It is a simple problem. Pakistan relies heavily on imported fuel sources such as reliquified natural gas (RLNG) to produce electricity. Whenever there is an international crisis, such as the Russia-Ukraine war, Pakistan’s energy sector is rocked by the ripple effect. There is a simple solution. Cheaper fuel — something like coal perhaps. And the source is right there too. Spread over more than 9000 km2, the Thar coal fields are one of the largest deposits of lignite coal in the world — with an estimated 175 billion tonnes of coal that according to some could solve Pakistan’s energy woes for, not decades, but centuries to come.

The question is, if this rich natural resource is available, why has it not been utilised more than it is currently? Discovered in the early 1990s by the Geological Survey of Pakistan (GSP), Thar Coal accounts for around 660 MW of electricity produced in the country. The potential is much greater. If new projects that are currently under construction become operational, in the next year electricity production from the Thar coalfields is expected to increase to as much as 2000MW.

In short, Thar Coal offers a cheap, alternative, local source of energy that can be used to produce electricity and help Pakistan escape its topsy-turvy reliance on international markets to maintain its energy supply. Of course, choosing to rely on a fossil fuel like coal comes at a price. It is one of the most environmentally damaging sources of energy there is, and will give pause to environmental scientists — particularly given the state of the smog-addled Punjab region.

But let us be very real here. Environmental reasons are not why the potential of the Thar coalfields have not been realised. In fact, in the wake of the current commodity supercycle, the government has attempted to increase its already existent reliance on coal as an energy source. To do that, the government is relying on imports of coal. And while this is a queasy thing for environmentalists to think about, if coal is going to be used to produce electricity in Pakistan, it might as well be domestic coal rather than imported coal — at least electricity will be cheap that way.

Pakistan is continuing to import its fuel sources to produce energy because it has been unable to build the necessary infrastructure that would be required to use coal from the Thar fields. So what will it take, and how good of an idea is it?

The state of the sector

It starts with the dams. Pakistan is, for the first time since at least the completion of the Tarbela dam in 1976, on the precipice of having a majority of its electricity generation coming from imported primary fuel sources rather than domestic ones.

Following the Indus Water Treaty in the 1960s, immediately began working on the Mangla dam, on which construction started in 1961 and ended in 1965. The much larger, and more ambitious Tarbela dam was constructed between 1968 and 1976.

The truly mind-blowing fact about these two dams? If every single coal-fired power project in Thar came online today, all of them combined would produce less electricity than Tarbela and Mangla. These two dams – and the spree of dam construction that followed over the next two decades – meant that the bulk of Pakistan’s electricity needs were met by clean, domestically produced hydroelectric power plants. Yes, in the 1980s, the government began setting up oil-fired power plants, but the vast majority of Pakistan’s electricity came from water until at least the early 1990s.

What followed on from now was a string of bad decisions beginning from setting up IPPs reliant mainly on oil, and then in the early 2000s the Musharraf Administration decided to convert at least some of that thermal power generation capacity from imported oil to domestic natural gas, under the assumption that Pakistan had abundant domestic reserves.

Throughout this time, coal was not a priority, even though the Thar fields had been discovered in the 1990s. “The total reserves from Thar Coal are more than the combined oil reserves of Saudi Arabia and Iran. The reserves are around 68 times higher than Pakistan’s total gas reserves. Compared to this potential the current utilisation of Thar Coal in the total power generation mix is less than 10% which means that there is huge opportunity to expand in this sphere,” explains Amir Iqbal, CEO of Sindh Engro Coal Mining Company.

“That means Thar Coal has the potential to produce approximately 100,000 megawatts of electricity for 200 years – enough to make Pakistan self-sufficient in the energy sector.”

In fact, it would not be until 2013 when the Nawaz Sharif administration introduced power plants reliant on imported coal. For more details of what happened to lead Pakistan to where its energy sector is, read: The end of cheap energy.

What matters is that we are currently in a situation where we are dependent on RLNG. When RLNG was introduced into Pakistan’s energy mix, it was relatively cheaper and also environmentally friendlier than coal. Although long-term agreements with Qatar still provide gas at a relatively affordable rate, the spot market is a blood bath.

