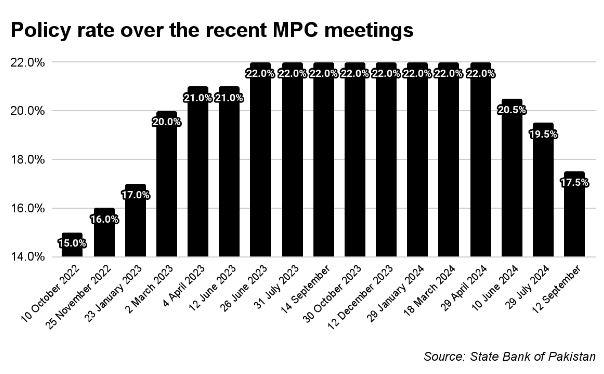

As the State Bank of Pakistan (SBP) Governor announced a significant 200 basis point cut in the policy rate, bringing it down to 17.5%, his composed demeanour reflected growing confidence in Pakistan’s improving economic indicators. However, beneath this veneer of optimism lies a complex reality: while progress is evident, the nation is not yet fully out of troubled waters.

A measured step toward economic stability

The decision to lower the policy rate stems from a cautiously optimistic view of Pakistan’s economic landscape. Recent developments point to progress in stabilizing the economy, with signs of potential sustainable growth on the horizon. A key factor driving this optimism is the assessment that underlying inflationary pressures are subsiding, a result of the previously tight monetary stance and ongoing fiscal consolidation efforts.

Notably, the pace of disinflation has surpassed expectations, partly due to delayed adjustments in gas and electricity prices. The international oil market has also seen favorable movements, though there’s an acknowledgment of the inherent uncertainty in these developments.

Several key economic indicators have shown improvement in recent months. Inflation has fallen more sharply than anticipated, providing relief to consumers and businesses alike. The SBP’s foreign exchange reserves have maintained stability at $9.5 billion, a positive sign given the weak official foreign exchange inflows and ongoing debt repayments.

Government securities’ secondary market yields have seen significant decreases, indicating growing investor confidence. Business sentiment has also shown improvement, although consumer confidence has seen a slight decline. It’s worth noting that FBR tax collection during July-August 2024 fell short of the target, highlighting ongoing fiscal challenges. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan