Barely two years after taking the helm as Chairman of Mitchell’s Fruit Farms, Najam Sethi has stepped down from the position in favour of Shahzad Ghaffar. Sethi, who is the husband of MPA Jugan Mohsin whose father was the owner of Mitchell’s, will now serve as interim CEO of the publicly listed company until a permanent chief executive is appointed.

Shahzad Ghaffar is the husband of Moni Mohsin, the other daughter of the company’s founder S M Mohsin. He is the second successive son-in-law to become the chairman of Mitchell’s.

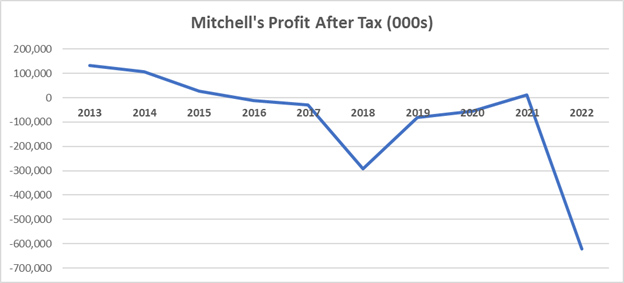

Sethi was elected chairman of the board back in 2020 to try and turn the company around. His chairmanship had been considered a last-ditch effort by the family to fix Mitchell’s problems after an attempt to sell the company fell through. In the two years in between, Sethi did manage to make a promising start after the company narrowed its losses and increased its firepower, setting itself up for a financial recovery at the one-year mark of taking over. However, in 2022, Mitchell’s faced an annual loss of Rs 621 million — the biggest in its history.

The latest development comes only a few months after the passing of the family’s patriarch, Syed Muhammad Mohsin. Mohsin died in July this year after bequeathing some of his shares to his son Mehdi Mohsin. Since then, his three children have also been on a buying spree. Collectively they have bought 471,600 shares at an average price of 75 per share, indicating they may be consolidating before selling the company.

To read the full article, subscribe and support independent business journalism in Pakistan

The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account.

Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.

Thanks for this great information

Welcome. Thanks for reading.

nice sirrrrrrrrrrrrrrrr, finally got around to reading it

A very insightful article to highlight a much valid point, however I would have appreciated if some recommendations for the solution were also presented here.

사설 카지노

j9korea.com