Engro Corporation (ENGRO) has officially entered into an Amalgamation Agreement with Pakistan Mobile Communications Limited (PMCL), more commonly known as Jazz. Through this deal, PMCL’s tower assets, currently held by its wholly owned subsidiary, Deodar Private Ltd, will be transferred to Engro Connect, a 100% subsidiary of Engro Corporation. The total transaction, valued at US$563 million, includes a US$187.7 million payment to PMCL along with the repayment of Deodar’s US$375 million debt.

By way of this Arrangement, PMCL’s tower assets housed under its wholly owned subsidiary, Deodar (Private) Limited, will vest into Engro Connect, a wholly owned subsidiary of Engro.

Engro Corporation shared this information with the Pakistan Stock Exchange (PSX) on Friday in accordance with Sections 96 and 131 of the Securities Act, 2015 and Rule 5.6.1 of the Rule Book of the PSX.

“We are pleased to inform you that Engro Corporation Limited (“Engro”) has entered into an Amalgamation Agreement with Pakistan Mobile Communications Limited (“PMCL”) relating to a Scheme of Arrangement to be sanctioned by the Honorable High Court,” read the notice.

Why sell Deodar?

The telecom industry in Pakistan has been grappling with rising operational costs, stagnant revenues, and a crippling energy crisis. For Jazz, Deodar’s ownership, which includes managing over 10,500 towers, has become a financial strain. Transferring these assets to a specialized operator like Engro allows Jazz to refocus on core services, such as expanding 4G penetration and preparing for 5G deployment.

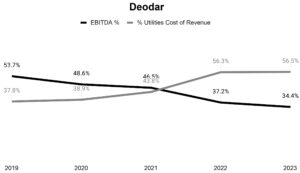

Why now? Deodar’s energy costs alone provide a clue. In 2023, Deodar’s energy expenditure accounted for 56.5% of its total revenue, up from 43.8% just two years earlier. Diesel and electricity price hikes, coupled with persistent grid outages, have rendered direct tower ownership increasingly unviable. Jazz CEO’s remarks on the matter highlight the operational advantages of outsourcing: “An asset-light model not only cuts costs but accelerates digital growth in a challenging economy.”

And the deal itself is not unexpected. Jazz has been out in the market looking for buyers since it acquired Warid back in 2016. The deal marks Jazz’s third significant attempt to divest its towers. Earlier attempts included negotiations with Edotco in 2018 and the TPL-TASC consortium in 2022. Both fell through due to regulatory hurdles and economic volatility. These setbacks delayed Jazz’s journey toward an infrastructure-light model, a path necessitated by industry trends favoring shared infrastructure to optimize costs.

The Industry Context

The sale of Deodar is part of a broader trend of telecom operators divesting their passive infrastructure to reduce operational costs. But why are towers suddenly a burden?

Over the past decade, the telecom industry’s revenue streams have shifted drastically. In the mid-2000s, operators enjoyed an ARPU of $9; today, it stands at just $0.90 (or Rs. 249). While mobile data has become the industry’s lifeblood, its affordability has cannibalized traditional revenue streams like voice and SMS.

Telecom towers consume massive amounts of electricity, much of which is sourced from diesel-powered generators during grid outages. With diesel prices skyrocketing and the national energy supply remaining unreliable, energy costs now erode profitability across the board.

Despite lobbying for reduced energy tariffs, telecom operators remain subject to high commercial electricity rates. This lack of relief compounds the challenges of maintaining profitability in an inflationary environment.

Why Engro?

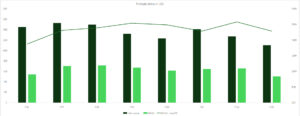

Engro Enfrashare has already emerged as a leader in Pakistan’s tower infrastructure market, with a portfolio heavily powered by renewable energy solutions. Over 46% of its sites are solar-powered, reducing dependency on costly and environmentally detrimental diesel generators. This operational efficiency makes Engro a suitable candidate to take on Deodar’s towers while optimizing their energy use.

This deal with Engro Connect is poised to have a substantial impact on Engro’s tower infrastructure, as Deodar’s portfolio comprises 10,500 towers, placing the price per tower at US$53,590. In comparison, Engro’s existing tower portfolio under Engro Enfrashare includes 4,063 towers, with an asset base valued at Rs69 billion (approximately US$250 million), translating to a per tower value of US$61,545. This deal represents a significant growth for Engro in the telecom tower sector, especially given the substantial gap in tower assets between Engro Enfrashare and the new acquisition.

The potential acquisition aligns with Engro’s strategy to expand its portfolio, especially in urban and semi-urban areas. Given its expertise in managing energy costs and providing infrastructure-sharing solutions, Engro can extract more value from Deodar’s assets than Jazz could under its current structure.

The sale also aligns with global telecom trends. Infrastructure-sharing models, such as sale-and-leaseback agreements, are increasingly common, enabling operators to rent back the towers they sell. This approach not only reduces maintenance costs but also frees up capital for network expansion.

However, in some ways, the acquisition presents a challenging profitability scenario in the initial years due to the high debt component, which makes up 67% of the transaction. According to estimates shared by Topline Securities, Engro currently earns Rs. 245,000 per tower per month, and revenues from Deodar’s towers are projected to fall between Rs. 250,000 and Rs. 280,000 per tower monthly. This could generate annual revenues in the range of Rs. 30–35 billion.

Engro Enfrashare, the company’s tower subsidiary, reported a gross profit margin of 41% for the first nine months of 2024 and an EBITDA margin of 60% in 2023. However, the high financing costs associated with the acquisition have kept the bottom line in the red, with initial returns on this investment expected to be breakeven or negative. These projections underscore the importance of operational efficiencies and cost management to improve profitability over time.

Implications for Pakistan’s Telecom Sector

Jazz’s sale of Deodar is more than just a business transaction—it’s a bellwether for the future of telecom in Pakistan. With energy costs eating into margins and ARPU stagnating, the asset-light model may become the industry standard.

However, the shift also underscores the urgent need for structural reforms such as a national push toward renewable energy.

It would also pave the way for expanding the scope of shared infrastructure agreements would optimize resource use and enhance service quality nationwide.

Conclusion

The sale of Deodar to Engro is not merely a financial maneuver; it’s a survival strategy in a sector facing existential threats. As Jazz aims to shed its passive infrastructure burden, the deal underscores the pressing need for innovation and collaboration to sustain Pakistan’s digital infrastructure. Whether this pivot will reinvigorate the industry or merely buy time remains to be seen, but one thing is clear: the days of owning and operating towers as strategic assets are long gone.