A crisis is afoot and the media industry is choosing to stay mum about it. According to the annual media agency rankings from RECMA, a French research company that evaluates media agencies worldwide, the top eleven media agencies in Pakistan are losing money year on year.

Featuring data on media agency revenues, media agency headcount, the ratio between earnings and number of employees, and the share of revenues coming from nontraditional – digital and social – media, the report shows a harrowing decline in advertising expenditure (AdEx) that all members of the Pakistan Broadcasters Association (PBA) depend on.

In no particular order, the top eleven media agencies in Pakistan profiled by RECMA are:

- WPP’s Mindshare, Wavemaker, and Mediacom,

- Publicis affiliates Brainchild Communications Pakistan (BCP), Blitz Advertising, and Adcom Media,

- Omnicom affiliates Manhattan and Orient Communications,

- Dentsu affiliate Synchronise Carat

- Havas Media affiliate Media Axis

Per RECMA, the top five media agencies in 2017 and 2018 were ordered as Mindshare, Starcom & MediaVest affiliate BCP, Maxus, OMD affiliate Manhattan, and Spark affiliate Blitz Advertising. The research company reported that in 2019 the top five media agencies were BCP, Mindshare, Wavemaker, Manhattan, and Blitz Advertising. In 2020, this changed to BCP, Mindshare, Wavemaker, Blitz Advertising, and Adcom Media.

“Brainchild [grew] by 22%,” said the 2020 RECMA media agency ranking report. “Activity is boosted by the organic increase of key existing clients (P&G, Mondelez, Friesland Campina, and China Mobile), coupled with additional businesses in 2020 (Telenor GSM, Easy Paisa, Lotte Kolson, and ARY Laguna).”

After over a decade at the very top from an individual agency rankings perspective, Mindshare was dethroned by affiliate agencies under the Publicis Groupe. That said when considering revenues as a group – i.e. WPP vs Publicis vs Omnicom, vs Dentsu vs Havas – the media agencies under WPP still come out on top even in the 2020 report.

When measured as a group, WPP’s Mindshare, Wavemaker, and Mediacom are estimated to hold the market share leadership at 42.3% while Publicis affiliates BCP and Blitz Advertising under Z2C Limited only hold 37.5% market share.

“The group ranking is unchanged with GroupM at the top, challenged by Brainchild,” said the report. “Mindshare, Wavemaker, and Mediacom grew by an estimated 5% each.”

In a pure WPP and Publicis faceoff, the latter comes out on top due to Adcom Media controlling 5.9% of the market, bringing the Publicis market share to 43.4% and comparing three versus three media agencies.

In terms of growth rate, the 2020 RECMA media agency ranking found that

- Zenith affiliated Adcom Media grew by 26%,

- Starcom affiliated Brainchild grew by 22%,

- PHD affiliated Manhattan grew by 13%,

- Spark affiliated Blitz Advertising grew by 8%

There were of course those agencies that shrunk as well, with Pakistan Broadcasters Association data on their clients’ list showing an inability to win as many new clients – possibly due to lacking relative media muscle sought by advertisers that commoditize media – including troubles with client retention, and a focus on client categories that are historically suspended:

- OMD affiliated Manhattan shrunk by 48%,

- Carat affiliated Synergy Dentsu shrunk by 23%,

- Havas affiliated Media Axis shrunk by 18%,

And UM affiliated Orient Communications shrunk by 17%.

The $20 million Nestle media review will drastically change all of the above in the 2021 report from RECMA, given that it makes up 40% of Wavemakers’ 2020 revenue and 11.6% of the overall 2020 revenue of GroupM, which is still the market leader in Pakistan in terms of revenue and headcount.

