What pops in your mind when you blurt out the word “Russia”? For the average Pakistani, it unleashes a kaleidoscope of images — our tangled history with it, the frigid climate, a certain beverage that may leave you with a headache the next morning — but for the past year and a half, it has been known exclusively for one thing in Pakistan: oil. Oil that we could get for a steal, oil that would be our salvation. But recent news out of Pakistan Refinery Limited has raised an issue regarding oil that we hadn’t really fathomed before: Russian crude is not the miracle we had dreamed of. It churns out less gasoline per barrel than other sources. So, what’s the catch?

Oil itself is not a simple substance. Mind-blowing, right? It’s not something that we really meditate on. At most in our daily lives the decision boils down to whether we want petrol or diesel at a pump. The thing is; it is a different liquid depending on where it’s dug up. It has a myriad of dimensions, intricacies, and forms.

Just like the Akmal brothers — Kamran, Umar, and Adnan — who are all cricketers but showcase different talents and tactics. Or the different Muslim Leagues — Muslim League (N), Muslim League (Q), Muslim League (F), Muslim League (Z), and the Awami Muslim League — who are all political parties but pursue divergent ambitions and doctrines.

Oil has its own variations, and not all oil is created equal.

Oil 101

Petroleum — colloquially referred to as crude oil or simply oil — is a naturally occurring, yellowish-black liquid mixture composed of hydrocarbon deposits and other organic materials. It is formed from the remains of ancient flora and fauna that lived millions of years ago.

However, crude oil is not homogeneous; it is a heterogeneous amalgamation of hydrocarbons and other organic materials that vary in their physical and chemical properties. These properties determine how crude oils are classified, processed, refined, and valued in the market.

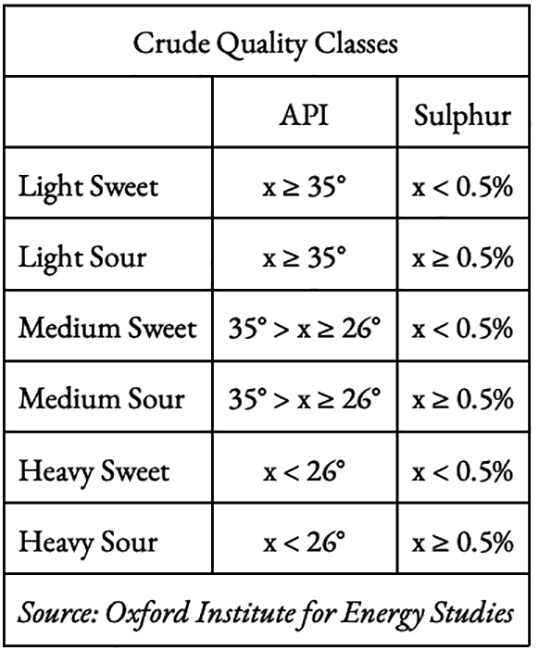

One of the most crucial properties of crude oil is its density, which is measured by the American Petroleum Institute gravity (API gravity). API gravity is a measure of how heavy or light a crude oil is compared to water. If the API gravity is higher than 10, it means that the crude oil is lighter than water and will float on it. Conversely, if the API gravity is lower than 10, it means that the crude oil is heavier than water and will sink in it.

The higher the API gravity, the lighter the crude oil — and the more valuable it is. Light crude oils have more light hydrocarbons, which are easier to refine into high-value products such as petrol and diesel. Heavy crude oils have more heavy hydrocarbons, which require more complex and costly processing to produce high-value products, which makes light crude oil more preferable for refineries.

The other critical property of crude oil is its sulphur content, which measures how sour or sweet a crude oil is. Sulphur is an impurity that makes crude oil corrosive and harmful to the environment. The higher the sulphur content, the sourer the crude oil — and the less desirable it is. Sweet crude oils have less than 0.5% sulphur content, while sour crude oils have more than 0.5% sulphur content. Sweet crude oils are easier to refine and produce less pollution than sour crude oils.