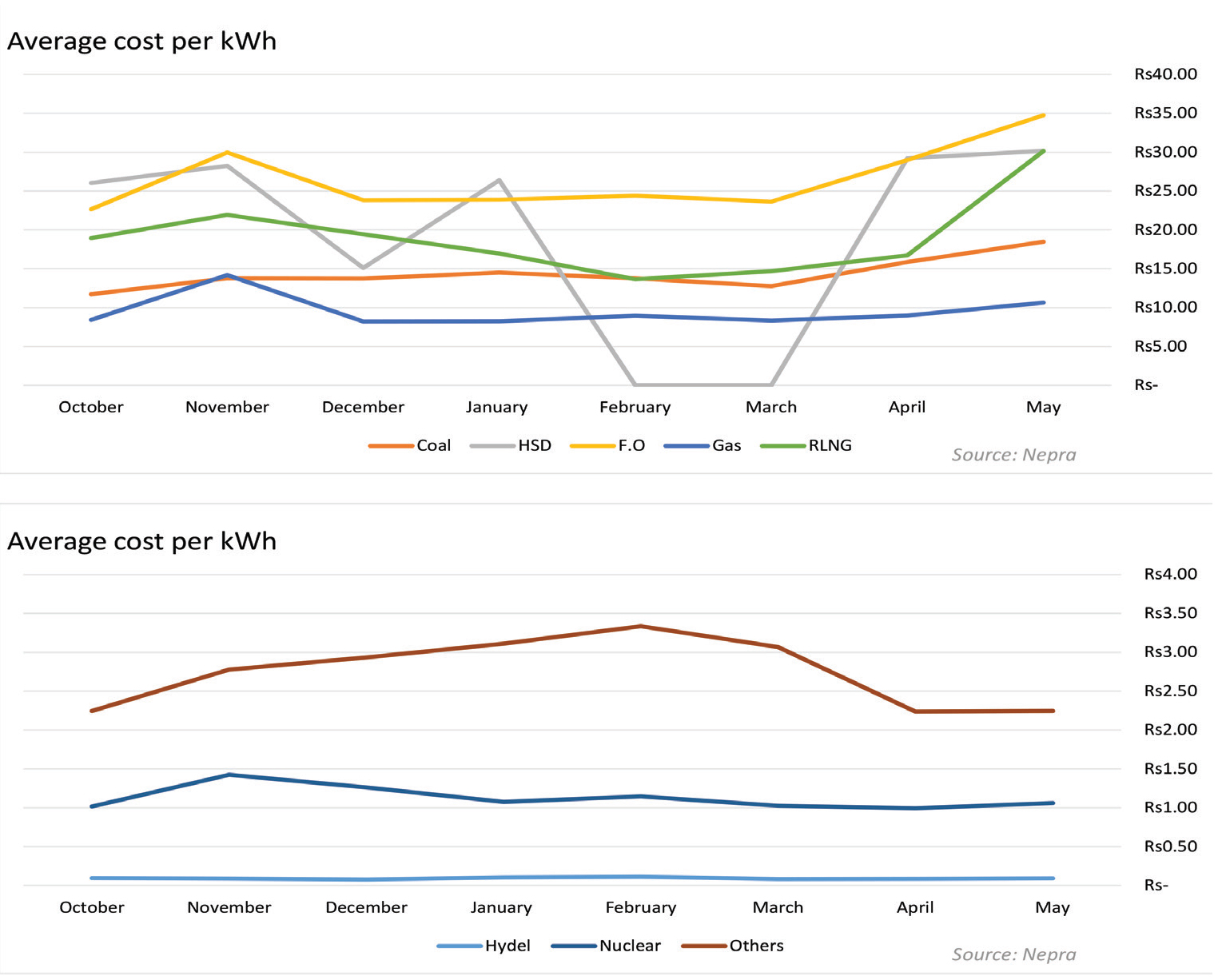

Pakistan has been turning more and more to the spot market to address the growing local demand for gas. Considering the data published by Nepra in the monthly fuel charge adjustment reports, RLNG at its lowest point in the past nine months in February cost Rs 13.65/kWh, whereas in June the costs rose to Rs 29.87/kWh.