Usurping a market leader while losing money #FunnyAndSad

The RECMA reports show that the combined earnings of all eleven agencies equaled $478 million in 2017, $397 million in 2018, $395 million in 2019, and $407 million in 2020. As reported numerous times by Profit, the existence of self-serve advertising tools, the nationwide trend of media in-housing, the proliferation of influencer marketing ecosystems, and the lowered barriers to entry for media buying mean that less than 25% of the $2 billion of the 2021 media and advertising industry in Pakistan is covered by media agencies.

It’s also worth noting that there are more than eleven agencies in Pakistan with media wings, the bulk of which did not make the RECMA ranking, such as The Brand Partnership, Spectrum Communications, the infamous Midas Pvt Ltd, the rapidly growing Oktopus 360 Media, former Maxus MD’s IG Square, M&C Saatchi World Services, and Wings Media, to name a few.

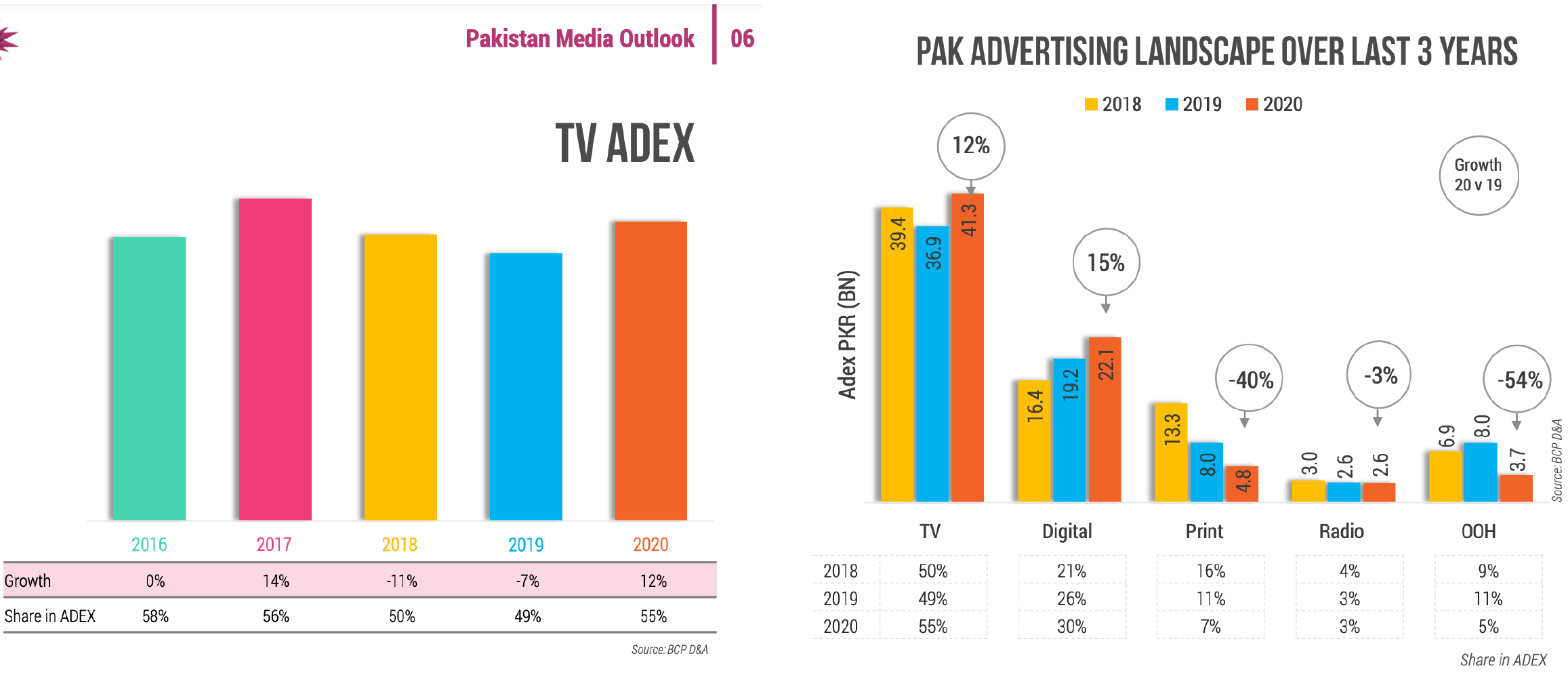

According to the Pakistan Media Outlook 2021 report from Brainchild Communications Pakistan (BCP), AdEx in Q2 2020 declined sharply by 27% than Q2 2019 due to the pandemic induced recession. According to the report, AdEx in 2021 is expected to outgrow previous years following normalization in Q3 2020, which was quantified by a 12% growth in AdEx directed at the TV inventory through Q4 2020.

Data from the annual Global Advertising Forecast (GAF) by Magna Global shows that linear and digital ad spend both grew by high-single digits to double-digits from 2013 until 2018 in Pakistan, which was plagued with economic and political uncertainty.

“The Pakistani rupee depreciated by over -30% amidst a growing current account deficit, and the media industry was hit hard by spending cuts from many major TV spending verticals, including CPG/FMCG and communications,” said Michelle Bovee Stange, an associate director of Global Market Intelligence at Magna Global, who studied the Pakistan media landscape for the GAF. “2019 saw a return to stability for the Pakistani economy and the advertising market, bolstered by cyclical events like the 2019 Cricket World Cup.”

