K-Electric has a new owner. The sale happened quietly, and nearly 14,000 kilometres away in the Cayman Islands, far away from Pakistani regulators and investors. With very little fuss and almost completely out of the public eye, Pakistan’s only vertically integrated utilities company changed hands from the infamous Abraaj Group to a little known company by the name of AsiaPak Investments — an energy investment company owned and operated by Shaheryar Chishty.

A former high-flying international banker, Chishty is also the owner of Daewoo in Pakistan and has significant interests in multiple energy projects including mining rights in Block 1 of Thar Coal. Largely a private individual, Chishty has had his eyes on K-Electric for more than a decade. And now that he owns it, he is here to stay.

The transaction was complicated, and it does not mean Chishty has taken control of the management at K-Electric. He has simply acquired Abraaj’s position in the company. So who is the new owner of KE? How did he come to acquire Karachi’s only electricity provider, and what are his plans to turn it around? According to him, the goal behind changing the fate of K-Electric is to look beyond the company and look at the city of Karachi itself and change it for the better. But can he pull it off?

Profit sat down with Chishty for a one-on-one interview to understand what the future holds for K-Electric and where Shaheryar Chishty fits into it.

Parallel tales — Chishty’s story

There are two stories to tell here. The main one, of course, is the story of K-Electric. It is a story that goes back more than a hundred years and has in many ways been told before, including by this publication. There is of course a pretty significant new event in the life of this company: a new owner. And that is the second story that needs to be told. Who is Shaheryar Chishti and what role does he have to play in this saga that dates back longer than living memory? So let us begin there.

In 2011, Shaheryar Chishty was coming back home. For the past 15 years he had spent most of his time abroad as a banker. He moved to Hong Kong in 1997 as an investment banker with Salomon Smith Barney, Citigroup. He spent most of his professional life at Citi, serving in various senior roles including as Head of Asia Industrials Investment Banking, and Head of North Asia Mergers & Acquisitions. From 2009 to 2011 he worked at Nomura International in Hong Kong first as Asia Head of Industrials Investment Banking then also as Global Head of Industrials Investment Banking. During his 18-year investment banking career, Shaheryar was one of Asia’s most prolific deal makers having advised on completed mergers & acquisitions transactions valued at over $60 billion and raised over $18 billion in debt and equity capital.

But by this point he was ready to give it all up. “Around this time I had started feeling there was more to be done. For 15 years I had seen economies grow and become massive from nothing. I constantly used to think of how this could be replicated in Pakistan as well,” Chishty tells us. Sitting in his office right next to Daewoo’s main terminal on Ferozpur Road in Lahore, he is calm and affable. “At the same time Daewoo was a very good client of mine in Korea. They had a business in Pakistan which wasn’t a core business for them and they were looking to get out of the country. Now, I was always talking about Pakistan this and Pakistan that with my clients so they told me to put my money where my mouth and to buy them out. And that was when I took the option and bought them out in 2011.”

It is an admittedly strange trajectory. Before his career as a banker, Chishty was a typical upper class kid from Karachi. His father served in the navy, retiring as an admiral and Chishty went to Karachi Grammar School completing his A levels from there before studying economics at Ohio Wesleyan University in the US. He briefly worked at KASB Securities as an associate right out of college before joining Citibank in Karachi. From here his career was a series of promotions that kept him mostly in Hong Kong but flying all over the world.

So what finally brings the scion of a navy family and a career banker to take on something as large and convoluted as the transport business in Pakistan? “I’ve done some really big deals in my life. I’ve served at very senior positions. When I started thinking about moving back to Pakistan the idea of coming back and serving at another bank really didn’t appeal to me. What I did want to do was pick up an orphan asset, pour some attention into it and make it thrive,” he tells us.

On a fatherly scale, Chishty is on the stoic end of the equation. Speaking to us his voice is stable, his words measured, and his tone calm but confident. He does not quite give the impression of a man interested in rescue missions. Yet as he explains to us, his entire schtick as a banker was working on a lot of companies that are considered “orphan assets” — meaning businesses that are profitable but too small for their parent company to really focus on and hence not doing well.

Investors like Chishty make it their life’s mission to pick up such businesses and turn them around. Daewoo was one such company. Chishty explains this to us calmly and with brevity. The wall behind his desk is littered with pictures of Chishty posing with Chinese officials and senior officers of the Pakistan Army at different project sites of the China Pakistan Economic Corridor (CPEC).

While Chishty is most well known among the public for his ownership of Daewoo, which was also the reason for his return to Pakistan in 2011, his real area of interest lies in the energy sector. In February 2012, Chishty formed and became the CEO of AsiaPak Investments. The company owns Daewoo but two of its other key investments are Thar Coal Block 1 (a CPEC “early harvest” project consisting of 7.8 mln tons per annum coal mine and 1,320 MW mine mouth IPP) and Liberty Power Limited (a 235 MW gas fired IPP).