The average cost of gas is rising at a very rapid pace, as this particular fuel is in short supply due to the war in Ukraine. Sanctions imposed on Russia have crippled the global energy supply chain as Europe is attempting to shift to RLNG, which is transported via specially designed ships, not to be mixed with the piped gas being supplied to Europe by Russia.

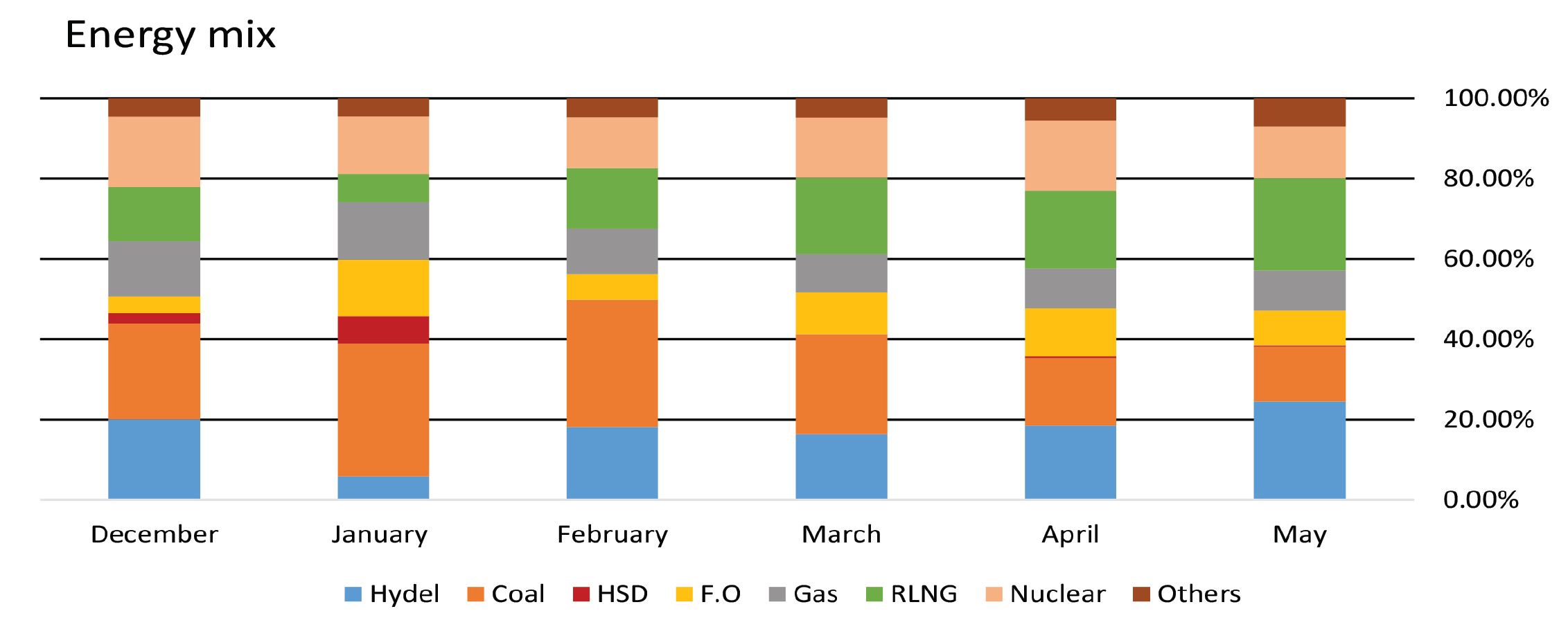

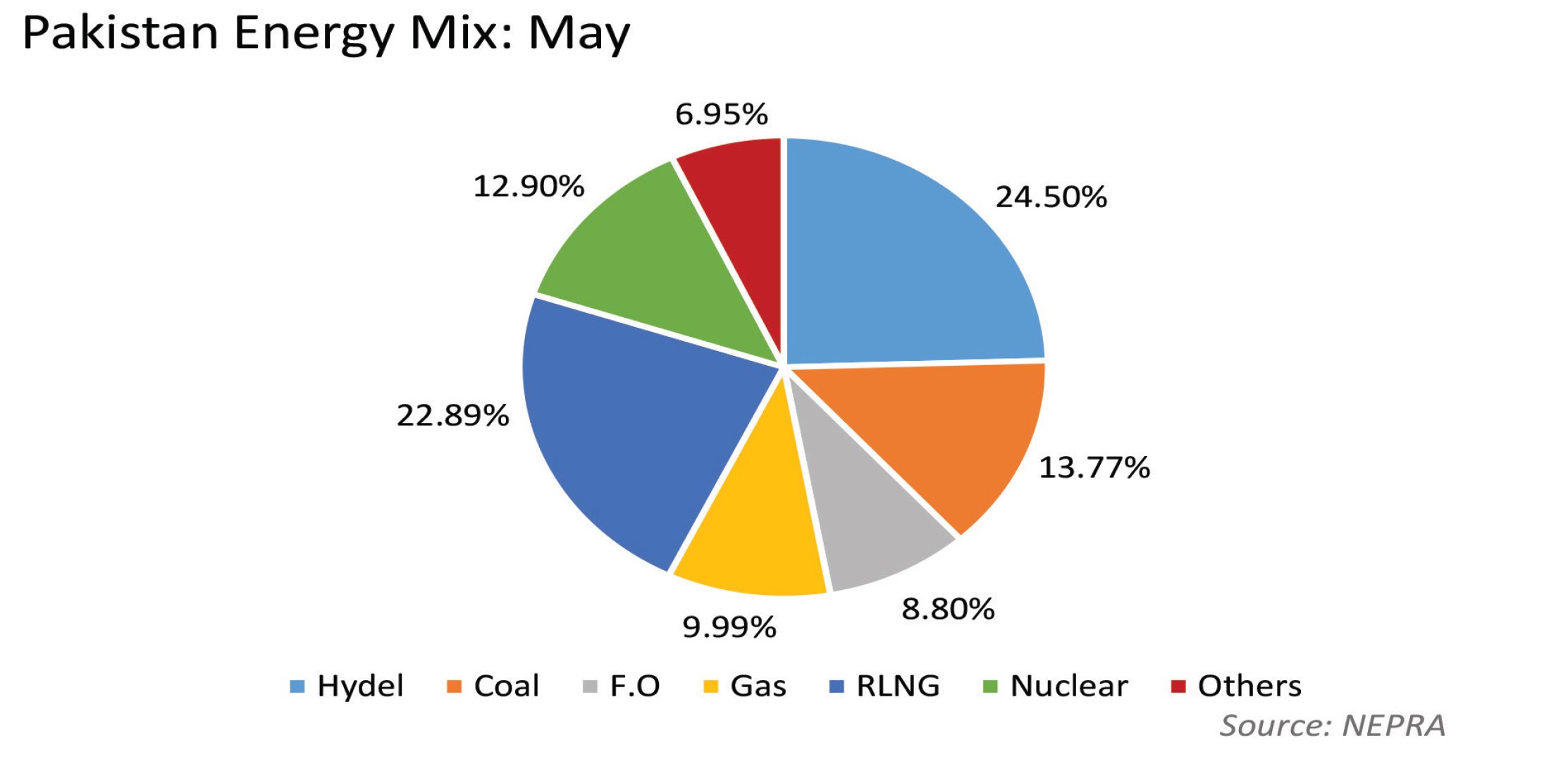

Now, RLNG is a significant contributor to Pakistan’s electricity production. Enough so that the rising price of RLNG on the spot market has caused havoc in Pakistan. RLNG on average has amounted to 17.73% over the course of the past 10 months. This is a considerable contribution to the grid in terms of electricity; the inability to secure any new cargoes at affordable prices threatens the already fragile energy situation of the country.