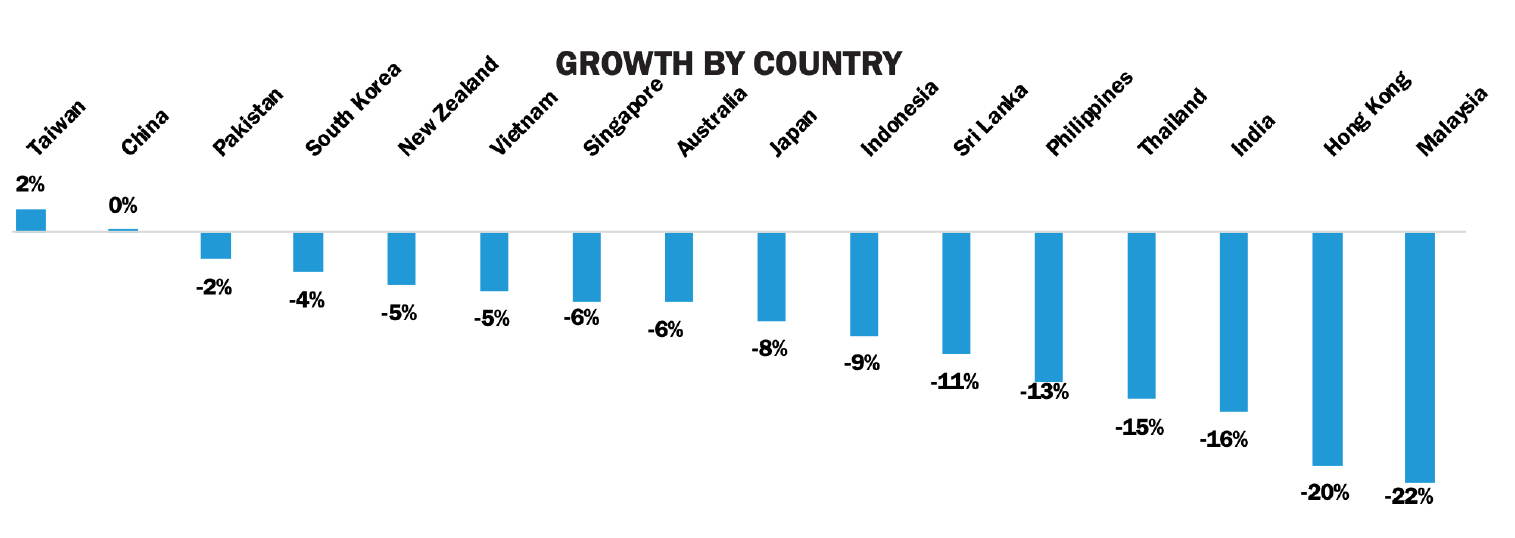

As reported by Profit, when Pakistan went into COVID lockdown on the 24th of March 2020, the linear AdEx decline was relatively modest compared to many other APAC markets. The GAF suggests that AdEx declined in Pakistan by 6% in 2020, with cinema seeing the steepest decline of 15%, from a very low base; OOH declined by 10%, and television and radio declined by 5%. Analysis by GAF suggests that digital spend slowed significantly, but still saw double-digit growth of 18%, bringing total net digital ad revenues to $15 million—just 18% of total net advertising revenue.

“Digital video (+28%) and social (+23%) are the engines of growth, followed by search (+11%) and finally display (+4%). 2021 should bring recovery for most media formats, including radio (+3%), OOH (+4%), and magazines (+1%),” said Bovee Stange. “Television will see continued erosion, -2%, while digital will accelerate (+21%). Growth will continue in 2022, supported by improving macroeconomic fundamentals (real GDP: +4%, following growth of +1% in 2021).”

If this is the case, why are media investment companies such as GroupM and Z2C coughing up significant amounts of upfront revenue commitments towards sports such as the rating funeral that is the ICC games and motorsports for the elite? And aside from these 15 ways of stealing from marketers, how are media agencies staying afloat – and getting fancier offices – when AdEx is on a decline?

The answer appears to reside with the race to become the largest and specialized sports marketing agency, since pushing advertisers towards music platforms is proving to be a losing battle amid market saturation and the death of music channels in Pakistan. The leading example of a sports marketing agency in Pakistan is Blitz Advertising, the only full-service agency to make the necessary upfront guarantees to the Pakistan Cricket Board which led to six seasons of the Pakistan Super League from 2016 to 2021.