“More than anything else I was once again backing my orphan asset strategy. I realised very quickly that the energy sector is one area where there is a lot of inefficiency and thus a lot of room for expansion. The electricity consumption in Pakistan per capita is half of what it is in India and South Korea which tells you how much more people would want to use electricity. These are economies that were once in similar positions to the one Pakistan is in today,” Chishty tells us.

“I had a background in finance within the energy sector as well and so we bought power plants in Quetta. They were gas powered and owned by American shareholders who were exiting. We bought this in 2012, sold it in 2016 to some local investors, provided a profitable transaction, and then moved on to our next project which was a gas powered power project in Sakhar which was owned by a Malaysian company.”

And thus Chishty and AsiaPak Investments continued on their merry way. Over the next few years, aside from running Daewoo, the company would invest in a number of energy projects that were down in the dumps, revive them, and make handsome amounts off them. Throughout all of this, however, Chishty had his eyes on one particular company in the energy industry. And that company was K-Electric.

Parallel tales – KE’s story

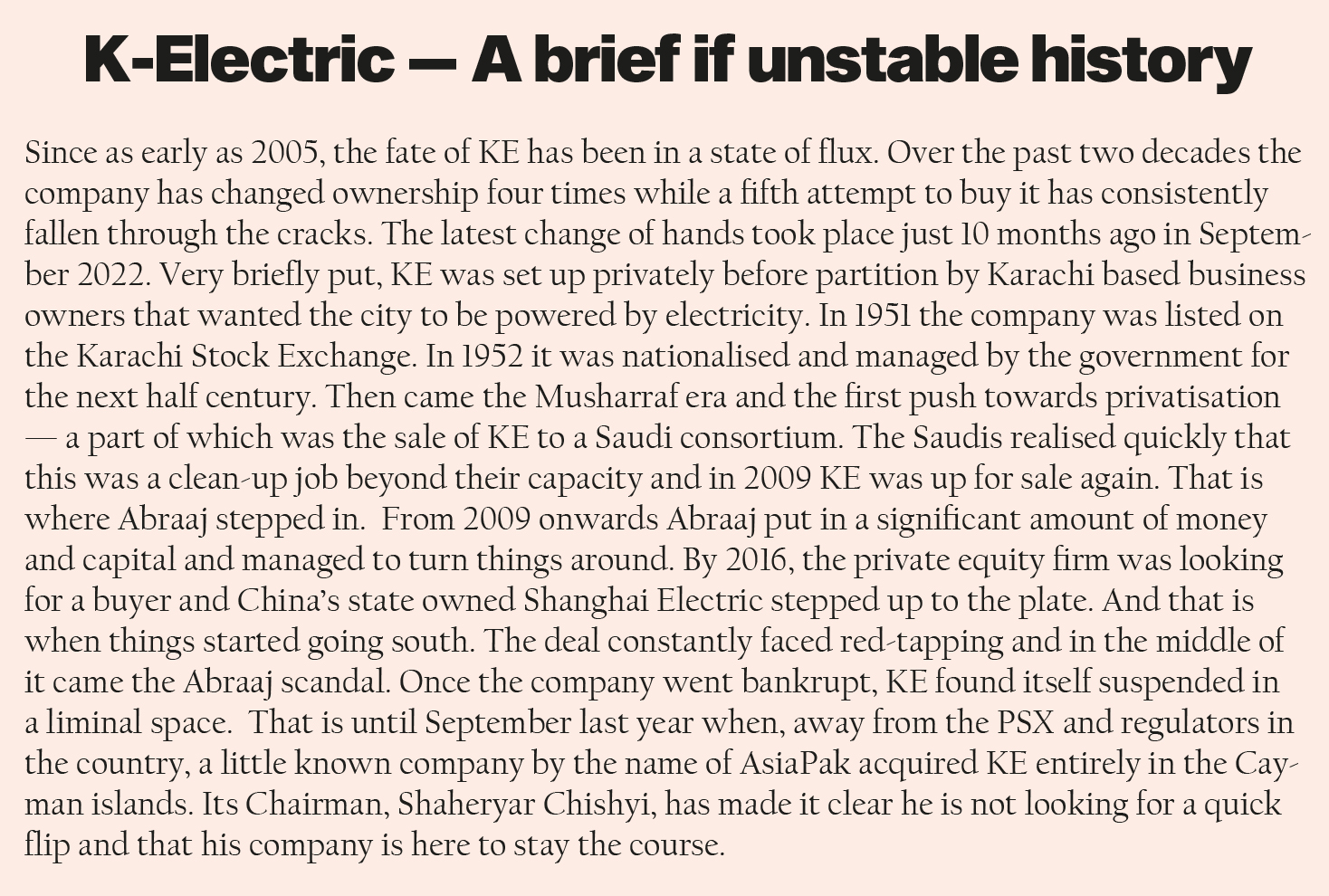

It isn’t really surprising that Shahreyar Chishty was impressed with K-Electric. At the time that he returned to Pakistan, the company was undergoing a massive rehaul under the ownership of Abraaj. The story of KE is one that started with business ingenuity and is now at a point of desperate reform. The brief history of the company was concisely summarised in 2016 by Profit’s then Managing Editor in these words:

