums that want to try and buy PIA. Control of the airline, particularly for others in the aviation industry, means having a large network and routes but also a lot of problems.

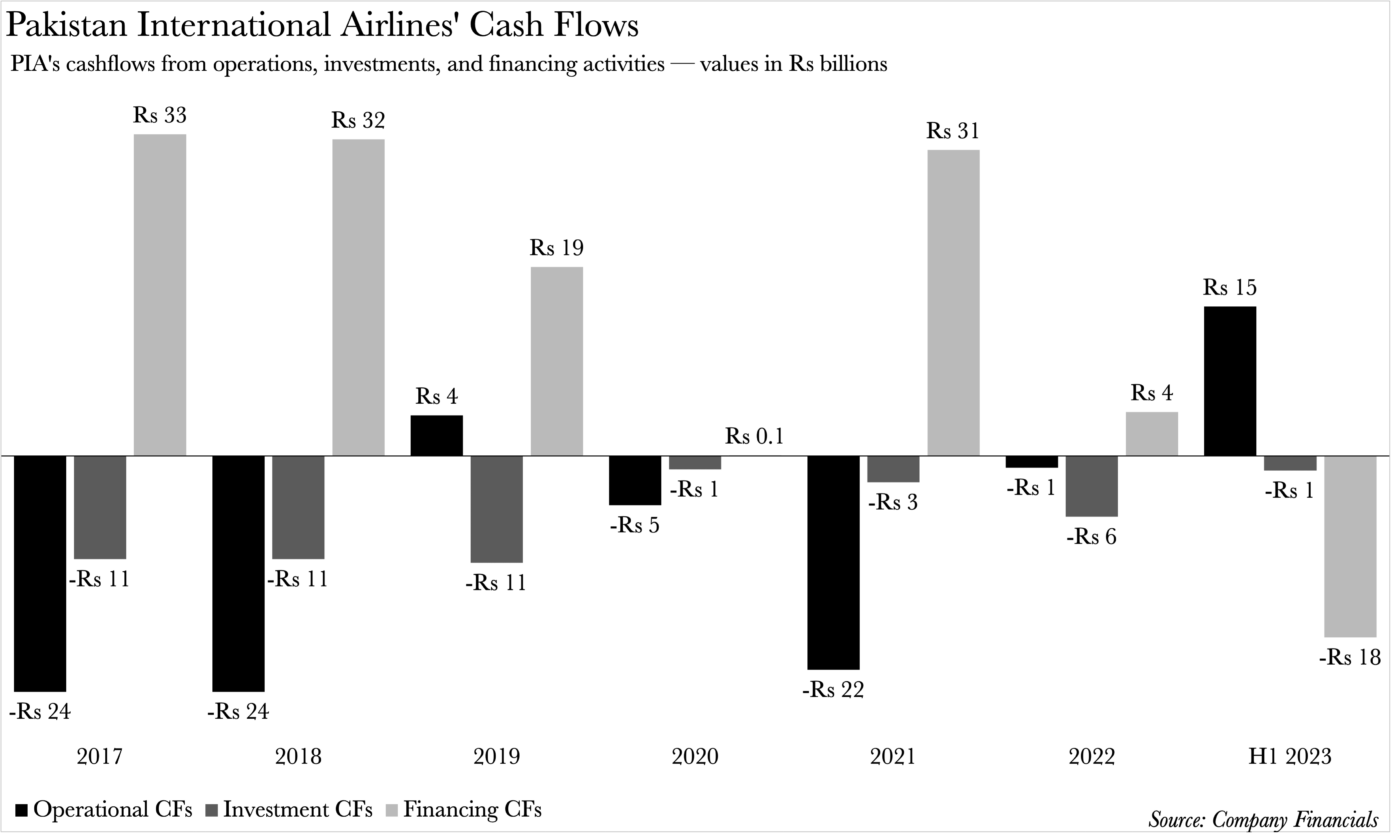

PIA’s losses are so staggering that it is hard to wrap one’s mind around them. PIA’s cash flows are in a state of chaos. A retrospective glance at PIA’s cash flows from 2017 to June 2023 paints a grim picture. PIA only managed to keep its head above water for a fleeting one and a half years. The remaining five years saw PIA grappling with negative cash flows from its operating activities. In layman’s terms, PIA was bleeding money from its core airline operations. So, how has it managed to stay afloat? The lifeline has been debt.

