When any news about Amazon and Pakistan breaks there are bated breaths and soaring hopes. Pakistan is nowhere close to having Amazon here warehousing and distributing products like it is in other parts of the world. Yet the $1.7 trillion company is so famous and it’s constant referencing in mass media has meant that the desire to see Amazon-like services in Pakistan is high, particularly because of the growing worries over fraudulent sellers on local platforms like Daraz.

So when the consumers found out that Amazon was not coming to Pakistan but had rather just added Pakistan to its list of authorized sellers, This does not mean that Amazon products are going to be available in Pakistan, but it does mean Pakistani producers can now sell their products on Amazon. This is a big deal, particularly because after decades of selling a range of products through Amazon using businesses registered outside Pakistan, manufacturers and brands from the world’s fifth-most populous country may finally be able to unlock their export potential through Amazon.

It’s worth noting that as of 17th May 2021, Amazon has not actually added Pakistan to its list of countries accepted for seller registration. The only visible change is that Pakistan and the PKR have been added to the list of countries and currencies supported by Amazon for disbursement.

Nonetheless, this article addresses whether the people behind Pakistan’s stagnant export trajectory have the will to use the platform that reportedly generates $70 billion a year in exports for China. Assuming that Prime Day occurs in the second quarter of 2021, the market leader in shopping, entertainment, smart devices, and cloud computing expects its net sales to be between $110.0 billion and $116.0 billion in the second quarter of 2021, which is a growth of between 24% and 30% compared with the Q2 2020.

According to the latest earnings call, the operating income for Q2 2021 at Amazon is expected to be between $4.5 billion and $8.0 billion, compared with $5.8 billion in the second quarter of 2020. This guidance assumes approximately $1.5 billion of costs related to COVID-19.

For context, the $110 billion that Amazon expects to earn during the second quarter of 2021 is $3 billion more than the combined annual exports for the four years between 2016 to 2019 from Pakistan according to Macrotrends. The market capitalization of the 27-year-old company is nearly six times greater than the GDP of the 74-year-old 33rd-largest country by area.

Data from the World Bank states that Pakistan went from a current account deficit of US$2.0 billion for June-December 2019 to a recorded surplus of US$1.1 billion for June-December 2020, the first half-yearly surplus in almost a decade. The international financial institution chalked this up to strong official remittance inflows which more than offset a wider trade deficit, which itself grew to the users of informal channels to send remittances to the country no longer being able to do so due to COVID-19.

The inclusion of Pakistan in the Amazon seller list (ASL) will reportedly create new opportunities for exporters to sell their products through the platform, which serves both brand owners and resellers, as well as mass producers that want to produce for Amazon brand items. It’s worth being wary and skeptical given the evidence that Amazon colludes to control a powerful customer by engaging in loss-leading pricing and other forms of aggressive behavior which threaten to create a monopoly, reducing consumer choice, and diminish the vitality of the top export categories in Pakistan.

Using offices outside the country, some local manufacturers and brands already sell on Amazon, with sources expecting that the inclusion in the ASL democratizes platform adoption for small & medium businesses – and their subsequent access to the daily active users on Amazon – including the ability for the Government of Pakistan to finally widen the tax net and collect capital gains taxes from businesses that sell their Amazon accounts.

“There are over a million third-party sellers on Amazon,” said Omer Gajial, the former general manager of category development for North America at Amazon during a webinar hosted by Shoaib Sarwar, the deputy consul general of Pakistan in Los Angeles. “Last year, my team and I undertook a pilot wherein 60 companies from Pakistan were onboarded on Amazon.com as sellers. Then we sorted the shipping of items from the various ports in Pakistan to the rest of the country. The pilot was successful.”

What revenue lift is expected?

Sources told Profit that it is impossible to quantify the revenue lift that ASL will create for manufacturers and brands in Pakistan due to the way in which success on Amazon is created. Sources from Extreme Commerce told Profit that Pakistani brands generated $350 million in the past three years on the marketplace, with an additional billion-dollar rise since the officiation being a reasonable target.