As of October 2021, Blitz Advertising holds broadcast media rights for the Lanka Premier League, Kashmir Premier League, Pakistan Celebrity League (CLL), along with contracts with the Pakistan Hockey Federation, Pakistan Volleyball Federation (PVF), and the Pakistan Kabaddi Federation (PKF). The full-service agency jointly holds rights for the CLL, PVF, and PKF games with the Trans Group.

There is a direct correlation between Blitz Advertising investing in securing media rights for mainstream and niche sports events and in its rise to the top five slots of the annual media agency rankings from RECMA. This appears to be the same strategy mirrored by both GroupM Pakistan and BCP.

Direct or indirect sports content ownership, deep vertical integration, and the drive towards owning influencer marketing ecosystems appear to be the survival strategy of the Big Three. For the remaining eight, ignorance is bliss.

How are broadcasters reacting to this?

One would think that members of the Pakistan Broadcasters Association would be alarmed at the decline in AdEx year-on-year and perhaps attempt to maintain a semblance of relevance.

In an attempt to capture more of the AdEx pie, ARY Digital Network has followed through on our last story by securing a license for A Sports, its first sports-focused channel, in the lead-up to broadcast the ICC games. It has also awarded exclusive live digital streaming rights to Daraz for its app, with the Alibaba-owned marketplace capitalizing on the subsequent app downloads and promising no interruptions in the form of ads.

This could just refer to the absence of digital video commercials (DVCs) of advertisers that don’t stock products with Daraz, while Profit speculates that ads for contextually relevant products – perhaps cricket merchandise – may still pop up while app users attempt to watch the ICC games.

This week, advertisers and agencies received a proposal from ARY Digital Network for packages around sponsoring the 2021 ICC Men’s T20 World Cup. The packages are categorized into six types of sponsors namely presenting, main, associate, support, exclusive, and post-match exclusive features.