“Thirty-two years after Thomas Edison created the world’s first utility company in Lower Manhattan, the Karachi Electric Supply Company (KESC) was founded in 1913 (rebranded in 2013 as K-Electric). It is the country’s only vertically integrated utility, with its own power generation, transmission, and distribution assets. While it is not the oldest utility in the country (the Lahore Electric Supply Company was founded a year earlier in 1912), it is the oldest company to still be listed on the Pakistan Stock Exchange, having first been listed in 1948 on what was then the Karachi Stock Exchange, though the company was nationalised in 1952.

Until the late 1960s, KESC was largely a financially self-sustaining entity. In the 1980s, the company briefly became a subsidiary of the Water and Power Development Authority (WAPDA) and was at one point placed under the management of the Pakistan Army.

In 2005, the Musharraf Administration sold off a 66.4% stake of the company to a consortium of the Al-Jomaih Holding Company, a diversified Saudi Conglomerate, and the National Industries Group, a publicly listed Kuwaiti financial conglomerate (which also owns a large stake in Meezan Bank). For three years, the Saudi-Kuwaiti conglomerate failed to make any headway in turning around the company, finally turning in 2008 to Arif Naqvi, the former Karachiite who had gone on to create Abraaj Capital in Dubai.

Abraaj was already the largest private equity firm in the Middle East by then, and had previously made forays into the Pakistani market before. In October 2008, Abraaj bought out half of the Jomaih-NIG stake in KESC, injecting $391 million into the company. It then began a turnaround effort the likes of which have never been seen in Pakistan before. Abraaj spared no expense in trying to turn around KESC, investing upwards of $1 billion in the company’s power generation and transmission infrastructure, which brought the utility’s power generation efficiency rate from 30% in 2008 to 37% in 2016, and its transmission losses from 4% to 1.4% in the same period.”

It was right in the middle of this turnaround that Chishty landed in Pakistan. “I started my business in Pakistan in 2011 and separately this was also happening with Abraaj and K-Electric. Now, I had nothing to do with K-Electric back then but I was aware of the happenings there because a lot of the people involved were from the same circles as me.”

“I was simply watching from the sidelines. If you play cricket, a good way to understand it is that I was sitting in the dressing room watching Abraaj play a good knock. At the seven year mark, Abraaj said you know what, we have put in a lot of work and it is time to reap our rewards so they put it up for sale. Remember Abraaj was a private equity fund so they were never going to be long term owners.”

And that is when, in 2016, Chishty decided to shoot his shot. At that point, CPEC was at its peak and Chinese investors were deeply interested in putting money into Pakistan. Because of his involvement in CPEC projects in the past, particularly in Thar Coal, Chishty was well connected in China and put together a consortium that would bid for control of KE. “There were Chinese investors, other Asian investors, and a couple others with interests in KE as well but in the end Abraaj ended up receiving a very good offer from Shanghai Electric.”

Shanghai Electric’s $1.77 billion acquisition of $66.4% of K-Electric would have been the second largest acquisition in Pakistani history and the largest in a decade, after Etisalat’s $2.6 billion acquisition in 2006 of management control in Pakistan Telecommunications Company Ltd.

At first glance, K-Electric’s sale by Abraaj Capital is the epitome of a successful private equity-led turnaround story. Indeed. It is the very reason private equity firms came into existence in the first place. A storied company, sullied by bad management but still serving a unique economic purpose, bought out by a skilled private equity firm at its nadir, turned around through a combination of strategic capital investments and modern management techniques, and then sold off in a healthy, relatively unleveraged state to a strategic buyer. And a Harvard Business Review case study to document it all.

But then came the roadblocks. To cut a very long story short, consistent delays on the part of the government meant the Shanghai deal could not go through. Despite a lot of political lobbying on the part of Abraaj’s Arif Naqvi, the deal was dead in its tracks. And then came the crash. In 2019, Arif Naqvi and Abraaj were involved in an international scandal that ended with the company utterly bankrupt. And along with it the Shanghai Electric deal went kaput. For six years Abraaj’s baggage weighed the Shanghai deal down and KE remained unsold. That is of course until a quiet, seemingly normal September day last year.

The sale and all its intricacies

Now this is the important part. How exactly did Chishty go about buying K-Electric? Since KE is owned by Abraaj, which as a company has gone bankrupt, its assets are a little all over the place. Just take a look at the ownership structure of KE. When the Al Jomaih group entered the picture in 2005, they created KES Power Limited (KESP) which was a Cayman Islands company. This company paid the government of Pakistan directly and acquired a 66.4% stake in K-Electric in Pakistan.