“Almost all our sales are from Amazon,” said Jabran Niaz, CEO of Utopia Industries. Utopia Industries is a textile and steel products manufacturer that is one of the top Amazon sellers from Pakistan. “Our USA company Utopia Deals revenue for the last 12 months is $361 million, we sell around 50,000 units of products daily. We started selling in 2011. Initially, we had to pack each order and that was some effort. Later we shipped inventory to Amazon fulfillment centers, they provided packing services to us that made things easier.”

He told Profit that the ASL development is significant, allowing local garment brands and similar businesses to sell their products at Amazon in various countries where they can use DHL or similar services to ship their products. He added that only a very small percentage of products will be feasible in such a model but these sellers may eventually set up their companies in foreign countries.

“Utopia Industries was formed less than 2 years ago, to move our manufacturing from China to Pakistan,” said Niaz. “This fiscal year ending June 2021, we expect to export around $50 million.”

To improve their discoverability within the platform, Amazon offers a host of advertising tools to help online sellers such as hosting shoppable live streams, using audio ads on the ad-supported and free Amazon Music platform, sponsored posts that appear in the feed of the Amazon app, and more.

The advertising business division has been a consistent source of revenue for Amazon, generating $21 billion in total across the four quarters of 2020, with the latest reported numbers of $6.9 billion earned in Q1 2021 being a 76% growth when compared to the same period last year. As a result of its prominence, sellers on Amazon that use proprietary advertising services have a higher chance of being discovered by the platform’s daily active users and securing preferential treatment.

This aforementioned preferential treatment matters a great deal given the plethora of examples coming out of Daraz featuring third-party resellers scamming hapless shoppers with defective products, false advertising, and poor customer service. According to Gajjal, enough strikes against the benefit of the end customer can lead to even the largest multi-million dollar companies being delisted from Amazon, forever losing their account and access to the CRM database they built.

Manufacturers that are used to business development based on under-the-table dealings may find this shift most distressing and difficult to adjust with, where a privileged class can no longer bank on their family name or subsidies to compete with an algorithm led and customer-centric platform. It remains to be seen whether the meritocracy of ASL sits well with the status quo of the manufacturers in Pakistan.

Much like how the labor unions representing film and television performers nationwide lobby to have fame democratization apps such as TikTok and SnackVideo blocked by the Pakistan Telecommunication Authority in order to limit the competition for endorsement deals, it remains to be seen how large manufacturers seek to influence the commerce ministry on which sellers should be cleared for the ASL.

Paths to success

Logistics

Taking a leaf out of the China playbook with regards to Amazon, Gajjal shared that the state-owned enterprise operating the official postal service of China – known as China Post – knows how to ship eaches and containers, whereas in Pakistan only the latter is prioritized. Gajjal said that manufacturers and brands in Pakistan that hope to benefit from the ASL need to focus on eaches and packets instead of thinking that the container strategy will immediately work for them on an online marketplace.

“Chinese brands did their research on US, European, and Latin American customers with the hope of understanding how to solve the problem of the customer,’ said Gajjal. “While they do worry about their P&L, they understand that first and foremost the need of the customer needs to be understood and how the customer can be consistently served. The Chinese electronics company Anker Innovations earns close to a billion dollars from Amazon alone.”

Speaking with Profit, Niaz said that despite the ASL development, he would not switch his Amazon account to sell from Pakistan due to the high shipping costs from Pakistan to the USA. He added that Pakistani sellers don’t have to pay income tax if they ship from Pakistan and that Amazon will collect sales tax for both local and Pakistani sellers.

Ease of payments

In the event that various infrastructure and power issues create inventory shortages or delay production cycles, there will be a need for brands and resellers to order products from China to make up for the local delay. With the drop-shipping model, when a store sells a product it purchases the item from a third party and has it shipped directly to the customer outside Pakistan.

