Recent economic headwinds and the latest fiscal budget may have left you feeling anxious or even distressed. However, amidst this turmoil, a surprising development emerged: the Pakistan Stock Exchange became the world’s best-performing bourse in Fiscal Year (FY) 2024.

The benchmark KSE-100 index delivered an impressive 89% annual return in rupee terms during FY24, with an even more remarkable 94% return in dollar terms.

This news might have many scratching their heads, given that the economy was struggling with uncertainty, political instability, and a foreign exchange crisis all these months.

While a detailed timeline of the national bourse’s performance would be interesting, we’ll save that for another time. Instead, we’re more intrigued by a different question: Have stocks consistently been the best-performing asset class in Pakistan, or is there more to the story?

To answer this, Profit presents a primer on the performance of various asset classes over multiple time periods, aiming to determine which has truly stood the test of time in the country.

What’s there to offer?

Pakistan offers a diverse range of investment opportunities across various asset classes, each with its own distinct features, potential returns, and associated risks. Before delving into the performance analysis, let’s provide a concise overview of the most prominent asset classes available in the country.

If you’re already familiar with these, feel free to skip to the next section.

Equities, traded on the Pakistan Stock Exchange, offer potential for high returns but come with significant volatility. These represent ownership in public companies across 38 sectors, ranging from essential goods with inelastic demand to more volatile sectors. For equity investments, diversification and a long-term approach (minimum five years) are recommended to balance risk and reward.

Fixed income investments provide a more stable option, offering regular payments with lower risk. This category includes government-issued Pakistan Investment Bonds and corporate Term Finance Certificates. These instruments are ideal for investors with a shorter investment horizon of less than five years, providing a steady income stream while preserving capital.

The money market offers highly liquid, short-term investments such as Treasury Bills, typically issued by the government with maturities up to one year. These low-risk options are suitable for risk-averse investors or those looking to park capital for a short period. Both fixed income and money market returns are influenced by the policy rate.

Gold presents an interesting investment option, often outperforming during high inflation periods but lacking income generation. It’s suggested as a diversification tool during economic instability, despite its volatility and storage challenges.

Real estate, while potentially lucrative, requires significant capital and is largely dominated by institutional investors. However, retail investors can access this market through more liquid Real Estate Investment Trusts (REITs).

Lastly, foreign currencies, particularly the US Dollar, are popular due to their liquidity and role in international trade. The dollar’s prominence in global reserves (58.41% as of 2023) makes it a desirable asset for many investors looking to preserve value.

Which Asset Class to Bet On?

Your investment strategy should be tailored to your individual circumstances and goals. Several key factors influence the most suitable choice of asset classes.

Age plays a significant role in determining risk tolerance. Younger investors generally have a higher capacity for risk, allowing them to consider more volatile assets like equities and gold. As you approach retirement, it’s often prudent to shift towards safer options such as fixed income or money market instruments.

Your investment horizon, or the length of time you plan to remain invested, significantly impacts asset allocation. Longer investment horizons typically allow for riskier asset classes, as they provide more time to weather market volatility.

Income level often correlates with risk appetite. Higher income generally allows for greater risk-taking capacity, as you’re better positioned to absorb potential losses.

Your specific investment goals, whether saving for retirement, education, or a major purchase, should guide your asset selection. Long-term goals like retirement may favor equities for their potential growth, while shorter-term goals might be better served by more stable, lower-risk options.

The broader macroeconomic environment plays a crucial role in investment performance. High interest rates may favor fixed income and money market instruments, high inflation periods might make gold more attractive, while low inflation and interest rates often benefit equities.

