It was a strange sight watching a ranking officer of the Federal Board for Revenue (FBR) receive applause as he took the dais at an event organised by the Society for the Protection of the Rights of the Child (SPARC). What does an Additional Director of the FBR’s Track and Trace Project have to do with advocating for children’s rights?

The answer might surprise you: Big Tobacco. The 1st of June is marked as the international day for ‘No Tobacco’. The event organised by SPARC was meant to raise awareness regarding the dangers passive smoking poses to the health of children. Mr Sarfaraz was present at the event because of a recent achievement by the FBR — they have managed to increase the amount of tax they collect from tobacco producers.

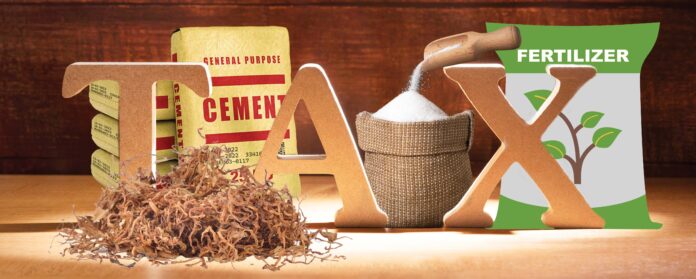

The revenue board claims that behind this success is a ‘Track-and-Trace’ or ‘T&T’ system that they have been in the process of implementing since late 2021. And it isn’t just tobacco. As part of Pakistan’s commitments to the IMF, T&T systems have been introduced in the cement, fertiliser, and sugar industries as well in addition to tobacco. In fact, sources within the FBR have told Profit that by their estimation they can collect around Rs 200 billion tax by implementing T&T in five sectors including petroleum, tea, pharmaceutical, tyres and spices. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

In the fertilizer example, if the T&T system is missing bags why is the manufacturer is worrying about the efficiency of the system; has he not just have to pay a less tax?

Weak analysis and a lot of misinformation. T&T is a instrument for production monitoring. FBR should have restricted it to Tobacco and Sugar only. Vendor selection was flawed and controversial that was prevented by Courts multiple times but FBR powered on to appease the hybrid regime. Nothing wrong with the principle of T&T in fact Pakistan is obligated to implement it as a FCTC Protocol member for tobacco control. Was it suppose to result in higher tax revenue is a subject of Enforcement/Audit/Recoveries which is a completely different subject and a systemic problem (not restricted to T&T)