Due to archaic regulations of the SBP, sources shared that they are unable to pay their suppliers in China due to rules around bringing the purchased stock first to Pakistan, which only raises overheads. The SBP requires an import receipt in order to allow local businesses to pay their suppliers, a rule that should have evolved a decade ago. So while Pakistan is included in the reseller list, this regulation can get in the way of scaling the benefits of the platform, which lobbyists at PASHA are reportedly engaging policymakers on in the coming weeks.

“While it is true that Pakistani’s have sold merchandise on Amazon using businesses registered abroad, the new development means that the dropshipping business model will take off and require legislative corrections from the State Bank of Pakistan to facilitate it,” said Syed Muzamil Hasan Zaidi, founder of one8nine Media. “After experiencing nationwide eCommerce through Daraz, large brands will finally be able to learn a new contactless means of doing B2B sales.”

Customer centricity

He shared that the success of Anker Innovations on Amazon is rooted in customer centricity, listening to concerns, and chasing verified & authentic customer ratings on the marketplace. Gajjal shared that listening to the voice of the customer is an uncommon practice across Pakistan adding that businesses that wish to win with ASL need to shift their business culture towards customer-centricity. This statement mirrors the oft-repeated hypothesis of Extreme Commerce (EC) founder Sunny Ali, who runs a business that helps ordinary people setting up Fulfillment by Amazon accounts.

“Amazon listens to the customers,” said Gajjal. “The star rating of a seller impacts their financials, logistics, and enforcement. Apparel manufacturers from Pakistan need to understand that they cannot trick the system because customers vote and it’s a marketplace. The color on the items sold starts to fade or there is an issue with the size shipped or an issue with the material/fabric used, the negative customer review will trigger an algorithm that attempts to benchmark the average number of negative reviews per million sales across the same product category. If you exceed the mean/median average, Amazon will block your account and question the root of these defects.”

Gajjal added that Amazon will kill seller accounts if it finds evidence of attempts to tamper with the review system with fake or paid reviews, which is a problem the company faces all over the world. In the Pakistan market, businesses recruit various writers through freelance marketplace websites to write fake reviews in order to boost ratings on Google Map listings, Facebook pages, and marketplace accounts.

One of the most prominent destinations for fake reviews is the Facebook group for Pakistan Freelancers, which is known to feature posts of buyers and sellers requesting or offering services to create fake video views, subscribers, and worsen the advertising fraud problem in Pakistan.

“It’s a marathon, not a 100-meter race,” said Gajjal. “On Amazon, there are resellers for Shan Foods masala products but the manufacturer itself is not selling directly on the platform, which – if it were – would be classified as a brand owner, who has greater privileges on the marketplace than the reseller.

Branding

Given the tremendous emphasis on product detail pages (PDP) and quality image photography on Amazon, Profit expects that services such as Brandverse will have a competitive advantage in the Pakistani market in providing images with speed and scale, cross-benefiting with listings on Chikoo.

“Our largest manufacturers know how to create products, they may even understanding branding, but the science of presentation and positioning on Amazon is very valuable now,” said Aisha Humera Moriani, Joint Secretary at the Ministry of Commerce & Textile. “If we use this opportunity to grow our exports, particularly those products that are made in Pakistan, that can be a success story for us.”

A 2020 survey from GroupM of over 200 marketers and 500 online shoppers concluded that the former group values the PDP for its important role in driving conversion. Nearly 45% of the consumer group indicated that they visited a PDP at the time of purchase while 41% of those said PDPs had the biggest influence on their purchase. As stated many times over by Brandverse founder Raza Matin, high-quality images lift trust which in turn increases the chances that a casual shopper will turn into a customer.

“The detail page with rich content has a conversion that is 30% higher,” said Gajjal. “Amazon has its own standards that photographed products will have a white background, standards on the types of claims that can be made, and video that will be attached to lift chances of conversion.”

Any business that competes on price as a means of luring customers is a commodity, whereas brands compete on value and the story they help customers tell themselves or others about themselves. Even if manufacturers in Pakistan learn to accept that they need to invest millions of dollars into brand development and an omnichannel presence, the Pakistan market itself is scarce in professional services firms that can help with doing so.