At one end of the spectrum lies sweet light crude oil — the holy grail of petroleum — while at the other end lies heavy sour crude oil with some medium grades somewhere in between. Sweet light crude oil has a lower liquid density compared to water and a lower sulphur content while heavy sour crude oil has a higher liquid density compared to water and a higher sulphur content.

The light and sweet variety is preferred over its heavy and sour counterpart due to the amount of processing necessary to remove impurities for refinement into fuels such as gasoline and diesel. However, being that light and sweet crude is of a higher quality than its counterpart, it will likely cost you a premium.

So, how much do you get for the premium you might pay?

Looking inside the barrel

Fractional distillation — a term that may seem esoteric to the uninitiated, yet it is the cornerstone of our modern world. This process is the alchemical magic that transforms crude oil into the myriad petroleum products we depend on daily. From the petrol or diesel that powers our vehicles, to the gas oil fuelling machinery and furnaces, jet fuel for aircraft, and even the domestic and commercial heating oil that provides warmth to our homes and workplaces — all are gifts of fractional distillation.

This process is the inaugural step in refining crude oil, and it is often regarded as the primary separation process. It performs the initial rough separation of the various fuels. For our discussion, this is also the only part relevant to the scope of our discourse.

So, what exactly does fractional distillation do to crude oil? In layman’s terms, it boils the crude, allowing us to extract different distillates at their respective boiling points.