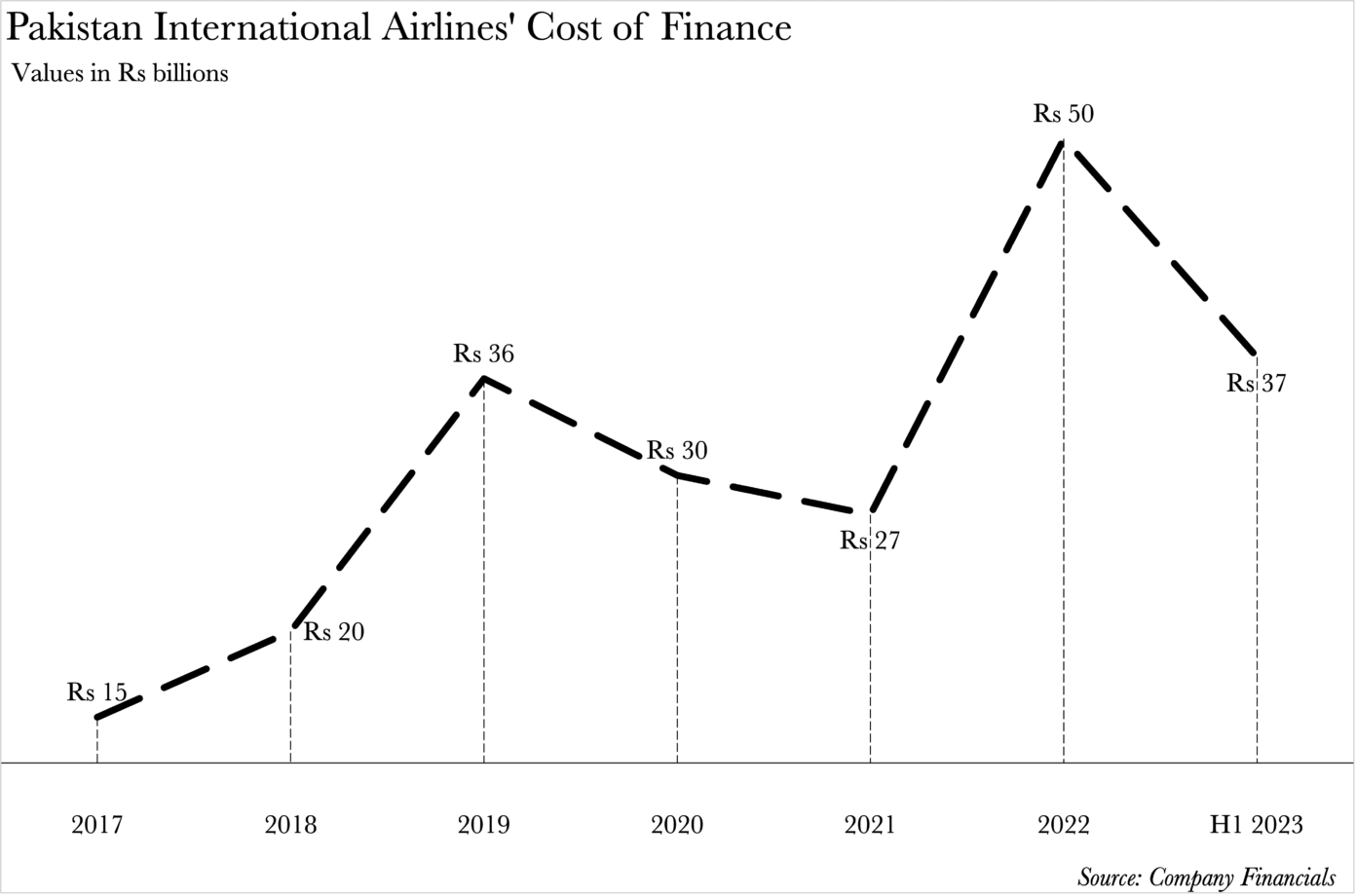

During the aforementioned period, it was only in the first six months of 2023 that PIA managed to repay more loans than it borrowed. That’s not to say it didn’t borrow. It did. This borrowing spree has been the lifeblood of its operations for the past six and a half years. Is this a sustainable model? Far from it. PIA’s finance costs for 2022 alone amounted to a staggering Rs 50 billion — a record high over the past six years. Yet, barely halfway into 2023, PIA has already incurred an alarming 74% of this cost. It is this escalating cost of finance that prompted PIA to engage the government in a dialogue for financial aid to alleviate its debt burden.

So, where does that leave us? Without pointing fingers, it’s just the tale of an organisation trying to do whatever it can to stay afloat in all honesty. The only problem is that it’s a public sector company, and therefore taxpayers are also paying the price.