At present, very few brand strategy consultancies operate in the Pakistan market, understandable due to the price-centric mindset around product commodification, hence the absence of high demand for the service. Leading brand marketers in Pakistan named a handful of service providers such as Penumbra, Designist, Madvertising, and KBW as being among the few leading players that offer full-service strategic brand consulting and design services.

“It is not easy,” said Niaz. “There are ten million sellers at Amazon and they are very smart and competitive. You must learn Amazon selling very well and then start with low competition products and slowly make your way up.”

Pricing

“The general rule of thumb for customer acquisition at Amazon can be somewhere between 60-70% of the selling price which includes product cost plus shipping cost plus Amazon storage cost plus Amazon referral cost plus FBA fees,” said Atif Ahmed, the sourcing lead at EC.

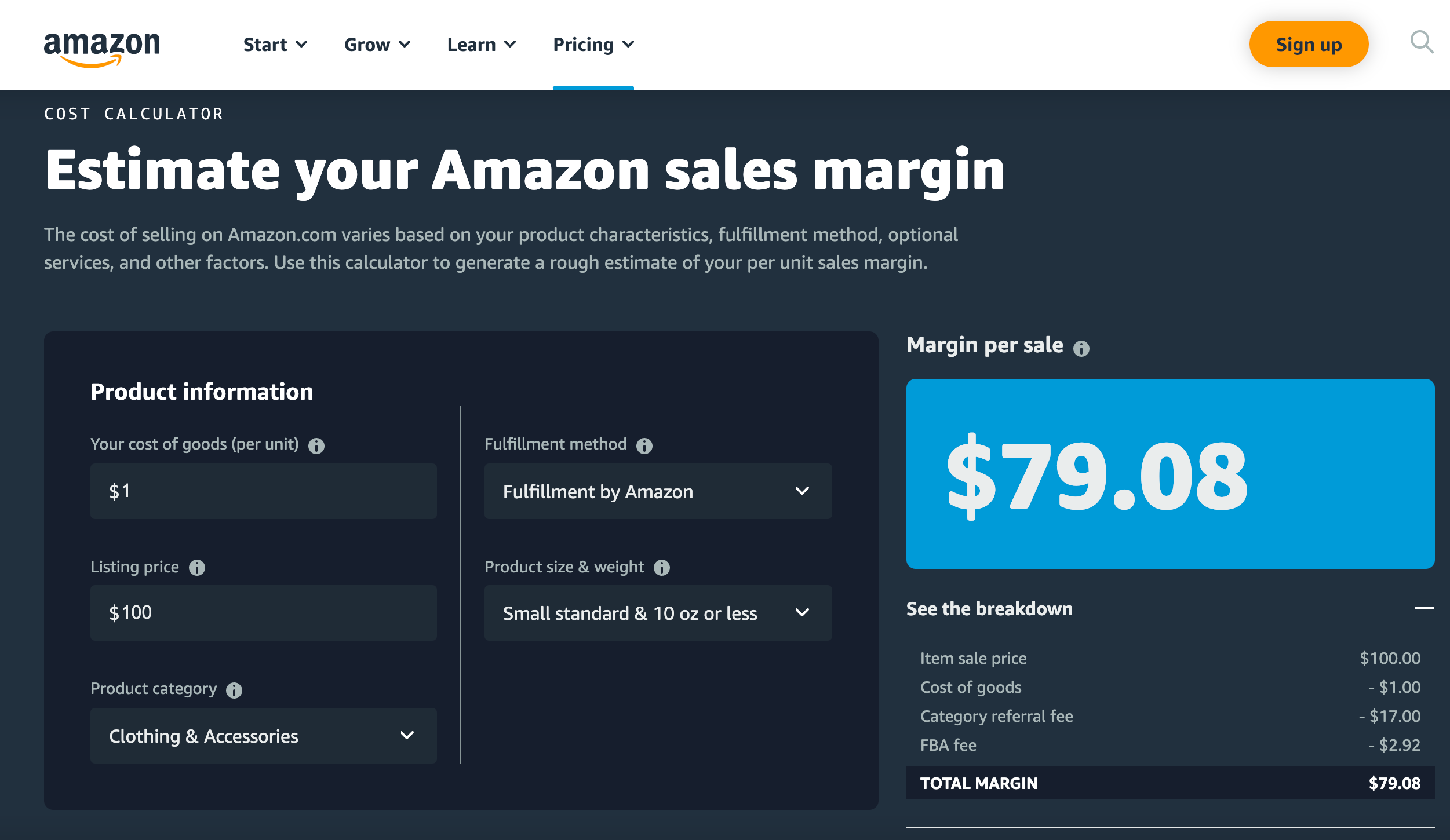

According to an Amazon sales margin calculator, a hypothetical clothing business with a selling price of $100 for a ten-ounce package and a cost of good per unit of $1 that uses FBA will keep $79 in margin per sale after a $17 category referral fee and an FBA fee. When being mindful of the pricing tiers used for apparel in Pakistan, how feasible will this be with the eaches approach? Businesses that are vertically integrated across their supply chain are likely to benefit the most despite these challenges.

In Competing with Complementors: An Empirical Look at Amazon.com researchers from Harvard University and the University of Oklahoma concluded that when working with platform owners, sellers must take value capture into account when building businesses on platforms. As platform owners are often strategic players, sellers need to understand the incentives and capabilities of platforms and not treat platform-based markets as being like regular markets.

”A high return rate is an indicator of problems with product quality which in turn reflects dissatisfaction amongst customers, hence strict check on product quality is important to ensure low return rates,” said Hameer Ali, general manager of EC. “Amazon, however, recommends staying within 4% breach of which could result in account suspension. “Amazon charges a basic fixed monthly subscription fee, commission on every sale, and a fixed fee for pick, pack & ship services which depend on the size of the product, along with Inventory storage costs which may cost approx 1-2% of the product selling price.”

Stranger danger