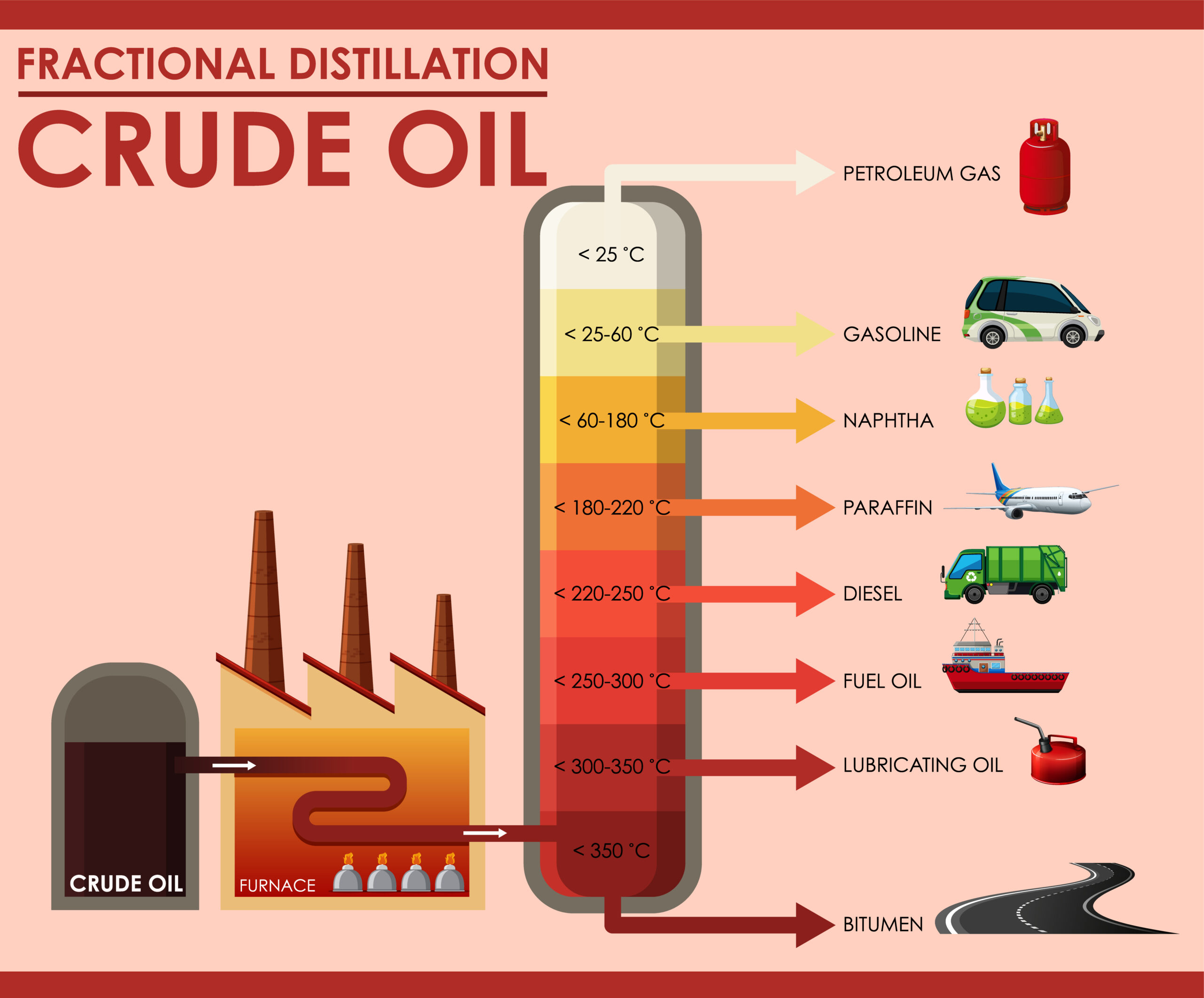

Distillates are the oil derivatives procured from the fractional distillation process of crude oil. They serve as energy sources and chemicals in a plethora of machinery and fuel applications. They are categorised into three key areas: light distillates, middle distillates, and heavy distillates. These terms are predicated on the boiling point of the products — light distillates have the lowest boiling point whilst heavy distillates have the highest.

The products with the lowest boiling points are extracted from the top of the fractional distillation column and the heaviest at the bottom. Thus, as oil is refined in the fractional distillation column, products are extracted in order of light, medium, and heavy distillates.

Light distillates — often referred to as ‘top of the barrel’ — have the lowest boiling point. These are primarily utilised as fuels and encompass gasoline or ‘petrol’, liquified petroleum gas, and naphtha.

Transitioning to middle distillates, these have a medium-level boiling point and include an array of fuels used to power everyday vehicles, aeroplanes, and industrial engines such as rolling stock and heavy machinery. Kerosene, jet fuel, and diesel are byproducts of middle distillate.

Lastly, we arrive at heavy distillates. These are often ‘cracked’ into more utilitarian products through a process involving extreme heat, pressure, and the use of a catalyst to break down the long hydrocarbon chains. Byproducts of heavy distillates include furnace oil — names also used interchangeably include fuel oil, heavy oil, marine fuel, marine heavy fuel oil, bunker oil, bunker fuel — and asphalt/bitumen.

Reports by the International Energy Agency elucidate the intrinsic yields of diverse types of crude oil — irrespective of their specific concoction. For instance, Light Sweet crudes such as West Texas Intermediate, Louisiana Light Sweet, and Brent typically yield 3% gases, 32% light distillate, 30% medium distillate, and 35% heavy distillate.

In contrast, Medium Sour crudes like Mars and Arab Medium generally yield 2% gases, 24% light distillate, 26% medium distillate, and a substantial 48% heavy distillate. Lastly, Heavy Sour crude blends such as Maya and Western Canadian Select yield on average per barrel a mere 1% gases, 15% light distillate, 21% medium distillate, and a staggering 63% heavy distillate. However, these are inherent yields. Actual yields will vary depending on the refinery itself. This is something we will get back to.

The gases, due to their proportion in relation to the distillates, renders them somewhat inconsequential. However, they are the initial extracts, albeit the least significant, from a barrel of crude oil. This category encompasses ethane, propane, butane, and natural gas, along with ethylene, propylene, and butylene. These gases serve as the fundamental ingredients in the production of an array of chemicals, plastic commodities, and synthetic rubber.

They have versatile applications such as heating, cooking, and transportation. They also function as additives for petrol and blending agents for crude oil derivatives. However, their proportion in relation to the distillates renders them somewhat inconsequential.

Now back to the distillates. The meat of the crude. What do these distillates signify for a refinery in terms of its profitability?