In 2009 when Al Jomaih decided to sell, Abraaj funnelled over $370 million in foreign direct investment into KE through the KESP company in Cayman. To date, the US$360 million invested by Abraaj in KE (routed through KESP) remains the only equity FDI invested into KE as new capital used principally to fund capital expenditures driving efficiency. Abraaj’s investment in KE was undertaken through the Infrastructure & Growth Capital Fund L.P. (“IGCF”), a $2 billion Cayman Islands private equity fund with investment contributed by over 100 different international investors, managed then by Abraaj Investment Management. The amounts invested by the Al Jomaih consortium in 2005 were paid directly to the GOP for purchase of existing shares with nil proceeds actually being invested into KE.

So when Chishty wanted to acquire Abraaj’s stake in KE, it could not acquire KE in Pakistan. It had to go to the KESP in Cayman. Chishty’s company, AsiaPak Investments, created a special purpose company called Sage Venture Group Limited (Sage) and registered it in Cayman. Sage then bought out the Infrastructure Growth and Capital Fund LP (IGCF or the Fund), which holds an indirect material stake in K-Electric Limited. These transactions were authorised in proceedings at a court in the Cayman Islands, according to court documents. Further, for the sake of clarity, the Fund does not have a controlling interest in K-Electric nor a controlling position on the K-Electric Board of Directors.

“The ultimate beneficial owner of Sage and AsiaPak is Shaheryar Arshad Chishty who is a Pakistani national. Following the acquisition of IGCF GP shareholding, the IGCF GP has decided to update certain directorships as it relates to K-Electric. The new IGCF directors to the KE board will include Shaheryar Chishty,” read a letter that reported this acquisition.

“I didn’t buy K Electric itself, I bought the fund. The fund had other things in it and KE was one of those assets,” explains Chishty. “It is a pretty simple process. KE is a company in Pakistan but it is mostly owned, I think around 66%, by a fund in the Cayman Islands and this has been true since the Aljomaih sale back in 2005. They had set it up there because of the tax exemptions in Cayman. The holding company is a Cayman Islands company. Any dividends that go to Cayman from Pakistan will be taxed there. That’s the first thing, there’s no loss to Pakistan for that. Second is that Cayman is a very normal and acceptable jurisdiction. Even Saudi and Kuwaiti investors decided to form a Cayman company. They could form it anywhere. So, these are legitimate business groups in their own countries and they formed a company in Cayman.”

“We have not acquired “control” over either KESP or KE. We simply aim to protect our rights as interested shareholders and investors, and we believe that as Pakistan focused energy and infrastructure investors, operators and builders, we have significant relevant experience to bring to bear and assist KE and its management to overcome the company’s many challenges.”

Chishty did not disclose the amount of money that went into buying the fund. However, given his history of picking up orphan assets it can be safely assumed that it was a significantly smaller amount than what Shanghai Electric was going to pay Abraaj back in 2016.

The problems over at KE

There is a bigger question in the middle of all this. Why would anyone want to buy K-Electric? The company is plagued by problems and is far from an investor’s dream. The only thing it has going for it is the monopoly it holds over electric supply in one of the world’s largest cities. Yet even this is under threat with people slowly coming to rely more and more on home based solar solutions.

As things stand, Karachi is caught in a vicious cycle of energy being insufficient, unaffordable, uncompetitive, unreliable. Unaffordable energy reduces consumer purchasing power and lowers quality of life, leads to reduced tax base, as well as growing dissatisfaction with provincial and municipal leaders.

Uncompetitive energy and disruptions in power supply lead to Karachi’s deindustrialization, eliminating employment, and reducing taxable economic activity. High rates of loss, theft, and non-payment further reduce investor confidence for making new capital investments, worsening energy problems. On top of this, most of our electricity generation is dependent on expensive, unreliable, and imported sources such as gas and oil.

In a letter to the Chairman of the Federal Board of Investment, Chaudhry Salik Hussain, Chishty outlined what he felt had resulted in K-Electric’s reversal of fortunes. According to him, Abraaj had come in and undone a lot of the damage that K-Electric had suffered from, but most of that work had been undone after Abraaj’s unravelling in 2019.

