The policy rate debate has again intensified in the business and economic circles of the country as the State Bank of Pakistan (SBP) is set to meet for the second monetary policy meeting of the calendar year 2024 on Monday, March 18, 2024.

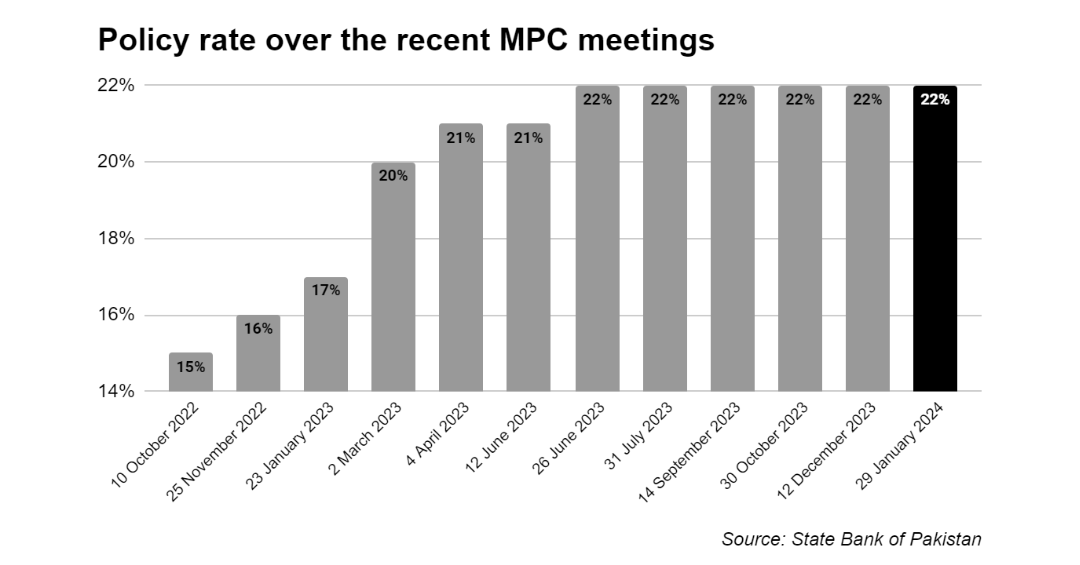

The SBP raised the policy rate to 22% in an emergency meeting back in June 2023 in a knee-jerk reaction to prevent a sovereign default by securing a short-term International Monetary Fund (IMF) agreement. Since then, SBP has maintained the policy rate at 22%.

In January, the SBP held on to the current rate due to augmented inflation expectations driven by high energy prices. However, non-energy inflation continued to decrease.

Yet, the SBP governor reaffirmed that the real interest rate remained significantly positive on a 12-month forward-looking basis, given the anticipation of a continued downward trajectory in inflation.

Simultaneously, the SBP raised the average inflation forecast for the fiscal year 2024 to 23%-25% from the previous projection of 20%-22%, due to the impact of energy prices.

Now these conflicting trends have had analysts divided on whether the central bank will opt for a rate cut or not with the majority believing that SBP will once again maintain the status quo. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

Excellent information collected and shred in this article

Excellent information collected and shred in this article