Fresh from raking in its highest profits ever, and amid whispers of forging a partnership with China’s BYD Auto to usher in more electric vehicles in Pakistan, the Hub Power Company (HUBCO) has revealed that it will increase its stake in the Sindh Engro Coal Mining Company. With an existing 8% share in the Sindh Engro Coal Mining Company, does bolstering its stake hold merit? At least at an initial appraisal, it appears so.

HUBCO’s strategy to augment its shareholding in Sindh Engro Mining is a shrewd manoeuvre on several fronts: it facilitates the streamlining of its own supply chain for two of its nascent plants, endows it with greater leverage in negotiations with the government over the circular debt conundrum, it is a secure investment that aligns seamlessly with HUBCO’s extant investment and risk profile, and it is one that promises to yield higher returns as the Thar Block II mine is undergoing an expansion with possibilities of future expansions. .

HUBCO isn’t the sole entity positioned to reap the benefits from the deal. Individual shareholders are likely to exhale a sigh of relief with the move, whilst banks looking to expand their credit lines are also set to be elated. Any joint venture partner in Sindh Engro Coal that wishes to diminish their share, thereby enabling HUBCO to enhance theirs, is also likely to profit, cognisant of the advantages this will confer upon HUBCO.

“It is merely HUBCO consolidating their triumphant run, so there should be no trepidation amongst individual shareholders,” declares Farid Alam, the Chief Executive Officer at AKD Securities. Similarly, “HUBCO is one of the most sought-after credits in the market. If it is bolstering its shareholding in a company, it should be perceived as a favourable development,” asserts Adnan Naqvi, the Group Head of Corporate and Investment Banking at the Pak-Brunei Investment Company.

What is the impetus driving HUBCO to invest? We tried to contact both HUBCO and Sindh Engro Coal, but we were met with silence from both of them.

So, what precisely is the Sindh Engro Coal Mining Company, and what renders it so enticing to HUBCO?

Building on a good year

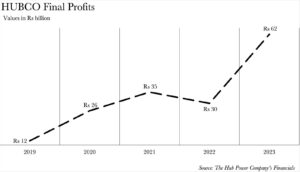

Before we delve into the heart of the matter, let’s take a moment to acknowledge what was a monumental year for BUBCO. In 2023 the company made an eye-watering profit of Rs 62 billion. This figure is more than double the earnings of the previous year, and astonishingly, it’s nearly on par with the cumulative profits of the three years leading up to 2022. We’ve already dissected the sources of HUBCO’s extraordinary windfall in a previous discourse.

Read more: How did HUBCO earn its highest ever profit?

Among the significant augmentations to HUBCO’s revenue streams were its two avant-garde power plants: the Thar and ThalNova. The former commenced operations in the autumnal month of October 2022, whilst the latter — an associated entity — became operational in the frosty February of 2023. The Thar plant contributed a staggering Rs 7 billion to HUBCO’s coffers, a revenue stream that was hitherto nonexistent, whilst ThalNova generated proceeds of Rs 1.9 billion for the first time since the dawn of 2020.

What sets these two new plants apart is their reliance on indigenous Thar coal, and their consistent ranking amidst the top five the merit order for electricity generation since their inauguration. The only blip was a brief fortnight in the balmy May of 2023, when Thar Energy momentarily slipped to the sixth position.

This ranking provides a safety net for HUBCO against potential reductions in energy purchases by the Government of Pakistan from power companies, in the event of a demand downturn. Even a minimal demand for electricity ensures that HUBCO’s Thar Plant and ThalNova can sell electricity due to their advantageous position in the merit order. The novelty of both plants also guarantees that electricity purchases by the Government of Pakistan from these plants will be a completely fresh income stream going forward, supplementing existing purchases by other plants and the historic capacity payments that HUBCO has reaped from.

This becomes all the more pivotal because all of HUBCO’s other direct and associated plants languish in the middle to lower ranks of the merit list. Government purchases from these plants will obviously not be as reliable as the aforementioned duo. Hence, bolstering your stake in the mines that will fuel your two most dependable plants is a textbook example of vertical integration.