“We observed that the progress made by KE started reversing after the Abraaj bankruptcy in 2019 when senior KE Management officials left the company, the board lacked a common vision for growth and oversight of day to day management reduced, KE started making a series of strategic blunders, including:

- A quixotic 900 MW gas power plant in a country that has no more gas to give

- Failure to procure LNG when rates were compellingly low

- A failed attempt to build an imported coal power plant, ignoring alternative domestic coal reserves;

- Failure to secure electricity from Thar coal at a time when the federal government managed to set up over 3,000 MW of Thar coal based capacity;

- Failure to develop renewable power (except for 100 MW solar IPPs) at a time when the federal government has managed to secure over 1,100 MW of wind power right on Karachi’s door-step;

- Failure to address operating inefficiencies, adopt modern technologies and control ballooning generation and operating costs and thus significantly increasing the burden of subsidies on the government and taxpayers;

- Failure to continue improving the distribution network and service quality, reduce load shedding, facilitate new connections,

- Ballooning of debt to over Rs 300 billion vs approximately Rs 70 billion in 2018

- Failure to prepare for impending competition in the electricity market.

“The result is that KE now has the highest cost generation fleet in Pakistan and is almost wholly dependent on imported fuels. Were it not for lower-cost electricity purchases from the national grid and subsidies from the federal government, Karachi consumers would have to pay the highest electricity prices not just in Pakistan but also in the region.”

The K-Electric masterplan

This is where we stand. Chishty has made it painfully clear that he is not interested in a quick flip — his stated goal is to come on board as a long term owner and stay the ship. But with competing energy sources such as solar fast on the heels of KE, what does he plan on doing?

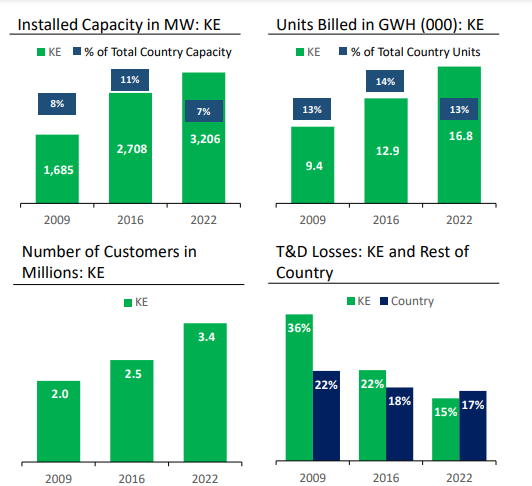

The problems are clearly in front of us. Over the years, KE has become sluggish and inefficient. The number of people wanting electricity has increased. According to Chishty, the solution is to make K-Electric central to a modern, thriving metropolis. And that requires Karachi to change. One of his biggest claims is that the city itself is surrounded by ample area to utilise solar and wind power. The biggest problem with solar and wind is that it is very expensive to setup for the average household. So if a utilities company like K-Electric can harvest this energy it can provide significantly cheaper electricity to households.

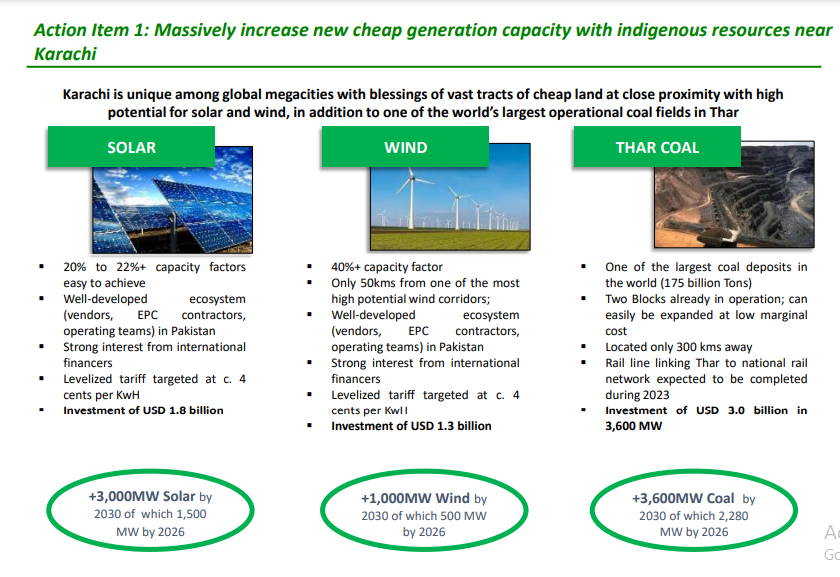

According to KE estimates, in the case of solar there are 20% to 22%+ capacity factors easy to achieve. There are already well-developed ecosystems vendors, EPC contractors, and operating teams in Pakistan. There is also strong interest from international financiers. According to the company’s estimate, this would require around $1.8 billion in investment. Similarly for wind energy, there is a capacity factor of over 40% which is significant. Karachi is only 50 kilometres from one of the most high potential wind corridors; and there is also strong international investment interest in this as well. The estimated investment required would be around $1.3 billion.