Refinery economics

The financial dynamics of a refinery are intrinsically tied to the Gross Refinery Margin (GRM) — a term that, in its simplest form, represents the disparity between the aggregate value of petroleum products birthed by a refinery and the cost of crude oil.

Consider this scenario: a refinery reaps $140 from the sale of products refined from a single barrel of crude oil, which itself costs $130. The resulting gross refinery margin is thus $10 per barrel. To bolster profitability, refineries continually tweak their product mix to optimise earnings. Fuel oil, for instance, is a low to negative margin product for local refineries. Despite being produced at a loss, it is offset by profits from higher margin products such as petrol and diesel.

Estimates, as of last summer, suggest that local refineries enjoy a margin of $48 per barrel on gasoline — a figure that towers 6.4 times higher than the five-year average. Similarly, the margin on Diesel stands at approximately $58 per barrel — 4.7 times greater than its five-year average. Similarly, the average refinery margins per barrel for gasoline and diesel oscillated within the range of $7.5 and $12.4 respectively. Profit has covered the topic in greater detail for those interested.

Read more: A primer on refinery margins

An industry insider — wishing to remain anonymous — explained the matter to Profit as well.

“The lower the furnace oil content in the crude, the better. An abundance of light or middle distillates is preferable — these are the simplest to refine into more profitable products,” our source expounded.

“Diesel, kerosene, and jet fuel — these are the game-changers. They have the potential to easily yield a profit margin of $10-$15 above the crude oil price. The commercial viability of petrol fluctuates with the seasons. At times, it will generate a profit above the cost of the crude oil used for its refinement; at other times, it will merely break even. Furnace oil, on the other hand, is sold at a loss — below the cost of the crude oil purchased for refinement and distillate extraction,” they articulated.

Now that we have a basic understanding of crude itself, let’s dive into the varieties Pakistan imports. And more importantly, why it imports what it does.

Pakistan, and its crude blends

Until June 2022, the lion’s share of oil imports hailed from the UAE, accounting for a substantial 56%, followed by Saudi Arabia at 34%, and Kuwait trailing at 4%. These import statistics were provided by the Trade and Development Authority of Pakistan. Regrettably, data beyond this period remains elusive.