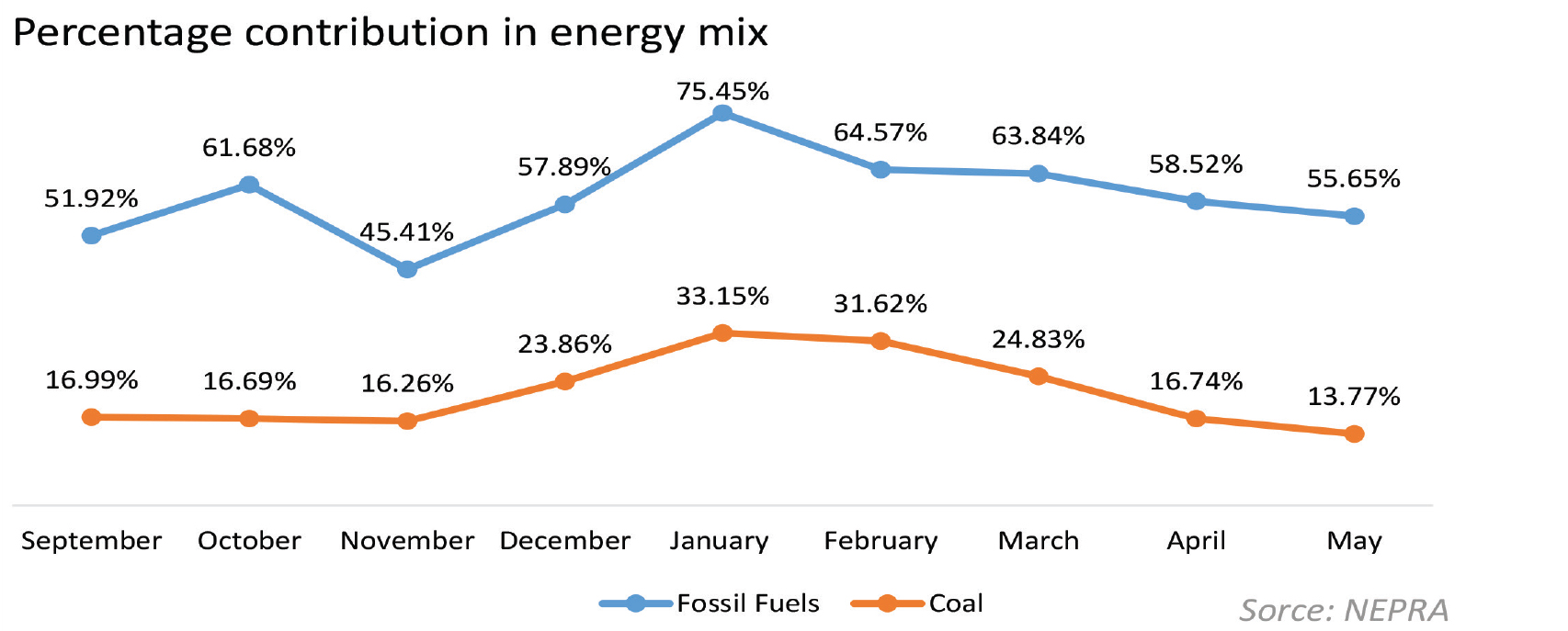

But it is still not the Most of the electricity produced in Pakistan is done through fossil fuels. From September last year to June of the current year, fossil fuels on average have accounted for about 60% of our energy production, as per Nepra fuel charge adjustment reports.

If we look at the average cost per kilowatt hour (kWh) an upward trend is visible. However, compared to the cost of electricity generated using other fossil fuels, coal is a lot less expensive. In fact, it is the cheapest after local gas. At the same time, the adverse impact on the environment is higher.

On average, coal costs Rs 15.17/kWh and local gas ends up at about Rs 9.5/kWh for the recorded period. Local gas is depleting at a very high rate and hence our reliance on RLNG has been increasing over the past decade.

