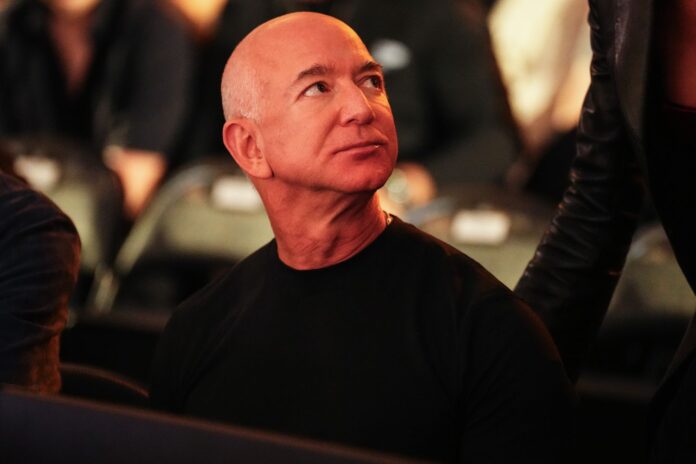

Jeff Bezos’ personal firm Bezos Expeditions is leading a $72-million investment in artificial intelligence data solutions company Toloka, which is looking to scale up its business, Toloka told Reuters on Wednesday.

Toloka, which helps train and evaluate AI models using a network of human experts and testers, is part of Nasdaq-listed AI infrastructure firm Nebius Group and has worked with Amazon, Microsoft and Anthropic.

Amsterdam-based Nebius emerged from a $5.4 billion deal, finalised last year, that split the domestic and international assets of Russian internet giant Yandex in the largest corporate exit from Russia since Moscow’s 2022 invasion of Ukraine.

Toloka founder and CEO Olga Megorskaya said the Bezos-led strategic investment was a milestone that should accelerate the company’s growth, particularly in the U.S. market, and support its development of products through human experts collaborating with AI agents.

“There will always be the need for control, verification, and help from human experts to ensure that the result is actually of high quality,” Megorskaya told Reuters.

Before finalising the split from Yandex, Nebius would have struggled to secure external investment from the likes of Amazon founder Bezos due to sanctions prohibiting U.S. investments in Russia.

Chip giant Nvidia was among the investors in a $700 million private placement raised by Nebius late last year.

In addition to Bezos Expeditions, Mikhail Parakhin, CTO of Canadian e-commerce company Shopify, is participating in the investment, Nebius said, and will join Toloka’s new board of directors as executive chairman.

Parakhin said he was excited to be joining Toloka at a time when the demand for world-class AI data expertise is more urgent than ever.

Bezos Expeditions did not immediately respond to a request for comment.

Nebius said it would continue to support Toloka as a shareholder, retaining a significant majority economic stake, but relinquishing majority voting control.

“The important thing about this round is that we gained the needed flexibility to operate independently,” Megorskaya said.

She said Toloka anticipated another investment round in the future.