Letting the Numbers Speak

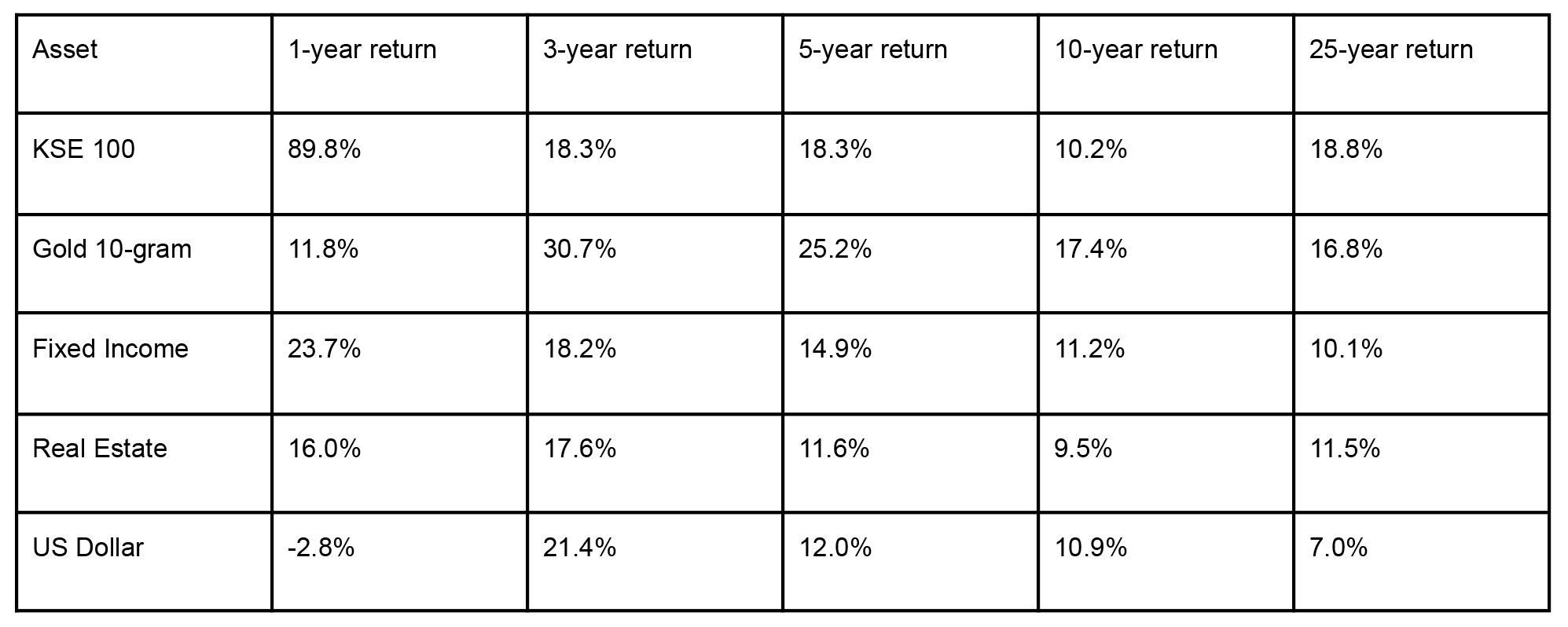

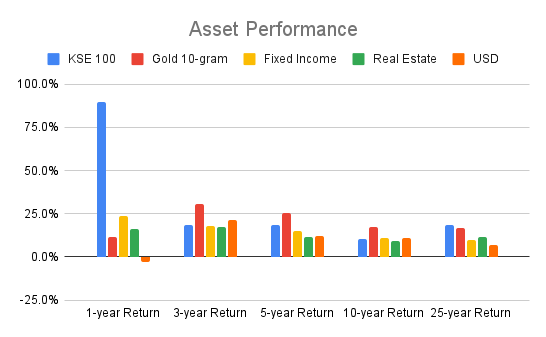

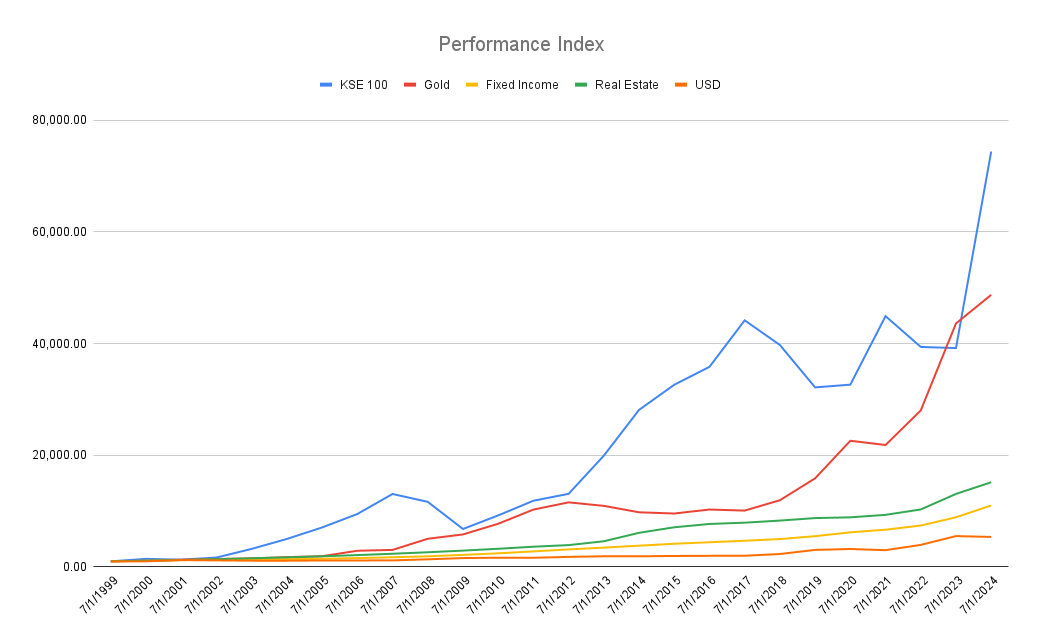

Now, let’s move to the business end of things. We’ll examine five major asset classes – equities, fixed income/money market instruments, gold, real estate, and foreign currency – over various time horizons. To provide a clear picture of their performance, we’ve compiled a comprehensive table and accompanying graph that illustrate the average returns for each asset class.