Coal plants in Pakistan

But then why aren’t we using more coal, particularly the domestic kind? To get a better understanding of Pakistan’s position on coal plants, it would be prudent to understand how many plants we have and how much they contribute to the national grid. At the moment the country is running five operating coal power plants owned by; Thar Engro Coal Power Project (Thar, Sindh), Lucky Electric Power Company Limited (Karachi, Sindh), Port Qasim Electric Power Company (Karachi, Sindh), China Power Hub Generation Company (Hub, Balochistan) and Huaneng Shandong Rui Group (Sahiwal, Punjab).

Apart from the Engro coal power plant in Thar, all other plants are currently relying on imported coal to produce electricity. Although it must be noted that the Lucky Electric power plant is configured to use domestic coal; it is temporarily importing coal and will shift to coal extracted from Thar once the second phase expansion of the mine is completed.

Data from the Nepra website indicates the contribution of coal in the overall energy mix fell significantly after February 2022. This was primarily due to the fact that Engro’s Thar coal plant as well as the Sahiwal coal power plant owned by a Chinese firm were both inoperative. It contributed to the overall energy shortage in those months.

The Engro plant had stopped producing electricity earlier in the year due to a major technical fault resulting in an explosion, whereas the Sahiwal plant was unable to procure coal, industry sources told Profit. The combined capacity of these plants is 1,980 MW. They however are expected to be back online over the year and the contribution of coal will increase.

However, imported coal will still be a problem. Coal was priced at $200-250 per tonne before the Russia-Ukraine war, and as of August 17th it costs $400-450 per tonne, a monumental increase of about 80%. And that takes us to Pakistan’s indigenous coal option: Thar coal.

Thar coal

Amir Iqbal, CEO Sindh Engro Coal Mining Company (SECMC), told Profit that “The recent global supply chain disruptions have brought to light how Pakistan’s reliance on imported fuels is detrimental to its long-term economic growth,” says Engor Mining boss Amir Iqbal. “The country’s energy mix needs an urgent overhaul with more indigenous sources like Thar Coal added to it. This will save precious foreign exchange reserves and put Pakistan on the path of sustainable energy security.”

“This is one of the major advantages of using Thar Coal, as it is the most economically viable source of fuel for the country. Thar coal expansion could also provide a huge relief for FOREX reserves of Pakistan with savings of approximately USD 2.5 billion, while it will result in the reduction of more than PKR 100 billion in circular debt on an annual basis.”

The potential, of course, is huge. “Currently, Pakistan is generating around 660 MW of electricity from Thar Coal. Within a year, the electricity generated from Thar Coal is expected to increase to 1,800-2,000 MW when new projects currently under construction become operational. Particularly, power projects on indigenous coal are promising a cheaper future for the country,” according to a statement given to Profit by HUBCO.

As of now, there are only two power plants configured to use domestic coal, having a combined capacity of 1,320MW. The power plants owned by Thar Engro Coal Power Project (660MW) and Lucky Electric Power Company (660MW), both are considered to be critical for the grid. Although the Lucky plant, located at Karachi’s Port Qasim, is currently utilising a blend of imported and domestic lignite coal, the impact on the overall forex savings is still noteworthy.

Talking to Profit, Hubco also said that it is expected that another two power plants owned by the company, namely Thar Energy Ltd and Thal Nova Power Thar (Pvt) Ltd would come online within a few months. Both of the plants would be operated by HUBCO and utilise domestic coal adding a further capacity of 660MW.

Another 1,320 MW power plant at Thar block 1, which was conceived even earlier than Engro’s project, would also be operational later this year, said Shamsuddin Shaikh, CEO National Resources Limited, and an expert in the sector. These delays have been hugely detrimental for Pakistan’s economy.

“Sindh Engro Coal Mining Company (SECMC) is operating the country’s first open pit lignite mine in Thar Block II with the current mine capacity of 3.8 Mt/a providing coal to Engro’s power plant producing 660MW of power for the country as of today. As the mine expands and doubles its capacity to 7.6 MTPA by end of this year it would help add another 660 MW to the grid making the cumulative total to 1320 MW. As the project in Thar Block I comes online, another 1320 MW will be added to the grid,” says SECMC CEO Amir Iqbal.