However, Thar coal has a broader spectrum of applications than just fuelling HUBCO’s plants, and that might be what HUBCO is banking on.

Lucky & Co, and the endless possibilities

With an annual capacity of 7.6 million tons, the Sindh Engro Coal mine has reached its full potential. However, Block II — the epicentre of Sindh Engro Coal’s operations — is in the throes of a third wave of expansion, set to bolster its capacity to an impressive 12.2 million tons. The question that arises then is, who is this surplus for? Enter Lucky Electric.

The Lucky Electric plant is tailor-made for Thar coal. It has secured a coal supply agreement with Sindh Engro Coal and is poised to switch from imported coal to Thar coal in summer 2024, once the expansion is complete. Is there room for further growth in Block II? Certainly. Are there other contenders for the excess supply? Possibly.

There has been a relentless whirlwind of speculation regarding the feasibility of retrofitting the Sahiwal, Port Qasim, and the China Power Hub plants to operate on Thar coal as opposed to imported coal, albeit with some modifications. However, the viability of such alterations remains a topic of debate. In a similar vein, there exists the potential for the local cement industry to transition from Afghan and South African coal to Thar coal.

Power Cement embarked on a trial run for the conversion last year, but progress has seemingly stalled since then. The challenge lies in the high moisture content of Thar coal, necessitating large-scale drying technology to render it more viable. Yet, the potential is palpable.

While HUBCO is presented with a plethora of possibilities, the shareholders of HUBCO stock are likely jubilant about the move, as it assuages their concerns regarding HUBCO’s plans for its cash reserves.

What might happen to HUBCO stock?

“The quintessential HUBCO investor is perpetually apprehensive about the funds being invested in such a manner that the company’s ability to pay dividends is compromised, even if only temporarily. The outlay for increasing their stake is unlikely to impede their capacity to pay dividends,” explains Alam.

“Had HUBCO been investing in a greenfield project, it would have undoubtedly raised a few eyebrows among the existing shareholders. However, this is a project in which HUBCO already has a stake. It’s also a project that’s generating returns, and I foresee their market capitalisation skyrocketing in the near future, which bodes well for medium-term investors,” adds Alam.

In terms of risk averse investing, HUBCO’s current Chief Financial Officer also happens to be the individual who led the finance team that arranged the $2 billion for the first phase of the Sindh Engro Coal —marking the initiation from Engro’s end.

However, if this deal is as lucrative as it appears, then why is someone else willing to relinquish their shares?

Cracks in the original six member club

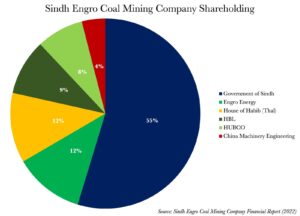

Sindh Engro Coal is a joint venture between Government of Sindh, Engro Energy Limited (formerly Engro Powergen Limited) and its partners namely; Thal Limited (House of Habib), Habib Bank Limited (HBL), HUBCO; China Machinery Engineering Corporation.

The Government of Sindh holds the lion’s share of 55% of the total shares, while HUBCO had the second lowest stake in the company at 8%, per Sindh Engro Coal’s 2022 financial report — the most recent one available.

“In the case of Sindh Engro Coal, all other joint venture partners are also prime customers for any potential creditor. Hence, it is crucial to ascertain who is divesting, and for what reason,” asserts Naqvi. That is a valid question indeed.

Whilst Engro is in talks with Liberty Power about its entire thermal assets portfolio, HBL and Thal have not divulged any information regarding their possible reduction of stake in this HUBCO transaction. Likewise, the Government of Sindh and China Machinery have remained silent.

So, why would anyone want to sell their stake to HUBCO in something that seems to have so much upside? We will have to bide our time for the official announcement from the seller, or for HUBCO to disclose it once their deal is finalised.

Nice but a complicated analysis

no money to buy imported fuel