Across all six packages, the total possible AdEx based on this proposal is Rs. 617.5 million ($3.625 million), of which 40% of profits will go to the GroupM and ARY consortium per their agreement with PTV. As reported by Profit, there was no additional clarification sought by PTV to determine how it would safeguard itself from low profit created by exaggerated costs which benefit the consortium. Industry insiders also claim that rules of public procurement (PPRA) were also flouted by PTV while finalising this tri-party deal.

Given that PEMRA has rules to the number of licenses allowed per network, the fine team at ARY Digital Network formed a completely new company called Horizon Communications (item 119) to secure a license of the forthcoming sports channel known as A Sports.

The SECP database shows that Horizon Communications is led by a CEO named Irfan Malik who just happens to be the SVP of ARY Films. When asked to comment on the connection between A Sports and ARY Digital Network, Malik said that there was no connection between the two. He declined to answer further questions and was even shown visuals for the aforementioned sponsorship proposal, which did not prompt a response.

Even If we ignore the proposal from ARY Digital Network for packages around sponsoring the 2021 ICC Men’s T20 World Cup, one could have still argued that A Sports has nothing to do with the Pakistani pay television network. They could argue this point by saying Irfan Malik is operating a non-competing channel on his own independently, having possibly severed his employment with ARY as a whole. This could very well be the case. But there’s more.

And there was light

The SECP database shows that the directors of Horizon Communications are:

- Sabeen Salman – the wife of Salman Iqbal, the CEO of ARY Digital Network,

- Mehak Yaqoob – the wife of Yaqoob Iqbal, brother of Salman Iqbal

- Tariq Wasi – the head of ops at ARY Digital Network,

- Muhammad Mohsin – the SVP of human resources at ARY Digital Network

and Ayesha Mehboob, whose connection to ARY could not be verified at the time of publishing.

Sources confirmed that it was Irfan Malik that led the bid for the license around A Sports, without PEMRA conducting any audit or even considering the possibility of an attempt to circumvent the rules of the media regulator, which are framed as a vehicle to avoid monopolization but could very well also be a response to the limited on-air space and slots available on satellite and cable.

According to the amended PEMRA Ordinance 2002: the authority is meant to ensure that undue concentration of media ownership is not created in any city, town, or area and the country as a whole: Provided that if a licensee owns, controls, or operates more than one media enterprise, he shall not indulge in any practice which may impede fair competition of the level playing field.

Perhaps by placing the new channel under a company owned by spouses, the leaders of ARY Digital Network are overcoming this rule: the authority shall ensure that undue concentration of media ownership is not created by virtue of the applicant for a broadcast or CTV operation license already owning or operating, as a sole or joint shareholder of any other broadcast or CTV station, printed newspaper or magazine.

While this may work on paper, there is no way the remaining members of the broadcast industry will stand for this, and no one believes that spouses are actually competing with each other instead of colluding behind the scenes. This is Pakistan, after all.

“Many, paradoxically, consider policies of PEMRA to actually be responsible for the unprecedented progress of the media industry in the country, which ironically paved the way for the concentration of ownership and the unbridled political influence enjoyed by the owners of media organizations,” said Sehar Raothar, a seasoned media consultant. “In fact, successive Pakistani governments have endeavored to revisit their previous policy vis-à-vis media regulation and licensing of electronic media in the country, and an erstwhile inefficient PEMRA has recently been instructed by the government to reconsider a few policy initiatives related to the cross-media ownership and licensing of new television channels.”

She told Profit that the industry as a whole needs to duly explore the relationship between media regulation and concentration of ownership in Pakistan through the lens of the political economy of communication. She concluded that owner-friendly policies of PEMRA and its inefficiency in implementing its mandate have resulted in the concentration of ownership, one way or the other, which facilitated diagonal growth of a handful of companies that control the airwaves in the Pakistani media industry – whether they do it through nepotism by creating different channels under new ownerships.

“In developing countries such as Pakistan, where privatization of electronic media and its regulation are nascent experiences, communication regulation grows even more complex,” she said. “With the introduction of advanced communication technologies, new regulatory challenges emerge that require decision-making and regulatory policies that can best serve the interests of citizens – however, loopholes in the PEMRA laws or the lack of fear of consequences for violating these laws are prevalent in the ARY/Horizon case.”