The antitrust implications of platforms introducing their own competing products have been well documented, with Amazon being no exception. The antitrust cases against platform companies such as video game consoles, smartphones, online auction markets, search engines, and social networking

Sites that pushed successful products out of their markets, not by competition, but by choosing to compete directly with the registered sellers.

In 2008, Apple denied the sale of Podcaster on the App Store because it duplicates the functionality of iTunes. In 2012, the Mountain Lion operating system update by Apple rendered ten popular competing apps obsolete. The creation of Internet Explorer and Windows Media Player by Microsoft extinguished Netscape and Real Networks. Platform intermediaries operating in two-sided markets seek to profit by transferring surplus from the seller to the consumer. When the growth on one side of a matched market induces growth on the other, exploitable surplus is created, much to the dismay of antitrust regulators.

Academics have documented that when a product category enjoys a combination of high sales, good reviews, and the absence of the Amazon fulfillment service, Amazon will enter 3% of those spaces over a ten-month period. Research finds that Amazon is less likely to enter product spaces that require greater seller effort to grow.

“Our empirical evidence suggests that Amazon’s entry strategy is likely premised on acquiring new information after forming partnerships with third-party sellers,” said the researchers from Harvard University and the University of Oklahoma. “Using propensity-score matching to compare products affected and unaffected by Amazon’s entry, we find that entry increases product demand and reduces shipping costs, and affected third-party sellers are discouraged from growing their businesses on the platform.”

It is, therefore, imperative more than ever that third-party sellers that choose to have a presence on Amazon invest in building a brand that competes on value more than it competes on price, and that significant heed is paid to the oft-repeated advice of Profit to create owned commerce points of sale as a means of collecting first-party data and turning customer retention into a science. An upcoming paper from the Anderson School of Management will help businesses convert sales rank data into sales quantity, which can be used to understand the top margin categories with inelastic demand.

Additional reporting by Ariba Shahid and Taimoor Hassan

That’s Good.

The giant e-commerce store Amazon, by marking Pakistan as a seller, it’s enough alone to uplift the consumer’s confidence. There is surely a flavor of intangibility in it let. Nevertheless, the savory aroma is already in the air.