And then there is the biggest card that Chishty has up his sleeve to save K-Electric; Thar Coal. When you think about it, the problem is actually very simple. Pakistan relies heavily on imported fuel sources such as reliquified natural gas (RLNG) to produce electricity. Whenever there is an international crisis, such as the Russia-Ukraine war, Pakistan’s energy sector is rocked by the ripple effect. There is a simple solution. Cheaper fuel — something like coal perhaps. And the source is right there too. Spread over more than 9000 square kilometres, the Thar coal fields are one of the largest deposits of lignite coal in the world — with an estimated 175 billion tonnes of coal that according to some could solve Pakistan’s energy woes for, not decades, but centuries to come.

Discovered in the early 1990s by the Geological Survey of Pakistan (GSP), Thar Coal accounts for around 660 MW of electricity produced in the country. The potential is much greater. If new projects that are currently under construction become operational, in the next year electricity production from the Thar coalfields is expected to increase to as much as 2000MW. In short, Thar Coal offers a cheap, alternative, local source of energy that can be used to produce electricity and help Pakistan escape its topsy-turvy reliance on international markets to maintain its energy supply.

“The total reserves from Thar Coal are more than the combined oil reserves of Saudi Arabia and Iran. The reserves are around 68 times higher than Pakistan’s total gas reserves. Compared to this potential the current utilisation of Thar Coal in the total power generation mix is less than 10% which means that there is huge opportunity to expand in this sphere,” explains Amir Iqbal, CEO of Sindh Engro Coal Mining Company.

Chishty has a similar although more colourful explanation. “Thar Coal for Pakistan is like the Plains Buffalo for the Native Americans”, he explains. This was a very particular kind of bison that was found in America which the Native Americans relied upon heavily for their economic activity.

“This buffalo provided everything to the Native Americans. They would hunt these animals and consume their meat for sustenance but that is not all. They would use its bones to create instruments and use its skin to create leather and its fur to keep warm — everything and every part of the animal was vital to the movement of this native economy,” he explains. “That is what Thar Coal can be for us”.

Of course, choosing to rely on fossil fuel like coal comes at a price. It is one of the most environmentally damaging sources of energy there is, and will give pause to environmental scientists — particularly given the state of the smog-addled Punjab region. There are also concerns such as transport costs and the quality of coal that is to be found in Pakistan.

But let us be very real here. Environmental reasons are not why the potential of the Thar coalfields have not been realised. In fact, in the wake of the current commodity supercycle, the government has attempted to increase its already existent reliance on coal as an energy source. To do that, the government is relying on imports of coal. And while this is a queasy thing for environmentalists to think about, if coal is going to be used to produce electricity in Pakistan, it might as well be domestic coal rather than imported coal — at least electricity will be cheap that way.

Chishty is naturally a big believer in Thar Coal. Two blocks of this project are already ready for operations. And according to a K-Electric document, the company feels they can easily be expanded at a low marginal cost. Located only 300 kilometres from Karachi, transportation is also not going to be a major expense. Already a rail line linking Thar to the national rail network is expected to be completed during 2023, and it will require an additional investment of just over $3 billion to produce 3600MW of electricity.

Using these three sources, K-Electric could increase domestic, industrial, and transport customers. And this isn’t where it ends. Chishty plans on also working with authorities in Karachi to build the City into a modern metropolis based on sustainable living. One of his goals is to introduce electric public transport and electric bikes with charging stations all over the city. Essentially, Chishty would also be synergizing his businesses. On the one hand he is in transport which can run the buses, on the other he owns KE which could provide the electricity, and he also has interest in Thar Coal which provides the raw material to create electricity in the first place.

In his letter to Saliq Hussain which was mentioned earlier, Chishty detailed the purpose and ideas behind why he came in and bought the Abraaj interest in K-Electric:

Our reasons for acquiring the Abraaj position in KE (through KESP) are:

- Be a long-term owner. We are not looking for a “quick flip”

- Take positive long-term decisions to enable KE to better serve all of its stakeholders (consumers, employees, the state of Pakistan, and shareholders)

- Dramatically increase the supply of electricity in Karachi at lower rates to trigger a quantum leap in demand through greater industrial and commercial activity and greater demand from households once power is made affordable and reliable

- Integrate KE with the Thar coal fields thereby delivering significant quantities of cheap, indigenous, base load power to Karachi;

- Facilitate KE’s finally taking advantage of the massive wind and solar potential right at Karachi’s doorstep;

- Cause KE to lead Karachi’s transition to electric mobility and waste to energy so that KE can play its uniquely qualified role in making Karachi an environmentally friendly city, and reduce demand for imported fuel;

- Continually improve operating efficiencies, adopt modern technologies and control operating costs.

“For the sake of Karachi’s consumers and economic revival, we appeal to your good offices to help us set KE on the path to recovery. We hope that our Saudi and Kuwaiti partners in KESP will also share the same goals, and we are keen to work with them for the betterment of KE”.

Can he pull it off?