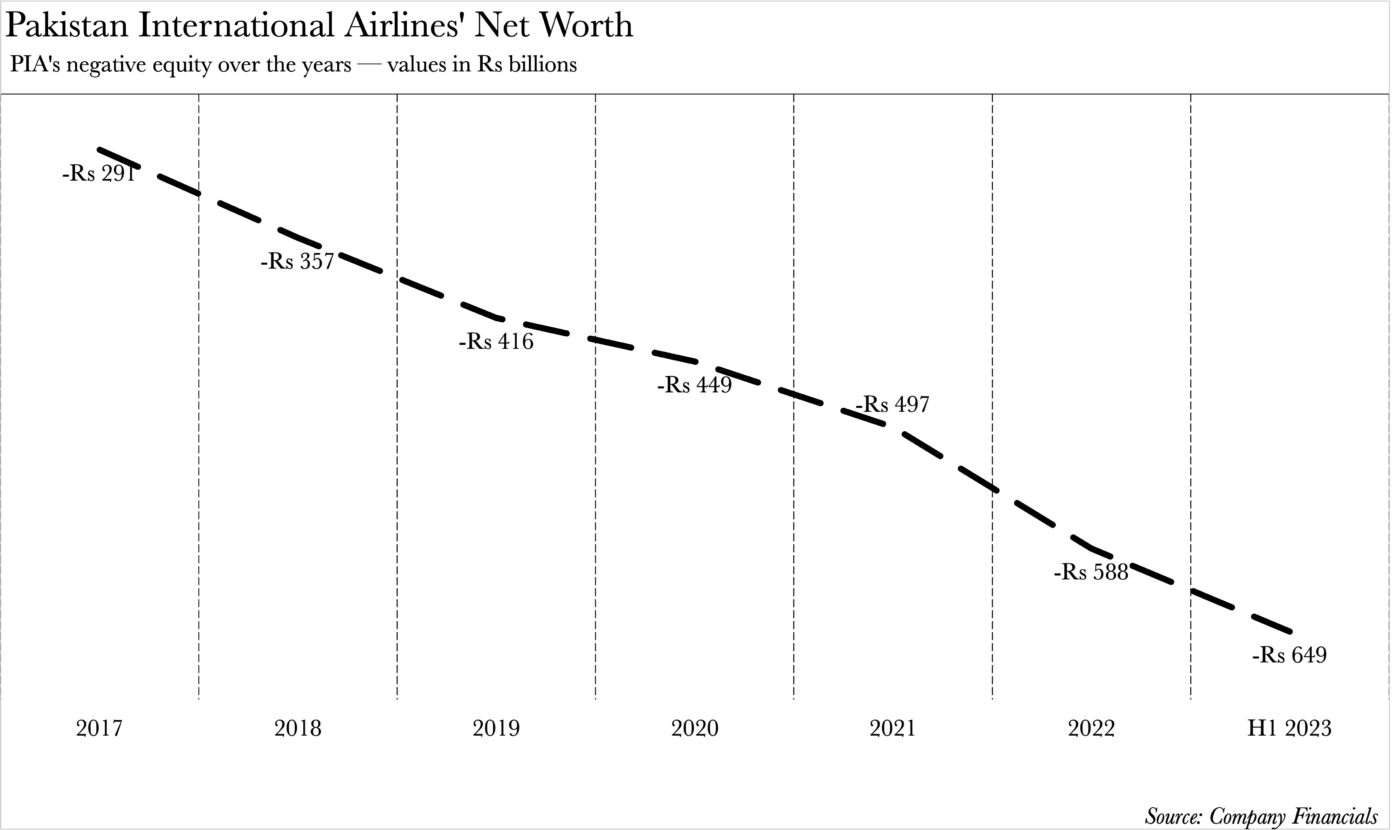

PIA is a negative equity company. Negative shareholder equity is a chilling scenario where a company’s liabilities to its investors eclipse the worth of its assets. In layman’s terms, when a company’s mountain of debt towers over the aggregate value of its assets, even after a complete liquidation, it is branded with the ominous label of negative equity.

The fiscal abyss that PIA finds itself in has only yawned wider with time. The negative equity has mushroomed from Rs 291 billion in 2017 to an astronomical Rs 649 billion in June 2023. This gargantuan sum also symbolises the debt albatross that any prospective buyer would be saddled with upon acquiring PIA.