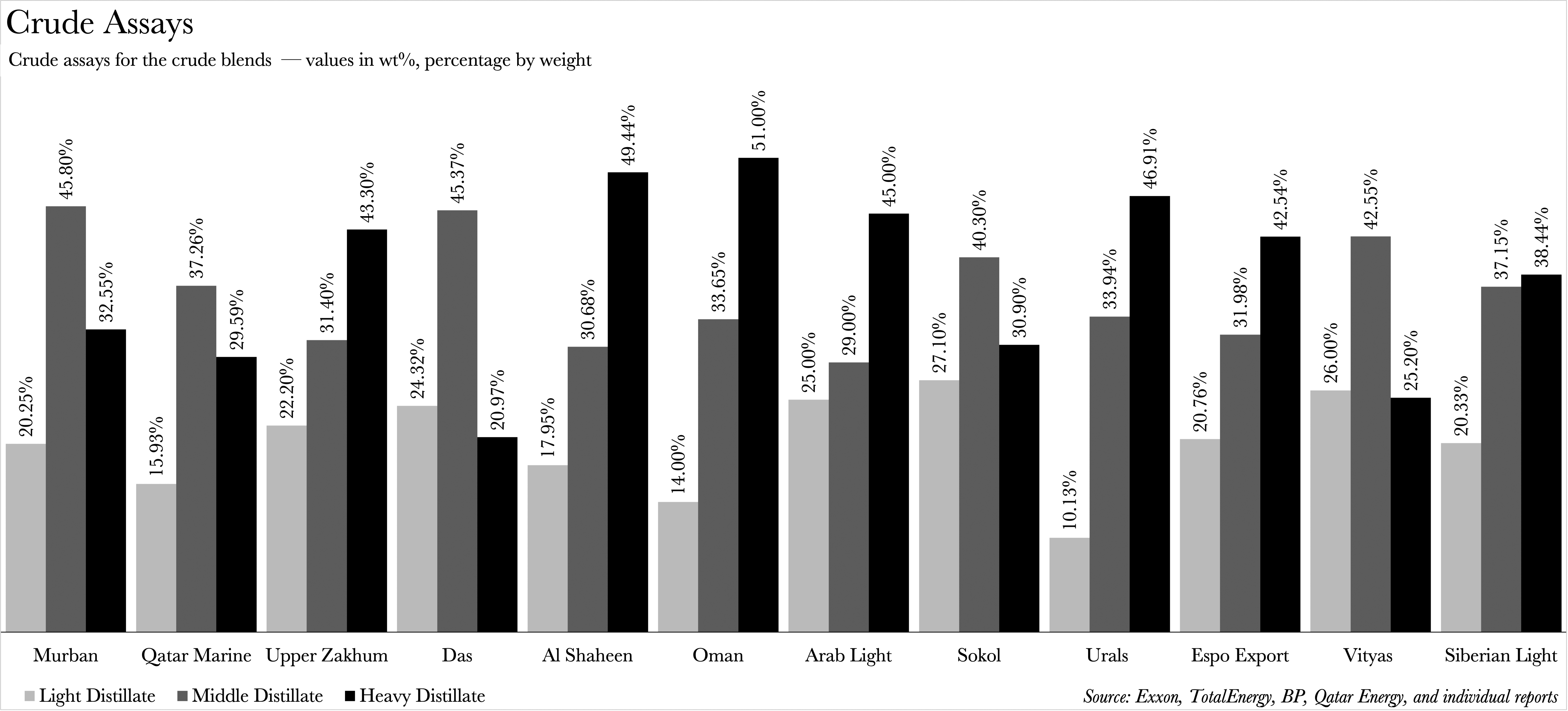

The latest entrant to this list is Russian crude, imported earlier this year. Profit delved into the myriad crude blends identifiable through their respective assays. A crude oil assay, in essence, is a chemical evaluation of crude oil feedstocks conducted by petroleum testing laboratories. To put it simply, it’s akin to dissecting a barrel of crude based on the distillates mentioned earlier.

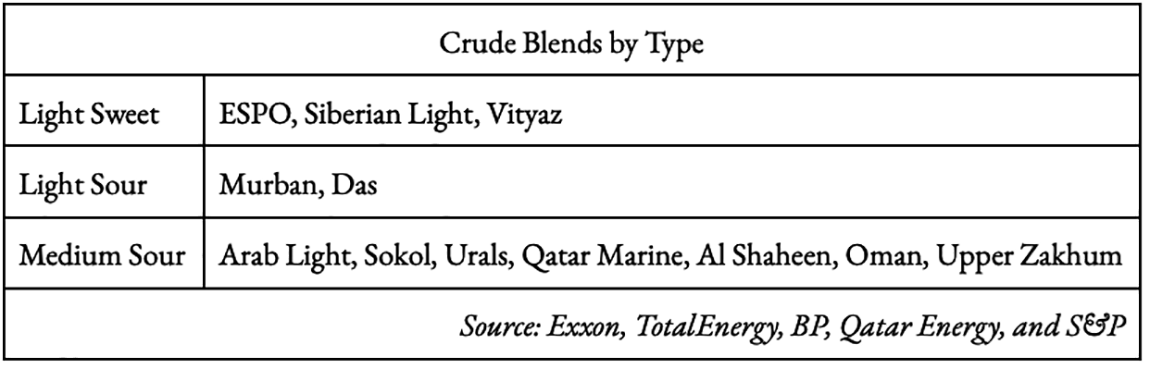

The crude blends under scrutiny included Murban (UAE), Upper Zakhum (UAE), Das (UAE), Qatar Marine, Al Shaheen (Qatar), Oman blend, Arab Light (Saudi Arabia), and Urals (Russia).

We also looked at additional Russian blends such as Sokol, ESPO Export, Vityas, and Siberian Light. These were once considered potential imports. Regrettably, our investigation could not extend to Kuwaiti blends or the UAE-based Umm Lulu blend due to the unavailability of their assays.