Less than a month ago, several media agency leaders considered severing their ties with ARY based on concerns that the Pakistani pay television network would help GroupM steal its clients with undercutting rates. Amid industry pressure, this did not come to pass. The deal with PTV was perhaps intended to strengthen GroupM’s chances of retaining the $20 million Nestle media review, amid a senior replacement at Wavemaker.

Industry sources confirmed to Profit that the Starcom affiliate BCP has won the account on a local level. The incumbent Nestle media agency, Wavemaker, will lose 40% of its recurring revenue, assuming the RECMA data from 2020, showing the media agency network earned $50 million in that year, is correct.

When the watchmen are asleep

“PEMRA has failed to effectively check cross-media ownership and has not been able to exercise its authority to implement an efficient regulatory regime as enshrined in its mandate,” said Azmat Rasul, a faculty member at the Valdosta State University, in a paper titled Regulation and Media Monopoly: A Case Study of Broadcast Regulation in Pakistan. “Prior to the PEMRA era, these groups were monopolizing the print media market and the new regulatory body brought novel chances of expansion for these large media corporations.”

The sponsorship proposal for the 2021 ICC Men’s T20 World Cup was floated by ARY Digital Network despite sources at Star Middle East – the audio-visual rights holder for ICC games between 2015 and 2023 – stating that they had not received a bank guarantee from ARY Digital Network, which GroupM cannot provide under its compliance rules.

Given that ARY Digital Network agreed to partner with GroupM on the condition of guaranteed business from the world’s largest media investment company, it is unclear why the Pakistani pay television network is unable to provide Star Middle East with the bank guarantee.

Media and account managers across the country expressed confusion over the sponsorship proposal for the 2021 ICC Men’s T20 World Cup floated by ARY Digital Network given that there is no MediaLogic data to use to even extrapolate the potential reach and ratings of A Sports – which is yet to go on air.

While Ten Sports does air without a license, media and account planners shared that there is MediaLogic data attached to the channel but no multinational client is willing to partake due to the illegal nature of the channel airing.

Meanwhile, the ICC official broadcasters list states that only Ten Sports and PTV Sports are the respective satellite and terrestrial channels for Pakistan, with no mention of A Sports by ARY Digital Network, which makes the proposal from ARY Digital Network for packages around sponsoring the 2021 ICC Men’s T20 World Cup even more perplexing.

The Pakistani pay television network is reportedly working out a deal with the cable lobby to replace a relatively smaller competing network channel with A Sports while attempting to broadcast the channel in the areas suspected of being used by MediaLogic for PeopleMeter data collection.

This suspicion is founded on sources within the cable lobby, PTCL, and in the latest MediaLogic data showing an unusual spike in ratings for ARY Digital Network channels.

That’s right, taking advantage of a legal system where one stay order after the other and a relationship with the powers that be, can hold the media regulator back ad nauseam. We went from being told that no new licenses would be awarded by PEMRA to one being arranged in a matter of days.

“In all societies, regulation of media organizations and the market has remained a contested area generating heated debates, like mass media and other means of communication have traditionally run counter to the interests of elites in democratic societies,” said Raothar. “Therefore, communication policymaking and regulation have emerged as a challenge of great magnitude in transitional societies such as ours that are witnessing the rapid growth of electronic media. Policymaking in the field of communication is considered to be a measured intervention by the government in the structural designs and business plans of companies offering media and communication services.”

Admiring the time and energy you put into your website and detailed

information you offer. It’s nice to come across a blog every once in a

while that isn’t the same outdated rehashed information. Wonderful read!

I’ve saved your site and I’m adding your RSS feeds to

my Google account.

Great delivery. Sound arguments. Keep up the amazing effort.

Feel free to visit my blog post; Best Coffee Uk Online