Unity Foods, one of Pakistan’s leading food conglomerates, is doubling down on its Sunridge brand, a fast-growing player in the wheat flour segment. The company’s retail strategy saw significant gains in fiscal year 2024, as it expanded its footprint with new Sunridge-branded outlets and diversified its product offerings.

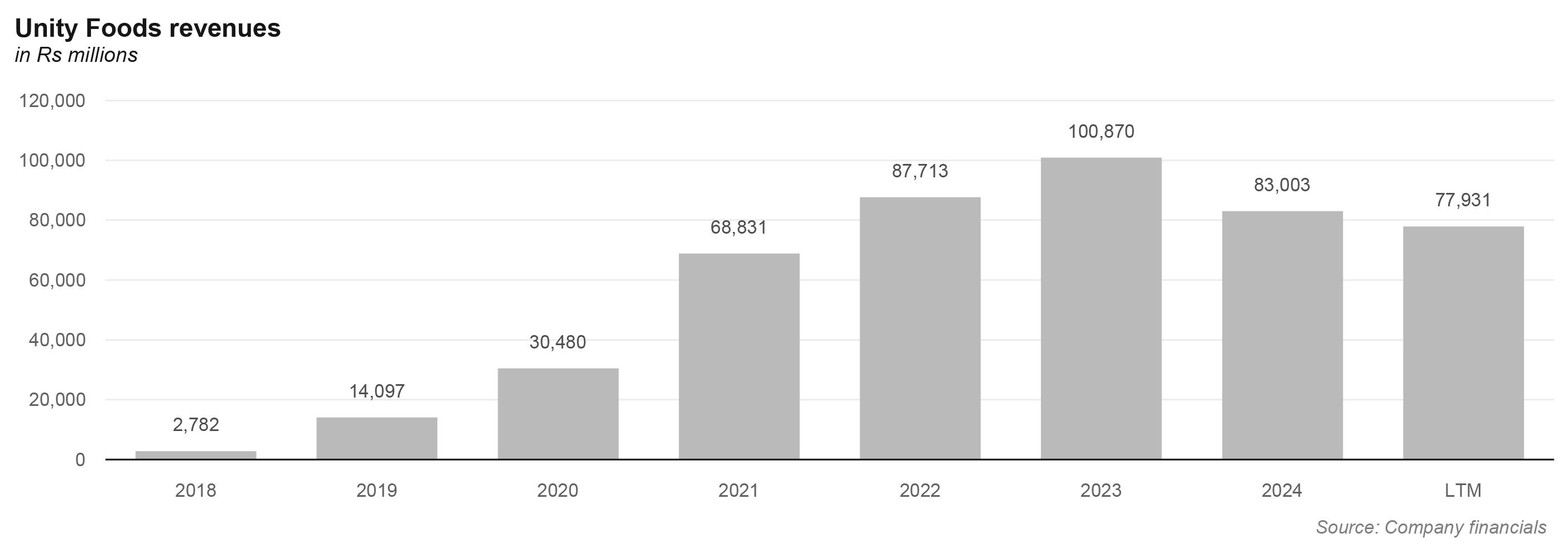

Sunridge, which accounted for 27% of Unity’s Rs83 billion revenue in fiscal year 2024—up sharply from 11% in fiscal year 2023—has become a cornerstone of the company’s transition from an edible oil-focused business to a comprehensive staples provider. To bolster brand awareness, Unity launched seven dedicated Sunridge marts and four kiosks in fiscal year 2024, showcasing over 100 stock-keeping units (SKUs).

The company views these retail outlets as a superior branding tool compared to traditional advertising. Plans are already in motion to extend this retail strategy to Lahore, a key metropolitan market.

Despite Sunridge’s growth, edible oil remained Unity’s largest revenue driver, contributing 48% to fiscal year 2024 sales. However, the segment saw challenges, with consumer pack sales declining due to high interest rates and extended cash cycles. The edible oil business was further pressured by a supply glut from increased palm oil imports in fiscal year 2023.

Unity is optimistic about recovery, with management projecting 80-85% capacity utilisation for edible oil and wheat in fiscal years 2025 and 2026.

Unity’s export revenues surged to Rs7.86 billion in fiscal year 2024, a dramatic rise from Rs0.86 billion the previous year, with the company now exporting to eight countries. Management sees significant export potential, particularly in rice and confectionery, as it scales operations.

Additionally, Unity has invested in capacity expansions across multiple categories, including edible oil, flour, rice, and confectionery, and installed a 2MW solar plant to reduce energy costs.