This is what it all boils down to. Chishty has acquired a majority stake in the holding company that owns K-Electric. That holding company also has a number of other shareholders. This means that while Chishty is the new owner of KE, he does not have the controlling stake to overhaul the management on his own.

What he can have is a seat on the board of directors. The success of his visions will now be dependent on how well he can navigate the boardroom and how well he can get along with the rest of the stakeholders involved in the company. As an entity, K-Electric has many legacy costs and is plagued with the indecision of any highly bureaucratized organisation. To fix its ills will require a concentrated and united effort. As things stand, the vision that Chishty brings along with his ownership is one that most can appreciate. The focus on renewable energy and Thar Coal as well as the efforts to transform Karachi along with K-Electric are commendable and the only real way forward. But getting there won’t be easy.

KE is the LOOTER of Karachi & Pakistan.

to earn from k.e is a legal and morally appreciative practice! but earning by wrong means will always bring curse from survivors ! your intentions are good clear and focused on improvement! we survivors hope best for you please try not to be one among those who get cursed like others by corruption practice !

Excellent article with facts and figure

All the mafias are ruling Pakistan and all of them are

ruining Pakistan Luttus Machhi hai Pakistan main

all who have power do not fear Allah but they should

note that one day they all have to answer their deeds

on the day of Judgement

Please do a complete due diligence. Mr Chishty is a defaulter of IFC (international finance corporation) in Daewoo. You claim he is a Pakistan citizen when in fact he is a Swiss citizen. Should a foreigner be allowed control of a strategic asset like KE? You don’t mention the controversy about his father (the admiral you mention) and the alleged kickbacks on Augusta submarines of Pakistan. A simple ask on how an admiral’s son affords expensive private US education might tip you off.

there is no controversy about his father late (Arshad Munir),the people who know about Chishty and his father actually knows the truth,

why not an admiral son afford US education? if a captain of an army afford beachon school fee then why not an admiral son,and by the way Shehryar Chishty studied on scholarship,he is bright and intelligent from every young age,pls try to spend some positivity,

Well said👌

No need to spread negativity. Shehryar Chishti had done well in his career and now he wants to do good at KE is commendable and at the same time courageous. He has a clear business plan and could be a game changer for Karachi. We should be applauding rather than picking silly points against him.

👍

Yes, they need to conduct complete due diligence.

As a Pakistani, our strategic asset is being sold/purchase without any penny coming to Pakistan. Second deal between Abraaj funneled over $370 to over acquire Al Jomirah is nothing just a transfer of papers, then AsiaPak investment acquire Abraaj stake in Cayman Island through IGP funds.

Out of certain, a new buyer came into existence AsiaPak Investment through known person Shehryar Chishty. Pakistan authorities must look into the transaction, give management rights to only those parties/stakeholder who has expertise, competency, vision etc. This AsiaPak investment company is conglomerate entity whose stakes in different business, they’ll wind up their business once it is profitable.

Another point for concern is that Chishty considering Thar Coal feasible option for KE, whereas he also owns invest in Block-1. Conflict of interest

Environment issues is there in using Coal

Comprehensive Article ever published in the history of K.E.S.C.Karachi.. I want one thing that KESC should provide regular electric facility without fail to it’s Star Subscribers . I wish that KESC would produce n deliver to the Subscribers according to the expertise of Mr. Chishti. wish you Good luck.

Whatever is stated in this article, keeping set aside of the total contents, K-Electric has completed its 20 years contract with Government of Pakistan and NEPRA is supposed to hold open bidding of K-Electric to be sold to the highest bidder.

I have suggested to GoP that keeping in view of the past 20 years experience with formerly KESC or K-Electric, the power generating company should be sold to a group of foreign investors who are ready to purchase K-Electric and will improve its infrastructure equivalent to international standards.

The prospective group of buyers is ready to bring all sorts of best technical support from abroad including the engineers and other workers who will upgrade the present K-Electric’s infrastructure upto the extent that it will provide uninterrupted power supply to Karachiites and in adjoining areas with lowest per until tariff.

It is anticipated that drastic changes will not only be seen NEPRA from top to bottom but K-Electric’s all boards of directors will be removed and full fledge investigations will start against them in Pakistan since ever the formerly KESC was privatised.

Whatever Chisty is doing he is doing on his own without any consultation and nod by GOP.

K-Electric is a registered company in Pakistan and it has nothing to do with sale purchase of its shares abroad.

If any one in the government is found making underhand deal with Chisty he will be tried in the court of law after putting his name in the ECL.

i have noticed that quality of service of daewoo has gone down many folds for last three to four years. it seems entrepreneur could not manage daewoo. a power company is a totally different game.

Totally 100 agreed, he is not concerned with the quality of Buses being running by Daewoo Pakistan

iI am sure experts would have weighed the cost of transporting coal from Thar to Karachi and producing electricity in Karachi against that of producing electricity at Thar and transmitting the Electricity to Karachi..

how can ther coal be transported ?? do we understand what we are talking

Adil Gillani should go on the performance of this entrepreneur and his plans for future.His father is not relevant thus.Gillani is a well known employee of Mian Nawaz Sharif.