Moreover, we also incorporated Qatari blends into our analysis as we were informed that refineries have used them in the past according to our aforementioned source. This exploration underscores the importance of understanding the composition and characteristics of these diverse crude blends.

The conclusions drawn are as clear as daylight, and ostensibly straightforward. The superior the calibre of the crude oil, based on the aforementioned attributes, the greater the anticipated distillate yield. Moreover, within the crude oil categories, distinct types exhibit variation based on their inherent properties. It’s crucial to underscore that the yields Profit discovered can still fluctuate significantly depending on the specific refinery where they are processed and the configuration of that refinery.

So, we now know the crude that Pakistan imports. We also know the relative quality of it. However, there can be no debate pertaining to crude in Pakistan currently without addressing the elephant in the room: Russian crude is cheap despite being bad.

So, why is Russian crude so problematic?

Pakistan’s tryst with the Russians

“Russian crude serves as a prime exemplar of a yield inferior to that of Arabian crudes,” elucidates Zahid Mir, Managing Director and CEO of Pakistan Refinery Limited. The magnitude of this disparity? “It varies from refinery to refinery, contingent upon the technology and facilities each possesses,” Mir expounds. To clarify, our discourse is confined to the Urals blend, because that is the one that we got.

Nonetheless, if you have read till this point in the piece then this is simple knowledge for you. The apparent solution to this conundrum would be to procure one of the lighter Russian blends, correct? Alas, our financial constraints prevent us from doing so, given that our choice of the Urals blend was dictated by its cost-effectiveness. A cursory examination reveals that other Russian blends are also trading at a discount relative to our Arab blends, at least for the time being.

As of the week commencing 14th August, a barrel of Russian Urals is trading at a discount of $15-$20 against a barrel of Murban and Arab Light respectively. The differential narrows to $10-$12 when comparing the two Arab blends to the Russian Sokol and ESPO. This begs the question: why aren’t Pakistani refineries importing barrels of Russian crude en masse given these substantial discounts? Even if we were to entertain the argument that the Urals blend is more challenging to process, surely the lighter blends could find a place in the distillation process?

However, the market price for barrels only tells half the story. “It’s a complex amalgamation of factors. There’s an elevated shipping cost. There are also higher financial charges due to the convoluted payment process which involves multiple currency conversions: Pakistani Rupees into US dollars, then into Chinese Yuan, and finally into Russian Rubles,” elucidates Ammar Khan, an independent economic analyst.

“For a typical oil letter of credit, you have the liberty to settle it with any bank offering competitive rates. For this one, you’re confined to 1-2 Chinese banks who will levy a premium for their services,” Khan adds. How much does this erode from the discount? While Profit was unable to procure an exact figure, it’s evidently substantial enough to deter mass import of barrels of Urals blend.

“Pakistani refineries predominantly utilise Middle Eastern crude due to its close proximity which translates into shorter distances, reduced freight costs and easier access. The commercial viability of a certain crude depends upon the yields any refinery can achieve and the landed cost of that particular crude,” Mir supplements.

“Russian crude is an example where the yields are inferior to Arabian crudes; however, it is commercially more viable because the lower landed price more than compensates for the difference in yield value,” Mir adds.

Mir’s response provides a fitting conclusion when considered in conjunction with Khan’s statements. There are profits to be reaped; however, these gains are obscured by the aforementioned additional friction. If these gains were truly accessible, why would Pakistan need to negotiate preferential rates with Russia in the first place?

As entities driven by profit maximisation, refineries are likely to import barrels when opportunities present themselves. This is particularly evident when we consider that one refinery previously sampled Qatari crude independently.

If we are not to move beyond the bi-partisan buffoonery of the last 18 months, then our diplomatic corps might need to instead familiarise themselves with the liquid we mentioned at the outset. However, at least now we understand what constitutes a barrel of crude and why we import Arabian crude.

Iranian crude — now that’s an entirely different ball game.