“Over 65% of Pakistan’s electricity is generated using imported fossil fuels, which exposes us to international supply chain shocks and fuel price fluctuations. The long-term solution for this problem is to increase the reliance on local sources of fuel such as Thar Coal, exploring alternate sources of natural gas, expanding hydel power plants and other sources of renewable energy”.

The inability of the government to promote domestic coal is a critical factor in the underutilisation of Thar coal. He said that the government was advised to increase the reliance on domestic coal back in 2016-17, this could have been possible by retrofitting coal plants with the ability to process a blend of both imported and local coal.

The existing plants can accommodate a blend of imported and domestic coal in certain ratios, without undertaking major capital expenditures to retrofit plants. However to convert completely to domestic coal would require the companies to incur capital expenditures for altering the configuration of the plant.

Using domestic coal to produce electricity would be one way to save precious dollars, according to HUBCO officials, it is estimated that Pakistan has been able to save foreign exchange worth $200 million since the commercial operations of first Thar coal plant i.e. Engro Powergen Thar Limited.

Imported vs domestic

The difference in the cost of producing electricity from domestic coal and imported coal is substantial. The cost of producing electricity from the Engro plant, which uses domestic Thar coal, is Rs 10.44/kWh, whereas the Lucky Electric plant which uses the same type of coal (lignite) but imports it costs Rs 20.92/kWh, according to data from Nepra’s latest monthly fuel cost adjustment report.

The other three coal plants, which use imported coal, owned by Port Qasim Electric Power Company (Karachi, Sindh), China Power Hub Generation Company (Hub, Balochistan) and Huaneng Shandong Rui Group (Sahiwal, Punjab), cost Rs 25.94, Rs 24.96 and Rs 28.88 per kWh respectively.

As per information received from HUBCO: “The current price of Phase I of Thar coal is around USD 65/tonne which is significantly lower than the imported coal price of approximately USD 400/tonne. As the mine will be expanded with Phase II and Phase III becoming operational, the economies of scale will further reduce the cost of coal to approximately USD 27/tonne, resulting in an overall lower cost of electricity generation.”

“One of the major advantages of using Thar Coal, as it is the most economically viable source of fuel for the country. The coal expansion could also provide a huge relief for Forex reserves of Pakistan with savings of approximately USD 2.5 billion, while it will result in the reduction of more than Rs 100 billion in circular debt on an annual basis” says Amir Iqbal.

The Phase II expansion of the mine is set to be completed later this year coinciding with the new coal power plants scheduled to be operational later this year as well. This can be seen as a huge development for the economy as it would help in decreasing reliance on imported fuels.

Ideal vs workable

In a discussion with Profit, Zofeen T. Ebrahim, an independent journalist, known for her dedicated contributions to areas of environment, and her interest in renewables stated that, around the world, the global energy crisis is compounded with climate-related disasters prompting developed countries to shift to renewable sources. It can mean the end of the dominance of fossil fuels. With plenty of sunlight and wind, Pakistan has the good fortune of transitioning and riding the renewable energy wave, she believes.

Ideally, Pakistan should be moving towards renewable energy, or at least more environment-friendly fuels, is the unanimous opinion that different stakeholders have voiced in discussions with Profit. However, as the situation stands, the world is running low on gas, and prices are spiking, hence necessitating a strategy that can insulate Pakistan’s energy sector from international price fluctuations. Data published on the Nepra website corroborates the fact that renewable energy is cheaper, and because renewables require no additional fuel to run they would free the country from expensive fuel imports.

An economist, Dr. S. M Naeem Nawaz, an expert in tariff determination, while talking to Profit says, “the only way forward should be to align the power policy with the global climate change vision by focusing on renewable resources (primarily hydel and solar) to transform the primary fuel mix from fossil fuels to renewables in the long run.”

Another relevant point is made by Rahmat Kamal Ghanghro, legal expert on energy and natural resources with over a decade of experience in the sector. “To break the country’s addiction to imported fossil fuels, renewable energy and Thar coal are necessary components of a well planned out energy mix. The current account deficit and global fuel dynamics have reinforced that reliance on imported fuels is not sustainable,” she explained.