Note: The returns of the 6-month T-bill and its reinvestment have been assumed while calculating returns of fixed income. The real estate returns were calculated by assigning weightages to Zameen indices for major cities in proportion to their areas, while the long term CAGR of Real Estate (2011 to 2024) was utilized to estimate the returns from 1999 to 2011.

Note: The returns of the 6-month T-bill and its reinvestment have been assumed while calculating returns of fixed income. The real estate returns were calculated by assigning weightages to Zameen indices for major cities in proportion to their areas, while the long term CAGR of Real Estate (2011 to 2024) was utilized to estimate the returns from 1999 to 2011.

However, before we put our verdict out, it’s important to clarify that this is an analysis of historical data and an assessment based on that, not investment advice.

One-Year Return

A look at the performance of these assets over the past one year, and we have a clear winner in equities, having generated a return of 89.8%. While fixed income gave a return of 23.7%, real estate provided a return of 16%, gold produced a return of 11.8% and US dollar generated a return of -2.8%.

The equities have managed to perform quite well over the past one year due to subdued inflation, resurgence of foreign investors, and the stable exchange rate of the Pakistani Rupee.

Three-Year Return

When examining the performance of various asset classes over the past three years, a contrasting pattern emerges.

Gold stands out as the top performer, delivering an exceptional return of 30.7% per annum, significantly outpacing other investment options. The US Dollar also showed strong performance, yielding a 21.4% annual return, largely due to the substantial depreciation of the Pakistani Rupee during this period.

Fixed income instruments and equities demonstrated nearly identical performance, with returns of 18.2% and 18.3% per annum respectively, highlighting their resilience and attractiveness in Pakistan’s economic climate.

Real estate in Pakistan also proved to be a solid investment, generating a return of approximately 17.6% annually.

This period was marked by high inflation and rupee devaluation which played a critical role in the spectacular performance of gold and dollar.

Five-Year Return

Gold superseded all the other asset classes in the five-year investment horizon as well, it generated a return of 25.2% per annum, equities produced returns of 18.3% per annum, fixed income’s return was recorded at 14.9% per annum, while real estate posted returns of around 11.6% per annum and USD’s return stood at 12.0% per annum.

Once again, high inflation combined with high interest rate environment coerced investors to flock towards gold which resulted in sharp upsurge in its price.

Ten-Year Return

In the ten-year investment horizon, gold’s reign over the top spot continued, it generated a return 17.4% per annum, fixed income managed a return of 11.2% per annum, US Dollar posted a return of 10.9%, equities produced a modest return of 10.2% per annum, while real estate gave a return of 9.5% per annum.

The ongoing fiscal and monetary issues that have resulted in low foreign investment and sluggish growth post-2017 somewhat justify these investment return patterns.

These obstacles which hindered the growth of the Pakistani economy propelled gold to become the best performing asset class in three investment horizons. It serves as a save haven for Pakistanis, who wish to preserve their purchasing power.

The Pakistani equities despite their stellar performance during the past one year are trading at historically low multiples. They have immense potential which could transform them into a juggernaut in the coming years, however, this assertion is contingent upon favorable macroeconomic conditions and political stability.

Twenty-Five Year Return

The historical data of the past twenty five years corroborates the potential of equities in Pakistan, as they outperformed all the other asset classes and generated a return of 18.8% per annum, gold secured the second spot with a return of 16.8% per annum, fixed income fetched 10.1% per annum, real estate posted a return of 11.5% per annum, and the USD generated a return of 7.0% per annum.

