In the last full year of its term, the PTI government has managed to land itself back to the same position it was in at the beginning, back in 2018. Once again they are looking at a severe adjustment to control a ballooning current account deficit, a raft of deeply popular tax measures to shore up the fiscal equation and continued hikes in interest rates to curb inflation. In short, once again they have to apply the brakes to growth in order to manage growing macroeconomic instability, and along the way pay the political price that comes with such measures.

Look at the projections for the current account deficit (CAD) in the remaining months of the fiscal year, running from January to June 2022. In line with the State Bank’s projection, the CAD is expected to reach $13 billion by June 2022 according to the IMF. At the same time, gross official reserves stock is expected to hit $21.2bn, when it currently stands at $17.7 (including the one billion dollar each from the IMF tranche and the recent Sukkuk flotation).

Now consider this. The CAD has already reached $9bn in the July to December period, meaning it can only rise by another $4bn at best in the remaining months of the fiscal year to remain within the program projection. This means an average monthly CAD of $666 million for the next six months where it has averaged $1.5bn per month so far. How is such a sharp deceleration in the CAD to be achieved?

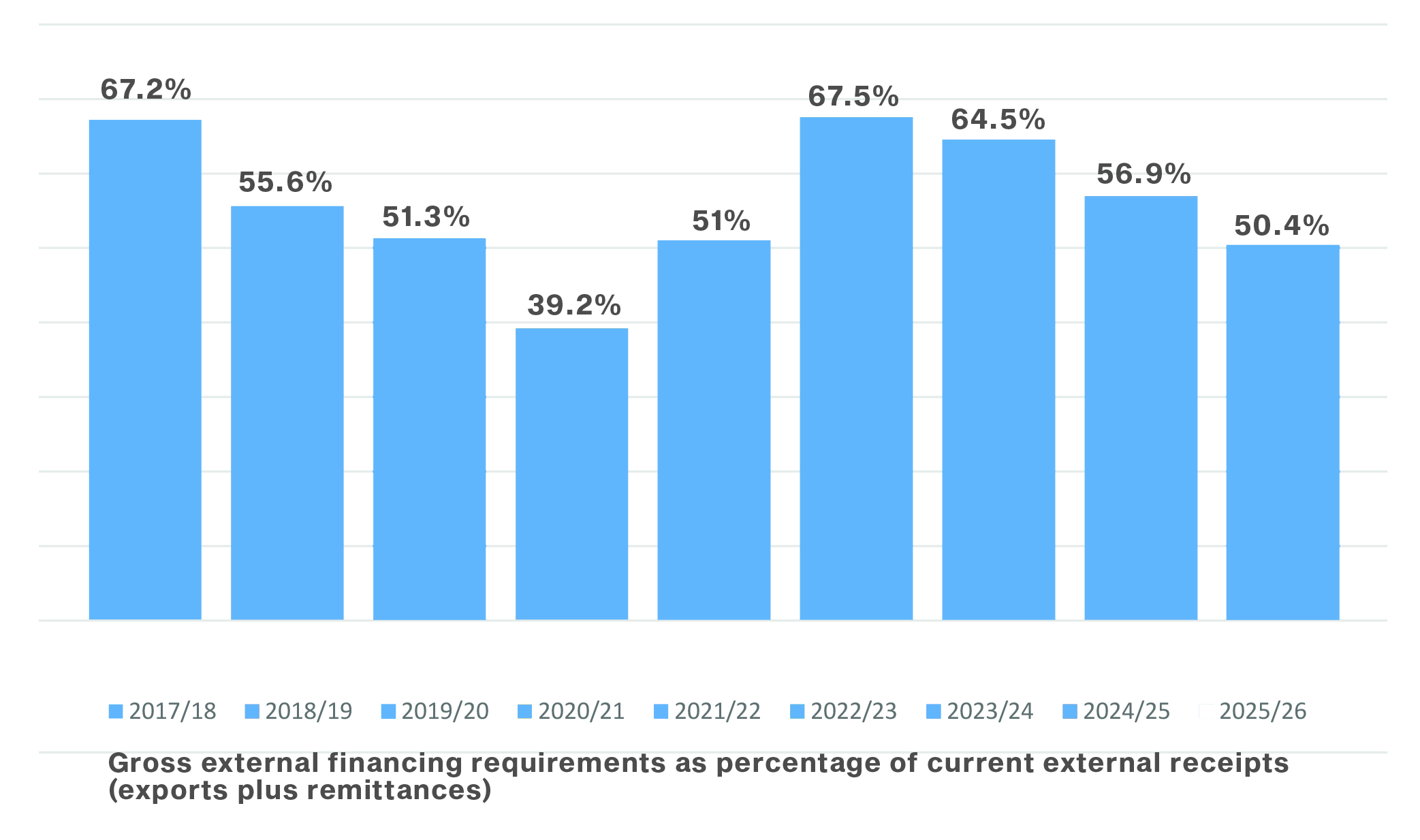

The only way would be through a sharp deceleration in the trade deficit. But the program projects anything but a deceleration. According to the original projection on trade deficit (goods, services and net income) for FY2022 made back last April this deficit was supposed to come in at $34bn by this June. In the projection made in the latest document released on Friday, this amount will be more than $45bn. For the next few years it is projected to remain around this level, meaning the additional import requirement that the economy has added since April last year now has to be carried through more stringent reserve accumulation measures. Perhaps this partly explains the sharp jump in the external financing needs, the near unseemly urgency of the government to borrow (lifting a billion dollars from international markets at exorbitantly high interest rates even before the IMF program had been approved by the board).

The government’s stint in power began with the country facing a massive current account deficit and a troubled approach to the IMF for immediate assistance. It took them nine months to get an agreement on a Fund program, and jettison their star finance minister – Asad Umar – along the way. From November 2018, when the negotiations began, till July 2019, when they were concluded with Hafeez Shaikh’s signature, the government cut a difficult path trying to water down the scale of the adjustment the fund was demanding and soften some of the conditions. Nine months later they signed on the dotted line, after removing their finance minister and bringing another one in.

To read the full article, subscribe and support independent business journalism in Pakistan

The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account.

Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.

Deeply popular?! I surely think not.

A very good analysis, but does the PTI government has any road map to come out of the economic crisis, in my opinion its a big NO.

I think the writer here exaggerates a lot and does not take into account the rising global commodity prices. The global economy’s rebound on the back of stimuli provided by respective central banks along with check on crude supplies by the OPEC+ and the surge in gas and RLNG prices is the deriving factor behind current commodity spike. In normal global circumstances, current numbers for exports and remittances are more than enough to offset the increase in import numbers. So much for a senior economist.

love it keep it up thanks for sharing keep posting