When asked about the role Thar coal can play, Ebrahim said that in the interim, indigenous Thar coal could make a huge difference in securing the country’s economic and energy requirements. However, it must be underscored that a comprehensive renewable energy plan must be developed at an accelerated pace to eventually replace fossil fuels forever.

But, practically speaking, she believes that if emission reduction requirements are raised now for projects which are already in the pipeline, the end user would have to bear the brunt of the costs. The fact of the matter is that the planning process related to these strategically vital projects has to be majorly revised, all factors and stakeholders have to be involved and be on the same page to make emission reduction a priority in our national psyche.

In response, even SECMC has acknowledged the reality of coal. “As a company we never deny that coal is not the best source of fuel but considering the needs of the country and for its sustained economic growth; developing coal and other sources of indigenous resources is the need of the hour,” says the SECMC CEO.

“Over 50% of the total power generation of China, over 40% of total power generation of India and over 25% of the total power generation of Australia relies on coal amongst other developed countries of the world. These countries have realised the need of going back to coal and Pakistan should also follow suit by prioritising the energy security of the country. It is pertinent to say over here that the contribution of the Thar Coal power project to the overall carbon emission of Pakistan is less than 0.10%.”

The way forward

Maintaining energy security all while ensuring sustainability and affordability is a very tough nut to crack, countries around the world have made a lot of headway, yet there’s a long way to go globally.

In the context of Pakistan, energy security has been a question of the ages. As far as public policy and government initiatives go most of them have lacked oversight and have failed in adopting a long-term approach on the issues of energy.

Regardless, discussions with stakeholders and experts have all ended on the same note; the most economically feasible and sustainable approach would be to focus on renewables and Thar coal. Utilising domestic resources rather than relying on imports is invaluable to forex reserves in the long run.

Additionally, it would significantly bring down the cost of electricity, based on calculations of Rs/kWh of electricity mentioned earlier in the article.

At the same time, the environmental impact of burning coal is a real and present danger but that requires mitigation through policies.

Renewable energy such as wind and hydel energy cost significantly less than even Thar coal, but also have limitations. For starters, renewables are unreliable sources to handle the base load, which is the minimum demand of electricity over a period of 24 hours. Electricity being produced by wind or solar farms is susceptible to variations in efficiency based on weather conditions and time of the day. Additionally, establishing renewable projects on a larger scale would involve massive capital investments to develop infrastructure.

A working combination of Thar coal and renewable energy can ensure a sustainable long-term solution. The Indicative Generation Capacity Expansion Plan (IGCEP) 2021 also states that, “inclusion of variable renewable energy, hydro and Thar coal will help in lowering the basket price of the overall system thus providing much needed relief, though in the long run, to the end consumers”.

Iqbal, was also of a similar point of view stating that, “by creating a long-term strategy and attracting investors through consistent policy related decisions, Pakistan will come out of its energy crisis and embark on the path to sustained economic growth as cheaper electricity is one of the most essential components of a growing and developing country”.

Though the role of Thar coal in the country’s overall energy mix is on the rise, there is potential for the government to do more and fast track development plans.

If coal is $400 to &500 I would process this coal increase its carbon percentage and sell to international market and later produce electricity from it.

Sir when will this happen . Thar can change Pakistan destiny but our children Will see this change because politician are in the state of war . If you see any channel you Will note that war has been broken in the country . My people my country is destroyed by power crisis ,floods and politicians .

im surprised no analysis was presented on the quality of thar coal vs imported coal .Thar coal is probably half as energy efficient vs imported coal.

But this is sufficient to produce electricity for us . Yes It has half the Colorific value but more than 10 time’s economical than the imported coal . Another advantage of thar coal is we don’t need any dollars for this that is a big problem to our economy. Thar coal can be use for base load where as solar and wind can’t .

I have perused every one of your posts and all are exceptionally enlightening. Gratitude for sharing and keep it up like this.

사설 카지노

j9korea.com