Does it make sense for anyone to want to buy it? Surprisingly, yes. As explained to Profit last year, PIA unfurls an unparalleled opportunity for any ambitious newcomer yearning to penetrate Pakistan’s airspace, or an incumbent aiming to fortify their position. While the buyer would need to brace for the depreciation of the rupee earnings, they stand to reap rich rewards from the dollar-denominated earnings accrued from Pakistanis embarking on overseas journeys. Moreover, they would not only carve out a niche in the country but also tap into the vast and untapped reservoir of the diaspora.

Perhaps the biggest factor in this which will be a boon for potential buyers of the airline is the decision to restructure PIA’s debt. In March this year, The Pakistan International Airline Holding Company approved the restructuring of the airline’s Rs 268 billion commercial debt, incorporating it into the public debt. The term sheet was finalised by the Ministry of Finance with commercial banks. The government’s decision to merge the airline’s debt into public debt means that taxpayers will bear the cost of PIA’s historic inefficiency and mismanagement.

All of this has been done quite hastily and has been quickly agreed to by the banks that are owed by PIA. They agreed to extend their debt for ten years and reduce interest rates from the existing approximately 23.5% to a maximum of 12%. This has been done exclusively to appeal to potential buyers, and as part of the restructuring, a clause has been added to the restructuring in which banks will have the right to reopen the deal and demand an interest rate equal to prevailing rates in 2027 in case the government is unable to privatise PIA in three years.

Essentially, PIA will be split into two companies. That is why the government has created the PIA Holding Company. In May this year, the Competition Commission of Pakistan (CCP) approved the 100% acquisition of PIA by this company. Through this, the airline’s bad debts, including commercial loans, trade debts, and government borrowings, transferred to the holding company. Over Rs 650 billion of the Rs 825 billion PIA debt will be transferred to the holding company, leaving a clean PIA to be sold to investors. Essentially, the holding company will take over all of PIA’s bad assets leaving the rest to be sold off nice and easy.

The privatisation process process itself is pretty transparent. Independent financial advisory teams are engaged through a competitive process. Which then conducts detailed due diligence to arrive at a fair value, identify transaction roadblocks and suggest any changes that are required to optimise the privatisation proceeds. A successful bidder is selected based on the highest bid, through a well defined transparent process,” Ishtiaq adds. A reference price for the bids is normally calculated based on factors such as net asset value, future cash flows, and potential dividend streams.

So what are the buyers actually getting and why is the government so keen to sell? Based on the balance sheet at June 30th 2023, it can be seen that the company has assets worth Rs 160 billion. The problematic part is the fact that the airline has suffered losses for many years which means it has accumulated losses of Rs 650 billion. In order to fund their operations, they have taken liabilities of more than Rs 825 billion. So what is so attractive in such an investment? Who would want to pay for a company to take on so much debt? In order to make this a viable investment, it was decided to divide the company into two parts. A holding company was created which would absorb all the bad debts, commercial loans, trade debts and government borrowings. This would transfer debts worth Rs 650 billion out of Rs 825 billion to be transferred from the books of PIA itself.

The debt that has been transferred to the holding company has further been restructured. Not talking on the haste with which that was done, the debt that has been transferred to the holding company of Rs 268 billion has been restructured in order to make it digestible for the holding company as well. Even though this is a third of total debt that has been transferred, the goal is to allow the holding company to manage its own debts as well. The debt has been incorporated into public debt which means that the government and tax payers will end up bearing this expense.

The restructuring means that banks have agreed to extend the debt for ten years at a reduced rate of interest. This rate was around 23.5% which has been set at a maximum of 12% for the tenor. This would mean that interest payment of Rs 32 billion will be made to the banks. The banks will get Rs 300 billion in interest over the 10 year period which will exceed the total debt.

The 6 buyers looking to buy PIA will see a reduced amount of debt when they take over the aviation business and the government will be able to make it more attractive to them. Currently, debt falls by Rs 650 billion which will reduce the negative equity of the new company. The government has made this arrangement to be able to generate proceeds once they are able to well the company. These proceeds can then be used to pay off some of the debt of the holding company of allow it to make the interest payments.

The biggest advantage that the buyers will get from this deal is that they get to start fresh as much of the debt is wiped off. With assets of Rs 160 billion, they will see their debts fall to Rs 175 billion. Even though this does mean they will bear some of the accumulated losses of the company, they can look to inject more equity in this situation. Rather than setting up a company from scratch, they will be able to use the name and route portfolio of PIA without having to build much of the it by themselves.

With 75% of its debt wiped off, the new company will see its finance cost slashed as well. Recent half year accounts show the finance cost alone was Rs 37 billion. To put this in context, the fuel expense was Rs 49 billion. The new company will have a more manageable expense.