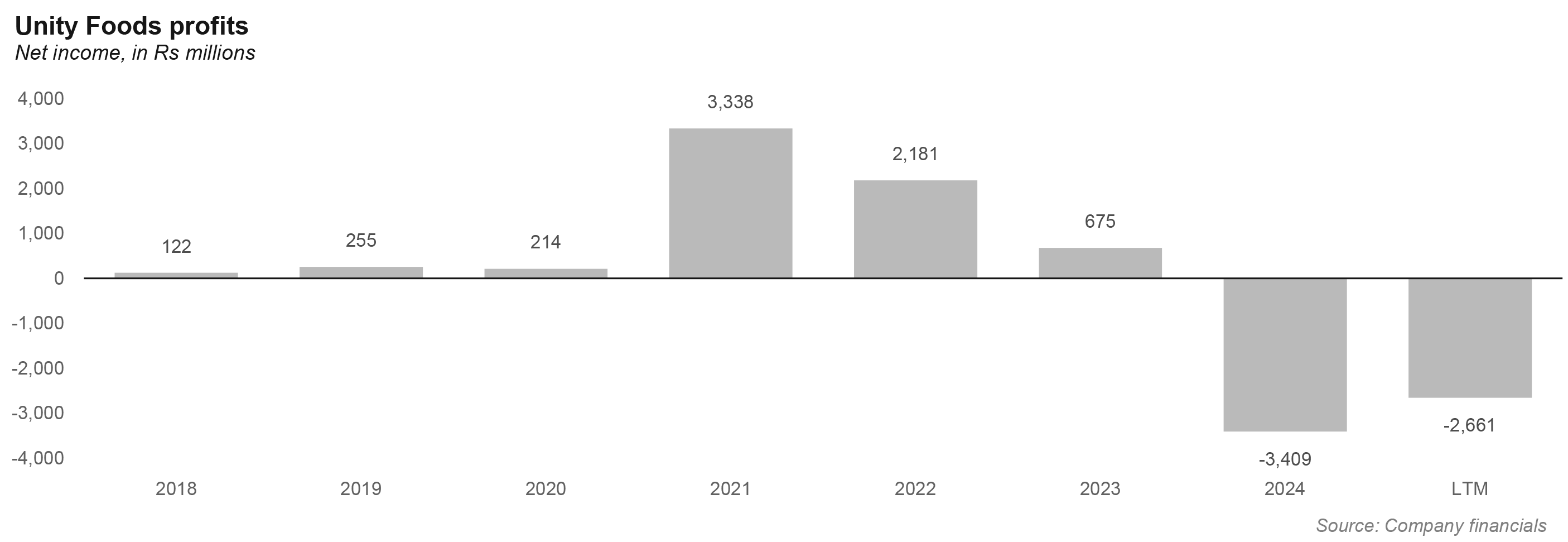

Like many businesses, Unity grappled with inflation and high borrowing costs in fiscal year 2024, which drove up finance expenses to Rs7.44 billion from Rs3.56 billion in fiscal year 2023. Distribution and administrative expenses as a percentage of sales also rose due to product diversification and export-related costs.

Management anticipates cost relief as interest rates decline in the near term. Meanwhile, international palm oil prices are expected to remain stable despite volatile weather patterns impacting supply.

Unity’s strategy signals a pivot toward becoming a full-spectrum staples provider, with the Sunridge brand at the forefront. With its retail footprint expanding and export markets growing, the company is poised for steady growth.

The company known today as Unity Foods originally started its life as Taha Spinning Mills, a textile company that went bankrupt in 2008. In 2016, a new ownership and management team agreed to buy out the company in a backdoor IPO of sorts, and in 2017, the company raised Rs1.65 billion through a rights share offering that helped it finance an expansion of its edible oil production business.

The company today offers a wide range of food products, including edible oils and fats, staples such as flour, rice, lentils, and pulses, industrial fats, animal feed ingredients for poultry and livestock, and specialty fats for chocolate, confectionery, and bakery products

The company markets its products under several brand names, including sunridge (for staples like atta, all-purpose flour, chickpea flour, semolina, salt, and rice), Dastak, Ehtimam, Zauqeen, Lagan, and Unity Oil (for oils and banaspati products), and Pure (for animal feed products).

Unity Foods has a large domestic presence in Pakistan and has expanded its reach to international markets. The company exports its products to various countries across Asia, the Middle East, Africa, and Europe, including Sri Lanka, Malaysia, Vietnam, Bangladesh, the United Arab Emirates, China, and Singapore.

In early 2024, a significant stake in the company was acquired by Wilmar International Ltd, a Singaporean food processing and investment holding company with more than 300 subsidiary companies. Founded in 1991, it is one of Asia’s leading agribusiness groups alongside the COFCO Group. It ranks amongst the largest listed companies by market capitalisation on the Singapore Exchange (SGX).

Wilmar had been part of the initial acquisition of the company in 2016, and its increased shareholding this year was viewed by the market as a sign that the company’s prospects were viewed favourably by its foreign investors, a rarity in the Pakistani market these days, where many longstanding foreign investors have faced years-long delays in being able to repatriate their profits back to their home countries.

Wilmar International business activities include oil palm cultivation, edible oils refining, oilseeds crushing, consumer pack edible oils processing and merchandising, specialty fats, oleochemicals, and biodiesel manufacturing, grains processing and merchandising, and sugar milling and refining. It has over 500 manufacturing plants and an extensive distribution network covering China, Indonesia, India and some 50 other countries. The group employs a multinational workforce of more than 100,000 people.