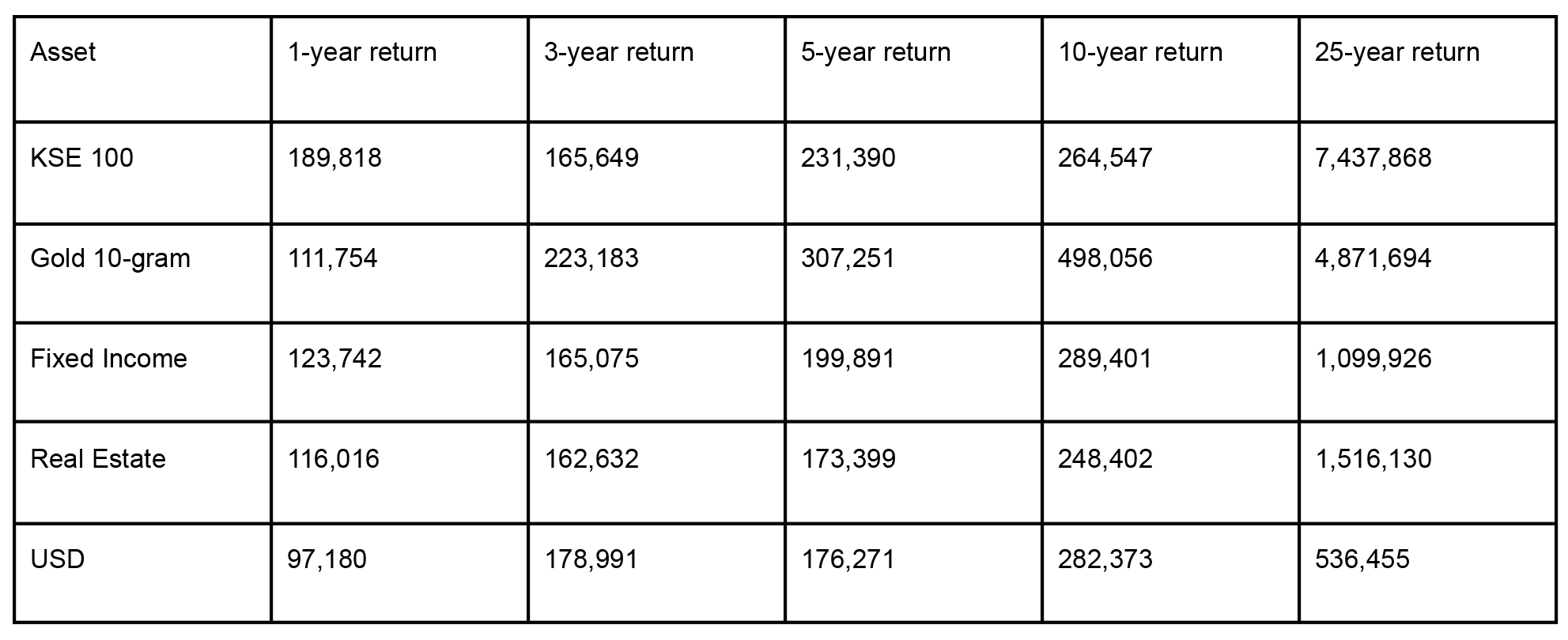

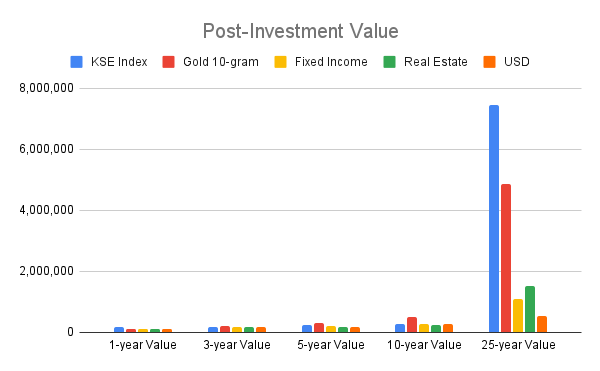

The following tables and graphs would give you an idea about the worth of your investment, considering different time horizons. This analysis assumes that you had invested PKR 100,000 at the beginning.

Our comprehensive analysis of Pakistan’s major asset classes reveals that equities are the most suitable option for investors with a long-term horizon of around twenty-five years.

Historical data over this period not only supports this conclusion but also demonstrates that equities have consistently outpaced inflation and outperformed other asset classes.

For these long-term investors, allocating a portion of their portfolio to gold can provide a hedge against high inflation and economic instability, potentially boosting overall returns.

On the other hand, more risk-averse investors, those requiring steady cash flow, or those with short-term investment goals should consider fixed income and money market instruments.

These highly liquid investments generally beat inflation and offer the flexibility of redemption at any time.

For investors seeking consistent returns, optimized risk, and maintained liquidity, a balanced portfolio approach is recommended.

This strategy involves allocating capital across equities, fixed income/money market instruments, and gold. The specific allocation to each asset class should be tailored to the investor’s goals and risk tolerance.

Ultimately, the key to successful investing lies in understanding one’s financial objectives, risk appetite, and investment timeline. By aligning these factors with the characteristics of different asset classes, investors can create a robust portfolio designed to weather various economic conditions and achieve their financial goals.