Is Mr. Chisity son of admiral Chisity ?

He is son of Admiral (Late)Arshad Munir.

Admiral was son of Dr Chishti.That is why Sharyar uses Chisti with his name.

Chishty is offering a glimmer of hope.

Streamlining new inexhaustible sources of energy for Karachi ie solar, wind power, and Thar coal, will eliminate the continuous drain due to imported fuel costs.

A comprehensive plan that incorporates E-vehicles and maximizes local labor input and resources is the key for economic recovery.

Best wishes for your success

A very informative and interesting article on Shehryar Chishti his interest in energy and transport sector and his latest acquisition of K-Electic. Enjoyed reading it…

A truly genius article.Shehryar is a brilliant banker. He has all the necessary tools to revive any sick unit. I am sure KE will have bright future and the Karachites would have a breath of comfort

The story reads like a novel. Lots of common sense plans (don’t know why people not use it much) which are not complicated. All renewables are beset with output variation eg what do you do when suddenly in summers the demand rises by more than 6000 MW? Pakistan is blessed with Thar Coal. We should use it judiciously to our best advantage bearing climatic concerns in mind. Surely, balance can be achieved.

The holding company having been already purchased by Mr. Chishti, as reported in the news article, the KE already would stand under his control. He has already knowledge and experience of work and environment of Pakistan. His plans as described in the article appear to be very logical and reasonable, technically as well as economically, as I think as a professional working in (and with) Power Sector for last 55 years. in fact, I had proposed many years before (In WB and USAID Conferences), to KE to focus on Wind Power besides Solar, due to their accute defincy of generation, dependence on expensive thermal, and proximity of wind power (about 40-50 km) instead of Ex WAPDA Discos which had huge problems, due to long distance, and therefore additional costs, for them as against KE. Resultantly, KE was very late to contract it’s first Wind station. This there are many other ideas and proposals for improvement of KE system.

We should talk about Pakistan and Stakeholders should aim to improve the livability of its cities and provide access to quality public services such as reliable Electricity, Gas and Water supply on affordable prices to enhance the labor market.

Energy sector of Karachi needs further attention to improve this sector, including the initiation of new policies and funding schemes to fulfill the biggest city of Pakistan.

Plans of Mr. Chishti are really appreciable as it is necessary to implement alternative energy sources like Solar, wind power and Thar coal.

Use of natural resources for power generation optimize energy planning and policy to find a secure and sustainable energy option for Karachi will boost up economy of Karachi and Pakistan.

We hope Karachi will get Electricity on affordable prices again.

Congratulations. Abraj …Shanghai…So on.

Another bad decision for the industry and people of Karachi and Pakistan. A company based at a Pirate Island clearly states the nature of deals going on with the assets of this country, set to be looted again and again and again….by the mafia through their frontmen.

The only ray of hope is the dynamic leadership of Mr.Chishty. Let’s hope for the best.

Not sure my comments will appear 🤔

Somehow it feels like he also owns Profit, pun intended.

😂

The article is well written and informative. I have served electric utility companies for many decades. The only problem with these companies is mismanagement and quoting wrong figures particularly of T&D losses for their so-called improved efficiency. wrong billing is unrecoverable and thus main source of increasing circular debt. Relying on such wrong data may not be helpful to device future strategy.

Starting in urdu also in web site

Urdu English both languages better for us

Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading the Crypto market has really been a life changer for me. I almost gave up on crypto currency at some point not until I got a proficient trader Bernie Doran, he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony, I invested $5000.00 and got back $50,500.00 within 5 days of investment. His strategies and signals are the best and I have gained more knowledge.

If you are new to cryptocurrency. You can reach to him on Telegram: @BERNIE_FX ,through Gmail :[email protected] or his WhatsApp : +1424(285)0682

Wonderful… The most successful man in Pakistan… Well deserved…

One serious issue is Karachi is a country. it is not just a town or city. 30 million population.

it cannot be left at the mercy of a single company. . the article on Chisti and KE future is ok. but. it is time to spend your brain ‘s on how to create more competition. deviding generation and distribution. making smaller competing companies with lower overheads. easier to manage with newer technologies. easy to train.

The article is well written and informative.

Karachi is a country. it is not just a town or city.

it cannot be left at the mercy of a single company,

it is time to create more competition.

dividing generation and distribution.

making smaller competing companies with lower overheads. easier to manage with newer technologies.

easy to train.

Best Wishes for Chisty..

Chishti is reportedly a front man of Chs of Gujrat all of deals are dubious and mainly via black money like KE’s through Cammon Islands. Daewoo is reportedly owned by Monis and likewise. This is alledged but needs investigation.