Perhaps one of the most frustrating features of Pakistani politics is fuel pricing. What makes this particular facet of governance particularly annoying is the lack of control that any government can exert on the issue of fuel prices.

Pakistan does not produce its own fuel and its consumption is entirely dependent on imports. As such, Pakistani consumers are beholden to international fuel prices which play out in pedantic and predictable ways. If the international price of oil foils, whoever is in father touts it as a win. If the prices are on their way up, whoever is in the opposition runs with it.

There have long been calls to stop the politicisation of this subject. All have fallen on deaf ears. One reason, of course, is that the government does regulate petrol prices to some extent. They charge levies and taxes on it and also make sure the price of petrol is uniform across the country.

Until now.

The government is making efforts to relinquish its role in setting petroleum product prices. It has been reliably learned by Profit that Prime Minister Shehbaz Sharif has directed the petroleum division to finalise and present the deregulation framework for petroleum products. A meeting about this topic was supposed to be held on the 25th of July but no details have emerged since. What we do know is that the Petroleum Division, in a letter dated July 24, 2024, has asked OGRA Chairman to present the matter along with analysis, implications, and the way forward for deregulation of the petroleum sector.

What will this look like? Consumers near courts and refineries would benefit and attention would be diverted largely towards Oil Marketing Companies (OMCs) rather than the government. Or that is what they are hoping for. The question is, could it work?

How it works right now

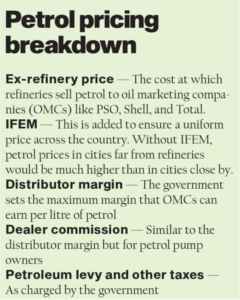

Petrol prices in Pakistan are determined by a number of factors. The main input is the international price of crude oil, which is imported into the country by oil refineries which then process it and turn it into fuel. The price of fuel after processing is what is known as the ex-refinery price. But then other things get tagged along onto this. A margin is added to make sure the price is uniform throughout the country and not cheaper in areas close to the refinery, distributors naturally take a cut, and then dealers and petrol pumps also charge their own service premiums. On top of this, the government also takes a cut. Petrol is currently subject to a petroleum levy of around Rs 40 per litre.

The base price is the imported price, in the case of oil imports, or the ex-refinery price in the case of domestic oil production. On top of that, there are retailer and freight costs which include the inland freight equalisation margin, OMC profit margins (what PSO, Shell, etc. earn), and dealer commissions (what the petrol pump owners get to make). Lastly, comes the taxation which includes general sales tax and the petroleum development levy. The ex-refinery price is the price at which refineries can sell their fuel to OMCs and the price at which importers can sell distillates within Pakistan. One of the first additions that happens to this initial pricing are the commissions that retailers and dealers receive.

The next significant addition is the Inland Freight Equalization Margin (IEFM), which is the cost of inland movement incurred by a refinery for the transportation of crude oil from the source to the refinery. It also includes the cost incurred by an OMC while transporting the finished product to various depots across the country. This basically includes all transport costs within the company. The purpose of this margin is to establish and maintain parity in the prices of fuel throughout the country. The money collected from this margin goes on to create a pool.

After all of these pricing tools, we finally come to taxes, because the last two additions to the price the consumer sees at the gas station are the general sales tax (GST) and the petroleum development levy.

The GST is a ratio rather than an absolute number, it varies with a change in the price of petrol. The levy, on the other hand, is a surcharge and set as an absolute rupee amount per litre, though the government does vary how much it charges under this tax relatively frequently. It is used as an instrument to bring about stability in the price of petrol by offsetting the impact of drastically changing import prices and costs associated with fuel. The levy, however, is often seen as a political and fiscal tool to either pass on ‘relief’ to consumers during an election year or to generate more revenue in other years.

The role of the OMCs

The prices of fuel in the country are decided based on the average price available through Platts plus PSO’s premium. The weighted average cost of supply is calculated by OGRA, the oil sector regulator every fortnight the cost build up for the marketing companies is then applied to this average to include margins for OMCs and inland freight equalisation, commissions for the dealers, petroleum development levy and so on. The retail price is set by the regulator in this way. OMCs can make their money from the margin allowed to them in the cost build up, or by hunting down sources of supply cheaper than the weighted average cost calculated by the regulator.

As of now, the government controls and caps many of these margins. But under the new proposition being heard, all this would change. How would it affect things?

While the final framework will need approval from the federal cabinet and the Special Investment Facilitation Council (SIFC), deregulating petrol and high-speed diesel (HSD) prices will end uniform pricing across the country, allowing oil companies to set their own prices for different locations, they added.

As per sources, the government has faced public criticism for rising petroleum prices and is accelerating the deregulation process to shift public discontent towards the OMCs. Currently, the government announces fortnightly fuel prices based on OGRA’s calculations, which reflect international market fluctuations and exchange rates.

In the past, the government only notified kerosene prices, while petrol, HSD, and light diesel oil prices were influenced by notified tax rates and fixed profit margins for dealers and marketing companies. The oil industry sets its own rates for furnace oil and high-octane blending components (HOBC).

Now, the government plans to fully deregulate petrol and diesel prices, including OMC and dealer commissions, similar to HOBC. The IFEM mechanism is also expected to be deregulated, leading to significant price variations between cities and oil companies. Consumers near ports and refineries may benefit from lower prices, while those further away may face higher costs, with differences ranging from Rs3 to Rs8 per liter.

On the other hand, regarding the government’s proposal to deregulate the petroleum industry, the Pakistan Petroleum Dealers Association (PPDA) expressed concerns that deregulating diesel and petrol prices and profits could lead to a monopoly by oil marketing companies (OMCs).

Sources have indicated that petroleum dealers might oppose transferring price-setting authority to oil marketing companies (OMCs) due to concerns about potential unfair profiteering by the OMCs.

Nauman Ali But, a senior leader of the PPDA while talking to Profit said that even under the current regulated system, OMCs are involved in illegal activities, irregularities, and the exploitation of dealers’ margins. Applications highlighting these issues have already been submitted to the Competition Commission of Pakistan through the Chairman Senate and Secretary Petroleum.

The PPDA warned that giving OMCs free rein could cause widespread anxiety and anger among dealers. They emphasised that dealers, as key stakeholders, should be included in any decisions regarding this sudden change.

“OGRA, OMCs, and representatives of the PPDA should all be part of this process,” said Nauman Ali Butt, senior representative of the PPDA.

It is relevant to note that the Oil Companies Advisory Council (OCAC), representing over three dozen oil companies and refineries, previously warned the government about the impact of smuggled petroleum products from Iran on local investment and refinery operations. In a letter to the SIFC, the council highlighted the risks to upcoming investment projects due to ongoing smuggling.

It is pertinent to mention that the government has been under public criticism for rising petroleum product prices. However, with rising fuel prices and industry complaints about smuggled oil products, the government is expediting the deregulation process to shift the burden of public criticism to the OMCs.